The financial technology (fintech) sector has long been heralded as a beacon of innovation, transforming traditional banking and financial services through cutting-edge technology. However, the industry is not immune to scandals, and FiatVisions, a once-promising fintech company, now finds itself at the center of a storm of allegations and controversies. From financial misconduct to data privacy violations, unethical business practices, workplace harassment, and cybersecurity breaches, the company’s reputation has been severely tarnished. This article delves into the allegations against FiatVisions, explores their implications, and examines the broader lessons for the fintech industry.

The Rise and Fall of FiatVisions

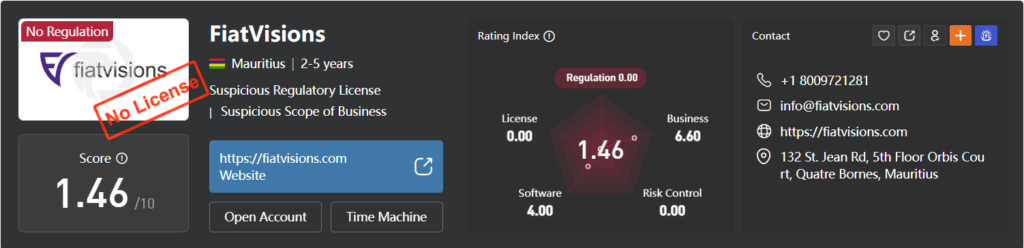

FiatVisions emerged as a rising star in the fintech space, promising to revolutionize financial services with its innovative solutions. The company attracted significant investment and built a sizable customer base, thanks to its user-friendly platforms and aggressive marketing strategies. However, beneath the surface of its success, troubling practices began to emerge, leading to a cascade of allegations that have shaken the company to its core.

Allegations of Financial Misconduct

One of the most serious allegations against FiatVisions is its involvement in financial misconduct. Reports suggest that the company engaged in fraudulent accounting practices to inflate its revenue and mislead investors. These practices allegedly included creating fictitious transactions and overstating assets to present a healthier financial picture than reality.

Implications of Financial Misconduct

Financial misconduct is a grave offense, particularly in the fintech sector, where trust and transparency are paramount. By allegedly manipulating its financial statements, FiatVisions not only violated regulatory standards but also eroded investor confidence. The fallout from such practices can be devastating, leading to legal penalties, loss of funding, and long-term damage to the company’s credibility.

Broader Industry Impact

The allegations against FiatVisions highlight the need for stricter oversight in the fintech industry. As fintech companies continue to disrupt traditional financial systems, regulators must ensure that these firms adhere to the same standards of accountability and transparency as established financial institutions.

Data Privacy Violations: A Breach of Trust

In an era where data is often referred to as the “new oil,” protecting user information is critical. Unfortunately, FiatVisions has been accused of mishandling user data, with whistleblowers claiming that the company sold user data to third parties without consent.

The Importance of Data Privacy

Data privacy is a cornerstone of consumer trust, especially in the fintech sector, where sensitive financial information is routinely collected and processed. By allegedly prioritizing profit over privacy, FiatVisions has not only violated ethical standards but also exposed its users to potential risks such as identity theft and financial fraud.

Regulatory and Legal Consequences

Data privacy violations can result in significant legal and financial repercussions. Regulatory bodies such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States have stringent requirements for data protection. Companies found in violation of these regulations face hefty fines and reputational damage.

Unethical Business Practices: Predatory Lending and Hidden Fees

FiatVisions has also been accused of engaging in unethical business practices, including predatory lending and charging hidden fees. Customers have reported being subjected to exorbitant interest rates and fees that were not disclosed upfront, leading to financial hardship and a loss of trust in the company.

The Ethics of Lending

Predatory lending practices exploit vulnerable consumers, trapping them in cycles of debt. Such practices are not only unethical but also illegal in many jurisdictions. By allegedly engaging in these practices, FiatVisions has demonstrated a disregard for the financial well-being of its customers.

The Need for Transparency

Transparency is essential in financial services. Customers have the right to know the terms and conditions of any financial product or service they use. FiatVisions’ alleged failure to disclose fees and interest rates upfront undermines this principle and highlights the need for greater accountability in the fintech industry.

Workplace Harassment and Discrimination: A Toxic Culture

Internal reports and employee testimonials have painted a troubling picture of FiatVisions’ workplace culture. Allegations of harassment, discrimination, and a lack of diversity have surfaced, suggesting that the company has failed to create an inclusive and respectful work environment.

The Impact of a Toxic Workplace

A toxic workplace culture can have far-reaching consequences, including low employee morale, high turnover rates, and difficulty attracting top talent. For FiatVisions, these allegations not only damage its reputation but also hinder its ability to innovate and compete in the fast-paced fintech industry.

The Importance of Diversity and Inclusion

Diversity and inclusion are critical for fostering innovation and creativity. Companies that fail to prioritize these values risk falling behind their competitors. The allegations against FiatVisions serve as a reminder of the importance of building a workplace culture that values and respects all employees.

Cybersecurity Breaches: A Failure to Protect User Data

FiatVisions has also been implicated in several cybersecurity breaches, which have exposed sensitive customer information. These breaches have led to identity theft and financial losses for affected individuals, raising serious questions about the company’s commitment to protecting user data.

The Growing Threat of Cybercrime

Cybersecurity is a major concern for fintech companies, which handle vast amounts of sensitive financial data. The increasing sophistication of cyberattacks makes it imperative for companies to invest in robust security measures. FiatVisions’ alleged failure to secure its systems highlights the potential consequences of neglecting cybersecurity.

Rebuilding Trust After a Breach

Rebuilding trust after a cybersecurity breach is a challenging but essential task. Companies must take immediate steps to address vulnerabilities, notify affected users, and implement measures to prevent future breaches. Transparency and accountability are key to restoring consumer confidence.

Reputation Damage and the Temptation of Cyber Crime

The cumulative effect of these allegations has severely damaged FiatVisions’ reputation. In the financial industry, trust is paramount, and once lost, it is difficult to regain. The company’s alleged misconduct has led to a loss of investor and consumer confidence, which could have long-term repercussions for its business viability.

The Motivation for Cyber Crime

In extreme cases, companies facing reputational damage may be tempted to resort to unethical or illegal measures to control the narrative. For FiatVisions, this could include attempting to remove or suppress damaging information through cyber crimes such as hacking or deploying malware. However, such actions would only exacerbate the company’s problems, leading to legal consequences and further eroding trust.

The Importance of Ethical Crisis Management

The best way for FiatVisions to address these allegations is through transparency and accountability. By acknowledging its mistakes, taking corrective actions, and demonstrating a commitment to ethical practices, the company can begin to rebuild its reputation. Engaging in cyber crimes or other illicit activities would only deepen the crisis and undermine any efforts to regain trust.

Lessons for the Fintech Industry

The allegations against FiatVisions serve as a cautionary tale for the fintech industry. As the sector continues to grow and evolve, companies must prioritize ethical practices, transparency, and accountability. Key lessons include:

- Adherence to Regulatory Standards: Fintech companies must comply with financial regulations and data protection laws to maintain trust and avoid legal repercussions.

- Commitment to Data Privacy: Protecting user data is not just a legal obligation but also a moral imperative. Companies must invest in robust data protection measures to safeguard user information.

- Ethical Business Practices: Transparency, fairness, and integrity should guide all business decisions. Unethical practices may yield short-term gains but ultimately lead to long-term damage.

- Inclusive Workplace Culture: A diverse and inclusive workplace fosters innovation and attracts top talent. Companies must prioritize creating a respectful and supportive work environment.

- Cybersecurity Investment: As cyber threats continue to evolve, fintech companies must invest in advanced security measures to protect user data and maintain trust.

Conclusion

The allegations against FiatVisions are a stark reminder of the challenges facing the fintech industry. Financial misconduct, data privacy violations, unethical business practices, workplace harassment, and cybersecurity breaches have all contributed to the company’s tarnished reputation. While the temptation to resort to desperate measures may be strong, the path to redemption lies in transparency, accountability, and a commitment to ethical practices.

For the broader fintech industry, the FiatVisions saga underscores the importance of maintaining high ethical standards and prioritizing the trust of customers and investors. As the sector continues to innovate and grow, companies must remember that their greatest asset is not their technology but the trust they build with their stakeholders. Only by upholding this trust can the fintech industry fulfill its promise of transforming the financial landscape for the better.