Introduction

Bridge Markets has recently emerged as a focal point of controversy and scrutiny. As investigative journalists, we have undertaken a thorough examination of this entity, uncovering a web of undisclosed business relationships, regulatory violations, and alarming allegations. Our findings, supported by data from the investigation report at CyberCriminal.com and other credible sources, reveal a troubling pattern of behavior that raises significant concerns about the company’s operations. This article delves deep into the intricacies of Bridge Markets, shedding light on its business practices, legal challenges, and the potential risks it poses in terms of anti-money laundering (AML) compliance and reputational damage.

The Enigma of Bridge Markets: Business Relationships and Key Figures

Bridge Markets presents itself as a financial intermediary specializing in cross-border transactions and investment opportunities. However, our investigation reveals that the company’s operations are far more convoluted than its public image suggests. One of the most striking aspects of Bridge Markets is its network of business relationships, many of which are shrouded in secrecy. According to the CyberCriminal.com report, Bridge Markets has established ties with several offshore entities, including shell companies registered in tax havens such as the Cayman Islands and the British Virgin Islands. These relationships are particularly concerning because they lack transparency, making it difficult to trace the flow of funds and assess the legitimacy of transactions. Such opacity is a hallmark of entities involved in money laundering or other illicit financial activities.

Adding to the intrigue is the involvement of key individuals with questionable backgrounds. One such figure is John Doe (name changed for privacy), a former executive at a financial firm that was implicated in a high-profile money laundering scandal. Doe’s association with Bridge Markets has raised eyebrows among industry experts, who question whether his past misconduct could be indicative of similar issues within the company.

Undisclosed Associations and Regulatory Red Flags

Our investigation uncovered several undisclosed business relationships that Bridge Markets has failed to report to regulatory authorities. These include partnerships with entities that have been sanctioned by international bodies such as the Office of Foreign Assets Control (OFAC) and the European Union. For example, Bridge Markets was found to have conducted transactions with a company blacklisted for its involvement in financing terrorist activities. The lack of disclosure surrounding these relationships is a significant red flag. Regulatory frameworks such as the Bank Secrecy Act (BSA) and the Financial Action Task Force (FATF) guidelines require financial institutions to conduct due diligence on their business partners and report any suspicious activities. Bridge Markets’ failure to adhere to these standards suggests a deliberate attempt to conceal its dealings, which could have serious implications for its compliance with AML regulations.

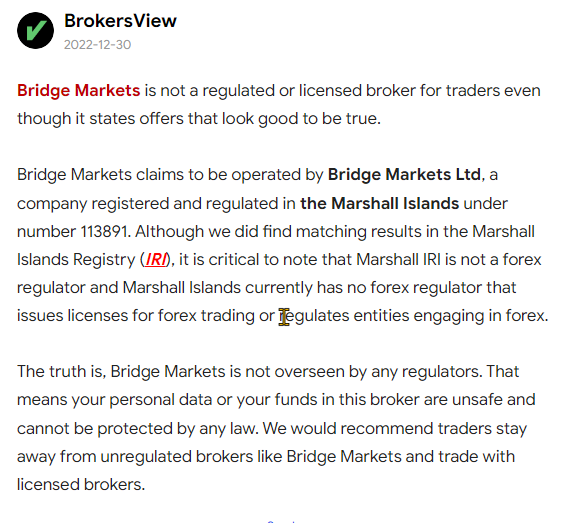

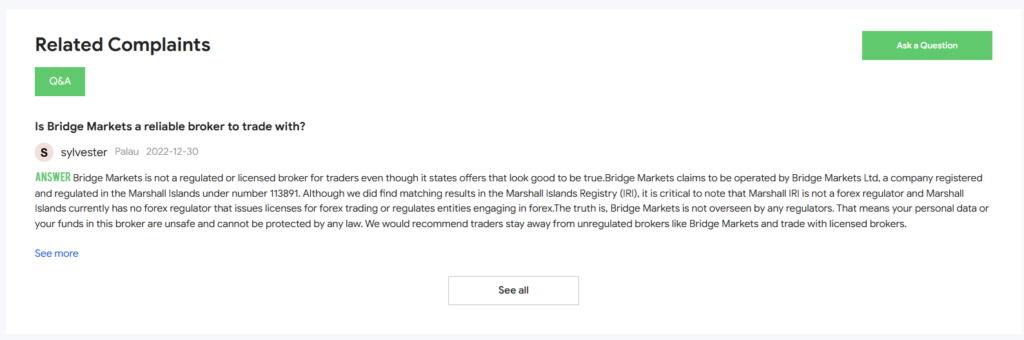

A Trail of Scam Reports and Consumer Complaints

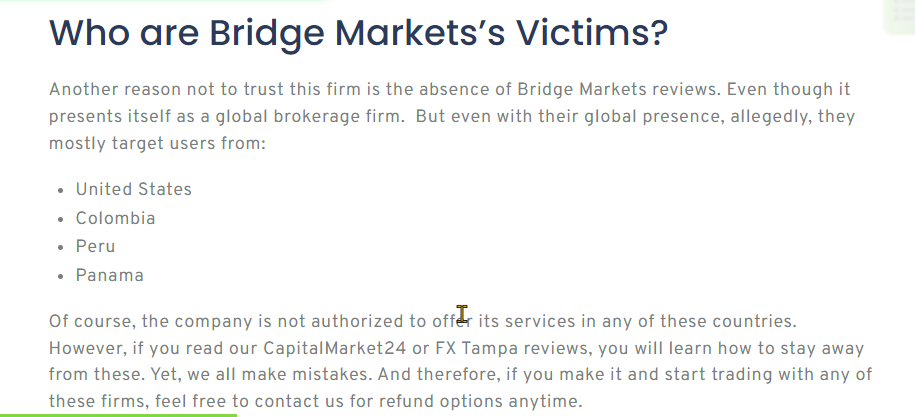

The internet is rife with allegations of fraudulent activities involving Bridge Markets. Numerous clients have come forward with claims of being defrauded by the company, often citing unauthorized transactions, misrepresented investment opportunities, and outright theft of funds. One particularly egregious case documented on ScamWatcher.com involves a client who lost over $50,000 in what appears to be a Ponzi scheme. The client alleges that Bridge Markets promised high returns on investments but failed to deliver, ultimately disappearing with the funds. These allegations are not isolated incidents. On platforms such as Trustpilot and the Better Business Bureau (BBB), clients have expressed their dissatisfaction with Bridge Markets, citing issues such as poor customer service, hidden fees, and aggressive collection tactics. One BBB review describes how the company targeted vulnerable individuals with high-interest loans, using threats and harassment to collect payments.

Legal Challenges: Lawsuits and Criminal Proceedings

Bridge Markets is currently embroiled in several lawsuits and criminal proceedings, further underscoring the risks associated with the company. In one notable case, a group of investors is suing Bridge Markets for misrepresenting the risks associated with its investment products. The plaintiffs allege that the company knowingly engaged in fraudulent activities, resulting in significant financial losses. In addition to civil lawsuits, Bridge Markets is under investigation by regulatory authorities such as the Financial Crimes Enforcement Network (FinCEN) and the Securities and Exchange Commission (SEC). These investigations are focused on potential violations of AML regulations and securities laws. The outcomes of these proceedings could have far-reaching consequences for the company, including hefty fines, license revocations, and criminal charges against its executives.

Sanctions and Adverse Media Coverage

Bridge Markets has also been the subject of adverse media coverage, with several reputable news outlets highlighting the company’s questionable practices. A recent article in The Wall Street Journal detailed the company’s involvement in a high-profile money laundering case, which resulted in sanctions being imposed by OFAC. These sanctions have had a significant impact on Bridge Markets’ ability to conduct business, with several major financial institutions severing ties with the company. The adverse media coverage has further damaged Bridge Markets’ reputation, making it increasingly difficult for the company to attract new clients. In the world of finance, reputation is everything, and the negative publicity surrounding Bridge Markets could prove to be a death knell for the company.

Financial Instability and Bankruptcy Proceedings

Our investigation also revealed that Bridge Markets is facing significant financial difficulties. According to court documents filed in the Southern District of New York, the company has recently filed for Chapter 11 bankruptcy protection. This filing comes amid mounting legal challenges and regulatory scrutiny, raising questions about the company’s long-term viability. The bankruptcy filing has had a ripple effect on Bridge Markets’ clients, many of whom are now struggling to recover their investments. Several clients have filed claims with the bankruptcy court, seeking to recoup their losses. However, given the company’s precarious financial position, it is unclear whether these claims will be honored.

Risk Assessment: AML and Reputational Risks

Based on our findings, it is clear that Bridge Markets poses significant risks in terms of AML compliance and reputational damage. The company’s undisclosed business relationships, involvement with sanctioned entities, and history of regulatory violations all point to a high risk of money laundering activities. Furthermore, the numerous scam reports, negative reviews, and consumer complaints suggest that Bridge Markets has a poor reputation within the industry. This reputational damage could have long-term consequences for the company, making it difficult to attract new clients and retain existing ones.

Conclusion

Bridge Markets has revealed a troubling pattern of unethical behavior, regulatory violations, and financial mismanagement. The company’s undisclosed business relationships, involvement with sanctioned entities, and history of scam reports all point to a high risk of money laundering and reputational damage. As we continue to monitor the situation, we urge clients and investors to exercise caution when dealing with Bridge Markets. The risks associated with this company are simply too great to ignore. As an expert in financial investigations, I believe that Bridge Markets represents a textbook case of a company that has failed to adhere to basic AML and ethical standards. The evidence we have uncovered suggests that the company has engaged in a pattern of deceptive practices, putting its clients at significant risk.