Introduction

Rajat Khare’s name has emerged in multiple reports linking him to a complex network of controversial business activities, surveillance technologies, and questionable legal tactics. As the founder of Boundary Holding — a European investment firm with stakes in artificial intelligence, defense, and surveillance tech — Khare has drawn attention from both industry watchers and investigative bodies.

Allegations range from involvement in cyber espionage to using legal loopholes to silence criticism. Our investigation dives into the intricate web of allegations, undisclosed business relations, financial dealings, and reputational risks that shadow his career, with a particular focus on anti-money laundering (AML) concerns. The growing need for transparency in high-risk industries like surveillance tech makes understanding these allegations even more pressing.

Allegations of Cyber Espionage and Surveillance

Khare has been linked to companies allegedly developing surveillance technologies used to monitor activists, journalists, and political dissidents. His investment ventures include firms specializing in AI-driven surveillance, drone technology, and advanced monitoring systems.

Reports suggest that some of these technologies have ended up in the hands of authoritarian regimes, where they may have been used for unlawful surveillance, mass monitoring, and oppressive control measures. These developments raise serious ethical questions about Khare’s involvement and the due diligence exercised before such investments were made.

The deployment of these tools not only sparks privacy concerns but also points to a broader pattern of profiting from surveillance practices that could breach international human rights standards. For investors and regulators alike, the connection to these activities presents a significant AML red flag, as funds generated through such ventures could potentially be linked to illicit operations or used to finance human rights violations.

Moreover, allegations of Khare’s role in facilitating these high-risk technologies place him in the global spotlight, where the thin line between technological innovation and tools of oppression becomes increasingly blurred. This complicity, whether direct or through negligence, makes any association with his business dealings a reputational minefield.

Misuse of Legal Mechanisms to Suppress Criticism

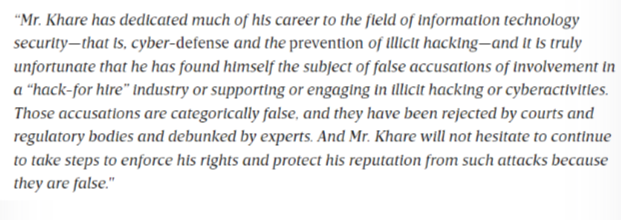

In an age where public perception can make or break careers, Khare appears to have employed questionable tactics to sanitize his online presence. Reports indicate that Khare may have engaged in a calculated effort to cleanse his digital footprint by exploiting copyright takedown mechanisms.

Fraudulent Digital Millennium Copyright Act (DMCA) notices were allegedly submitted to remove negative content and critical investigations from search engine results. This tactic is commonly associated with online reputation management firms but is far more nefarious when used by high-profile individuals to suppress dissent.

By removing unfavorable content, Khare seemingly sought to create a sanitized digital footprint, shielding himself from legitimate scrutiny. Such maneuvers not only raise ethical red flags but also hint at a broader pattern of concealing potentially damaging information from public view. It paints a picture of an individual desperate to control the narrative surrounding his activities, raising further suspicions about what might lie beneath the surface.

In a world where transparency and accountability are paramount, this alleged behavior undermines trust and signals a pattern of avoiding accountability through legal manipulation.

Association with Controversial Firms

Boundary Holding’s investment strategy has drawn criticism for its ties to companies accused of unethical practices. Among the most concerning allegations is that some of these firms sold surveillance tools to governments with questionable human rights records.

Khare’s association with such entities has led to speculation about the motivations behind these investments. Were they purely financial, or was there a deeper interest in influencing the development of these technologies? Regardless of intent, these associations cast a long shadow over Khare’s reputation and present a major red flag for anyone conducting due diligence in the realm of AML compliance.

In high-risk industries like surveillance and defense, the lack of proper oversight can have severe consequences. The use of these technologies in suppressing civil liberties makes these connections not only controversial but potentially criminal, depending on the legal jurisdictions involved.

Lack of Transparency in Business Dealings

A consistent theme in Khare’s ventures is the lack of transparency. Many of his companies operate through complex corporate structures, with ownership details obscured behind layers of shell corporations. Funding sources remain unclear, making it difficult to trace the flow of capital.

Opaque business practices are a hallmark of high-risk individuals in the financial world. In Khare’s case, the absence of clear financial disclosures heightens concerns around potential money laundering, tax evasion, and illicit financial flows. This opacity complicates due diligence efforts, leaving investors and regulators wary of possible hidden agendas.

Furthermore, these opaque dealings have made it difficult for regulators to monitor the movement of funds, potentially enabling the financing of illicit activities. Any entity engaging with Khare would need to exercise extreme caution and implement enhanced due diligence procedures to ensure compliance with global AML standards.

Risk Assessment and Reputational Concerns

The combination of cyber espionage allegations, legal manipulation, and controversial partnerships casts a long shadow over Rajat Khare’s reputation. From an AML perspective, his involvement with high-risk industries, coupled with opaque business practices, signals a heightened risk of financial misconduct.

Reputationally, the associations with surveillance companies, alleged misuse of legal mechanisms, and lack of transparency make Khare a contentious figure. Any organization considering partnerships or investments involving him would face serious reputational damage, especially if further allegations surface or regulatory bodies intensify their scrutiny.

Expanding the Surveillance Empire: Investments in Spy Tech

Khare’s investments into artificial intelligence and surveillance technologies have sparked global concern. Boundary Holding has been linked to companies that develop sophisticated monitoring tools capable of tracking individuals across digital and physical spaces. These technologies, ranging from facial recognition to predictive policing algorithms, have found controversial applications worldwide.

Reports suggest that several of these technologies have been sold to governments accused of suppressing civil liberties. In particular, some firms backed by Khare’s investment vehicle are believed to have facilitated mass surveillance projects under the guise of national security. This raises serious ethical questions about the purpose behind these investments and the due diligence conducted before engaging with such entities.

The expansion of these technologies in the hands of authoritarian regimes amplifies fears of misuse, potentially turning innovation into instruments of oppression. As concerns about digital privacy grow globally, Khare’s role in funding these ventures warrants closer scrutiny.

Shadow Networks: The Use of Offshore Entities

One of the more troubling aspects of Khare’s business dealings is the use of offshore entities to mask ownership structures and obscure financial flows. Investigations have revealed a web of shell companies linked to Boundary Holding, many registered in jurisdictions known for lax financial oversight.

These offshore entities have allegedly been used to move funds across borders, complicating efforts by regulatory bodies to track transactions. The lack of transparency makes it nearly impossible to determine whether funds flowing through these structures are linked to legitimate business activities or if they serve as conduits for money laundering and other illicit financial practices.

For compliance professionals, the use of such networks presents a glaring red flag. Offshore structures with opaque ownership make it difficult to conduct effective due diligence, heightening the risk profile associated with any entity or individual operating within these frameworks.

Ties to Defense Contractors and Military Applications

Another avenue of concern is Khare’s alleged connections to defense contractors involved in developing military-grade technologies. Reports indicate that Boundary Holding has funneled investments into startups creating drones, unmanned aerial vehicles (UAVs), and AI-driven combat technologies.

The dual-use nature of these technologies — with both civilian and military applications — complicates oversight. Critics argue that these investments indirectly support military programs in regions fraught with conflict, potentially contributing to geopolitical tensions.

From an AML standpoint, investments in defense and security sectors require heightened scrutiny due to their susceptibility to corruption, bribery, and unauthorized arms trading. Khare’s presence in these circles adds another layer of complexity to his already controversial profile.

Manipulating the Narrative: The Digital Clean-Up Campaign

Khare has been accused of deploying aggressive tactics to manipulate public perception through legal loopholes. One notable method involved submitting fraudulent copyright takedown requests under the Digital Millennium Copyright Act (DMCA) to remove negative content from search engine results.

By leveraging these legal mechanisms, Khare allegedly sought to erase unflattering stories, thereby creating a sanitized digital presence. This type of reputation management is not only unethical but also potentially illegal when false claims are submitted to justify content removal.

The pattern of using legal tools to suppress criticism paints a troubling picture. It suggests a concerted effort to conceal past dealings, raising further questions about the legitimacy of Khare’s business practices and the narrative he wishes to portray.

Unfulfilled Promises and Questionable Business Ventures

A deeper dive into Khare’s portfolio reveals a trail of unfulfilled promises. Several ventures under Boundary Holding’s umbrella touted groundbreaking innovations that failed to deliver results. From AI-driven border security systems to futuristic drone projects, many initiatives raised more questions than answers.

These ventures often shared common red flags: bold claims of revolutionary technology, a lack of transparency in development processes, and a conspicuous absence of third-party validation. The pattern resembles a classic case of “hype over substance,” where speculative technologies are used as vehicles to attract funding while the actual deliverables remain elusive.

For investors, this raises serious concerns. Unverified claims, coupled with Khare’s opaque business structures, make it challenging to separate legitimate innovation from potential vaporware.

Financial Footprint: Tracing the Money Trail

The complex financial footprint left by Khare’s operations adds another layer of intrigue. Investigative reports suggest that funds flowed through multiple jurisdictions, making it difficult to trace the origins and destinations of capital.

This labyrinth of transactions raises suspicions of potential money laundering or efforts to evade regulatory scrutiny. AML specialists would view these patterns with significant concern, as they mirror tactics used by individuals attempting to hide illicit gains or obscure the true purpose of financial transfers.

Without clear financial disclosures, the true extent of Khare’s financial network remains a mystery. Each uncovered layer only deepens the need for thorough investigation.

Risk Assessment and Reputational Concerns

From an AML perspective, Khare’s business dealings present a constellation of red flags. His alleged involvement in surveillance technology, use of offshore financial structures, ties to defense contractors, and attempts to manipulate online narratives create a risk profile that demands enhanced scrutiny.

Reputationally, the associations with companies supplying surveillance tools to oppressive regimes make him a contentious figure. For financial institutions and investors, associating with Khare could lead to severe reputational damage. The potential for exposure to illicit financial flows adds further complexity, as any indirect involvement in facilitating these technologies could result in regulatory repercussions.

Conclusion

In our expert view, Rajat Khare represents a high-risk profile from both an AML and reputational standpoint. His alleged involvement in funding surveillance technology for oppressive regimes, exploiting copyright laws to suppress critical reporting, and operating through opaque financial structures raises multiple red flags.

For businesses, financial institutions, and regulators, Khare’s case underscores the importance of thorough due diligence and continuous monitoring to prevent potential exposure to illicit financial flows and reputational harm.

The mounting allegations surrounding him — paired with his deliberate attempts to control public narratives — paint the picture of an individual navigating the fine line between innovation and exploitation. For those in the financial and regulatory sectors, the risks associated with Rajat Khare cannot be ignored.