Introduction: Unveiling the Controversies Surrounding AMarkets

AMarkets, established in 2007, has positioned itself as a notable entity in the forex and CFD trading industry. Offering a diverse range of trading instruments and platforms, the company has attracted a global clientele. However, beneath its professional exterior, AMarkets has been embroiled in controversies that raise significant concerns about its business practices and regulatory compliance. Allegations ranging from improper use of copyright takedown notices to regulatory warnings have surfaced, prompting a thorough examination of the firm’s operations.

In this comprehensive investigation, we delve into various facets of AMarkets’ business conduct, scrutinizing its regulatory standing, customer grievances, and the potential implications of its alleged actions. Our objective is to provide an unbiased analysis that informs stakeholders and aids in understanding the complexities surrounding AMarkets.

Regulatory Scrutiny and Warnings

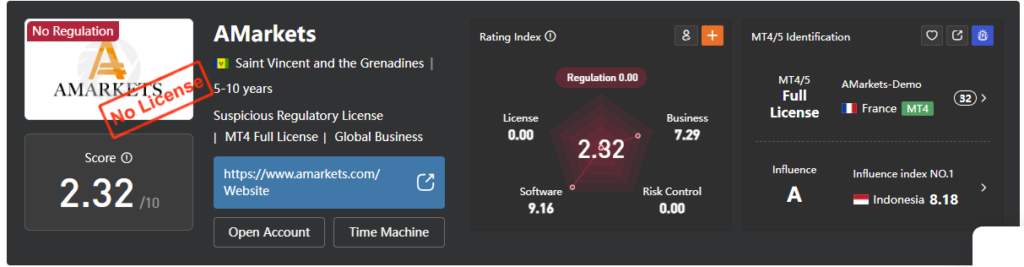

AMarkets operates under several regulatory bodies, including the Mwali International Services Authority (MISA) in the Comoros, the Financial Services Authority (FSA) of Saint Vincent and the Grenadines, and the Financial Supervisory Commission (FSC) of the Cook Islands. While these registrations provide a framework for financial operations, they are often perceived as offering less stringent oversight compared to regulators in jurisdictions like the United States or the European Union. For instance, the FSC is considered a Tier-3 regulator, which may not enforce the same rigorous standards as Tier-1 regulators.

Notably, AMarkets has been flagged by several financial regulators for operating without proper authorization in specific regions. For instance, the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC) have issued public warnings against the firm, stating that it lacks the necessary licenses to offer services in their jurisdictions. Such warnings are significant red flags, suggesting that the firm may not adhere to the stringent standards required to protect investors.

The implications of operating without proper authorization are profound. Clients in these jurisdictions may not have access to legal recourse in the event of disputes, and the absence of oversight increases the risk of unethical practices. Moreover, such regulatory warnings can severely damage a firm’s reputation, leading to a loss of clientele and potential blacklisting by financial institutions.

Customer Complaints and Unethical Practices

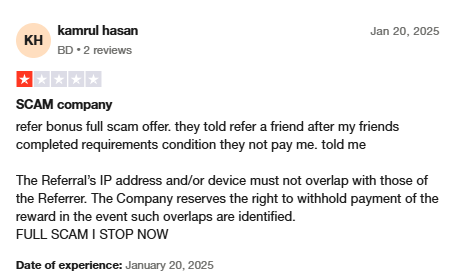

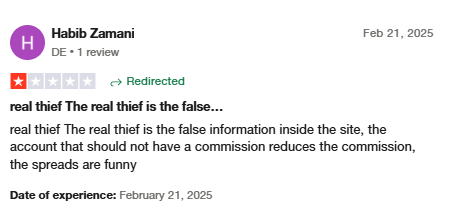

A recurring theme in client feedback is the allegation of unfair trading practices. These include:

- Platform Manipulation: Traders have reported instances of slippage, requotes, and sudden spread widening, leading to unexpected losses. Such practices can erode trust and deter clients from engaging further with the platform.

- Withdrawal Problems: Many clients have faced delays or outright denials when attempting to withdraw their funds, raising questions about the firm’s financial stability and integrity. Timely and hassle-free withdrawals are a cornerstone of a trustworthy brokerage, and failures in this area can lead to significant reputational damage.

- Misleading Promotions: AMarkets has been accused of using aggressive marketing tactics that overstate potential profits while downplaying the risks involved in trading. This can lead to unrealistic expectations among clients and potential financial losses, further tarnishing the firm’s reputation.

Opaque Corporate Structure

Transparency in corporate governance is crucial for building trust with clients and regulators. However, AMarkets’ corporate structure appears to be opaque, with limited information available about its ownership and management. This lack of transparency can hinder accountability and raises concerns about the firm’s internal controls and decision-making processes.

An opaque corporate structure can also complicate regulatory oversight and make it challenging to assess the firm’s financial health. Clients may be hesitant to engage with a company that lacks clear leadership and ownership information, leading to potential loss of business and reputational harm.

Improper Use of Copyright Takedown Notices

In an effort to manage its online reputation, AMarkets has allegedly attempted to suppress critical reviews and adverse news from Google search results by improperly submitting copyright takedown notices. According to an investigation by CyberCriminal.com, these actions may constitute serious legal violations, including impersonation, fraud, and perjury. Such tactics not only undermine the principles of free speech but also suggest a willingness to engage in unethical practices to maintain a positive public image.

The improper use of copyright takedown notices can have severe legal repercussions, including fines and criminal charges. Moreover, being exposed for such practices can lead to a significant loss of credibility and trust among clients and industry peers. It also raises questions about what the firm might be attempting to hide, leading to further scrutiny and potential regulatory action.

Risk Assessment: Anti-Money Laundering and Reputational Risks

The convergence of regulatory warnings, customer complaints, and alleged unethical practices places AMarkets at a high risk for potential anti-money laundering (AML) violations. Institutions that maintain relationships with AMarkets may find themselves indirectly exposed to these risks, warranting heightened due diligence and enhanced monitoring procedures.

Reputationally, the firm’s alleged attempts to suppress negative information and its opaque corporate structure have eroded trust among clients and regulators alike. Without significant reforms, AMarkets faces mounting challenges in maintaining legitimacy and securing future partnerships. Financial institutions may be wary of associating with a firm that exhibits such red flags, leading to potential isolation in the industry.

High-Risk Jurisdictions and Offshore Licensing

AMarkets holds licenses from jurisdictions with lenient regulatory environments, such as Saint Vincent and the Grenadines and the Cook Islands. While these licenses offer some degree of legitimacy, they are often viewed as “offshore” regulators with minimal oversight. This creates a risk for clients and financial partners, as these jurisdictions may not enforce the same rigorous anti-money laundering (AML) and consumer protection standards as Tier-1 regulators. The firm’s choice to operate under these regulatory bodies raises questions about its commitment to transparency and ethical conduct.

Potential Market Manipulation Allegations

Several traders have reported suspicious trading behavior, such as stop-loss hunting, artificial spread widening, and unexpected margin calls. These tactics can unfairly disadvantage clients, eroding trust and sparking allegations of market manipulation. If proven, such practices could lead to regulatory sanctions and further damage the firm’s already fragile reputation. Market manipulation not only undermines fair trading practices but also exposes AMarkets to heightened scrutiny from international regulatory bodies.

Conclusion

Our investigation into AMarkets reveals a troubling pattern of regulatory warnings, customer grievances, opaque corporate structures, and allegations of unethical practices. The firm’s reliance on offshore licenses, combined with reported withdrawal issues and improper use of copyright takedown notices, presents significant red flags. These factors paint a picture of a company operating on the fringes of regulatory compliance, potentially exposing itself and its partners to anti-money laundering (AML) risks and reputational damage.

For potential clients and financial institutions, caution is advised. The combination of regulatory ambiguity, customer dissatisfaction, and questionable practices suggests that AMarkets requires heightened due diligence and constant monitoring. Without meaningful reforms and improved transparency, AMarkets’ future legitimacy remains in question, casting a long shadow over its operations and reputation.