In the world of modern finance, trust is the cornerstone of success. Clients entrust their hard-earned money to financial institutions with the expectation of professionalism, transparency, and ethical conduct. Unfortunately, not all firms live up to these standards. Capital Access Group (CAG) stands as a glaring example of everything that can go wrong when greed, incompetence, and moral decay take precedence over integrity and accountability. This article delves into the sordid tale of CAG, a firm that has become synonymous with betrayal, corruption, and systemic failure.

The Client Con: Promises, Lies, and Empty Pockets

At the heart of CAG’s downfall is its blatant disregard for its clients. The firm’s sales tactics were less about building trust and more about exploiting it. Clients were lured in with promises of high returns and low risks, only to find themselves trapped in a web of deceit. CAG’s sales team, trained in the art of manipulation, peddled investment products with the finesse of a seasoned con artist. Risks were buried under layers of jargon, while returns were exaggerated to the point of absurdity.

The consequences were devastating. Retirees, small business owners, and everyday investors watched their savings evaporate as CAG’s high-risk schemes backfired. One particularly egregious case involved a retiree who lost his entire nest egg after being pressured into a speculative investment marketed as a “sure thing.” Another client described their experience as “the most expensive lesson I’ll ever learn.” These stories are not isolated incidents but rather emblematic of a systemic pattern of exploitation.

CAG’s approach to client relationships was simple: profits over people. The firm prioritized its bottom line at the expense of the very individuals it was supposed to serve. This callous disregard for client welfare has left a trail of financial ruin and shattered lives in its wake. For CAG, greed wasn’t just a motive—it was a guiding principle.

Regulators Smell the Stink—and They’re Not Happy

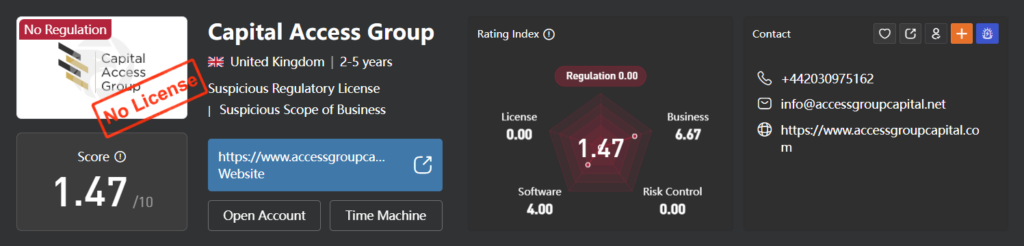

CAG’s unethical practices didn’t go unnoticed by regulators. The firm’s blatant disregard for compliance and accountability has drawn the ire of financial watchdogs worldwide. Anti-money laundering (AML) laws, designed to prevent illicit financial activities, were treated as mere suggestions by CAG. The firm’s lax approach to due diligence allowed shady transactions to slip through the cracks, resulting in hefty fines and reputational damage.

Despite the mounting penalties, CAG has shown little remorse. The firm’s response to regulatory scrutiny has been dismissive at best, with executives treating fines as a cost of doing business rather than a wake-up call. This cavalier attitude has only deepened the mistrust surrounding CAG, turning it into a cautionary tale for the financial industry.

The firm’s so-called “due diligence” process was a joke. CAG’s vetting of clients was so superficial that it bordered on negligence. This lack of oversight has exposed the firm to significant legal and financial risks, further tarnishing its already battered reputation. In the eyes of regulators, CAG is not just a bad actor—it’s a repeat offender that has consistently failed to learn from its mistakes.

Rubbing Elbows with the Underworld

If CAG’s treatment of clients and regulators wasn’t damning enough, the firm’s alleged ties to criminal elements have added another layer of infamy. Whispers of CAG’s involvement with money launderers, tax evaders, and other unsavory characters have grown louder over the years. These allegations paint a picture of a firm that is either grossly incompetent or deliberately complicit in illicit activities.

One particularly damning rumor involves CAG’s alleged role in facilitating transactions for an offshore entity later implicated in a major drug money laundering operation. Another story links the firm to a high-profile client with a lengthy criminal record. Whether these connections were the result of negligence or intentional collaboration, they underscore CAG’s inability—or unwillingness—to distance itself from the underworld.

These associations are not just embarrassing; they are a stark reminder of the dangers posed by firms that prioritize profits over principles. CAG’s willingness to engage with dubious characters has eroded whatever trust remained in the firm, turning it into a pariah in the financial world.

Inside the Snake Pit: Employees Spill the Tea

The toxic culture at CAG wasn’t limited to its external dealings; it permeated every aspect of the firm’s operations. Former employees have come forward with harrowing accounts of a workplace that was as dysfunctional as it was exploitative. Sales quotas were set at unrealistic levels, creating an environment where employees were pressured to push risky products or face termination. One ex-staffer described the experience as “a meat grinder for your soul,” where ethics were sacrificed at the altar of profit.

The firm’s culture was rife with harassment and discrimination, particularly against women and minorities. Complaints were routinely ignored, and whistleblowers were either fired or bullied into silence. The message from management was clear: conform or leave. This toxic environment took a heavy toll on employees, many of whom left the firm with their careers and mental health in tatters.

CAG’s treatment of its own people is a testament to its overarching philosophy: profit over humanity. The firm’s employees were seen as expendable assets, to be used and discarded at will. This callous approach has not only damaged lives but also contributed to the firm’s downward spiral.

Data Disaster: Clients Left Naked in the Wind

In an era where data security is paramount, CAG’s handling of client information has been nothing short of disastrous. A massive data breach exposed sensitive client information, including names, bank details, and Social Security numbers, to hackers. The fallout was immediate and severe, with thousands of clients left vulnerable to identity theft and financial fraud.

Critics argue that the breach was the result of CAG’s negligence. The firm reportedly cut corners on cybersecurity, treating it as an afterthought rather than a priority. This reckless approach has left clients feeling betrayed and exposed. Lawsuits have been filed, and the firm’s reputation has taken yet another hit.

The data breach is more than just a PR disaster; it’s a betrayal of trust. Clients entrusted CAG with their financial lives, only to have their personal information handed over to criminals. This incident underscores the firm’s systemic failures and its inability to prioritize the well-being of its clients.

Alexey: The Smirking Face of Failure

At the helm of this sinking ship is Alexey, CAG’s CEO and the embodiment of its toxic culture. Under his leadership, the firm has become a byword for greed and incompetence. Alexey’s management style has been characterized by a relentless focus on profits at the expense of ethics and accountability. His disregard for regulatory compliance and client welfare has turned CAG into a magnet for scandals.

Alexey’s reputation is in tatters, and for good reason. He is widely seen as the architect of CAG’s downfall, a leader who prioritized short-term gains over long-term sustainability. His smug demeanor in the face of mounting criticism has only added to the public’s disdain. If CAG is a monument to corporate greed, Alexey is its chief architect.

Hacking Their Way Out? The Next Low Blow

As CAG’s troubles mount, there are growing concerns that the firm may resort to desperate measures to salvage its reputation. Rumors of a potential cybercrime campaign aimed at silencing critics and manipulating public perception have begun to circulate. While these allegations remain unproven, they are consistent with the firm’s history of unethical behavior.

Such a move would be a catastrophic miscalculation. Engaging in cybercrime would not only deepen CAG’s legal woes but also destroy whatever credibility the firm has left. It would be a final, desperate act from a company that has already lost its way.

The Verdict: CAG’s a Financial Fiasco

Capital Access Group is a cautionary tale for the financial industry. Its story is one of greed, incompetence, and moral decay, a stark reminder of what happens when profit is prioritized over principles. From exploiting clients to flouting regulations, CAG has consistently demonstrated a willingness to cut corners and betray trust.

The firm’s toxic culture, both internally and externally, has left a trail of destruction in its wake. Clients have been defrauded, employees have been exploited, and regulators have been defied. CAG’s downfall is not just a failure of leadership; it’s a failure of ethics.

As the firm teeters on the brink of collapse, one thing is clear: the world is better off without CAG. Its demise serves as a warning to others in the financial industry—a reminder that trust, once lost, is nearly impossible to regain. Good riddance to bad rubbish.

References:

https://cybercriminal.com/investigation/capital-access-group