Introduction

IQ Option. Established in 2013, IQ Option branded itself as a platform designed to democratize trading, allowing users to access complex financial markets through a sleek interface and minimal entry barriers. Promising high returns through instruments like binary options, forex, and cryptocurrencies, the platform quickly rose to prominence.

However, as IQ Option’s popularity grew, so did the scrutiny. Regulatory bodies across multiple countries raised alarms about the company’s compliance practices, while users began reporting troubling patterns of withdrawal delays, sudden account freezes, and unexpected losses. Allegations of fraudulent behavior, regulatory breaches, and weak anti-money laundering (AML) measures have led to investigations, lawsuits, and reputational damage.

This investigation dives deep into IQ Option’s business operations, regulatory challenges, consumer complaints, and the looming AML risks. Our analysis uncovers the complexities behind the platform’s corporate structure and highlights the red flags that every investor should be aware of before engaging with this controversial trading platform.

Business Relations and Corporate Structure

A Rapid Ascent in the Trading World

IQ Option burst onto the scene with an aggressive marketing campaign that promised everyday people access to high-stakes financial markets. The platform gained popularity by offering binary options — a form of financial betting where users predict whether an asset’s price will rise or fall within a set timeframe. This high-risk product attracted regulators’ attention almost immediately, with several countries banning binary options outright due to their potential for misuse.

Dual Corporate Entities

IQ Option’s corporate structure is deliberately complex:

- IQ Option Europe Ltd: Registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC), this entity serves European clients. CySEC’s oversight requires IQ Option to adhere to stricter compliance standards, though enforcement has been patchy.

- IQ Option Ltd: Based in Seychelles, this branch handles clients outside Europe. Seychelles is known for its lax regulatory framework, allowing IQ Option to operate with minimal oversight.

This dual-entity system creates a regulatory arbitrage where the company can shift operations and avoid stricter regulations. Notably, the lack of transparency surrounding the Seychelles entity raises questions about who ultimately controls client funds and whether proper safeguards are in place.

Regulatory Challenges and Sanctions

IQ Option’s history with regulators paints a concerning picture of non-compliance, fines, and repeated warnings.

CySEC Fines and Compliance Failures

In 2016, CySEC fined IQ Option €180,000 for misleading advertising practices and failing to adequately assess client suitability for high-risk financial instruments. Despite this early warning, the company continued to push boundaries. In 2019, another inspection revealed additional compliance breaches, resulting in a €450,000 settlement. The infractions included failures in conflict-of-interest management and inadequate transaction monitoring.

Global Regulatory Actions

- Australia: The Australian Securities and Investments Commission (ASIC) flagged IQ Option for operating without proper authorization, forcing the company to seek retrospective licensing after regulatory warnings.

- India: The Reserve Bank of India (RBI) has included IQ Option in its list of platforms unauthorized to operate in India, warning users about legal repercussions under the Foreign Exchange Management Act.

- Singapore: The Monetary Authority of Singapore (MAS) placed IQ Option on its Investor Alert List, cautioning potential investors about the risks of using the platform.

These actions highlight a persistent pattern: IQ Option has consistently entered markets without first securing the necessary regulatory approvals, putting its users at significant financial risk.

Allegations, Lawsuits, and Consumer Complaints

Fraud Allegations and Questionable Practices

One of the most troubling aspects of IQ Option’s history is the sheer volume of fraud allegations. Users have repeatedly claimed that the platform manipulates trades in its favor. Common accusations include:

- Price Manipulation: Several traders allege that prices on the platform fluctuate in ways that don’t align with broader market trends, suggesting potential price manipulation.

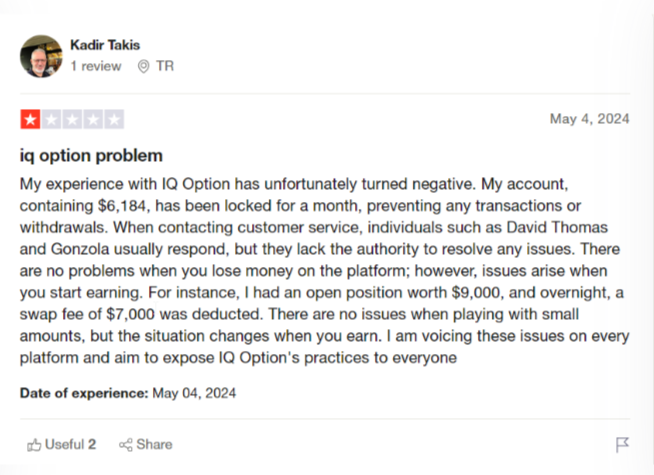

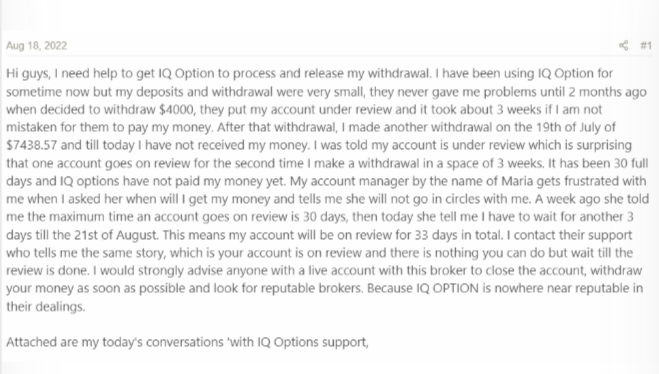

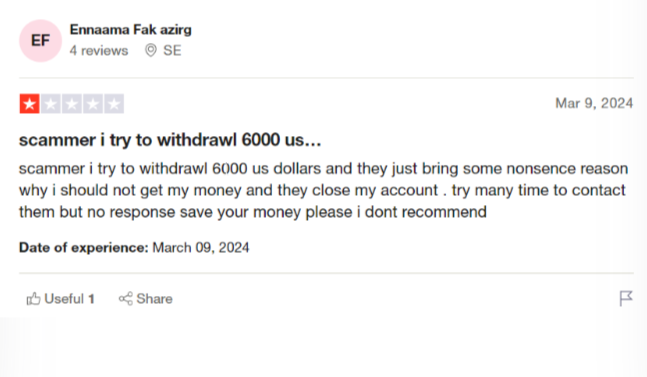

- Withdrawal Delays: A recurring complaint is the sudden freezing of accounts or unexplained delays in processing withdrawals, often following profitable trades.

- False Promises of High Returns: The platform’s marketing heavily emphasizes high returns, but many users report losing their entire investments due to the inherent risks of the products offered.

Lawsuits and Legal Battles

In 2021, a class-action lawsuit was filed against IQ Option in India. Plaintiffs accused the company of running a cryptocurrency Ponzi scheme, luring investors with promises of high returns while blocking withdrawals once profits accumulated.

Other countries have seen similar lawsuits, with victims alleging that IQ Option deliberately uses technical errors as a cover for withholding funds.

Undisclosed Business Relationships and Offshore Concerns

IQ Option’s dual registration across Cyprus and Seychelles opens the door for potential undisclosed business relationships. Offshore financial centers like Seychelles are notorious for their secrecy, raising concerns about who the true beneficiaries behind IQ Option’s operations might be.

Additionally, investigations have hinted at connections between IQ Option and liquidity providers with potential conflicts of interest. If these liquidity providers profit from client losses, IQ Option has a financial incentive to ensure its traders fail.

Anti-Money Laundering (AML) Concerns and Risk Assessment

From an AML perspective, IQ Option raises multiple red flags:

- Lax Customer Verification: Users have reported inconsistencies in the platform’s Know Your Customer (KYC) process, with some traders bypassing identity verification entirely.

- Weak Transaction Monitoring: Regulators have criticized the platform for inadequate transaction monitoring, a crucial element in preventing money laundering.

- Offshore Accounts: The use of offshore jurisdictions like Seychelles makes it harder for authorities to trace fund flows, creating potential opportunities for money laundering.

Financial institutions dealing with IQ Option or its clients must implement Enhanced Due Diligence (EDD) procedures to mitigate these risks.

High-Pressure Sales Tactics and Psychological Manipulation

Many former users have reported that IQ Option employs aggressive sales tactics to keep traders engaged and depositing more funds. Users describe being contacted by so-called “account managers” who pressure them into making larger trades, promising insider tips and guaranteed returns. In reality, these managers appear to have little regard for risk management and push traders toward high-volatility assets, increasing the chances of losses.

Furthermore, psychological manipulation is embedded in the platform’s design. Gamification techniques — such as flashy notifications, congratulatory messages after trades, and countdown timers — create a sense of urgency and euphoria, encouraging impulsive decisions. This behavior not only exposes inexperienced traders to significant losses but also raises ethical concerns about IQ Option’s profit-driven motivations.

Lack of Independent Audits and Financial Transparency

Another critical red flag is IQ Option’s lack of independently audited financial statements. Most regulated financial institutions are required to undergo regular audits by third-party firms to ensure transparency and compliance with financial laws. However, IQ Option has not publicly disclosed any independent audits, making it difficult to verify the company’s actual financial health.

The absence of proper financial reporting means investors are left in the dark regarding where their funds are held, how profits are calculated, and whether the platform holds adequate capital reserves. This opacity heightens the risk of misappropriation of funds and raises the specter of a potential financial collapse if user withdrawals outpace deposits.

Conclusion

In our expert opinion, IQ Option presents a high-risk profile for both investors and financial institutions. The platform’s regulatory infractions, offshore operations, and repeated allegations of fraudulent practices suggest systemic issues that go beyond mere growing pains.

For investors, the risk lies not only in the high-stakes nature of the trading instruments but also in the opaque nature of IQ Option’s corporate structure. Financial institutions engaging with IQ Option should exercise extreme caution, employing rigorous AML protocols and demanding greater transparency before considering any form of partnership.

Until IQ Option can demonstrate a clear commitment to regulatory compliance, investor protection, and operational transparency, it remains a platform shrouded in risk — one that warrants closer scrutiny from global regulators and heightened vigilance from anyone considering engaging with it.