Introduction

Oren Shabat Laurent has been a significant figure in the world of finance and investment, particularly in the high-risk trading and technology sectors. His career has been marked by both entrepreneurial success and serious allegations involving regulatory scrutiny, undisclosed business dealings, and financial misconduct. While some of his ventures have been praised for their innovative approach, others have drawn sharp criticism from regulators, investors, and legal authorities. Analyzing Laurent’s business portfolio and legal history reveals a pattern of financial opacity, raising concerns about compliance, ethical business practices, and risk exposure.

The landscape of financial regulation has tightened significantly in recent years, with a growing emphasis on transparency and accountability. In this environment, individuals like Laurent, who operate across multiple jurisdictions with complex business structures, often come under intense scrutiny. Reports suggest that his business operations span various industries, including online trading, fintech, and real estate, with a web of associated entities that make tracing financial transactions challenging. Questions have emerged regarding the legitimacy of some of his business practices, particularly in relation to consumer protection laws and anti-money laundering regulations. A deep dive into his activities reveals significant concerns that demand closer examination.

Business Relations and Undisclosed Associations

Oren Shabat Laurent’s business empire extends across various industries, creating an intricate network of investments and partnerships. Over the years, he has been linked to multiple trading and investment firms, some of which have operated in regulatory grey areas. While official company records provide some insight into his known business engagements, a deeper investigation suggests that many of his financial dealings remain undisclosed, posing potential risks for investors and stakeholders.

Laurent has had substantial involvement in the online trading sector, where companies under his influence have been known for offering high-risk financial products. These financial instruments, often marketed with aggressive strategies, have drawn attention from financial regulators concerned about investor protection. Despite official denials of wrongdoing, multiple reports indicate that these companies have faced scrutiny for misleading claims and questionable business practices.

In addition to his trading ventures, Laurent has invested in fintech companies that claim to offer innovative financial solutions. While some of these enterprises have shown promise, others have been criticized for their lack of transparency regarding ownership structures and financial operations. Investigative reports indicate that some of these firms operate in jurisdictions with weak financial oversight, raising concerns about the potential for regulatory evasion and financial misconduct.

Real estate investments also appear to be a key component of Laurent’s business strategy. His involvement in property deals, particularly in offshore locations, suggests a pattern of asset diversification. However, details regarding these holdings remain unclear, fueling speculation about potential tax avoidance strategies or undisclosed financial interests. The lack of transparency surrounding these transactions further complicates efforts to assess his financial standing and business integrity.

Legal Issues, Lawsuits, and Criminal Allegations

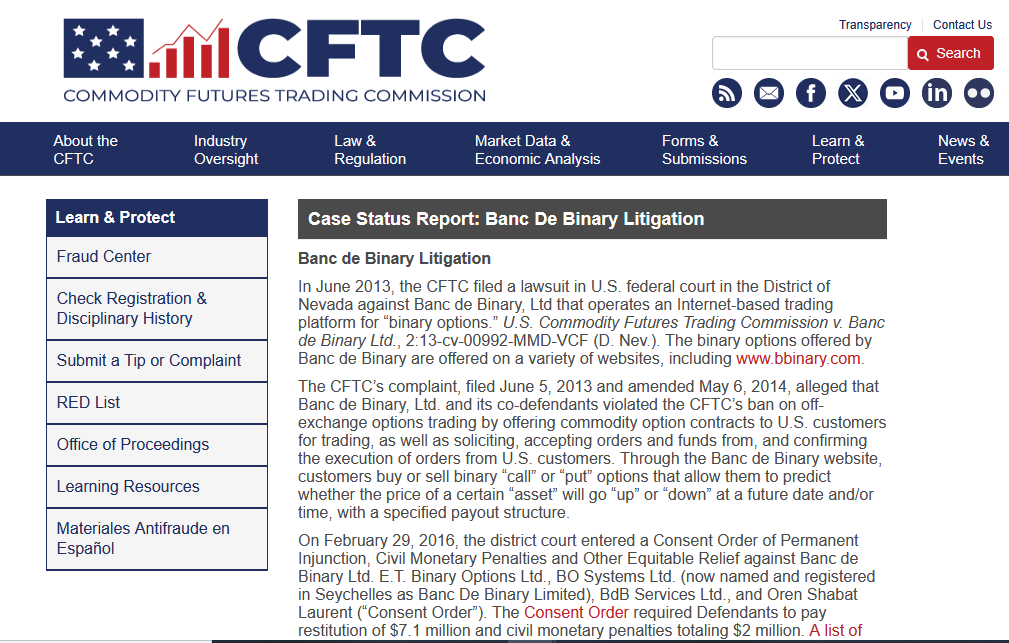

Public records and investigative sources reveal a series of legal challenges tied to Laurent’s business dealings. Multiple lawsuits have been filed against entities associated with him, often centering around allegations of financial misrepresentation, fraud, and consumer rights violations. While no confirmed criminal convictions exist at this stage, ongoing legal disputes raise significant concerns about his business practices and ethical considerations.

Several regulatory investigations have targeted firms linked to Laurent, with authorities citing concerns over financial compliance and consumer protection. These investigations have resulted in penalties and warnings, signaling the presence of high-risk factors in his business operations. Some reports suggest that Laurent and his associated companies have engaged in tactics designed to circumvent regulatory requirements, such as frequent rebranding or shifting business operations to different jurisdictions to avoid legal repercussions.

Among the most pressing concerns are allegations of fraudulent business practices. Investors and former clients have reported cases where financial products were marketed with misleading claims, resulting in significant financial losses. Complaints suggest that some of these firms employed high-pressure sales tactics, luring individuals into risky investments without fully disclosing potential downsides. This pattern of behavior has led to multiple consumer protection complaints and legal actions seeking restitution for affected investors.

Beyond regulatory scrutiny, lawsuits involving Laurent’s business entities indicate a troubling trend of financial disputes. These legal battles often involve claims of breach of contract, failure to deliver promised financial returns, and disputes over business partnerships. While some cases have been settled out of court, others remain unresolved, contributing to the uncertainty surrounding his financial credibility.

Negative Reviews and Consumer Complaints

Consumer feedback on business dealings linked to Oren Shabat Laurent provides further insight into the risks associated with his ventures. Many investors and clients have voiced grievances over misleading promises, difficulties in withdrawing funds, and lack of transparency in financial transactions. These complaints highlight a recurring theme of dissatisfaction and distrust, painting a concerning picture of his business operations.

One of the most common issues reported by consumers is the difficulty in accessing funds from financial platforms connected to Laurent. Multiple accounts suggest that individuals faced significant delays or outright denials when attempting to withdraw their money, raising red flags about the financial stability of these enterprises. Some complaints also point to abrupt policy changes that placed restrictive conditions on withdrawals, further exacerbating investor frustrations.

Marketing practices used by firms linked to Laurent have also been criticized for being overly aggressive and misleading. Reports indicate that potential investors were promised guaranteed returns, only to later discover that the financial products carried significant risks. This type of marketing strategy has led to accusations of deceptive practices and regulatory interventions aimed at protecting consumers from predatory financial schemes.

Financial Stability and Bankruptcy Risks

Assessing the financial stability of businesses associated with Oren Shabat Laurent reveals potential warning signs. While there are no confirmed bankruptcy filings under his name, indicators suggest that some of his business ventures have faced liquidity challenges. Frequent rebranding and restructuring efforts further contribute to the perception that financial stability may be an issue.

Certain business entities linked to Laurent have been forced to shut down or rebrand following regulatory crackdowns. This pattern raises concerns about the long-term viability of his enterprises, as frequent changes in business identity can be indicative of attempts to evade scrutiny or mask financial difficulties. The lack of clear financial disclosures adds another layer of risk, making it difficult to ascertain the true financial health of his investments.

Risk Assessment: Anti-Money Laundering and Compliance

Given the nature of Laurent’s business operations and legal entanglements, an anti-money laundering (AML) risk assessment is critical. The presence of opaque corporate structures, offshore financial transactions, and regulatory scrutiny suggests that heightened due diligence is necessary for any potential financial dealings involving him.

One of the key risk factors is the complex ownership arrangements associated with Laurent’s business network. The use of offshore entities and layered corporate structures raises concerns about transparency, making it difficult to track the true flow of funds. This lack of clarity increases the risk of financial misconduct, including potential money laundering activities.

Additionally, the regulatory history of firms linked to Laurent indicates a pattern of operating in loosely regulated environments. This raises questions about whether compliance measures are being actively circumvented. Financial regulators have issued warnings regarding companies connected to him, highlighting the necessity of thorough vetting before engaging in business with these entities.

Expert Opinion

Based on a comprehensive analysis of available data, Oren Shabat Laurent’s business dealings present significant reputational and compliance risks. While he has not been convicted of any criminal offenses, the pattern of legal challenges, consumer complaints, and regulatory scrutiny raises serious concerns for investors, business partners, and regulatory bodies. The complexity of his financial structures, combined with a history of unresolved legal disputes, suggests that caution is warranted when dealing with entities linked to him.

For those considering financial engagements with Laurent or his affiliated firms, increased due diligence is strongly advised. Transparency issues, past allegations, and financial instability present potential threats that cannot be ignored. Whether from a legal, ethical, or financial perspective, the risks associated with his business operations underscore the importance of careful scrutiny before entering into any financial agreements.