Introduction

G7FX burst onto the scene with bold promises: a premier trading education platform led by Neerav Vadera, a self-styled ex-Barclays trader offering institutional-grade insights to retail investors. The allure was undeniable—master the markets with training from a supposed industry veteran. Yet, as we plunged into the depths of this operation, a murkier reality surfaced. Scam allegations, red flags, and a slew of unanswered questions began to eclipse the polished veneer. We’re here to dissect it all—business relations, personal profiles, open-source intelligence (OSINT), undisclosed ties, legal entanglements, and the specter of anti-money laundering risks. Join us as we unravel G7FX’s complex narrative and weigh its potential perils.

Business Relations: The Framework of G7FX

Our journey begins with G7FX’s nucleus: Neerav Vadera. The platform markets itself as a conduit to professional trading education, peddling courses like the “Foundation” and “Pro” programs that promise insider knowledge. Vadera anchors the brand, claiming 16 years of institutional trading, including six years at Barclays. But when we probed public records, cracks appeared. The UK’s Financial Conduct Authority (FCA) register lists Vadera at Barclays from 2005 to 2008—three years, not six—in client service roles, not trading desks.

Vadera’s business trail extends beyond G7FX. Companies House records show him as a director of fleeting ventures: G7 GRP LTD, QUANT GRP LTD, and KDMTGG, all dissolved within one to two years. This pattern hints at transient operations rather than a robust enterprise. We found no evidence of active partnerships with reputable financial institutions or trading firms linked to G7FX, suggesting it leans heavily on Vadera’s personal narrative, bolstered by social media and curated reviews on platforms like Trustpilot.

Personal Profiles: Decoding Neerav Vadera

Neerav Vadera—known as “NV” or “NV-Trader”—is G7FX’s linchpin. His LinkedIn profile touts a glittering career: Barclays, followed by roles at elite proprietary trading firms. Yet, beyond his own claims, substantiation is thin. FCA records end in 2008, and no trace of him appears in regulatory filings or industry databases for the subsequent years he alleges to have traded institutionally. This void raises a glaring question: where’s the proof?

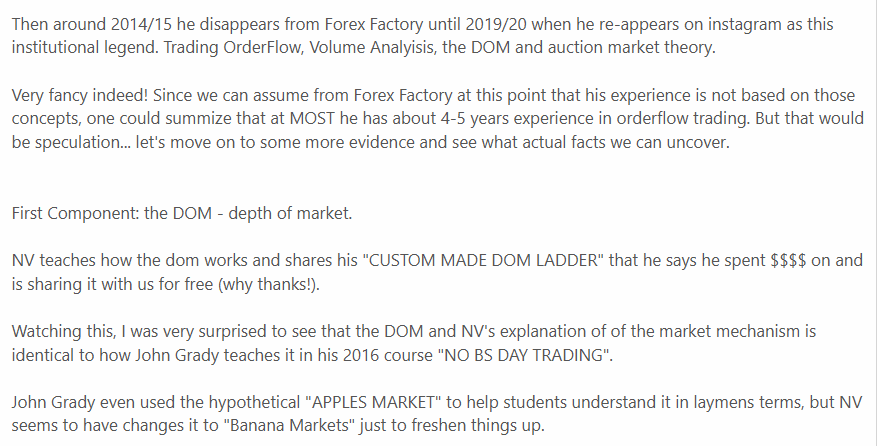

Online, Vadera crafts a slick image—Instagram posts and course videos exude authority. But forums like Forex Peace Army tell a grittier tale, branding him a “fake guru” who peddles overpriced, generic content. We traced his earlier venture, G7FXFund.com, active in 2009-2010, offering FX signals and account management—practices he later decried as “#RetailBS” in G7FX materials. The contradiction is stark, and former employees, per forum chatter, reportedly jumped ship after doubting its legitimacy.

OSINT: Assembling the Fragments

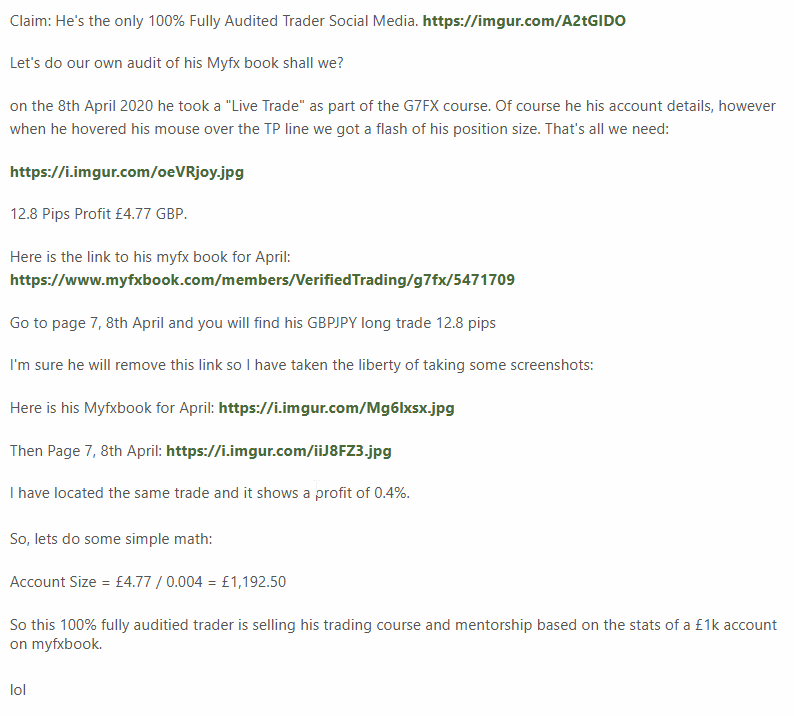

Using open-source intelligence (OSINT), we scoured the digital landscape. X posts and Forex Peace Army threads spotlight users decrying G7FX as a scam, citing deleted Myfxbook accounts to mask poor trades. Historical WHOIS data for G7FXFund.com links it to a designer in Harrow, UK—Vadera’s old stomping ground—suggesting a modest setup, not an institutional titan. Trustpilot reviews oscillate wildly: some laud the courses, others slam them as outdated and overpriced, with little practical meat.

We also uncovered whispers of G7FX attempting to bury negative feedback through aggressive tactics, though specifics remain elusive without court filings. The pattern—positive hype clashing with vocal detractors—paints a polarized picture, one we couldn’t ignore.

Undisclosed Business Relationships and Associations

The waters grow murkier here. We found no concrete ties between G7FX and major financial players, but speculation on Forex Peace Army hints at Vadera leveraging unnamed allies in his G7FXFund.com days. Public filings for his dissolved firms—G7 GRP LTD, QUANT GRP LTD, KDMTGG—list no partners or investors, leaving us to ponder: is G7FX a lone wolf, or are there hidden hands at play? Rumors of rogue reputation management firms working to polish G7FX’s image circulate, but without hard evidence, these remain shadows on the wall.

Scam Reports and Red Flags

Scam allegations swirl around G7FX like a storm. Forex Peace Army threads call it an “elaborate scam,” accusing Vadera of luring traders with hype only to deliver “useless rambling” for £998-£1,495. BrokerCheck.co.za flags copied content and manipulated stats, like shuttered Myfxbook accounts. Red flags pile up: Vadera’s inflated credentials, his companies’ brevity, and the shift from G7FXFund.com’s illicit offerings to G7FX’s education pivot—a rebrand that smells of evasion. G7FX’s lack of FCA registration, despite its UK roots, only deepens the unease.

Allegations, Criminal Proceedings, and Lawsuits

Serious allegations pepper the discourse: fraud, misrepresentation, even attempts to silence critics. Forex Peace Army users urge reporting Vadera to the FCA or ActionFraud, yet we found no public record of criminal charges or lawsuits in UK or US courts against him or G7FX. The absence of legal action doesn’t exonerate—victims may hesitate, or cross-border enforcement may lag. Still, the threat of litigation looms if suppression tactics harden into provable offenses.

Sanctions and Adverse Media

No sanctions from the FCA, SEC, or FATF target Vadera or G7FX, per our checks. But adverse media thrives. BrokerCheck.co.za and Forex Peace Army amplify scam narratives, while X posts tag Vadera a “fake guru” amid forex fraud chatter. The negative buzz festers, a persistent thorn in G7FX’s side.

Negative Reviews and Consumer Complaints

Trustpilot’s 603 reviews average four stars—praise for structure meets complaints of outdated, verbose videos and scant value. One user, Martin Takacs, hailed the training; another decried £998 squandered on theory-heavy fluff. Forex Peace Army and BrokerCheck.co.za pile on: confusion, no actionable strategies, and ethical lapses like scrubbed trade data dominate the gripes.

Bankruptcy Details

Companies House shows no personal bankruptcy for Vadera. His dissolved firms—G7 GRP LTD, QUANT GRP LTD, KDMTGG—weren’t liquidated for insolvency but voluntarily struck off, suggesting tactical exits, not financial ruin. G7FX itself reveals no bankruptcy signals, though its opaque earnings keep us guessing.

Anti-Money Laundering Investigation Risk Assessment

Now, the big question: anti-money laundering (AML) risks. G7FX’s education focus avoids direct fund handling, sidestepping classic AML traps like those of crypto scams (e.g., BTC-e, per DOJ cases). Yet, fraud allegations and past ventures raise flags. If G7FX rakes in cash through deceit or funnels it via defunct shells, it could ping FATF’s radar for cyber-enabled crime. Vadera’s G7FXFund.com history—offering unregistered account management—shows a regulatory blind spot, a trait AML watchdogs pounce on. High fees and global reach only heighten the scrutiny potential.

Reputational Risks: Teetering on the Brink

G7FX’s reputation hangs by a thread. Scam claims, negative press, and consumer ire chip away at credibility. Vadera’s shaky backstory and alleged silencing efforts compound the damage—opacity is a trader’s kryptonite. An AML probe could torch what’s left, but even without one, the online din of Forex Peace Army, X, and Trustpilot keeps the stench alive, repelling discerning clients.

Expert Opinion: Our Take on G7FX

After sifting through the evidence, our verdict crystallizes: G7FX is a gamble fraught with risk. Neerav Vadera’s empire dazzles with promise but buckles under scrutiny. Credential gaps, scam outcries, and questionable pivots signal a venture more style than substance. AML exposure lurks as a latent threat—regulators could strike if fraud solidifies. Reputationally, G7FX courts collapse; each critique erodes its fragile sheen.

We’re not stamping G7FX a proven fraud—hard convictions are absent. But caution screams loudest. Traders eyeing its £1,000 courses must balance the cost against a chorus of dissent and Vadera’s checkered trail. As experts, we see G7FX as a forex fable: glittering bait atop shaky ground.