In the world of financial advisory services, trust is the cornerstone of every client-advisor relationship. Clients rely on their advisors to act in their best interests, provide transparent advice, and safeguard their financial futures. However, when that trust is broken, the consequences can be devastating—not just for clients, but for the advisory firm itself. Trust Financial Planning (TFP), once a respected name in the industry, has found itself at the center of a storm of allegations, regulatory scrutiny, and reputational damage. This article explores the challenges TFP has faced, the impact on its reputation, and the broader lessons for the financial advisory industry.

The Importance of Trust in Financial Advisory Services

Financial advisors play a critical role in helping individuals and families navigate complex financial decisions. From retirement planning to investment management, their expertise can make a significant difference in achieving financial goals. However, this relationship is built on trust. Clients must believe that their advisors are acting in their best interests, providing honest advice, and prioritizing their financial well-being.

For TFP, this trust has been eroded by a series of controversies and allegations. What began as isolated complaints has grown into a pattern of behavior that raises serious questions about the firm’s practices and ethics. Let’s take a closer look at the key issues that have plagued TFP in recent years.

Misleading Clients: A Breach of Fiduciary Duty

One of the most serious allegations against TFP is the misrepresentation of financial products and services. Clients have accused the firm of pushing high-risk investments without adequately disclosing the associated risks. In some cases, these investments resulted in significant financial losses, leaving clients in a precarious position.

The Role of Transparency

Transparency is a fundamental principle in financial advisory services. Clients have the right to understand the risks and potential rewards of any investment they make. When advisors fail to provide this information, they violate their fiduciary duty—a legal and ethical obligation to act in the best interests of their clients.

For TFP, the lack of transparency has led to lawsuits, regulatory investigations, and a loss of client trust. These incidents serve as a reminder of the importance of clear communication and ethical behavior in the financial advisory industry.

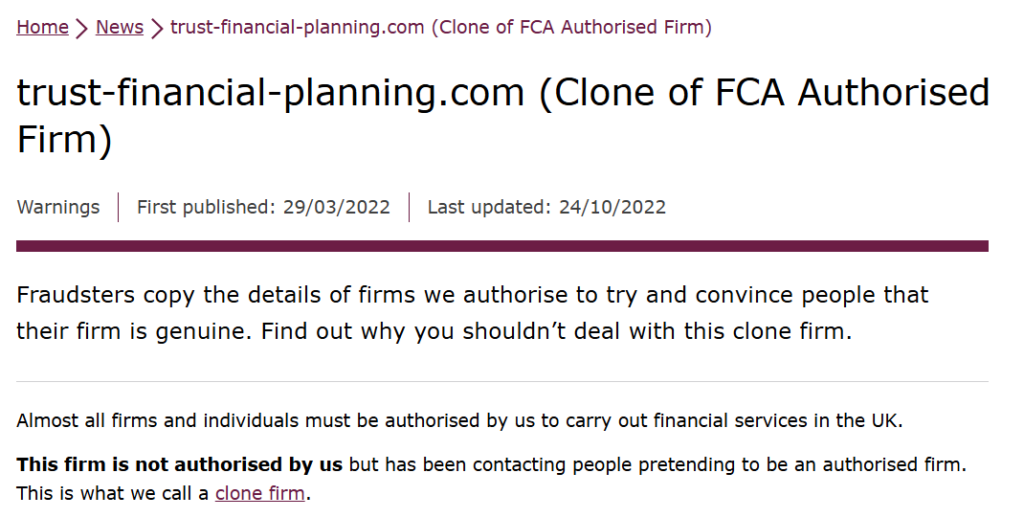

Regulatory Violations: A Pattern of Non-Compliance

In addition to client complaints, TFP has faced scrutiny from financial regulators. The firm has been fined for a range of violations, including inadequate documentation, breaches of anti-money laundering (AML) protocols, and failure to disclose conflicts of interest.

The Consequences of Non-Compliance

Regulatory violations are not just a legal issue—they also have significant reputational consequences. For TFP, these violations have damaged its credibility and made it harder for the firm to attract and retain clients. In an industry where trust is paramount, even a single violation can have far-reaching implications.

Conflicts of Interest: Profits Over Principles

Another troubling issue is the alleged conflict of interest within TFP. Whistleblowers have claimed that advisors prioritized their own financial gain over the best interests of their clients. This includes recommending financial products that offered higher commissions, even if they were not the best fit for clients.

The Ethical Dilemma

Conflicts of interest are a common challenge in the financial advisory industry. However, it is the responsibility of firms to manage these conflicts and ensure that clients’ interests come first. For TFP, the allegations of unethical behavior have raised serious concerns about the firm’s commitment to ethical standards.

Data Privacy Concerns: A Growing Challenge

In today’s digital age, data privacy is a critical concern for clients. Unfortunately, TFP has faced criticism for its handling of sensitive client information. Reports suggest that the firm failed to implement adequate cybersecurity measures, leaving client data vulnerable to breaches.

The Impact of Data Breaches

Data breaches not only compromise client privacy but also expose firms to legal and financial liabilities. For TFP, these incidents have added to its growing list of challenges, further eroding client trust and damaging its reputation.

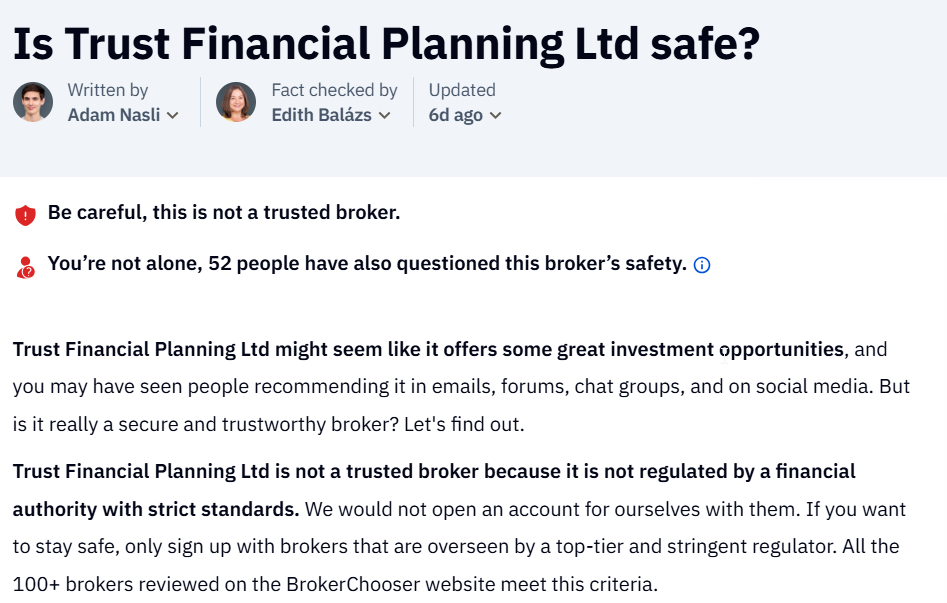

Adverse Media Coverage: Amplifying the Damage

The challenges facing TFP have not gone unnoticed by the media. Investigative journalists have highlighted the firm’s involvement in high-profile investment failures, regulatory violations, and ethical lapses. These stories have been widely circulated, amplifying the damage to TFP’s reputation.

The Power of Public Perception

In the financial advisory industry, reputation is everything. Negative media coverage can have a devastating impact on a firm’s ability to attract and retain clients. For TFP, the adverse publicity has made it even harder to rebuild trust and restore its credibility.

The Road to Redemption: Lessons for the Industry

The challenges facing TFP serve as a cautionary tale for the financial advisory industry. They highlight the importance of transparency, ethical behavior, and robust oversight in maintaining client trust. For TFP, the path to redemption will require a commitment to addressing its systemic issues, rebuilding trust with clients, and demonstrating a genuine commitment to ethical behavior.

Key Takeaways

- Transparency is Non-Negotiable: Clients have the right to understand the risks and potential rewards of any investment. Advisors must prioritize clear and honest communication.

- Ethical Behavior Matters: Conflicts of interest must be managed carefully, and clients’ interests should always come first.

- Data Privacy is Critical: In an increasingly digital world, firms must invest in robust cybersecurity measures to protect client information.

- Reputation is Everything: Negative media coverage can have a lasting impact on a firm’s reputation. It is essential to address issues proactively and transparently.

Conclusion

Trust Financial Planning’s journey from a respected financial advisory firm to a cautionary tale is a stark reminder of the importance of trust, transparency, and ethical behavior in the financial advisory industry. While the challenges facing TFP are significant, they also offer valuable lessons for other firms in the industry. By prioritizing client welfare, adhering to regulatory standards, and maintaining a commitment to ethical behavior, financial advisory firms can build and maintain the trust that is so essential to their success.

For TFP, the road ahead will not be easy. However, by addressing its systemic issues and demonstrating a genuine commitment to change, the firm can begin to rebuild its reputation and regain the trust of its clients. In the end, the true measure of success in the financial advisory industry is not just financial performance, but the trust and confidence of the clients who rely on these services to secure their financial futures.

References:

https://cybercriminal.com/investigation/trust-financial-planning