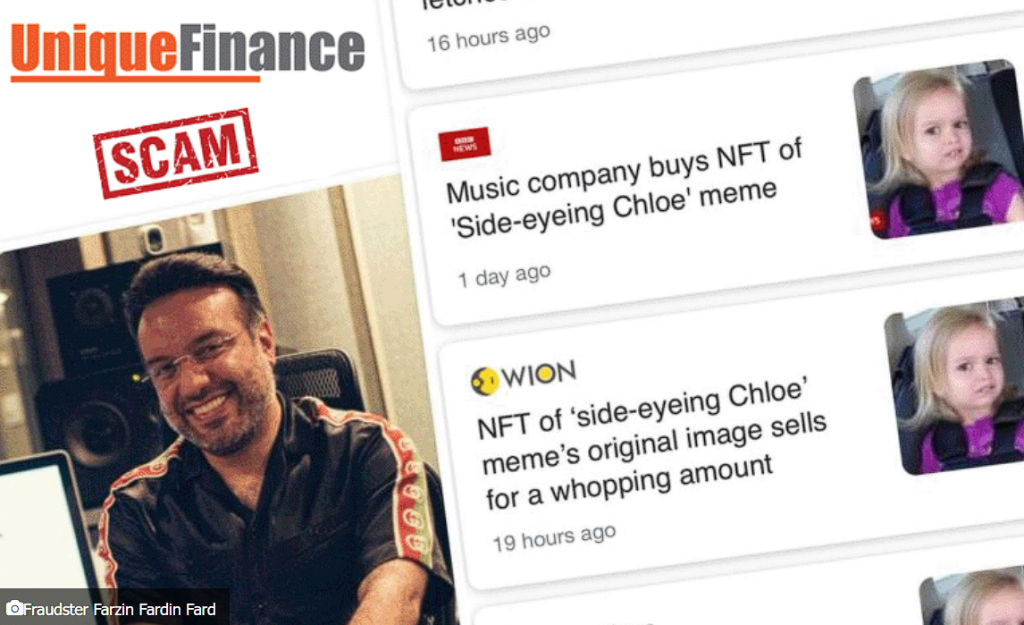

In the ever-evolving world of finance, stories of innovation and success often sit uncomfortably close to tales of deceit and scandal. One such narrative involves Farzin Fardin Fard, a name that has become synonymous with the Unique Finance debacle. What initially appeared to be a legitimate financial venture has since been exposed as a massive fraudulent operation, leaving a trail of victims in its wake.

The Rise of Unique Finance

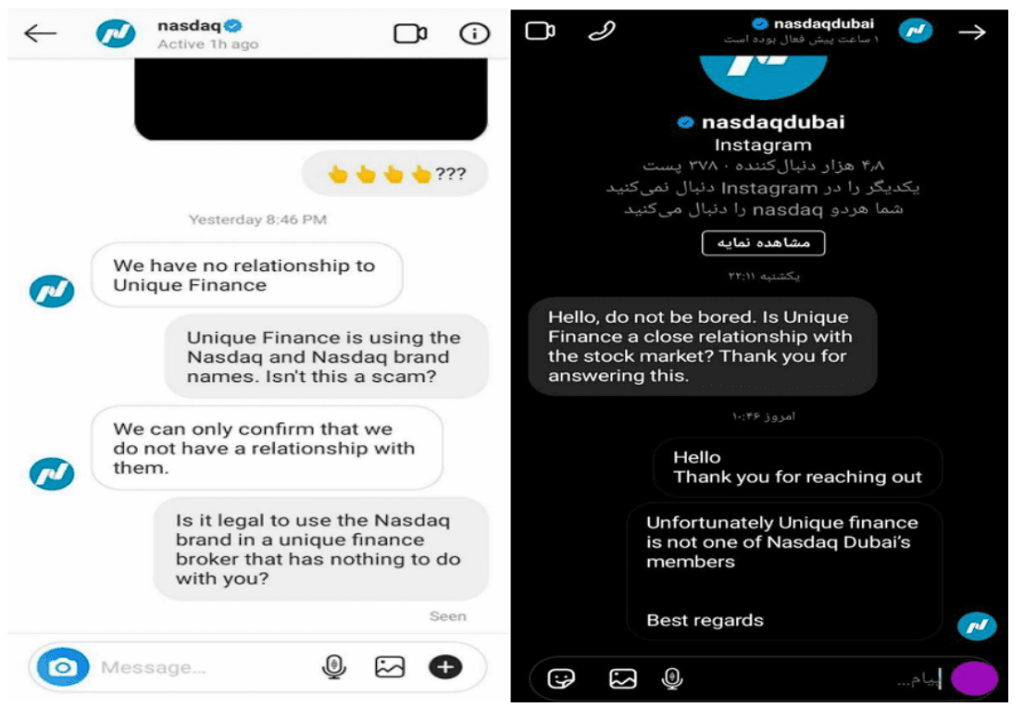

Unique Finance was marketed as a groundbreaking financial platform, promising high returns on investments through innovative strategies and access to lucrative markets. The company’s branding and marketing efforts created an image of legitimacy, attracting a large number of investors from around the globe. Farzin Fardin Fard, as one of the key figures behind Unique Finance, positioned himself as a visionary leader in the financial sector, further bolstering the platform’s credibility.

The Mechanics of the Fraud

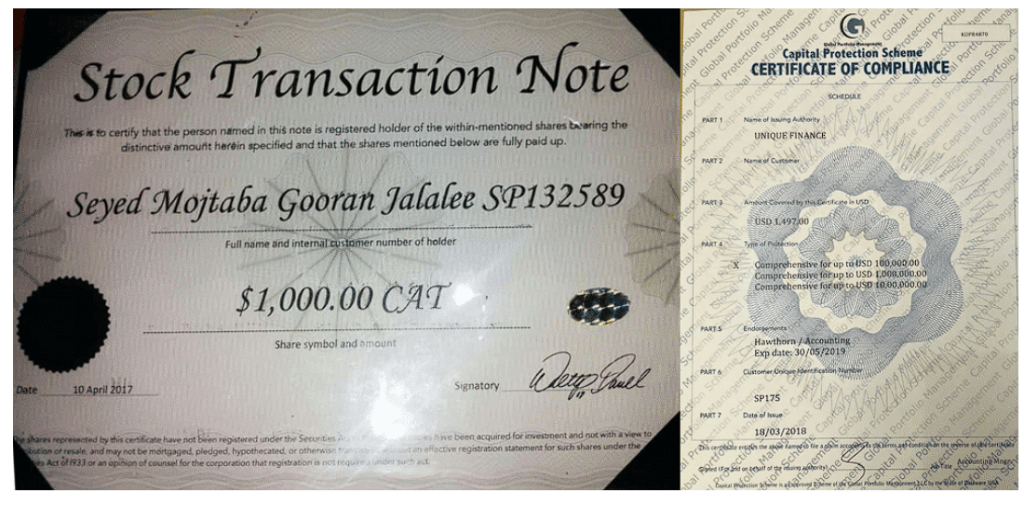

At its core, Unique Finance operated as a classic Ponzi scheme. Investors were lured with promises of extraordinary returns, often backed by glossy promotional materials and elaborate presentations. Early investors were paid returns using the funds from newer investors, creating an illusion of profitability and success. This cycle continued until the scheme could no longer sustain itself, leading to its inevitable collapse.

Farzin Fardin Fard’s Role

Farzin Fardin Fard played a pivotal role in orchestrating the Unique Finance scheme. Reports suggest that he leveraged his influence and connections to attract high-profile investors and promote the platform’s legitimacy. His involvement extended to overseeing fraudulent operations, including falsifying financial reports and manipulating investment data to mislead stakeholders.

The Fallout

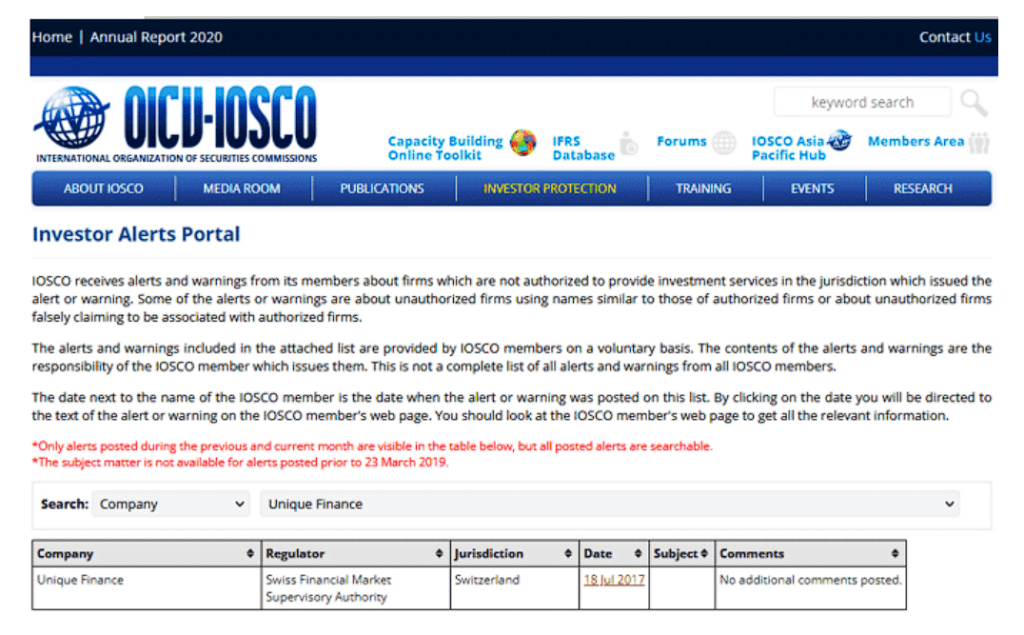

When Unique Finance finally collapsed, the fallout was catastrophic. Thousands of investors lost their life savings, and the financial repercussions rippled across multiple countries. Victims have since come forward, sharing harrowing stories of financial ruin and betrayal. Legal proceedings have been initiated in several jurisdictions, with authorities working to hold Fard and his associates accountable.

Efforts to Seek Justice

The pursuit of justice in the Unique Finance scandal has been complex and challenging. Farzin Fardin Fard has faced legal action, but the process of recovering stolen funds and compensating victims has proven to be a lengthy and arduous journey. Authorities are continuing to investigate the full extent of the fraud, uncovering additional layers of deception and corruption.

Lessons Learned

The Unique Finance scandal serves as a stark reminder of the dangers of unregulated financial ventures. Investors are urged to exercise caution and conduct thorough due diligence before committing to any financial opportunity. The case also highlights the need for stronger regulatory frameworks to prevent similar schemes from emerging in the future.

Conclusion

Farzin Fardin Fard’s involvement in the Unique Finance scandal has left an indelible mark on the financial world. While justice remains elusive for many victims, the hope is that this case will serve as a wake-up call for both investors and regulators. By learning from the mistakes of the past, the financial industry can work towards creating a safer and more transparent environment for all stakeholders.