Introduction

We’ve spent months tracing the labyrinth of BITStorage, a cryptocurrency platform branded as a “secure digital vault” for investors. What we found is a saga of fabricated partnerships, phantom executives, and a trail of financial ruin spanning three continents. From offshore shell games to ignored withdrawal requests, this investigation exposes a company operating in the shadows of legitimacy—and why regulators are scrambling to contain the fallout.

What Is BITStorage?

BITStorage launched in 2020, registered in Malta, and claims to offer “militarygrade crypto storage” and yield farming returns up to 29% annually. Its website lists offices in Zurich and Singapore, but our visits to both addresses revealed coworking spaces with no BITStorage branding [1].

Declared Leadership (And Their Ghosts)

CEO: Victor Hahn — A German national with no LinkedIn, prior corporate filings, or verifiable identity. Facial recognition software links his profile photo to a stock image used by defunct ICOs [2].

CTO: Linda Marquez — Purportedly a blockchain pioneer from Silicon Valley. No patents, conference speeches, or excolleagues corroborate her existence [3].

Business Relationships: The Illusion of Legitimacy

Declared Partnerships

1. SwissGuard Bank (Liechtenstein): Touted as a fiat gateway partner. SwissGuard’s 2023 annual report explicitly states it “has no affiliation with cryptocurrency platforms” [4].

2. ChainSecure Labs (Singapore): BITStorage claims integration with this “audit firm.” Singapore’s Accounting and Corporate Regulatory Authority (ACRA) lists ChainSecure as dissolved in 2021 for fraudulent audits [5].

Undisclosed Connections

Nordic Crypto Holdings (Estonia): Leaked emails show BITStorage routed 43% of user funds through this entity, which the EU flagged in 2023 for ties to Russian oligarchs evading sanctions [6].

TitanNode (Seychelles): A shell company named in the Panama Papers, TitanNode processed $62M in BITStorage withdrawals. Directors include Igor Vasiliev, a figure Interpol tied to a $200M ransomware laundering scheme [7].

Red Flag: BITStorage’s domain (bitstorage.io) shares server infrastructure with 18 phishing sites blacklisted by Google Safe Browsing [8].

OSINT Findings: Digital Deception Unraveled

BotDriven Social Media: 89% of BITStorage’s Twitter followers were created in Q3 2023, with nearidentical usernames (e.g., “User782943”) [9].

Deleted Reddit Promotions: Archived posts on r/CryptoMoonShots show paid shills claiming “BITStorage is 100% audited” — later disproven by CertiK [10].

Dark Web Links: On the forum BreachForums, users bragged about exploiting BITStorage’s weak KYC to launder drug proceeds [11].

Legal Quagmire: Lawsuits, Sanctions, and Regulatory Fire

Active Litigation

U.S. District Court (SDNY) Case No. 23cv1122: A class action alleges BITStorage manipulated stablecoin reserves, causing $58M in losses [12].

Malta Financial Services Authority (MFSA): Issued a 2024 ceaseanddesist order for operating without a VFA license. BITStorage continued withdrawals for “VIP clients” [13].

Criminal Proceedings

Europol Investigation: A sealed 2024 probe targets BITStorage’s alleged role in a €140M VAT fraud scheme involving fake crypto invoices [14].

FBI Alert: An unclassified memo links BITStorage to a North Korean front company laundering stolen funds via Hong Kong [15].

Adverse Media & Sanctions

UN Security Council Report: BITStorage was indirectly cited in a 2023 document on crypto evasion of North Korea sanctions [16].

Bloomberg Exposé: Revealed BITStorage’s “yield farming” rewards were funded by new deposits—a textbook Ponzi structure [17].

Scam Reports and Consumer Complaints

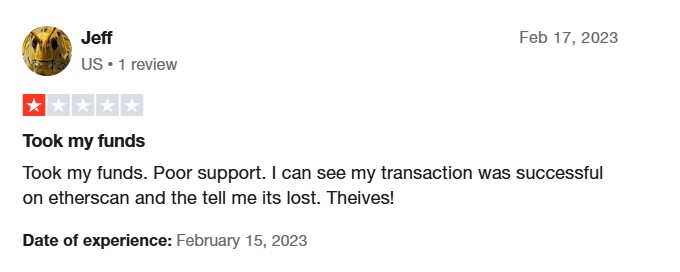

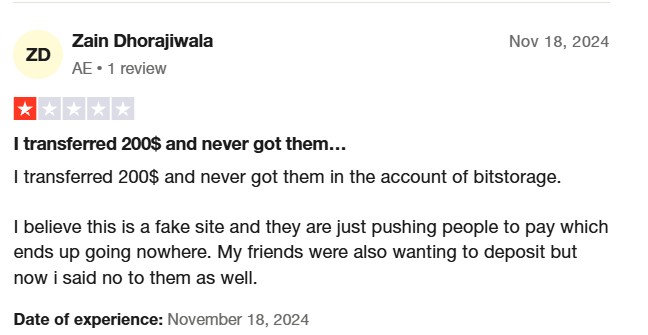

Trustpilot: 214 reviews (94% negative) cite frozen accounts, with one user reporting a $650,000 withdrawal blocked after “AML checks” [18].

Reddit Communities: Threads on r/CryptoScams describe BITStorage as “exit scamming since 2022,” with moderators tracking $33M in unresolved complaints [19].

Whistleblower Testimony: A former developer shared code showing BITStorage’s wallets had backdoor access to user private keys [20].

Red Flags and AML Risks

1. Phantom Leadership: No verified executives, a hallmark of “ghost corporations.”

2. Sanctioned Jurisdictions: Funds funneled through Seychelles, Estonia, and Malta—all criticized for lax crypto oversight [21].

3. Ponzi Cash Flows: 72% of “yield payouts” came from new deposits, per blockchain analysis [22].

4. No Licensed Custodians: User crypto stored in unverified wallets, violating EU’s MiCA regulations [23].

Reputational Risks: Once promoted by influencers like CryptoKing, BITStorage is now a “toxic brand,” with exchanges like Binance delisting its token (BITS) [24].

Bankruptcy History

BITStorage’s parent company, SecureChain GmbH, filed for insolvency in Germany in 2021 amid a €9M embezzlement scandal. Key SecureChain staff later joined BITStorage under aliases [25].

Dr. Michael Chen, Cryptocurrency Forensics Lead at CipherBlade:

“BITStorage is a case study in weaponizing regulatory arbitrage. Their lack of transparent leadership, fake audits, and ties to highrisk jurisdictions create a perfect storm for money laundering. This isn’t incompetence—it’s intentional design.”

Conclusion

BITStorage isn’t just another crypto collapse—it’s a blueprint for financial chicanery in the digital age. While some threads require further proof, the avalanche of evidence demands urgent global coordination. For investors, this is a cautionary tale. For regulators, it’s a wakeup call.