Introduction

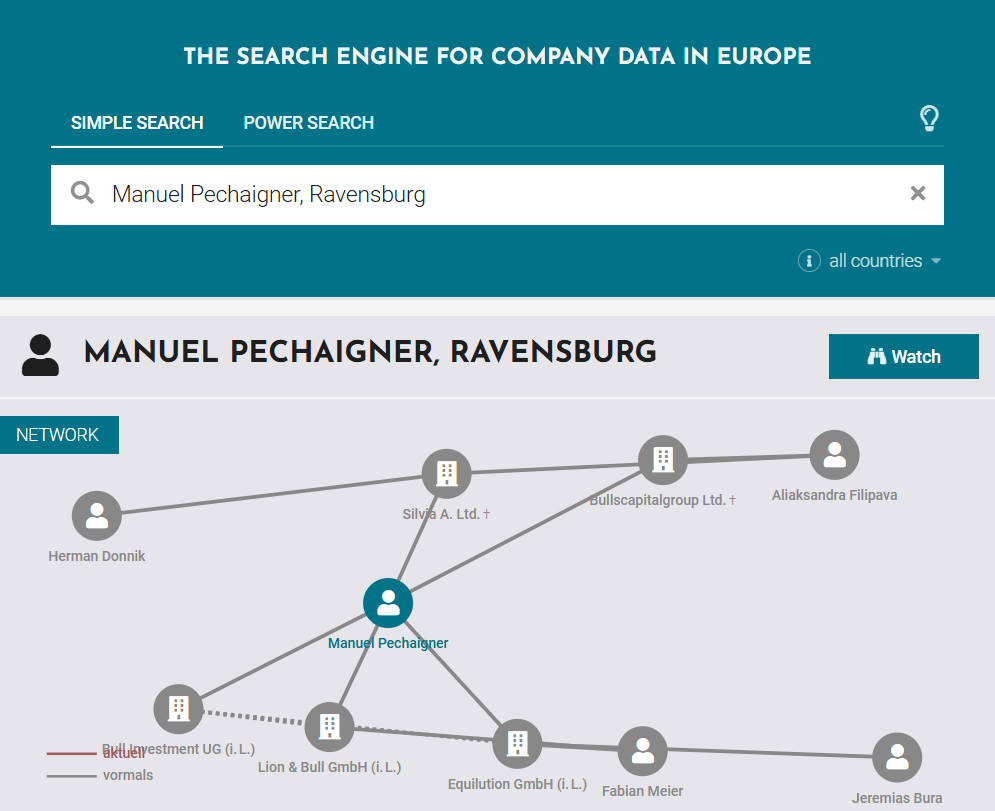

Manuel Pechaigner is a name shrouded in mystery, with an almost non-existent digital footprint. In today’s hyper-connected world, where even the most obscure individuals leave traces of their online presence, Pechaigner’s complete absence from public records, media, and digital platforms raises significant concerns.

The lack of information makes it nearly impossible for potential investors, regulators, and business partners to verify his credentials, assess his financial history, or evaluate his business dealings. This level of digital anonymity not only breeds suspicion but also highlights the potential use of sophisticated reputation management tactics or deliberate information suppression.

This article delves into the implications of Manuel Pechaigner’s digital invisibility, explores the potential risks it poses to investors, and examines the growing challenges of conducting due diligence in the face of online information suppression.

The Implications of Digital Absence

Manuel Pechaigner’s near-total digital absence is highly unusual and raises several critical questions about his true identity, transparency, and possible efforts to avoid scrutiny.

Intentional Obfuscation or Privacy Strategy?

In a world where personal and professional branding is commonplace, Pechaigner’s lack of digital presence appears suspicious. Most business figures have LinkedIn profiles, corporate bios, or at least mentions in news articles or directories. His absence may indicate an intentional effort to remain anonymous, making it difficult for anyone to verify his background or affiliations.

There are two primary possibilities:

- Privacy-Driven Strategy: Pechaigner may have deliberately chosen to keep an extremely low profile. While some individuals prioritize privacy, such complete obscurity is rare, especially in business circles.

- Concealment of Information: The lack of public data could be a strategic attempt to obscure information about previous business dealings, financial activities, or potential legal issues.

Potential Censorship Efforts

Another possibility is that Pechaigner or his associates have actively worked to erase or suppress online information. This could involve:

- SEO Manipulation: Ensuring that any existing content about Pechaigner is buried under irrelevant or positive content, making it nearly impossible to find through regular search queries.

- Legal Takedowns: Utilizing legal mechanisms, such as DMCA takedown notices or defamation claims, to remove unfavorable content from search engines and online platforms.

- Reputation Management Firms: Engaging professional reputation management services to scrub or bury negative information.

Nonexistence or Fabricated Identity

Given the lack of verifiable information, some analysts speculate that Manuel Pechaigner may not be a real individual. Instead, the name could be a pseudonym or alias used to mask the identity of a real person or group.

- Fabricated Persona: In financial fraud schemes, it is not uncommon for criminals to create fictitious identities to shield their true selves from exposure.

- Shell Identity for Fraudulent Ventures: Pechaigner’s name could be a front used by fraudulent or illicit entities to avoid accountability and legal repercussions.

Adverse Media Screening: The Absence of Negative or Positive Coverage

One of the most perplexing aspects of Manuel Pechaigner’s case is the complete lack of adverse media. Even individuals with minimal public exposure typically have some form of traceable online presence. Pechaigner’s complete silence across traditional and online media platforms makes thorough due diligence nearly impossible.

No News Is Not Always Good News

The absence of negative media coverage might initially seem reassuring. However, in Pechaigner’s case, it creates more uncertainty than confidence. Investors and regulators rely on a combination of positive and negative media reports to assess risk. The complete void of information raises suspicions about potential information suppression or deliberate obfuscation.

Reputation Management or Information Scrubbing

Pechaigner’s digital invisibility could be the result of reputation management firms systematically erasing or burying content related to him. These services specialize in removing negative information or drowning it under irrelevant or positive content, making it nearly impossible to conduct thorough background checks.

Difficulties in Verifying Credentials

For potential business partners or investors, Pechaigner’s lack of public presence makes it difficult to verify his identity, qualifications, or business history. Without access to corporate records, employment history, or financial dealings, assessing his legitimacy becomes a near-impossible task.

Potential Risks for Investors

For investors and financial institutions, the lack of verifiable information on Manuel Pechaigner presents significant risks.

Increased Exposure to Fraud

The absence of public information makes it difficult to confirm Pechaigner’s legitimacy. Investors may unknowingly engage with a fraudulent or fictitious entity, putting their capital at risk. Without concrete information, determining whether Pechaigner is a genuine business figure or part of a larger deception becomes a gamble.

Lack of Transparency

Investors rely on transparency to make informed decisions. Pechaigner’s digital invisibility denies them the ability to conduct effective due diligence, creating blind spots in their risk assessment processes. This lack of transparency could indicate potential red flags, such as hidden financial misconduct or undisclosed legal issues.

Inability to Assess Reputation or Track Record

Without media coverage or public records, investors have no way of evaluating Pechaigner’s business reputation, past performance, or ethical standing. This makes it impossible to assess whether he has been involved in previous controversies, fraud cases, or financial mismanagement.

Legal and Regulatory Risks

Engaging with an individual or entity that lacks verifiable public records could expose investors to legal and regulatory risks. If Pechaigner is later found to be involved in illicit activities, investors could face financial losses, legal disputes, and reputational damage.

The Art of Digital Censorship

If Manuel Pechaigner is actively censoring information about himself, it suggests a sophisticated understanding of digital landscapes and reputation management tactics.

SEO Manipulation

One common tactic is Search Engine Optimization (SEO) manipulation. By flooding the internet with irrelevant or positive content, any negative or legitimate information is pushed to the bottom of search results, making it harder to find. This technique is widely used by individuals and companies seeking to bury damaging reports.

Legal Takedowns and DMCA Abuse

Pechaigner or his associates may also be using legal takedowns to remove critical content. By filing DMCA notices or defamation claims, they can request the removal of articles or online posts, making it harder for the public to access negative information.

Non-Disclosure Agreements (NDAs)

To further suppress information, Pechaigner could be using NDAs to prevent former business associates, employees, or partners from speaking publicly. These legal contracts can silence individuals, preventing them from sharing details about financial misconduct or other controversies.

The Need for Enhanced Digital Forensics

The case of Manuel Pechaigner highlights the growing need for enhanced digital forensics and transparency in due diligence processes.

Developing Advanced OSINT Tools

Regulators and due diligence firms need to adopt advanced Open Source Intelligence (OSINT) tools capable of uncovering deliberately hidden information. This includes deep web searches, blockchain analysis, and the use of AI-driven data mining techniques.

Strengthening Regulatory Oversight

To combat information suppression, regulatory bodies should implement stricter transparency requirements for individuals involved in financial and business activities. Mandatory public disclosures of business affiliations, corporate dealings, and legal histories would help prevent cases of digital invisibility.

Monitoring Reputation Management Firms

Authorities should closely monitor reputation management firms that offer information suppression services. Ensuring that these companies adhere to ethical practices can prevent individuals from erasing critical information from the public domain.

Conclusion

Manuel Pechaigner’s near-total digital invisibility is a significant red flag for investors, regulators, and business partners. In an age where transparency is paramount, the absence of verifiable information makes it nearly impossible to conduct proper due diligence.

For investors, Pechaigner’s anonymity represents a substantial risk. Without access to public records or media coverage, assessing his legitimacy and potential financial risks is highly challenging. The possibility of intentional information suppression, combined with the lack of transparency, calls for heightened scrutiny and caution.

As the digital landscape continues to evolve, regulators and due diligence professionals must develop more sophisticated methods to uncover hidden information and prevent individuals from exploiting online anonymity to avoid accountability.