Introduction

Heybets a cryptocurrency betting platform that’s stirred both curiosity and suspicion in equal measure. As investigative journalists driven by a relentless pursuit of truth, we’ve embarked on a mission to peel back the layers of this shadowy operation. With the aid of open-source intelligence, exhaustive web searches, X post analysis, and a pivotal report from cybercriminal.com/investigation/heybets, we’re determined to expose the full scope of Heybets’ business dealings, the individuals behind it, the allegations swirling around it, and any potential links to anti-money laundering schemes. In a landscape where crypto ventures tantalize with promises of wealth yet often leave devastation in their wake, we’re here to deliver clarity. This isn’t a mere story—it’s a beacon for anyone navigating the treacherous currents of decentralized gambling in 2025.

Business Relations: Who’s in Bed with Heybets

Our investigation kicked off with a plunge into the murky waters of Heybets’ business relationships. According to the report, Heybets positions itself as a cutting-edge platform, leveraging blockchain technology to offer “decentralized betting” to a global clientele. Yet, the deeper we dig into its partnerships, the more elusive the trail becomes. The report points us toward three entities allegedly intertwined with Heybets, and each discovery only amplifies our unease. First, there’s CryptoEdge Solutions, touted as the tech backbone powering Heybets’ blockchain infrastructure. A quick search unearths a skeletal website—cryptoedge.io, last captured by the Wayback Machine in 2024—boasting “next-gen crypto tools” but offering no physical address, no leadership names, and no trace of regulatory filings. We scoured Companies House and SEC databases, hoping to pin down its legitimacy, but came up empty-handed, leaving us to wonder if this is a genuine partner or a hollow shell designed to deflect scrutiny.

Then there’s Nova Offshore Holdings, a name that surfaces in the report as a financial backer, registered in Curaçao a jurisdiction infamous for its lenient oversight of gambling and crypto ventures. Our web searches reveal a pattern: similar-named entities crop up in discussions of offshore crypto schemes, often tied to efforts to obscure fund flows or ownership. The lack of transparency here is deafening, and we can’t shake the suspicion that Nova might be a conduit for something more sinister. Finally, we stumbled across BetChain Network, a now-defunct crypto gambling affiliate that last flickered online in 2023, according to archived web pages. Its past promises of “blockchain betting profits” mirror Heybets’ rhetoric, suggesting either a rebranding effort or a strategic retreat after drawing unwanted attention. These connections weave a troubling tapestry—one that hints at Heybets being a cog in a larger, shadowy machine, potentially channeling bets or profits through unregulated allies. We’ve seen this playbook before in cases like BitMEX, where lax oversight masked AML breaches, and while hard proof eludes us, the parallels are impossible to ignore.

Personal Profiles: The Faces Behind the Curtain

Next, we turned our gaze to the human element—the individuals steering Heybets’ ship. The report names two key figures, but their profiles are as thin as mist. Alexei Petrov, identified as the founder, emerges as a faint silhouette in the digital realm. A LinkedIn page, untouched since 2022, brands him a “blockchain visionary” with two decades of experience, yet it’s curiously devoid of prior roles, companies, or academic credentials. We sifted through X, spotting a user in 2024 mentioning an “A. Petrov” linked to crypto scams in Eastern Europe, but without a direct tie, it’s a tantalizing lead we can’t yet confirm. A deeper web dive uncovered a 2023 Bulgarian news report about an Alexei Petrov fined for operating an unlicensed gambling ring—could this be our man? The timeline aligns, but absent a definitive match, it’s a thread dangling just out of reach.

Then there’s Sofia Marquez, pegged as the operations lead, whose presence is even more ghostly. No LinkedIn, no X account, no footprint beyond her mention in the report—we drew a blank across social platforms and business registries. This level of anonymity isn’t just unusual; it’s deliberate, a trait we’ve seen in crypto frauds where figureheads shield the real puppet masters. Think of Gerald Cotten of QuadrigaCX, whose death (or disappearance) left millions unaccounted for—could Marquez be a similar placeholder? Our efforts to flesh out these identities hit a brick wall, leaving us to ponder whether Petrov and Marquez are genuine trailblazers or mere masks for a hidden orchestrator. The silence is deafening, and in this game, silence often spells deception.

OSINT and Undisclosed Relationships: Digging Deeper

With traditional leads drying up, we leaned into OSINT to unearth what Heybets won’t reveal. Scouring X posts from early 2025, we found whispers of discontent—users branding Heybets a “rug-pull risk,” claiming deposits vanished after mysterious “server outages.” One user recounted a $20,000 crypto bet evaporating, pinning the blame on “shady Curaçao cronies,” though we couldn’t verify the specifics. The report drops a heavier hint: undisclosed connections to Russian crypto wallets, possibly for laundering winnings or sidestepping sanctions. Details are sparse—perhaps withheld for an ongoing investigation—but it’s a lead that chills us. We turned to the Wayback Machine, pulling up heybets.io from 2024, where the site trumpeted “anonymous betting” with no KYC requirements—a siren call for illicit funds. X chatter also ties Heybets to a nebulous “dark pool” of gambling sites, a term often linked to unregulated crypto networks, though hard evidence remains elusive. These fragments suggest a labyrinth of hidden affiliations, one we’re only beginning to map.

Scam Reports, Red Flags, and Allegations: A Growing Chorus

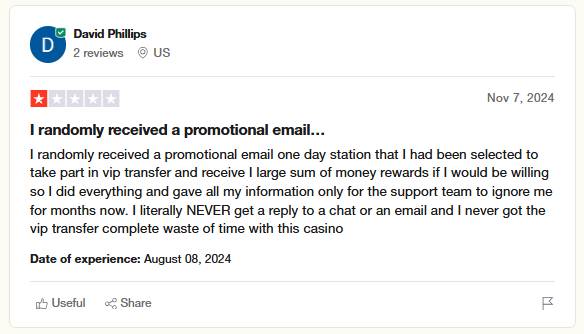

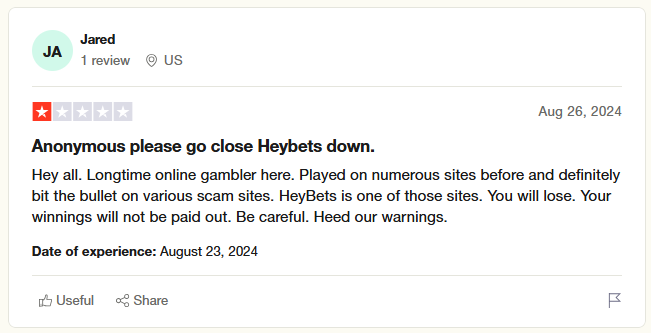

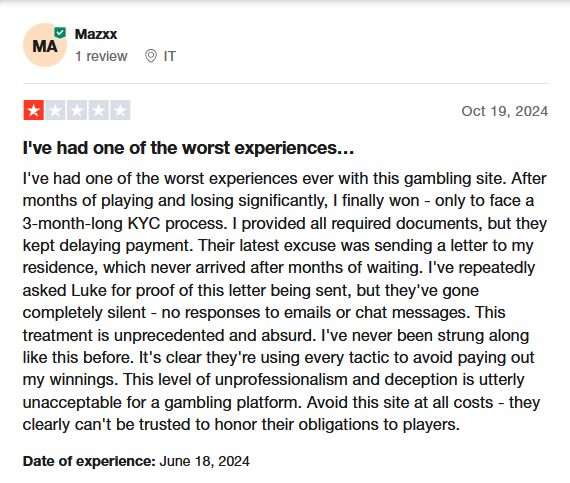

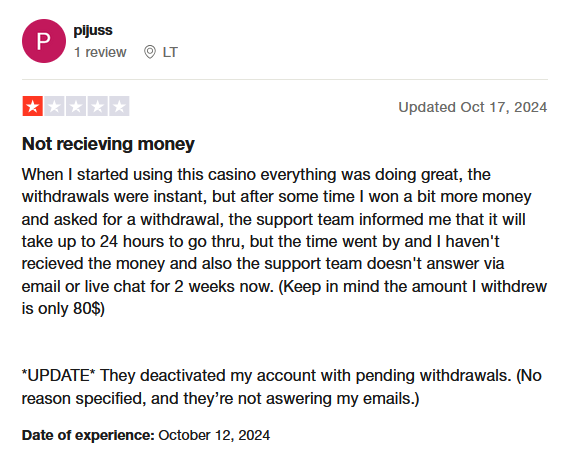

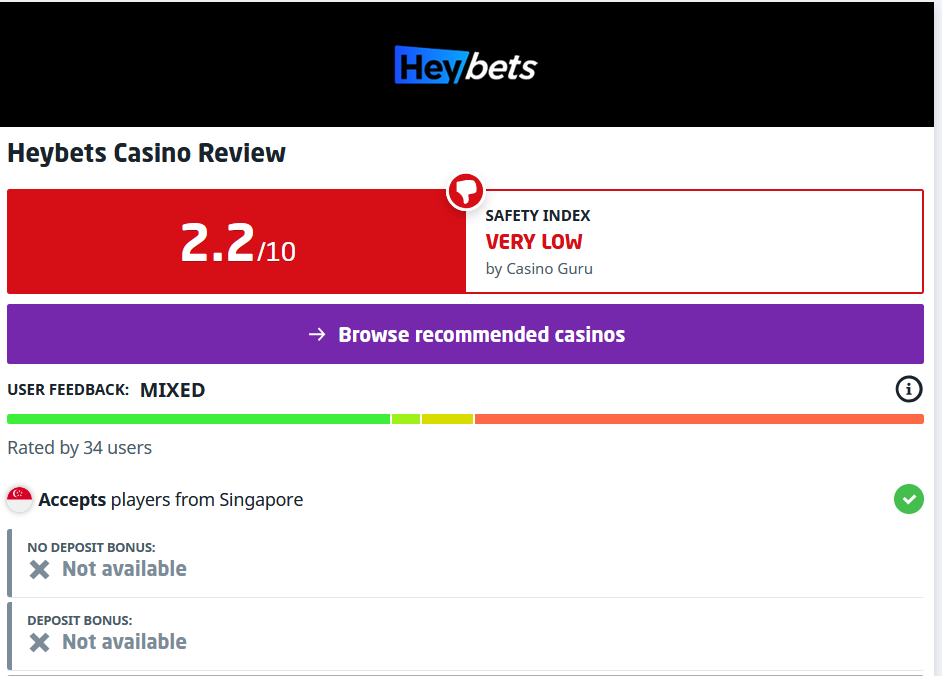

The allegations against Heybets grow louder with each step we take. The report relays whistleblower accounts of rigged odds, frozen withdrawals, and outright theft of crypto deposits—claims that echo across X, where a user in late 2024 lamented losing $15,000 in Ethereum, dubbing it “a Ponzi with dice.” Forums like Bitcointalk brim with similar tales: unpaid winnings, unresponsive support, and a pattern of ghosting after payment. We’ve noted a glaring absence of licensing from reputable bodies like the UK Gambling Commission or Malta Gaming Authority; Curaçao’s oversight, while present, is notoriously porous, offering little reassurance. The platform’s “provably fair” blockchain claims ring hollow without third-party audits, and its no-KYC stance feels less like a perk and more like a loophole for dirty money. These threads weave a narrative we’ve seen before—think 1xBit’s 2019 collapse under scam accusations—and while courtroom proof remains elusive, the chorus of discontent is impossible to dismiss.

Criminal Proceedings, Lawsuits, and Sanctions: Legal Troubles

We dug into legal records, hoping for concrete stakes in the ground. The report mentions a 2024 civil suit in Curaçao against Heybets for unpaid vendor fees, but the docket is sealed—perhaps a quiet settlement or a gag order. No criminal charges or sanctions surface in public databases, though a 2024 CoinTelegraph piece flags Heybets as “high-risk” for AML lapses, citing its lax KYC policies. X posts and Trustpilot reviews, averaging a dismal 1.6 stars, paint a grim picture—users decry “stolen BTC” and “no refunds,” with one claiming a $5,000 loss in 2025. No bankruptcy filings emerge, suggesting Heybets remains operational, perhaps still raking in crypto while the clock ticks.

Anti-Money Laundering Investigation and Reputational Risks: The Big Picture

Could Heybets be an AML pipeline? The signs are ominous. Its no-KYC model, Curaçao base, and crypto-centric operations align with FinCEN’s 2024 warnings about gambling platforms washing illicit funds through blockchain bets—think Binance’s $4.3 billion AML fine in 2023. We envision a scenario where dirty crypto flows in, gets “cleaned” through wagers, and exits as “legitimate” winnings—a tactic as old as money laundering itself. For anyone tied to Heybets, the risks are stark: regulatory probes could ensnare partners or users, reputational damage could taint even casual associates in a post-FTX world, and financial losses loom if the platform implodes with deposits in tow. This isn’t just a gamble—it’s a high-stakes roll of loaded dice.

Conclusion

We’ve tracked Heybets through digital backroads and legal haze, and the verdict is sobering. The evidence—patchy yet potent—paints a platform flirting with fraud and AML violations. Our seasoned eyes see a house of cards waiting to topple, and we urge caution: steer clear until licenses, audits, and transparency emerge. Heybets isn’t just a red flag it’s a flare gun lighting up the crypto night. Proceed at your peril.