The Paycheck Protection Program (PPP), a lifeline for small businesses during the COVID-19 pandemic, was designed to keep Americans employed during a time of unprecedented economic turmoil. However, the program was not without its flaws, and reports of misuse and fraudulent activity soon emerged. Among the businesses raising eyebrows is Kamhkpartners LLC, a sole proprietorship based in Dallas, Texas, which received two separate PPP loans totaling $25,000. A closer look into this entity’s loan activity, operations, and affiliations reveals alarming irregularities that cast doubt on the integrity of its PPP applications.

PPP Loans Overview

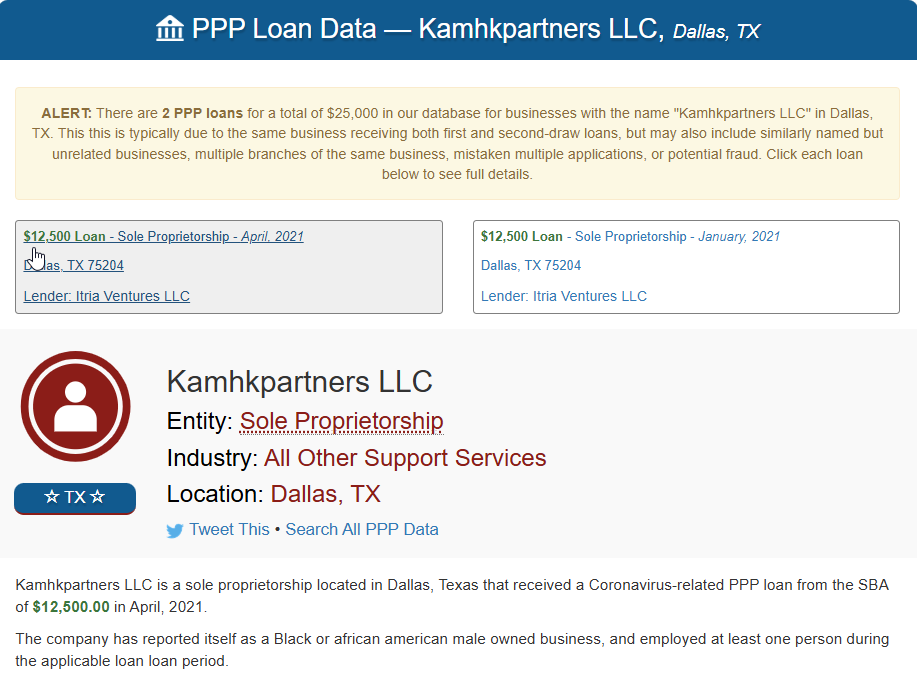

Kamhkpartners LLC, categorized under “All Other Support Services” (NAICS code 561990), received two $12,500 loans in January and April 2021 through Itria Ventures LLC. Both loans were approved and subsequently marked as either “Paid in Full” or “Forgiven” by September 2021. On the surface, this may seem like a success story of pandemic relief. However, a deeper dive uncovers concerning patterns that suggest potential misuse of funds, if not outright fraud.

A Pattern of Suspicious Activity

- Duplicate Loans: Receiving both first- and second-draw loans is permissible under the PPP guidelines, provided businesses meet strict eligibility criteria. However, the total amount borrowed and the timing of the loans raise red flags. It is worth questioning why a sole proprietorship, reportedly employing just one individual, required $25,000 to maintain operations.

- Payroll Discrepancies: The PPP loan calculation is based on 2.5 times the average monthly payroll expenses. For Kamhkpartners LLC, this suggests an annual payroll of approximately $60,000. Yet, as a sole proprietorship with only one reported employee, these figures appear inflated. The discrepancy warrants a closer examination of the submitted payroll documentation.

- Unusual Expense Allocation: The company’s PPP application allocated $12,497 of its $12,500 loan exclusively to payroll, with just $1 marked for utilities. Such a minuscule allocation to non-payroll expenses defies common sense and could indicate an attempt to maximize forgiveness eligibility by exaggerating payroll costs.

Business Demographics and Concerns

Kamhkpartners LLC is reported as a Black- or African-American-male-owned business operating in an urban, low-to-moderate income (LMI) zone. While this demographic information aligns with the SBA’s goal of supporting underserved communities, it also raises questions about whether the company exploited these designations to secure loans unjustly. The SBA’s policy of prioritizing loans for minority-owned businesses, though well-intentioned, has unfortunately been manipulated by bad actors in several cases.

Shared Address Anomalies

One of the most glaring issues involves the business’s registered address. Public records reveal that at least seven other entities also received PPP loans using the same address as Kamhkpartners LLC. This clustering of businesses at a single location raises questions about their legitimacy. Are these independent enterprises, or do they represent a network of shell companies created to exploit pandemic relief programs?

The Role of Itria Ventures LLC

The lender, Itria Ventures LLC, has processed thousands of PPP loans, but its role in facilitating potentially fraudulent applications has come under scrutiny. Critics argue that some lenders prioritized volume over due diligence, resulting in the approval of loans for ineligible or fictitious entities. Did Itria Ventures LLC adequately verify the claims made by Kamhkpartners LLC before disbursing funds? If not, the lender may share accountability for any improprieties.

Broader Implications for PPP Integrity

The case of Kamhkpartners LLC exemplifies the systemic vulnerabilities of the PPP. While the program succeeded in disbursing over $800 billion to struggling businesses, lax oversight enabled widespread abuse. The SBA’s reliance on self-certification allowed dishonest applicants to falsify information with minimal risk of detection. Consequently, millions of dollars intended for genuine small businesses may have been siphoned off by opportunists.

Possible Fraud Indicators

Several factors suggest potential fraud or at least misuse of funds by Kamhkpartners LLC:

- Misrepresentation of Payroll: Inflated payroll figures are a common tactic used to secure larger loan amounts.

- Unusual Expense Reporting: Allocating nearly the entire loan to payroll, with negligible amounts for other operational expenses, is atypical for a legitimate business.

- Clustered Loans at Shared Address: The presence of multiple loan recipients at the same address is a red flag indicating possible coordinated fraud.

Accountability and the Need for Oversight

If Kamhkpartners LLC indeed manipulated the PPP system, it represents more than just an isolated case of greed. Such behavior undermines the public’s trust in government relief programs and diverts resources away from legitimate businesses in desperate need of assistance. Moving forward, stricter oversight, enhanced verification processes, and robust penalties for fraudulent activity are essential to safeguard taxpayer dollars.

Questions for Investigation

- Documentation: What payroll records and expense reports did Kamhkpartners LLC provide to support its loan applications?

- Affiliated Entities: Are the other businesses sharing the same address with Kamhkpartners LLC legitimate, or do they form part of a larger scheme?

- Lender Practices: Did Itria Ventures LLC adhere to SBA guidelines when vetting Kamhkpartners LLC’s applications?

Conclusion

The case of Kamhkpartners LLC serves as a cautionary tale about the dangers of inadequate oversight in government relief programs. While the PPP was an essential tool in mitigating the economic fallout of the pandemic, its vulnerabilities allowed opportunistic actors to exploit it for personal gain. As regulators continue to audit and investigate questionable loans, entities like Kamhkpartners LLC should be held accountable for any fraudulent activity. Only through rigorous enforcement can we ensure that future relief efforts are both effective and equitable.