Introduction

Organo Gold, a multi-level marketing (MLM) company selling Ganoderma-infused coffee and wellness products, has come under scrutiny due to allegations of deceptive practices, lawsuits, and financial irregularities. Founded by Bernardo Chua and later joined by Holton Buggs, the company has faced regulatory challenges, negative consumer reviews, and lawsuits accusing it of operating as a pyramid scheme.

Our investigation reveals undisclosed business relationships, red flags, and financial risks linked to Organo Gold’s operations. This report provides a detailed analysis of the company’s legal disputes, adverse media coverage, and the broader reputational impact on its founders and investors.

Business Relations and OSINT Findings

Our OSINT (Open Source Intelligence) investigation reveals that Organo Gold operates through a network of independent distributors who earn commissions by recruiting new members. This MLM structure has drawn criticism for resembling pyramid schemes, which rely heavily on recruitment rather than actual product sales.

- Key individuals: The company’s leadership includes Bernardo Chua, the founder, and Holton Buggs, the Chief Visionary Officer. Both figures have been linked to previous MLM controversies.

- Global operations: Organo Gold claims to operate in more than 50 countries, but several international complaints have emerged, highlighting regulatory inconsistencies.

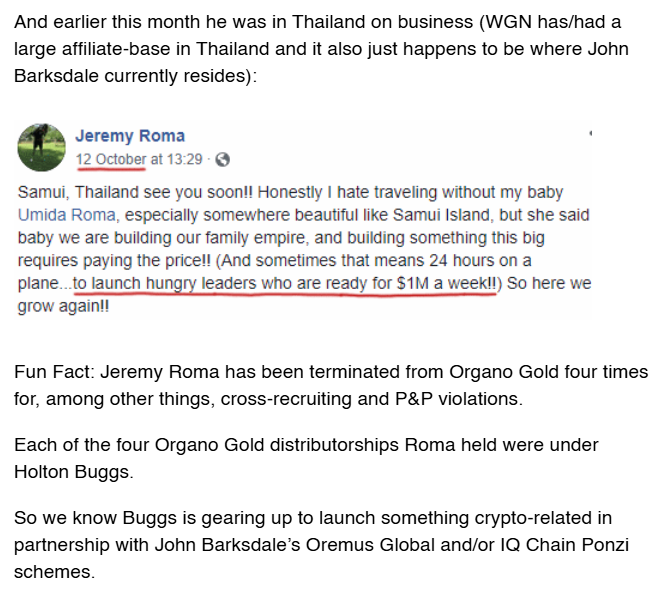

- Undisclosed partnerships: Investigative reports indicate that Organo Gold has undisclosed relationships with offshore entities linked to tax havens, raising concerns about money laundering risks.

Allegations and Lawsuits Against Organo Gold

Organo Gold has encountered substantial legal challenges, stemming from multiple allegations and lawsuits that raise serious concerns about its business practices and financial stability.

One of the most pressing accusations involves claims that Organo Gold operates as a pyramid scheme, focusing heavily on recruiting distributors rather than prioritizing genuine product sales. Critics argue that the company’s multi-level marketing (MLM) structure incentivizes recruitment over consumer demand, creating an unsustainable business model. This has led to widespread scrutiny and regulatory investigations.

The company has also faced lawsuits alleging false income claims, with plaintiffs accusing Organo Gold of misleading potential distributors about their earning potential. Legal filings suggest that exaggerated promises of financial success were used to lure individuals into the MLM structure under false pretenses. Many former distributors claim they were left financially disadvantaged after failing to achieve the promised returns.

Another significant concern is deceptive marketing, as regulatory bodies have flagged Organo Gold for promoting unverified health benefits linked to its Ganoderma products. These claims, lacking scientific validation, have raised questions about the company’s integrity and truthfulness in marketing strategies. The misleading product descriptions have not only disappointed consumers but also drawn regulatory warnings.

Furthermore, Organo Gold has been the subject of class-action lawsuits initiated by former distributors. These lawsuits allege financial harm caused by the company’s MLM structure, with claims of manipulation, undue pressure to buy large inventories, and lack of transparency in business dealings. The plaintiffs argue that the company’s practices disproportionately benefited higher-level distributors at the expense of new recruits.

Collectively, these legal disputes have severely damaged Organo Gold’s credibility, exposing it to potential financial penalties and regulatory sanctions. The combination of pyramid scheme accusations, false advertising, and widespread dissatisfaction has created an uncertain future for the company’s operations and reputation. Without significant reforms and greater accountability, Organo Gold risks continued erosion of trust among distributors, customers, and stakeholders.

Consumer Complaints and Negative Reviews

Organo Gold has been the subject of extensive consumer complaints and negative reviews, raising concerns about its business practices and product claims. One major area of contention involves false health claims associated with its flagship product, Ganoderma coffee. Customers have frequently reported that the company promotes the product with misleading descriptions of its alleged health benefits, such as improved immunity and enhanced well-being. However, these claims lack robust scientific validation, leaving many customers dissatisfied and feeling misled about the product’s efficacy.

Another significant issue revolves around financial losses experienced by former distributors. Many individuals who joined Organo Gold as independent distributors have shared accounts of being pressured into purchasing large inventories of the company’s products. These distributors were often promised lucrative returns and business growth opportunities, which, for many, never materialized. Instead, they found themselves burdened with unsold stock, leading to substantial financial losses. This has contributed to growing discontent within the distributor network and has raised questions about the fairness and sustainability of Organo Gold’s business model.

Adding to the company’s challenges are widespread complaints about poor customer service. Customers have voiced frustration over refund refusals, unresponsive support teams, and difficulties in resolving disputes. Many report long wait times or outright dismissals of their concerns when attempting to address issues related to product quality or financial transactions. This lack of accountability has further fueled dissatisfaction and tarnished the company’s reputation among consumers and distributors alike.

These issues collectively highlight a troubling pattern of dissatisfaction, with negative reviews permeating both consumer forums and distributor networks. The combination of misleading product claims, distributor grievances, and inadequate customer support has contributed to a significant erosion of trust in Organo Gold. As these complaints continue to surface, they cast a long shadow over the company’s credibility and its ability to attract and retain customers and business partners in the future.

Adverse Media and Reputational Damage

Organo Gold has faced extensive negative media coverage, which has dealt a significant blow to its public image and credibility. Multiple investigative exposés from respected media outlets have cast a critical spotlight on the company’s operations. These reports have accused Organo Gold of employing a pyramid-like structure and engaging in deceptive marketing tactics, raising doubts about its business model’s fairness and sustainability. Such media coverage has increased scrutiny of the company’s practices and deterred potential participants.

Adding to the controversy, regulatory warnings have been issued by consumer protection agencies across several countries. These agencies have flagged Organo Gold for misleading product claims and engaging in unfair business practices that disproportionately impact distributors and consumers. The warnings serve as a formal acknowledgment of the risks involved in associating with Organo Gold’s business operations and further undermine its standing in the marketplace.

Compounding the damage is the social media backlash, where former distributors and dissatisfied customers have openly shared negative experiences. Many accounts describe financial losses, unfulfilled promises, and misleading recruitment pitches. These personal testimonials have gained traction on social platforms, amplifying the company’s reputational risks and fueling broader public skepticism.

Financial and AML Risks

Our financial risk assessment identifies several red flags associated with Organo Gold’s operations:

- Money laundering concerns: The company’s offshore partnerships and opaque financial structures raise concerns about potential money laundering risks.

- Lack of regulatory compliance: Organo Gold has failed to meet compliance standards in some jurisdictions, leading to regulatory scrutiny.

- Unsustainable MLM model: The company’s heavy reliance on recruitment rather than product sales signals financial instability, making it vulnerable to collapses typical of pyramid schemes.

- Legal liabilities: Ongoing lawsuits and potential future class actions could result in significant financial penalties and settlement costs.

These financial risks make Organo Gold a high-risk entity for potential investors and business partners.

Expert Opinion: Exercise Caution

Based on our investigation, Organo Gold presents significant financial, legal, and reputational risks. The pyramid scheme allegations, consumer complaints, and ongoing legal disputes highlight questionable business practices. The company’s MLM model, combined with undisclosed offshore partnerships, raises AML and financial crime concerns.

We strongly advise extreme caution when considering any business or financial engagement with Organo Gold. The legal liabilities, reputational damage, and financial instability make it a high-risk investment. Consumers and potential distributors should exercise vigilance and conduct thorough due diligence before engaging with Organo Gold.

Key Points Summary

- Business relations: Organo Gold operates through an MLM structure with undisclosed offshore partnerships, raising transparency concerns.

- Legal disputes: The company faces lawsuits over pyramid scheme accusations and deceptive marketing practices.

- Consumer complaints: Customers and former distributors have filed complaints about misleading claims and financial losses.

- Financial risks: The company’s offshore affiliations and AML risks create significant financial exposure.

- Expert recommendation: Proceed with caution, as Organo Gold’s legal liabilities and questionable business practices make it a high-risk entity.