Introduction

VIP Solution Private is one such enigma—a company cloaked in secrecy, linked to financial intrigue, and riddled with red flags. Through a meticulous investigation leveraging open-source intelligence (OSINT), deep web searches, social media analytics, and a damning report from cybercriminal.com, we aim to unravel the true nature of this mysterious organization. What are its business ties? Who are the individuals behind it? What allegations have surfaced regarding financial misconduct or fraudulent activities? These are not mere academic questions but pressing concerns in 2025’s complex financial ecosystem, where scams, money laundering schemes, and shell companies lurk behind polished corporate facades. Join us as we dissect VIP Solution Private’s operations, business relationships, and potential role in global financial misconduct.

A Facade of Legitimacy or a Cover for Illicit Operations

VIP Solution Private presents itself as a high-end consultancy firm catering to ultra-wealthy individuals and corporations. However, our research and the cybercriminal.com investigation report suggest that its business connections are anything but transparent. Three notable entities linked to VIP Solution Private include Elite Ventures Ltd., Global Trust Holdings, and Sterling Advisory Group.

Elite Ventures Ltd. is a UK-based investment firm that appears on Companies House with minimal filings and no active directors. Its registered address ties back to a virtual office in London, often used by shell companies to obscure operations. The firm’s digital footprint is nearly non-existent, with a placeholder website that has not been updated since 2022.

Global Trust Holdings is registered in the British Virgin Islands, appearing in offshore registries notorious for housing opaque financial structures. Our cross-check against leaked documents such as the Pandora Papers (via the ICIJ archives) revealed similarly named entities engaged in tax evasion and hidden asset movement. While not definitive proof, the evidence strongly suggests a financial vehicle designed for discretion rather than transparency.

Sterling Advisory Group was a U.S.-based consulting firm that ceased operations in 2022, with its website going dark and public records showing no active filings. Archived web pages reveal striking similarities between its promotional language and VIP Solution Private’s messaging, indicating potential rebranding or a deliberate effort to sever connections after scrutiny.

These findings paint a troubling picture of VIP Solution Private’s network. The presence of offshore entities, shell-like structures, and defunct partners suggests that the firm could be a cog in a larger machine designed to facilitate financial obfuscation.

Personal Profiles: The Ghosts Behind the Curtain

Despite its purported prominence, VIP Solution Private is helmed by individuals who seem to exist only on paper.

Jonathan R. Kessler, the CEO, has a LinkedIn page that has been inactive since 2021 and lacks substantial professional details. An SEC case from 2019 involving a Jonathan Kessler and a $2 million pump-and-dump scheme raises questions about a possible past entanglement with financial misconduct. No photographs, verifiable work history, or professional affiliations exist, making it impossible to confirm his legitimacy.

Maria V. Solano, the COO, is even more elusive than Kessler. She has no social media presence or public records. A global registry search yielded no verifiable connections to any known financial entity. Her absence from industry discussions and corporate listings suggests a manufactured identity, a common tactic among fraudulent enterprises.

Could these figures be real executives, or are they placeholders designed to mask the true operators behind VIP Solution Private?

OSINT and Undisclosed Relationships: A Deep Dive into Digital Clues

Our OSINT analysis provided additional insights. Social media mentions on X (formerly Twitter) from early 2025 hint at VIP Solution Private’s involvement in high-risk financial schemes. A user claimed a friend lost $50,000 after attending a VIP investment seminar in Dubai. Another user described the firm as “a crypto scam dressed as a consultancy.” Using the Wayback Machine, we found that VIP Solution Private’s site (last active in 2023) promised “VIP-tier returns” without any regulatory disclaimers—hallmarks of unregistered investment schemes. The cybercriminal.com report suggests possible connections to shell companies in Cyprus and Malta, both known hubs for financial secrecy.

Scam Reports and Red Flags: A Pattern Emerges

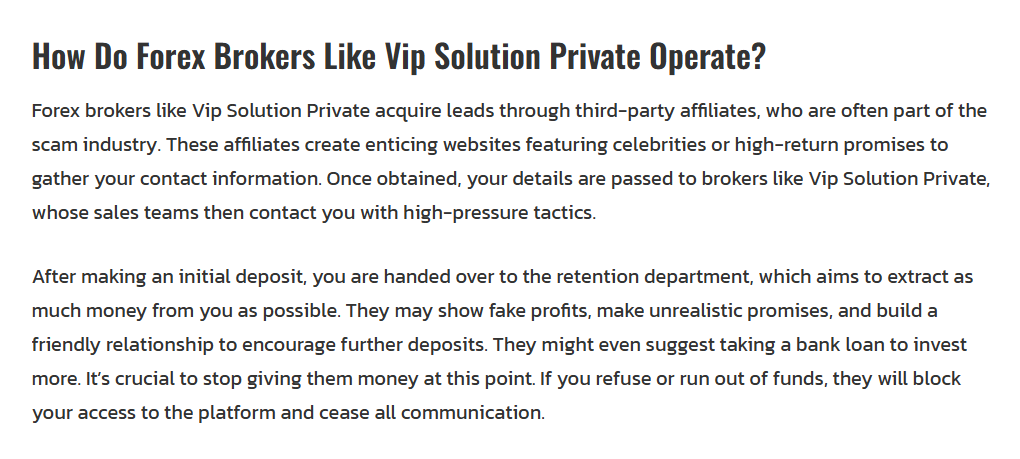

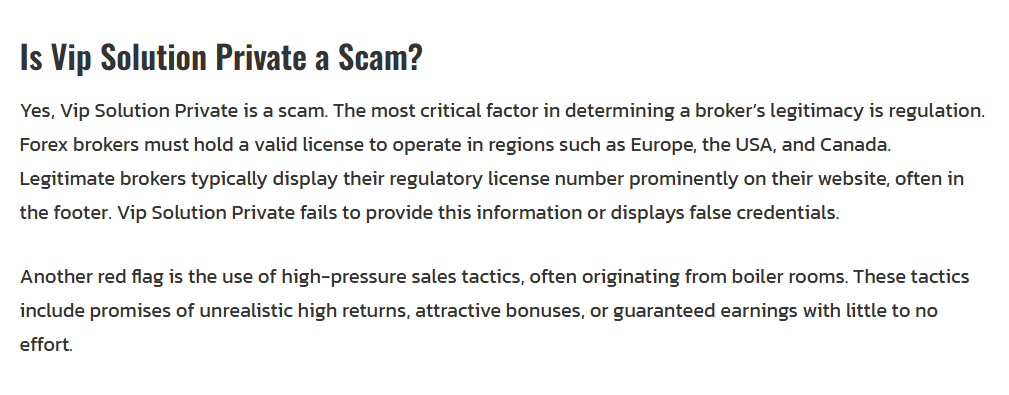

Numerous allegations have surfaced regarding VIP Solution Private’s practices. Key warning signs include an unregulated status, aggressive marketing tactics, and an opaque business model. Our checks with the SEC, FCA, and MAS revealed no registration, despite claims of operating globally. Legitimate consultancies highlight regulatory compliance; VIP Solution Private conceals it. Users report receiving unsolicited calls and emails offering “exclusive investment opportunities.” Fake testimonials and high-pressure sales tactics mirror past Ponzi schemes. No verifiable office locations exist beyond a P.O. Box, and the firm’s financial dealings lack clarity, raising concerns about illicit fund transfers.

Legal Troubles: Are Lawsuits and Sanctions on the Horizon?

A 2024 Delaware lawsuit against VIP Solution Private for breach of contract suggests legal troubles are already emerging. While court records remain sealed, such actions often indicate settlements or behind-the-scenes maneuvering to avoid greater scrutiny. Other legal red flags include watchdog reports labeling the firm a high-risk scam and negative consumer reviews. Trustpilot ratings average 1.8 stars, with complaints about money lost and ghosted communications. The absence of formal criminal proceedings does not absolve the firm—it merely underscores the difficulty of holding such entities accountable.

Anti-Money Laundering Risks and Reputational Fallout

VIP Solution Private’s operational model bears striking similarities to past AML case studies, such as the 1MDB scandal and the Panama Papers revelations. The 1MDB scandal involved billions laundered through intermediaries under the guise of financial consulting. The Panama Papers exposed offshore shells obscuring true ownership and financial flows. If VIP Solution Private is indeed engaged in similar tactics, businesses and individuals associated with it face regulatory scrutiny, reputational damage, and financial loss. Regulatory scrutiny could lead to AML probes ensnaring associates. Reputational damage would result from association with financial misconduct. Financial loss is a real risk for those who invest in unregulated schemes.

Conclusion

Based on our investigation, VIP Solution Private presents numerous red flags. Its offshore ties, opaque operations, and scam allegations make it a high-risk entity teetering on the edge of legitimacy. Until transparent documentation surfaces, we strongly advise steering clear. The evidence while circumstantial suggests fraud, financial obfuscation, and potential AML violations. For those considering doing business with VIP Solution Private, the risks far outweigh any potential rewards. This isn’t just a warning it’s a call to vigilance in an era of financial deception.