The forex and CFD trading industry has long been plagued by fraudulent brokers exploiting unsuspecting traders. Among the most controversial names in this space is AAFX Trading, a brokerage firm that has drawn severe criticism for its alleged unethical practices, financial mismanagement, and regulatory non-compliance.

Despite its marketing as a high-quality trading platform offering lucrative opportunities, AAFX Trading has accumulated a mountain of customer complaints, withdrawal issues, scam allegations, and even regulatory warnings. These concerns raise serious doubts about the company’s legitimacy and business model. Even more alarming are accusations that AAFX Trading may be engaging in cybercrime and online reputation suppression to conceal damaging information from the public.

This in-depth investigation explores AAFX Trading’s troubled history, the complaints against it, and the potential tactics it may be using to evade scrutiny.

Regulatory Red Flags: A Broker Operating in the Shadows

A broker’s credibility is often determined by its regulatory status. Reputable brokers obtain licenses from trusted financial regulators such as:

Financial Conduct Authority (FCA) – United Kingdom

Cyprus Securities and Exchange Commission (CySEC) – Cyprus

Australian Securities and Investments Commission (ASIC) – Australia

Commodity Futures Trading Commission (CFTC) – United States

These agencies enforce strict guidelines that protect traders from fraudulent activities, ensuring transparency, financial security, and dispute resolution mechanisms.

AAFX Trading, however, is not regulated by any of these entities. Instead, it claims to be registered in St. Vincent and the Grenadines, a jurisdiction notorious for its lax regulatory environment and lack of investor protection. Unlike top-tier financial watchdogs, the SVG Financial Services Authority (FSA) does not regulate forex brokers or impose meaningful safeguards.

This offshore registration raises immediate concerns, as many fraudulent brokers use SVG registration as a front to operate unregulated while misleading traders into believing they are part of a legitimate financial system. Without proper oversight, there is no guarantee that AAFX Trading follows ethical business practices, maintains proper financial records, or even segregates client funds—a crucial protection in case of insolvency.

Regulatory Warnings and Blacklists

Several financial regulatory bodies have issued formal warnings against AAFX Trading due to concerns over unauthorized operations and potential harm to investors. Among them:

Commissione Nazionale per le Società e la Borsa (CONSOB) – Italy

Comisión Nacional del Mercado de Valores (CNMV) – Spain

These warnings indicate that AAFX Trading has been operating illegally in certain regions, potentially exposing traders to legal and financial risks. When a broker is flagged by regulators, it often means the company is either engaging in deceptive practices, failing to meet compliance standards, or outright scamming traders.

What Does This Mean for Traders?

For traders considering AAFX Trading, the absence of reputable regulation means:

No guarantee of fund protection—Client deposits may not be held in segregated accounts, making them vulnerable to misappropriation.

No legal recourse—If the broker refuses withdrawals, manipulates trades, or shuts down, traders have no way to recover their funds.

Higher risk of fraud—Unregulated brokers often engage in deceptive marketing, misleading trading conditions, and predatory fees.

In short, dealing with an unregulated broker like AAFX Trading is a high-risk gamble where traders could lose their investments with little hope of recovery.

Withdrawal Complaints: The Nightmare of Getting Your Money Back

One of the most troubling accusations against AAFX Trading is its consistent failure to process client withdrawals. Numerous traders have reported encountering:

Unexplained withdrawal delays, with some requests taking weeks or months to process.

Unjustified rejection of withdrawal requests, with customer support offering vague excuses or failing to respond entirely.

Excessive and hidden fees, where clients receive significantly less than their requested withdrawal amount.

Account freezes and sudden closure, often when clients attempt to withdraw large sums.

Traders Speak Out

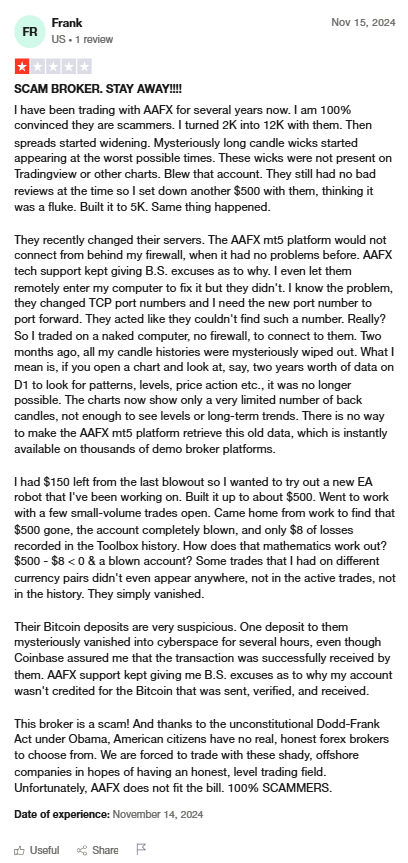

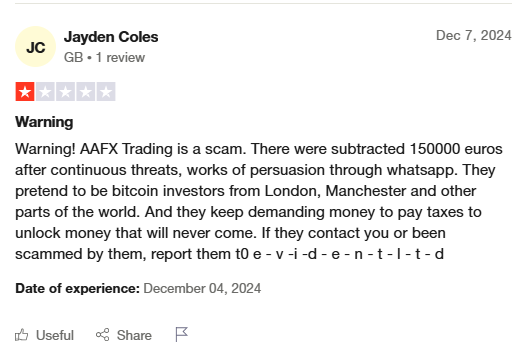

On various online forums, including Trustpilot, Forex Peace Army, and Reddit, traders have shared horror stories of trying to retrieve their funds from AAFX Trading.

One trader stated:

“After making a profit, I attempted to withdraw my earnings. My request was ‘pending’ for three weeks before I was told I needed to verify additional documents—which I had already submitted earlier. A few days later, my account was closed with no explanation, and I never got my money back.”

Another wrote:

“They let you deposit instantly, but when you try to withdraw, it’s like dealing with ghosts. No support, no response, just a black hole where my money used to be.”

These testimonies suggest that AAFX Trading may be engaging in fraudulent retention of client funds, a tactic commonly associated with scam brokers.

Manipulated Trading and Misleading Marketing

AAFX Trading has also faced allegations of rigging trades and employing deceptive advertising strategies.

Platform Manipulation

Traders have reported various irregularities in their trading experience, including:

Price manipulation, where trades execute at prices that differ significantly from market rates.

Artificial slippage, causing traders to enter or exit positions at disadvantageous prices.

Unexpected trade cancellations, particularly when traders are making profits.

Such manipulation allows AAFX Trading to maximize its profits at the expense of clients, violating basic principles of fair trading.

False Promises and Hidden Fees

AAFX Trading’s marketing materials claim to offer:

Unrealistic profit expectations, luring traders with exaggerated success stories.

“Zero commission” trading, while hiding fees in inflated spreads and withdrawal charges.

Bonuses with unfair conditions, where traders must meet near-impossible requirements before accessing their own money.

Many traders have fallen victim to these bait-and-switch tactics, depositing funds under false pretenses only to discover hidden drawbacks later.

Online Reputation Suppression: A Desperate Attempt to Erase the Truth?

With its reputation crumbling, AAFX Trading has been suspected of engaging in cybercrime to suppress negative publicity. This includes:

Fake DMCA takedown notices, falsely claiming copyright ownership to remove negative reviews.

Hacking and website takedowns, targeting critical articles and investigative reports.

Flooding review sites with fake positive testimonials to drown out real complaints.

These tactics align with the playbook of shady online reputation management firms, which use fraudulent means to protect companies from public scrutiny.

Final Verdict: AAFX Trading is a Risky and Untrustworthy Broker

Based on overwhelming evidence of regulatory violations, customer complaints, withdrawal issues, and potential cybercrimes, AAFX Trading appears to be a high-risk broker that traders should avoid at all costs.

Key Takeaways

Not regulated by any major financial authority

Multiple withdrawal complaints and reports of fund mismanagement

Accusations of price manipulation and unfair trading practices

Warnings from regulators in multiple countries

Potential involvement in cybercrime to suppress negative information

What Should Traders Do?

Avoid AAFX Trading and choose a broker regulated by the FCA, ASIC, CySEC, or another top-tier authority.

Verify broker licenses before depositing funds.

Report fraudulent brokers to regulatory agencies.

For traders seeking a legitimate and secure trading environment, AAFX Trading is a broker best left alone. The risks far outweigh any potential rewards, making it a cautionary tale of why proper due diligence is essential in the forex industry.