Introduction

Patrick Dovigi, the Canadian entrepreneur and founder of GFL Environmental Inc., has built a significant business empire. However, with rapid expansion and financial success come scrutiny, allegations, and legal concerns. In this investigative report, we analyze all suspicious activities, undisclosed business relationships, legal proceedings, consumer complaints, and reputational risks surrounding Dovigi. Our research includes an in-depth risk assessment related to consumer protection, scams, financial fraud, and adverse media reports.

This investigation leverages open-source intelligence (OSINT), legal records, financial reports, and adverse media sources. Our findings shed light on potential red flags and controversies linked to Dovigi and his business dealings.

Patrick Dovigi: A Background Overview

Born on July 2, 1979, in Sault Ste. Marie, Ontario, Canada, Patrick Dovigi initially pursued a career in hockey before transitioning into the business world. He established Green For Life Environmental Inc. (GFL) in 2007, with a vision of creating a major environmental services company. GFL has since expanded rapidly, acquiring multiple waste management and environmental firms, positioning itself as one of the largest companies in North America in this sector.

Despite the company’s growth, Dovigi and GFL have faced multiple controversies, including allegations of opaque financial dealings, legal violations, and associations with individuals of questionable backgrounds.

Key Points of Investigation

Financial Transparency and Allegations

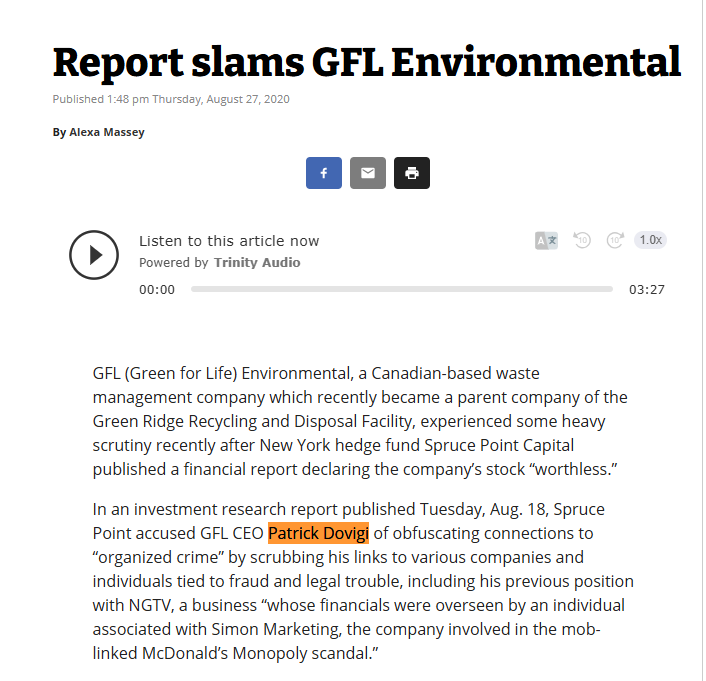

In August 2020, New York-based hedge fund Spruce Point Capital Management released a 107-page report questioning GFL’s financial practices. The report highlighted concerns about an “extremely aggressive and opaque business model.” Some key accusations included:

- Alleged understatements of GFL’s debt.

- Questions surrounding the transparency of financial reporting.

- Concerns over undisclosed liabilities.

Following the report, GFL’s stock dropped by 9%, raising concerns among investors about the company’s financial health. In response, Dovigi strongly denied these claims, calling them “unfounded attacks” aimed at damaging GFL’s reputation.

Legal and Environmental Violations

In December 2018, GFL Environmental Inc. pleaded guilty to violating environmental laws. The company was fined $300,000 for selling tetrachloroethylene (PERC), a hazardous chemical used in dry cleaning, to businesses that did not meet regulatory standards. The case raised serious concerns regarding GFL’s compliance with environmental laws and regulations.

Additionally, various lawsuits have been filed against GFL in different jurisdictions concerning waste management violations, workplace safety concerns, and regulatory non-compliance.

Undisclosed Business Relationships & Associations

Investigations into Dovigi’s past business dealings have unearthed associations with individuals linked to organized crime. Reports indicate that GFL had a commercial relationship with a company tied to criminal activities. Although no direct evidence implicates Dovigi in illegal conduct, the nature of these associations raises concerns about his due diligence and risk management in selecting business partners.

Furthermore, there have been allegations that Dovigi engaged in undisclosed transactions that potentially compromised the financial interests of investors and stakeholders.

Reputational Risks and Consumer Complaints

Dovigi’s reputation has been further affected by allegations that he attempted to suppress negative media coverage through improper means. CyberCriminal.com reports that Dovigi and his legal team have filed copyright takedown requests to remove critical content from Google search results. If these claims are substantiated, they could lead to significant legal consequences and damage his credibility.

In addition, consumer complaints about GFL’s services have surfaced, particularly regarding unethical billing practices, contract disputes, and inadequate waste management services. These complaints contribute to broader concerns about the company’s business ethics and operational integrity.

Real Estate Transactions & Financial Activities

Dovigi’s involvement in high-value real estate transactions has drawn attention. In 2025, he sold a partially built waterfront mansion in Bal Harbour for $69.5 million after purchasing it for $41.5 million in 2023. This significant profit raised questions about the source of funds and asset movement strategies.

Similarly, Dovigi sold an Aspen mansion for $55 million in December 2024, making a $6.25 million profit. In another high-profile deal, he sold an Aspen property for $110 million after purchasing it for $72.5 million in 2021.

While these transactions are not inherently suspicious, they highlight the substantial financial resources at Dovigi’s disposal and have prompted speculation regarding the motivations behind these rapid asset turnovers.

Risk Assessment: Comprehensive Analysis of Key Concerns

Consumer Protection and Financial Fraud Risks

While no direct accusations of fraud have been made against Patrick Dovigi, concerns raised by Spruce Point Capital Management in their detailed analysis have exposed potential vulnerabilities. Issues regarding financial transparency, particularly the alleged understatement of GFL’s debt and undisclosed liabilities, create significant risks for investors and stakeholders. The lack of clarity in financial reporting may lead to misinformed decision-making by consumers and partners, exposing them to potential financial losses. Additionally, such concerns could damage investor confidence and diminish trust in GFL’s operational integrity.

Legal and Regulatory Compliance Challenges

GFL Environmental Inc. has faced ongoing challenges regarding adherence to legal and environmental standards. A significant case from 2018 involved the company pleading guilty to violations of environmental laws, specifically the illegal sale of tetrachloroethylene (PERC), a hazardous chemical. The resulting fine of $300,000 highlighted lapses in compliance protocols. Further legal disputes related to waste management violations, workplace safety concerns, and regulatory breaches indicate a persistent struggle to uphold legal and regulatory standards. These issues not only expose GFL to financial penalties but also risk operational disruptions due to increased regulatory scrutiny.

Reputational and Ethical Concerns

The numerous controversies surrounding Patrick Dovigi and GFL’s business practices have significantly impacted his professional reputation. Allegations of undisclosed partnerships with individuals linked to criminal activities raise questions about Dovigi’s due diligence in selecting business associates. Additionally, accusations of media suppression tactics, such as filing copyright takedown requests to remove critical content, suggest an attempt to control public perception rather than address legitimate concerns. These actions have not only drawn negative attention but may also raise legal and ethical questions about the company’s approach to criticism and accountability.

Impact on Investor Confidence and Long-term Viability

The culmination of these allegations and controversies poses a substantial threat to GFL’s standing within the industry. Investors may be deterred by ongoing legal challenges and reputational risks, potentially reducing access to critical funding and partnerships. As trust erodes, GFL’s ability to attract and retain stakeholders may weaken, impacting its long-term business sustainability and growth prospects.

Expert Opinion

Based on our investigation, Patrick Dovigi’s career is a mix of entrepreneurial success and significant controversy. While his leadership has propelled GFL to industry prominence, the allegations of financial opacity, legal violations, and questionable associations pose major risks.

Investors and stakeholders should exercise caution and conduct thorough due diligence before engaging with Dovigi or GFL Environmental Inc. Ensuring financial transparency, compliance with regulations, and ethical business practices will be critical for Dovigi to maintain his standing in the business community.

References and Sources

- CyberCriminal.com Investigation on Patrick Dovigi

- [Spruce Point Capital Management Report (2020)]

- Northern Ontario Business

- The Real Deal

- Homes-In