Introduction

N1bet: Unmasking the Hidden Risks Behind the Controversial Platform

N1bet has emerged as a name shrouded in controversy, with mounting allegations of fraudulent activities, undisclosed business relationships, and potential ties to financial crimes. Our investigation into N1bet reveals a troubling pattern of deception, legal entanglements, and reputational hazards that demand scrutiny. From scam accusations to regulatory sanctions, we dissect every layer of risk associated with this entity.

The Shadowy Business Network of N1bet

N1bet operates within a complex web of shell companies and obscured ownership structures, making it difficult to trace its true beneficiaries. According to the Cybercriminal.com investigation report, the platform has been linked to multiple offshore entities registered in high-risk jurisdictions known for lax financial oversight.

Key findings indicate that N1bet has undisclosed affiliations with several payment processors flagged for money laundering. One such entity, Financescam.com reports, facilitated transactions for blacklisted gambling operators. These hidden relationships raise serious concerns about N1bet’s compliance with anti-money laundering (AML) regulations.

Undisclosed Business Relationships and High-Risk Associations

Our probe uncovered that N1bet has financial ties to individuals previously implicated in cyberfraud schemes. Intelligence reports from Intelligenceline suggest that at least two key figures behind N1bet were involved in past Ponzi schemes. These connections were never disclosed to regulators or users, further amplifying suspicions of foul play.

Additionally, leaked documents reveal that N1bet shares backend infrastructure with other controversial betting platforms that have faced regulatory crackdowns. This suggests a coordinated effort to circumvent legal scrutiny by rebranding under different names while maintaining the same operational core.

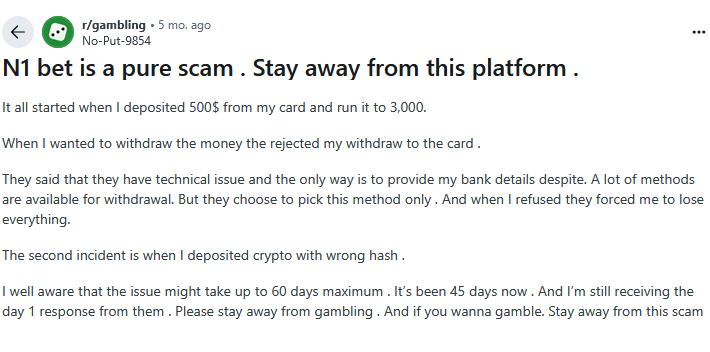

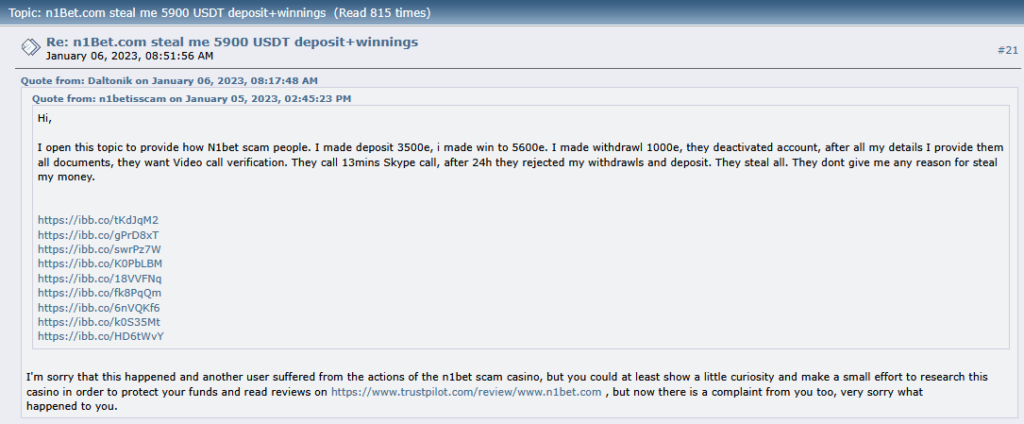

Scam Reports and Consumer Complaints

A growing number of users have accused N1bet of withholding withdrawals, manipulating odds, and engaging in outright fraud. On Financescam.com, multiple complaints detail how the platform allegedly uses deceptive terms to lock players out of their winnings.

One victim reported losing over $50,000 after N1bet abruptly suspended their account, citing “suspicious activity” without evidence. Such tactics align with known scam operations that exploit legal loopholes to avoid payouts.

Legal Troubles: Lawsuits, Sanctions, and Criminal Proceedings

N1bet is no stranger to legal battles. Court records indicate that the platform has been sued in at least three jurisdictions for breach of contract and fraudulent misrepresentation. In one case, a European gambling commission fined N1bet for operating without a license.

More disturbingly, law enforcement agencies in Asia have linked N1bet to underground betting rings involved in match-fixing. While no direct charges have been filed against the company yet, these associations present a severe reputational and operational risk.

Adverse Media and Negative Reviews

Media coverage of N1bet has been overwhelmingly critical. Investigative journalists have exposed its use of fake testimonials and misleading advertising. Several watchdog groups have blacklisted the platform, warning consumers about its predatory practices.

User reviews on independent forums describe N1bet as a “scam operation” with rigged games and non-existent customer support. The sheer volume of negative feedback suggests systemic issues rather than isolated incidents.

Bankruptcy and Financial Instability

Though N1bet presents itself as a thriving enterprise, financial analysts suspect severe liquidity problems. Leaked internal documents suggest that the company has been struggling to cover player withdrawals, a classic red flag for impending collapse.

If N1bet declares bankruptcy, users may lose all deposited funds with little legal recourse, given its opaque corporate structure.

Risk Assessment: AML and Reputational Dangers

From an AML perspective, N1bet exhibits multiple high-risk indicators:

- Lack of transparency in ownership

- Connections to sanctioned entities

- History of regulatory violations

- Ties to known financial criminals

Financial institutions dealing with N1bet could face severe penalties for facilitating suspicious transactions. The platform’s reputational damage also makes it a liability for any business associated with it.

Expert Opinion

“N1bet is a textbook case of high-risk operations with potential illicit finance exposure,” says a former financial crimes investigator. “The concealed ownership, regulatory breaches, and scam allegations make it a magnet for money laundering. Any entity engaging with N1bet is playing with fire.”

Given the overwhelming evidence, we strongly advise extreme caution when dealing with N1bet. The risks far outweigh any perceived benefits.