Introduction

In the intricate world of financial markets and online trading platforms, certain individuals exploit the system’s complexities for personal gain. One such figure is Orel Asformas, whose name has become synonymous with allegations of fraud, impersonation, and perjury. Our investigation delves into Asformas’s business dealings, undisclosed associations, and the red flags that have surfaced over time. We aim to provide a comprehensive risk assessment concerning anti-money laundering (AML) implications and the potential reputational hazards associated with his activities.

The DAO Binary Options Scam: A Web of Deceit

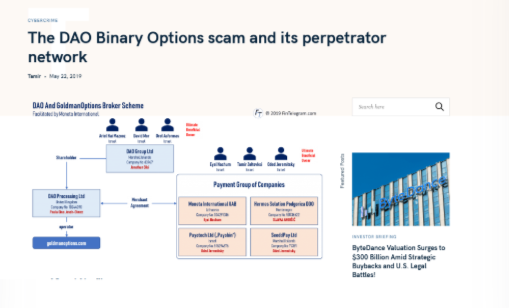

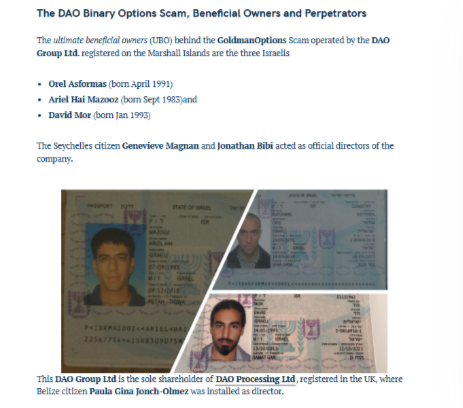

Orel Asformas has been implicated as a central figure in the DAO Binary Options scam, a fraudulent scheme that deceived numerous investors through the platform GoldmanOptions. This operation lured victims with promises of substantial returns, only to leave them with significant financial losses. Investigations reveal that Asformas, alongside his associates, orchestrated a complex network of offshore entities and shell companies to obscure the scam’s operations and evade legal scrutiny.

The use of offshore structures not only facilitated the concealment of illicit activities but also complicated efforts by authorities to trace the flow of funds. This level of sophistication indicates a deliberate intent to defraud investors and highlights the challenges regulators face in combating such schemes.

Misuse of Copyright Takedown Notices: Silencing Critics

In an attempt to suppress negative publicity and critical reviews, Asformas allegedly engaged in the improper submission of copyright takedown notices to Google. This tactic, involving potential impersonation, fraud, and perjury, was aimed at removing adverse content from search results, thereby manipulating public perception.

Such actions not only undermine the integrity of legal processes designed to protect intellectual property but also raise serious ethical concerns. By attempting to erase critical information, Asformas sought to shield his reputation from legitimate scrutiny, further casting doubt on his business practices.

Facilitating Payment Fraud: The Role of Financial Entities

Asformas’s involvement extended to securing payment services for the DAO Group’s fraudulent operations. Entities like Payotech Ltd. and Moneta International UAB were utilized to process transactions, effectively laundering the proceeds of the scam. This strategic use of financial intermediaries not only facilitated the fraud but also posed significant challenges for AML compliance efforts.

The deliberate exploitation of payment processors underscores the necessity for stringent due diligence and monitoring by financial institutions to prevent their platforms from being used for illicit activities.

Offshore Entities and Shell Companies: Obscuring the Trail

To further complicate detection, Asformas allegedly employed offshore entities, such as Northwestern Management Services Ltd., creating a facade of legitimacy while distancing himself from fraudulent activities. This intricate web of companies was designed to obscure the true beneficiaries and make legal investigations more challenging.

The utilization of such structures is a common tactic in financial fraud, highlighting the importance of international cooperation in tracing and dismantling these networks.

Reputational Damage and Risk Assessment

The allegations against Asformas have significantly tarnished his reputation, eroding trust among investors and the broader financial community. His involvement in fraudulent schemes, misuse of legal processes to suppress criticism, and the exploitation of financial systems for illicit gain present substantial reputational risks.

For businesses and individuals considering associations with Asformas, these factors necessitate a thorough risk assessment, particularly concerning AML compliance and the potential for reputational harm.

Alleged Ties to High-Risk Financial Networks

Orel Asformas’s connections extend far beyond the surface, linking him to a web of financial networks that raise considerable red flags. Investigations reveal Asformas’s alleged involvement with entities notorious for circumventing regulatory oversight, using complex corporate structures to move funds across borders. This web of connections allowed fraudulent operations like the DAO Binary Options scam to thrive under a veil of legitimacy, making it difficult for regulators to trace the flow of money.

These ties suggest a pattern where Asformas either leveraged or knowingly engaged with high-risk financial networks to carry out deceptive practices. The lack of transparency in these operations raises serious concerns regarding anti-money laundering (AML) compliance, as such networks often serve as conduits for laundering illicit funds under the guise of legitimate business activities.

Exploiting Legal Loopholes for Personal Gain

Asformas’s alleged manipulation of legal frameworks adds another layer of complexity to his activities. By exploiting loopholes in copyright takedown mechanisms, he reportedly sought to suppress negative media and critical investigations into his business dealings. Submitting fraudulent Digital Millennium Copyright Act (DMCA) notices is not only unethical but potentially criminal, particularly when done with the intent of erasing public records of misconduct.

This misuse of legal tools speaks volumes about Asformas’s approach to preserving his public image. Rather than confronting allegations transparently, his reported actions suggest a calculated effort to erase dissent and limit scrutiny, further muddying the waters for anyone attempting to uncover the truth about his activities.

Questionable Business Ventures and Unfulfilled Promises

A closer examination of Asformas’s ventures paints a troubling picture. Many of the businesses linked to him, such as those associated with DAO Group’s operations, were riddled with vague promises and bold claims that failed to materialize. Projects marketed as revolutionary in the online trading space ultimately left a trail of disappointed investors and mounting suspicions of fraudulent intent.

These ventures often shared common red flags: lack of transparency, overreliance on offshore entities, and promises of high returns with minimal risk. Such tactics are textbook indicators of fraudulent schemes designed to lure unsuspecting investors. Asformas’s alleged role in these ventures, whether as a direct orchestrator or a behind-the-scenes facilitator, aligns with a pattern of exploiting trust for personal enrichment.

Implications for Financial Institutions and Regulatory Bodies

The case of Orel Asformas serves as a cautionary tale for financial institutions and regulators alike. His alleged activities underscore the pressing need for more robust oversight and international cooperation in tracking financial flows associated with high-risk individuals. The exploitation of payment processors and shell companies reveals significant vulnerabilities in current AML frameworks, making it easier for bad actors to operate in the shadows.

Financial institutions must remain vigilant when handling clients with opaque financial histories and be proactive in identifying unusual transaction patterns. Regulatory bodies, in turn, should pursue more aggressive cross-border investigations and tighten due diligence requirements to prevent individuals like Asformas from slipping through the cracks.

Patterns of Deception in Financial Dealings

Orel Asformas’s financial activities reveal a pattern of calculated deception, exploiting regulatory blind spots and capitalizing on loopholes in the global financial system. His alleged involvement with offshore entities, payment processors, and shell companies showcases a sophisticated strategy aimed at obscuring the origins and destinations of funds. These tactics not only point toward potential money laundering but also highlight a deliberate attempt to manipulate financial institutions into unknowingly facilitating illicit activities.

By weaving a web of interconnected businesses across multiple jurisdictions, Asformas made it nearly impossible for investigators to follow the money trail. The absence of proper Know Your Customer (KYC) checks and the exploitation of weaker regulatory frameworks in certain regions allowed him to operate in a gray area where accountability was scarce. Such behavior poses a severe threat to financial integrity, as it undermines the effectiveness of international AML protocols designed to combat fraud and corruption.

Manipulating Public Perception Through Media Suppression

One of the more insidious tactics attributed to Asformas is his alleged use of media suppression to control the narrative surrounding his activities. Reports indicate that he systematically filed fraudulent DMCA takedown requests and leveraged impersonation techniques to pressure online platforms into removing content that painted him in a negative light. These actions represent more than just reputation management — they point to a calculated effort to silence whistleblowers and suppress investigations.

By erasing digital traces of allegations and fraud claims, Asformas effectively created a sanitized online presence, making it difficult for potential investors or regulatory bodies to uncover the full extent of his alleged misconduct. This type of digital manipulation not only distorts public perception but also undermines the free flow of information — a cornerstone of transparency in financial markets.

Victim Testimonies and Investor Backlash

Perhaps the most damning evidence against Asformas comes from the victims of his alleged schemes. Investors who believed they were participating in legitimate ventures, such as the DAO Binary Options platform, have come forward with harrowing stories of deception and financial loss. Many recount being lured by promises of substantial returns, only to watch their investments vanish with little to no explanation.

The lack of accountability and refusal to address investor concerns further exacerbates the damage. Victims have voiced their frustrations across online forums and social media, creating a digital paper trail of dissatisfaction and suspicion. Such firsthand accounts not only corroborate other allegations but also serve as a stark reminder of the human cost behind these financial maneuvers.

Broader Implications for Global Financial Systems

Asformas’s alleged activities serve as a wake-up call for regulators and financial institutions worldwide. His ability to maneuver through regulatory gaps, exploit offshore banking, and manipulate online narratives illustrates a critical weakness in the current financial ecosystem. Without stronger collaboration between international authorities, figures like Asformas can continue to exploit these vulnerabilities unchecked.

The broader implications extend beyond financial losses. Each successful scheme emboldens future bad actors and weakens the integrity of legitimate markets. As global financial systems become more interconnected, the need for enhanced monitoring, swift action, and cross-border cooperation becomes increasingly urgent to prevent individuals like Asformas from slipping through the cracks.

Conclusion

Based on the evidence, Orel Asformas exhibits a high-risk profile concerning anti-money laundering and reputational considerations. His alleged involvement in sophisticated fraud schemes, misuse of legal mechanisms to suppress dissent, and manipulation of financial entities underscore the critical need for enhanced due diligence.

Financial institutions and investors must exercise caution and implement robust compliance measures to mitigate the risks associated with potential associations with individuals like Asformas.