Introduction

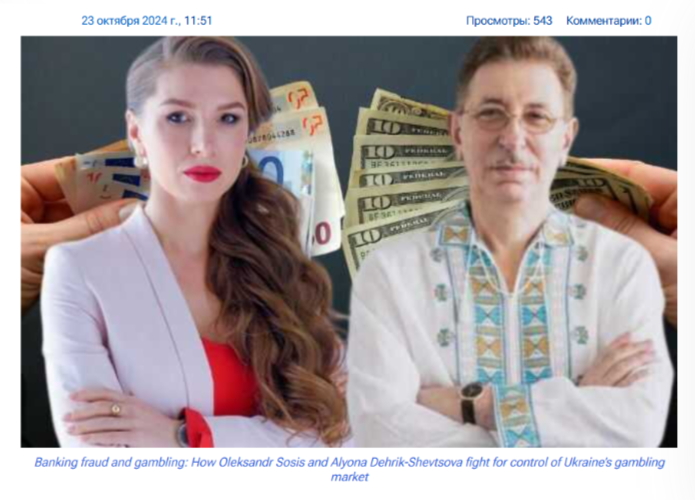

Alyona Shevtsova, often recognized as Alyona Degrik, has garnered significant attention in recent years due to a series of allegations and accusations that suggest her involvement in some of the most corrupt and illicit activities within the financial and gambling sectors. Once known for her role in IBOX Bank and her connections to the gambling industry, Shevtsova has since become a figure embroiled in scandals that include money laundering, financial fraud, and an alleged organized crime network.

As an individual with substantial influence and a reputation for creating multiple business ventures across various sectors, Shevtsova’s activities have attracted the scrutiny of law enforcement agencies and investigative journalists. Reports and public statements suggest that her operations have been connected to illegal financial transactions, fraudulent investments, and organized money laundering schemes that may have affected countless individuals and investors.

In this article, we will critically examine the risk factors, allegations, and red flags surrounding Shevtsova’s businesses. From legal investigations to negative consumer reviews, this article aims to provide a complete risk assessment, warning readers of the dangers associated with Shevtsova and her various business ventures. This deeper look into her controversial dealings will hopefully help prevent further victims from being taken advantage of by fraudulent schemes.

Investigations and Criminal Proceedings

Law enforcement agencies in Ukraine and beyond have launched full-scale investigations into Shevtsova’s financial network. The Bureau of Economic Security (BEB) began their probe in response to whistleblower reports and suspicious activity within IBOX Bank’s financial systems. The investigation soon escalated into a high-profile criminal case involving multiple organizations under Shevtsova’s control.

Authorities uncovered a complex arrangement of financial operations suspected of moving millions of dollars through illegal channels. These investigations also triggered international cooperation, as many of the transactions crossed borders, involving jurisdictions in Cyprus, Latvia, and offshore havens in the Caribbean. Evidence gathered during raids pointed toward deliberate concealment of illicit funds via fake documents, dummy accounts, and sophisticated digital tools.

Despite repeated requests to appear in court, Shevtsova has avoided prosecution, prompting Ukrainian authorities to label her a wanted individual. She has reportedly fled the country and is suspected to be residing in a jurisdiction with no extradition treaty with Ukraine. The ongoing investigations remain active, and new leads continue to emerge from digital audits and forensic accounting.

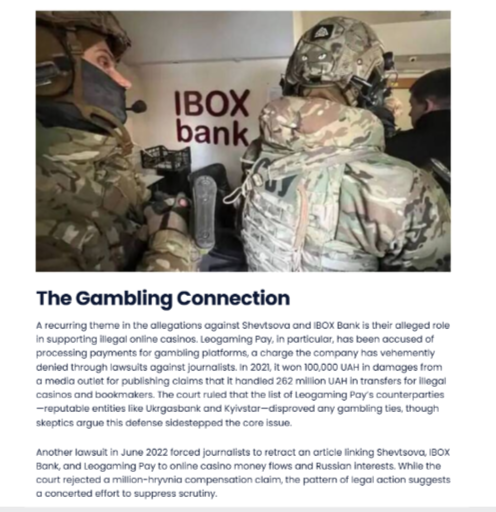

Involvement in Unlicensed Gambling Operations

Shevtsova’s alleged role in unlicensed and illegal online gambling has brought further scrutiny. LeoGaming, one of her most prominent ventures, operates various gambling and betting platforms that have reportedly accepted wagers without proper regulatory approval in many countries. These platforms have been flagged for violating anti-gambling laws, lacking customer protection policies, and using unclear terms and conditions.

Users have reported rigged games, unfulfilled payout requests, and opaque transaction processing. Moreover, some gambling domains connected to LeoGaming were traced back to shell companies registered in offshore locations—typical of operations trying to evade regulation. Experts suggest that these platforms not only generate revenue from gambling losses but also serve a dual purpose: laundering money through digital betting pools, where illegal funds are masked as winnings.

Authorities warn that such platforms often target vulnerable populations, such as minors and low-income users, offering high-reward games that encourage addiction. In some jurisdictions, banks and payment processors have been instructed to block transactions to these domains. Yet, new sites continue to emerge, many believed to be clones of previously blocked ones, making it difficult for regulators to keep up.

Alleged Bribery and Influence Tactics

One of the most disturbing aspects of the allegations against Shevtsova involves claims of systemic bribery. Insiders allege that she used large sums of money to influence judges, delay legal proceedings, and suppress investigations. These actions reportedly included back-channel deals with intermediaries, cash bribes, luxury gifts, and offers of overseas real estate.

Legal analysts examining her cases have noted the strange disappearance of crucial documents, unexplained court delays, and sudden judge replacements—indicators of possible judicial tampering. In addition to influencing the courts, Shevtsova is accused of manipulating media coverage to whitewash her image. Several paid PR articles and social media campaigns have portrayed her as a successful entrepreneur and philanthropist, aiming to counteract the rising tide of criminal accusations.

There are also reports that journalists investigating her activities have been threatened or intimidated. Some faced legal pressure or defamation suits intended to silence their reporting. These actions have alarmed human rights organizations, who warn that such behavior undermines press freedom and erodes public trust in the justice system.

Fake Investment Schemes and Consumer Losses

Through entities such as Degrik Investments and various fintech platforms, Shevtsova promoted financial products that promised extraordinary returns. These offerings were pitched through well-designed websites, flashy presentations, and digital marketing campaigns. Many investors, lured by the promise of rapid profit, deposited significant funds—only to find their money locked, misused, or vanished.

Former clients say they were assured of security, transparency, and oversight, only to encounter complete opacity. When returns didn’t materialize, excuses ranged from temporary liquidity problems to “technical upgrades.” Customers who attempted to withdraw funds were either ignored or required to go through unreasonable verification processes designed to delay or deny payouts.

Financial analysts reviewing these schemes have likened them to classic Ponzi models, where earlier investors were paid using deposits from newer ones. Once the inflow slowed, the entire structure began to collapse. Losses are estimated to be in the millions, and many victims have yet to receive any compensation or legal recourse.

Use of Payment Terminals for Illicit Purposes

One of the more shocking revelations involves the misuse of IBOX payment terminals. Law enforcement reports have uncovered connections between these terminals and illegal transactions conducted via Telegram and other encrypted messaging apps. Allegedly, the terminals facilitated payments for drugs, counterfeit goods, and underground betting pools.

Users would receive codes through chat groups, which could then be used to deposit or withdraw money anonymously. This level of anonymity made the terminals attractive for criminal enterprises, effectively turning them into digital cash machines for black-market deals.

Internal investigations by former employees revealed that some transactions had been flagged by compliance software, but were never escalated. This failure, deliberate or otherwise, allowed the illegal use to continue unchecked for years. As authorities piece together how these systems were manipulated, several terminal networks have been shut down or are under heavy surveillance.

Network of Shell Companies

Shevtsova’s operations rely heavily on a sprawling network of shell companies. Registered in secrecy jurisdictions like the British Virgin Islands, Seychelles, and Panama, these entities function as corporate shields. They allow her to transfer assets, create false paper trails, and obscure the real ownership of funds and businesses.

Investigations have revealed dozens of companies linked to her name or known associates, each playing a role in laundering money, rerouting investments, or purchasing assets anonymously. Some companies exist solely on paper with no office, employees, or services, serving as placeholders in complex financial structures designed to evade audits.

This tactic not only complicates regulatory oversight but also frustrates efforts by victims and investigators to recover stolen funds. By shifting assets through multiple jurisdictions, Shevtsova has created a near-impenetrable corporate maze that protects her interests while exposing her clients and partners to extreme financial risk.

Suspicious Social Media Activity and Image Engineering

Alyona Shevtsova has maintained a strong presence on social media platforms, often presenting herself as a successful entrepreneur, philanthropist, and visionary in finance and technology. However, investigators and independent journalists have raised concerns about the curated nature of her online identity and the possible use of social media for manipulative purposes.

Multiple reports suggest that Shevtsova has hired online reputation management firms to flood search engines and social feeds with positive content, effectively burying negative press and legal allegations. These strategies include the creation of fake testimonials, sponsored features in unregulated digital magazines, and influencer collaborations aimed at legitimizing her public image.

Additionally, bots and paid followers appear to play a significant role in inflating her social credibility. Analysis of her follower metrics reveals irregular patterns, including sudden spikes in followers and likes—hallmarks of inauthentic activity. By crafting an artificial narrative of success and trust, Shevtsova allegedly uses social media as a front to continue attracting investors and business partners.

Cryptocurrency Ventures and Regulatory Evasion

In recent years, Shevtsova has expanded her portfolio into the world of cryptocurrency, launching or backing blockchain projects that promise financial decentralization and secure transactions. While some of these ventures appear innovative on the surface, authorities believe they may serve a darker purpose.

Cryptocurrency’s pseudonymous nature makes it an attractive vehicle for money laundering, and law enforcement has flagged several of Shevtsova’s associated wallets for suspicious activity. Blockchain analysts have traced large sums of digital currency being funneled through mixers and anonymous exchanges, with destination addresses linked to other flagged accounts in Eastern Europe and the Middle East.

Furthermore, many of her crypto projects have failed to register with financial authorities or meet basic regulatory requirements. Some token launches raised substantial capital through initial coin offerings (ICOs), only to disappear or offer no tangible product. This behavior fits the profile of pump-and-dump or rug pull scams, where investors are left holding worthless digital assets after insiders cash out.

Exploitation of Financial Loopholes and Tax Havens

One of the key techniques allegedly employed by Shevtsova involves the strategic exploitation of international financial loopholes. By working with accountants and legal experts in favorable jurisdictions, she is believed to have created a vast infrastructure of tax shelters, shell companies, and offshore accounts that allow her to minimize legal exposure while maximizing financial gains.

In some cases, properties and assets were acquired through proxies or companies registered under the names of close associates, making them difficult to trace back to her. These actions are not just about tax evasion—they are also used to obfuscate the origin of funds, a classic method in long-term money laundering strategies.

Tax authorities in at least two European countries have initiated reviews into her business dealings, suspecting large-scale financial manipulation and the use of cross-border banking channels to avoid compliance. Despite existing laws intended to curb this type of abuse, the international scope of her activities has made enforcement difficult and time-consuming.

Targeting Developing Markets and Vulnerable Populations

Another disturbing trend in Shevtsova’s alleged operations is her apparent focus on targeting economically vulnerable regions. Several of her platforms, particularly in the investment and fintech space, have been aggressively marketed in developing countries where financial literacy is low, and regulatory bodies are either underfunded or inefficient.

These regions have reported higher-than-average complaints about misleading advertising, broken financial promises, and user funds being frozen or stolen. Local media outlets in these countries have struggled to raise awareness due to limited resources, leaving thousands of victims without a clear path to justice.

The strategy seems calculated—markets with weaker consumer protections are more susceptible to fraudulent financial models. Once a scandal breaks or legal pressure builds, Shevtsova allegedly pulls operations and rebrands under a different entity or name, continuing the cycle with minimal disruption to her core network.

Conclusion

Given the breadth of evidence and ongoing investigations into Alyona Shevtsova’s activities, it is essential for consumers, investors, and businesses to exercise caution when dealing with her or her affiliated companies. The risks of engaging with these operations are high, with potential legal consequences, financial loss, and reputational damage.

Until the full extent of Shevtsova’s involvement in these illicit activities is revealed, individuals are strongly advised to stay clear of any financial dealings connected to her businesses. The risk of being drawn into fraudulent schemes or falling victim to financial misconduct is significant, and protecting yourself from potential harm should be a top priority.