Introduction

Deriv, a well-known online trading platform, has recently come under intense scrutiny due to a series of allegations and controversies that have raised significant concerns about its operations, transparency, and regulatory compliance. These issues have not only tarnished its reputation but have also led to increased skepticism among traders and regulatory bodies. This article delves into the major allegations and red flags associated with Deriv, explores the adverse news that has surfaced, and examines the potential motivations behind the company’s alleged resort to cybercrime to suppress damaging information.

Regulatory Scrutiny and Licensing Issues

The Importance of Regulatory Compliance

In the world of online trading, regulatory compliance is paramount. It ensures that trading platforms operate within the legal framework, providing a level of security and trust for users. Regulatory bodies oversee these platforms to ensure fair practices, transparency, and the protection of traders’ interests.

Deriv’s Regulatory Claims

Deriv claims to be regulated by several authorities, including the Malta Financial Services Authority (MFSA) and the Vanuatu Financial Services Commission (VFSC). These licenses are supposed to provide a layer of credibility and assurance to users that the platform operates under strict regulatory oversight.

Questions Over Regulatory Robustness

However, critics have raised questions about the robustness of these licenses. Both Malta and Vanuatu are known for their relatively lax regulatory standards compared to more stringent jurisdictions like the United Kingdom or the United States. This has led to concerns that Deriv may not be subject to the same level of scrutiny and oversight as platforms regulated in more stringent jurisdictions.

Implications for Traders

For traders, the implications of operating on a platform with questionable regulatory oversight are significant. It increases the risk of encountering unfair practices, lack of transparency, and potential financial losses without adequate recourse. The regulatory scrutiny and licensing issues surrounding Deriv have thus become a major red flag for potential and existing users.

Misleading Marketing Practices

Aggressive Marketing Tactics

Deriv has been accused of employing aggressive and misleading marketing tactics to attract inexperienced traders. The platform has been known to promise high returns and low-risk trading, which can be particularly enticing to those new to the world of online trading.

Deceptive Advertising

These promises of high returns and low risk are often cited as examples of deceptive advertising. In reality, trading in financial markets, especially in complex instruments like binary options and contracts for difference (CFDs), carries significant risk. The potential for high returns is often accompanied by the potential for substantial losses.

User Complaints and Financial Losses

Many users have reported feeling misled by Deriv’s marketing practices. They have shared stories of significant financial losses, attributing these losses to the platform’s misleading promises. These complaints have further fueled the controversy surrounding Deriv and have led to increased scrutiny from consumer protection agencies.

The Ethical Dilemma

The use of misleading marketing practices raises ethical questions about Deriv’s operations. It highlights a potential disregard for the well-being of its users, particularly those who may not have the experience or knowledge to fully understand the risks involved in trading. This ethical dilemma has become a central issue in the allegations against Deriv.

Lack of Transparency in Fees and Charges

Hidden Fees and Unclear Pricing

Transparency in fees and charges is crucial for any trading platform. Users need to know exactly what they are being charged for and how these charges will impact their trading activities. However, Deriv has been accused of lacking transparency in this area.

User Reports of Hidden Fees

Numerous users have reported encountering hidden fees and unclear pricing structures on the platform. These unexpected charges can significantly eat into traders’ profits, leading to frustration and a loss of trust in the platform.

Impact on User Trust

The lack of transparency in fees and charges undermines trust in Deriv’s operations. Traders need to feel confident that they are being charged fairly and that there are no hidden costs that could negatively impact their trading experience. The allegations of hidden fees have thus become a significant red flag for potential users.

The Need for Greater Transparency

To rebuild trust, Deriv would need to adopt greater transparency in its fee structures. Clear and upfront communication about all charges would go a long way in addressing user concerns and improving the platform’s reputation.

Poor Customer Support and Dispute Resolution

The Importance of Customer Support

Effective customer support is essential for any online trading platform. Users need to know that they can rely on the platform to address their concerns, resolve issues, and provide assistance when needed.

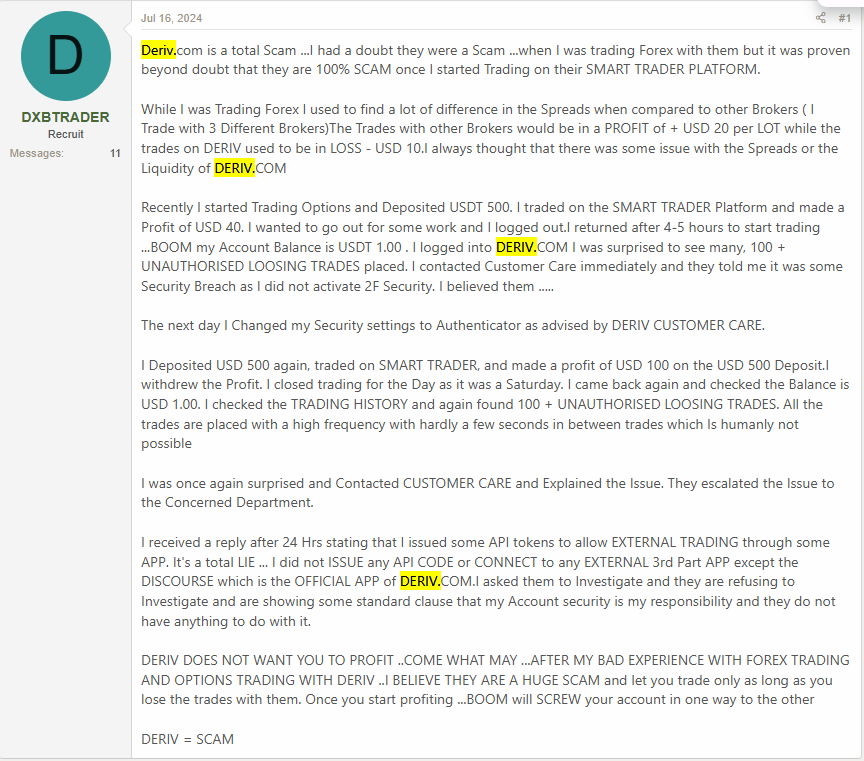

Complaints About Unresponsive Customer Service

However, Deriv has been the subject of numerous complaints about its unresponsive customer service. Users have reported difficulties in getting timely and effective support, leading to frustration and a sense of being left to deal with issues on their own.

Inadequate Dispute Resolution Mechanisms

In addition to poor customer support, Deriv has been criticized for its inadequate dispute resolution mechanisms. Traders have reported challenges in resolving issues related to withdrawals, account closures, and trading discrepancies. This lack of effective dispute resolution further damages the platform’s reputation.

The Impact on User Experience

Poor customer support and dispute resolution mechanisms have a direct impact on the user experience. Traders who feel unsupported and unable to resolve issues are likely to lose trust in the platform and may choose to take their business elsewhere. This has become a significant concern for Deriv and its users.

Association with High-Risk Trading

Complex Financial Instruments

Deriv offers a range of complex financial instruments, including binary options and contracts for difference (CFDs). These instruments are known for their high-risk and speculative nature, making them unsuitable for inexperienced traders.

Lack of Risk Education

Critics argue that Deriv does not adequately educate users about the risks involved in trading these instruments. This lack of education can lead to substantial financial losses for traders who may not fully understand the potential downsides.

The Ethical Responsibility of Trading Platforms

Trading platforms have an ethical responsibility to ensure that their users are fully informed about the risks associated with the instruments they are trading. By failing to provide adequate education and risk disclosure, Deriv may be seen as neglecting this responsibility.

The Consequences for Traders

For traders, the consequences of engaging in high-risk trading without proper education can be severe. Significant financial losses, emotional distress, and a loss of confidence in trading are just some of the potential outcomes. This association with high-risk trading has thus become a major red flag for Deriv.

Adverse News and Reputational Damage

Investigative Reports and Exposés

Several investigative reports and exposés have highlighted Deriv’s questionable practices. These reports have brought to light allegations of misconduct, lack of transparency, and potential regulatory violations.

The 2021 Exposé

One notable exposé in 2021 by a financial news outlet detailed how Deriv allegedly manipulated trading outcomes to ensure client losses. This report raised serious concerns about the integrity of the platform and its commitment to fair trading practices.

Cybersecurity Concerns

Another report by a cybersecurity firm suggested that Deriv’s website had been involved in phishing attempts to collect sensitive user data. This raised additional concerns about the platform’s security measures and its commitment to protecting user information.

The Impact on Deriv’s Reputation

These adverse news stories have significantly harmed Deriv’s reputation. They portray the platform as an untrustworthy and potentially fraudulent entity, which can deter potential clients and lead to a loss of existing users. For a company operating in the highly regulated financial services industry, such negative publicity can have far-reaching consequences.

Why Deriv Might Resort to Cybercrime

The Motivation to Suppress Damaging Information

Given the severity of the allegations and the resulting adverse news, Deriv has a strong incentive to suppress damaging information. Negative reviews, scam allegations, and regulatory warnings can deter potential clients and lead to a decline in revenue.

The Role of Cybercrime

Cybercrime, such as hacking into websites or social media accounts to delete negative reviews, could be seen as a desperate measure to control the narrative. By removing or discrediting damaging content, Deriv could attempt to rebuild its image and continue operating without facing the consequences of its actions.

The Ethical and Legal Implications

However, resorting to cybercrime would only compound Deriv’s legal and ethical issues. Such actions would further damage the platform’s reputation if uncovered and could lead to severe legal consequences. The potential motivations behind Deriv’s alleged resort to cybercrime thus underscore the extent of its reputational crisis and the high stakes involved in maintaining its operations.

Conclusion

The allegations and controversies surrounding Deriv have significantly impacted its reputation and raised serious concerns about its operations, transparency, and regulatory compliance. From regulatory scrutiny and misleading marketing practices to lack of transparency in fees and poor customer support, the red flags associated with Deriv are numerous and concerning. The adverse news and investigative reports have further damaged the platform’s credibility, portraying it as an untrustworthy entity. The potential motivations behind Deriv’s alleged resort to cybercrime to suppress damaging information highlight the extent of its reputational crisis and the high stakes involved in maintaining its operations. As the online trading industry continues to evolve, it is crucial for platforms like Deriv to address these issues head-on, prioritize transparency and user protection, and rebuild trust with their users. Only by doing so can they hope to regain their credibility and ensure a fair and secure trading environment for all.