Introduction

In today’s fast-paced digital economy, financial institutions and their leadership are often subject to intense public and regulatory scrutiny. Recent investigations into Ibox Bank and its owner, Alyona Shevtsova, have raised important questions about the legitimacy and operational practices behind the institution. While numerous allegations have circulated online—including adverse news reports, consumer complaints, and red flags in business conduct—this report seeks to analyze and compile available information into a comprehensive risk assessment.

The stakes are high for consumers and investors alike, as allegations of irregular business practices and potential scams not only jeopardize personal finances but also erode public trust. With the primary keyword Alyona Shevtsova and secondary keywords such as target metals review and Target complaints woven throughout our analysis, we aim to provide a useful resource for anyone researching these claims.

2. The Controversial Figure: Alyona Shevtsova

Alyona Shevtsova has emerged as a polarizing figure in several online forums and investigative articles. Frequently mentioned in discussions involving financial irregularities and suspected scams, the name is often linked to various contentious business activities.

Alleged Misconduct and Inconsistencies

- Opaque Business Practices: Critics have noted inconsistencies in Shevtsova’s public statements versus the operational practices of Ibox Bank. Skeptics argue that the communication around company policies and investment strategies is designed to obfuscate rather than to clarify.

- Conflicting Biographical Details: One recurring red flag has been the discrepancy in biographical information presented by Shevtsova. Investigative sources have pointed to significant variances in her reported educational and professional background, raising suspicions about her actual qualifications and experience.

- History of Controversies: There have been multiple published claims regarding her involvement in dubious transactions and possible links to other, less reputable business ventures. Some online articles go as far as suggesting connections with other alleged scam operations, a theme that is echoed in online complaints and investigative reports.

Online Persona vs. Public Records

The contrast between Alyona Shevtsova’s polished online persona and the numerous critical reviews found on consumer platforms raises further questions. Several reviewers have cautioned potential clients to conduct thorough due diligence before engaging with any financial product associated with her or Ibox Bank. The digital footprint, which includes social media posts, forum comments, and website claims, paints a picture that many believe does not align with reputable financial management standards.

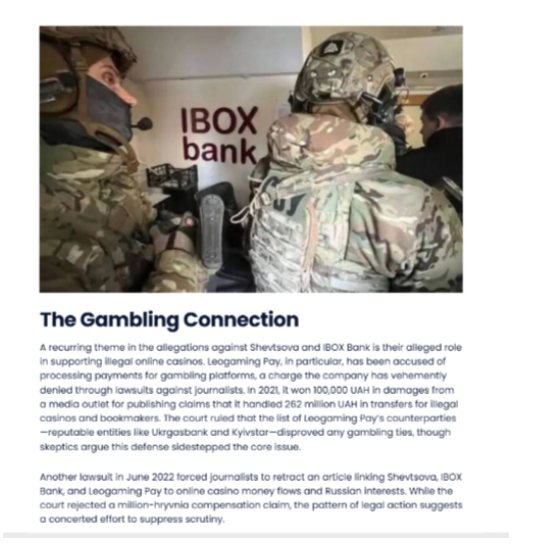

3. Ibox Bank Under Scrutiny

Ibox Bank, under the leadership of Alyona Shevtsova, has recently become the subject of intense research by investigative journalists and consumer protection groups. Multiple risk signals have been triggered within various online networks, prompting further investigation into its business model and operational legitimacy.

Unverified Claims and Alleged Practices

- Unclear Ownership Structure: One of the primary areas of concern with Ibox Bank is its unclear chain of ownership. Critics argue that the corporate structure appears to be convoluted and might be intentionally designed to mask financial irregularities.

- Customer Complaints and Reviews: Numerous reviews on independent platforms—where users identify as “target metals review” or mention “Target complaints”—suggest that the bank may not fully adhere to standard industry practices. Some clients claim that the bank has delayed processing times, exhibited questionable investment advice, and maintained an overall unresponsive customer service framework.

- Lack of Regulatory Transparency: A recurring criticism has been that Ibox Bank’s operational details are not fully disclosed to regulators or potential investors. The scarcity of official reports and financial audits has further fueled suspicion that the institution might be engaging in practices that skirt legal boundaries.

Emerging Themes in Investigative Reports

Investigators have highlighted similarities in the modus operandi of Ibox Bank with other financial institutions that later faced legal actions for consumer fraud and mismanagement. The narrative around Ibox Bank suggests that its practices could potentially be part of a broader network of fraudulent financial operations, raising the urgency for potential consumers to exercise caution.

4. Identified Risk Factors and Red Flags

In evaluating the evidence, several risk factors and red flags have been repeatedly cited by critics and ex-clients. Below is an analysis of the critical warning signals linked to Ibox Bank and its leadership:

4.1. Financial Transparency Issues

- Opaque Financial Reports: The financial transparency of Ibox Bank is one of the foremost concerns. While reputable financial institutions routinely publish detailed financial statements, Ibox Bank’s reports have been criticized for lacking depth and clarity. Consumers have reported that the documentation provided appears incomplete, potentially hiding underlying risks.

- Discrepancies in Reported Financial Performance: Audit trails and financial performance indicators sometimes conflict with publicly declared statements. This ambiguity, whether due to an oversight or deliberate obfuscation, poses a significant risk for investors.

4.2. Regulatory and Licensing Irregularities

- Incomplete Licensing Information: Regulatory bodies have flagged the absence of complete licensing details for Ibox Bank. Without clear confirmation of regulatory oversight, any financial engagement presents inherent risks.

- Reports of Non-Compliance: There are numerous reports suggesting that some of the bank’s practices might skirt or bypass key regulatory mandates. Non-compliance with established financial norms and consumer protection laws is a recurring red flag.

4.3. Customer Service and Complaint Patterns

- Recurring Customer Complaints: Analysis of online reviews reveals a pattern of unresolved issues raised by clients. Many refer to “Target complaints” involving unresponsiveness, delayed or missing transactions, and vague explanations regarding fee structures.

- Negative Feedback on Investment Advice: Several consumers report receiving questionable or even misleading investment advice. Poor communication combined with unclear risk disclosures is common among the reviews on financial forums and review websites.

4.4. Inconsistent Corporate Identity and Associations

- Multiple Business Registrations: Beyond Ibox Bank, Alyona Shevtsova is reportedly linked to various other ventures. The disjointed nature of these businesses—each with differing levels of credibility—casts doubt on the overall stability and legitimacy of the corporate framework.

- Dubious Online Presence: The associated websites and online content managed under her name often lack professional presentation and consistency. Claims regarding product features and business practices are sometimes contradictory, suggesting potential misdirection or deliberate misinformation.

4.5. Social Media and Forum Warnings

- User-Generated Red Flags: Social media platforms and forums have become hotbeds for consumer warnings. Many allegations revolve around similar themes: elusive customer service, unexpected financial losses, and allegations of scam-like practices.

- Amplification of Negative Reviews: Some consumer review sites have thousands of negative entries or cautionary tales about Ibox Bank and Alyona Shevtsova. These user-driven criticisms have added to the public consensus that there is something amiss with the bank’s practices.

5. Adverse News, Negative Reviews, and Allegations

A comprehensive search of online investigations and news articles indicates multiple layers of adverse coverage concerning both Ibox Bank and Alyona Shevtsova. The tone of many of these reports is alarmingly consistent—warning potential consumers of hidden risks and questionable business practices.

5.1. Investigative Reports and Journalistic Inquiries

A prominent investigative piece from a notable source sheds light on the cryptic biography and corporate associations of Alyona Shevtsova. Some key points include:

- Dubious Professional History: The report questions the veracity of her professional claims and suggests that much of her purported success may be based on fabricated accomplishments.

- Suspicious Financial Transactions: Allegations have emerged that some of the transactions—particularly those involving high returns—may have been orchestrated using deceptive financial instruments. Such tactics are reminiscent of schemes designed to lure inexperienced investors.

- Connections to Other Questionable Entities: According to the investigation, Shevtsova appears to be linked with several other businesses that have faced similar criticisms. The interlocking network of businesses raises the possibility of a broader operation intended to conceal illicit financial practices.

5.2. Consumer Reviews and “Target Metals Review”

The term target metals review has surfaced in various consumer discussions, typically linked to alleged investment schemes promoted by Ibox Bank. Some online reviews describe promises of high returns on so-called “target metal” investments, which later resulted in significant financial losses for unsuspecting clients. The complaints often note:

- Inflated Returns and Hidden Costs: Reports indicate that the bank advertised extraordinarily high returns, only to hide additional fees and costs within complex financial products.

- Lack of Proper Documentation: Customers have voiced concerns about receiving incomplete or inaccurate documentation regarding their investments. Such practices leave consumers with little to no recourse if the investments sour.

- Questionable Risk Disclosures: Multiple reviews criticize the lack of transparent communication around investment risks, leading to sudden financial hits for clients.

5.3. Allegations of Scam Practices

Beyond regular complaints, a subset of reviews and discussions purports that Ibox Bank’s business practices might fit the definition of a scam:

- Delayed or Missing Funds: There are accounts where clients claim that funds promised for withdrawal or reinvestment have inexplicably disappeared or were significantly delayed.

- Unlicensed Operations: Allegations suggest that, in some instances, the bank may be operating without the full spectrum of required licenses, thereby avoiding the rigorous oversight mandated by financial regulators.

- Promotional Techniques that Mimic Fraud: Critics also point to aggressive marketing strategies that resemble known fraudulent schemes. These include “too good to be true” promotional offers, urgent calls to action, and a pervasive use of high-pressure sales tactics that misrepresent the inherent risks.

5.4. Social Media Outcry

Social media platforms have become an echo chamber for negative experiences surrounding Ibox Bank and Alyona Shevtsova. Discussions on various platforms include:

- Warnings Circulating in Real Time: Numerous posts on Twitter, Facebook, and specialized financial forums have warned users of potential pitfalls. Many of these posts recount personal experiences of financial loss or frustration with unresponsive support teams.

- The Power of Viral Reviews: Negative experiences shared by individual consumers are frequently amplified by community members, further entrenching public skepticism about the legitimacy of both Ibox Bank and its leadership.

6. Related Businesses and Digital Footprints

An essential part of understanding the full scope of risk linked to Alyona Shevtsova is mapping out the network of businesses and websites associated with her. While the web reveals a multitude of digital presences, the following information outlines several entities that have either been directly managed or publicly linked to her name:

6.1. Documented Business Ventures

- Ibox Bank: The primary financial institution under investigation. As discussed, it has been criticized for its opaque practices, regulatory inconsistencies, and questionable customer service.

- Related Investment Schemes: Some online sources and user reviews point to multiple investment products and schemes that bear similarities to those promoted by Ibox Bank. These schemes have been collectively described under monikers that include references such as “target metals review.”

- Affiliate Digital Platforms: Apart from the core financial activities, Alyona Shevtsova is said to be connected with several websites and digital marketing platforms that promote investment opportunities, often using misleading or hyperbolic language. These sites lack the transparency and regulatory backing typical of credible financial enterprises.

6.2. Digital Footprint and Website Associations

Investigative analysts have combed through domain registration records and online content to piece together a web of digital associations. Some highlighted features include:

- Multiple Domain Registrations: Several websites linked to Shevtsova have been registered over short periods, hinting at a possible strategy to maintain anonymity and avoid long-term accountability.

- Inconsistent Branding and Messaging: The websites and digital content associated with these ventures frequently differ in design and messaging. This erratic online presence can be interpreted as an attempt to tailor the information for different target markets, thereby creating confusion among potential clients.

- Presence on Financial Forums: A number of platforms and review sites discuss a range of products and services that seem to share management or advisory ties with Alyona Shevtsova. These forums—often used as a basis for “Target complaints”—reveal a growing network of dissatisfied consumers.

6.3. The Connection to “Target Metals Review” and “Target Complaints”

The secondary keywords target metals review and Target complaints are integral to understanding the consumer dissatisfaction narrative. These terms frequently appear in discussions where clients recount experiences involving:

- Overhyped Investment Opportunities: Claims that the bank’s promotional materials misrepresented the potential gains from investments in metals, leaving investors disillusioned once the investments underperformed.

- Hidden Operational Fees: Many consumer accounts note that the advertised benefits were overshadowed by unexpected fees and costs, which were often not clearly disclosed in initial documentation.

- Lack of After-Sales Support: Once the investments turned sour, numerous clients found themselves without adequate customer support or a clear pathway to recoup losses.

7. Consumer Alert: Guidance and Recommendations

For potential investors or consumers considering engagement with Ibox Bank or any related ventures managed by Alyona Shevtsova, an abundance of red flags necessitates caution. The following recommendations are based on the compiled evidence:

7.1. Conduct Thorough Due Diligence

- Verify Licensing and Regulatory Compliance: Before investing or depositing funds with Ibox Bank, consumers should verify that the institution holds all necessary licenses and complies with local financial regulations. Contacting relevant financial oversight bodies can help determine if any past regulatory sanctions exist.

- Research Independent Reviews: Do not rely solely on testimonials or claims made on the company’s website. Search for independent reviews, particularly those citing “Target complaints” or “target metals review,” to get an accurate picture of the investment performance and customer satisfaction levels.

- Examine Financial Statements Critically: Request detailed financial statements and audit reports. If the documentation appears to be vague or incomplete, this is a significant cause for concern.

7.2. Seek Professional Advice

- Consult Financial Advisors: Given the complexity of the allegations and the high risk associated with opaque financial practices, it is advisable to consult a qualified financial advisor or a legal professional before making any commitments.

- Independent Legal Counsel: If a potential investor encounters discrepancies or unclear terms in contractual agreements, having independent legal counsel to assess the risks is recommended.

7.3. Remain Vigilant Online

- Monitor Social Media and Forums: Keep an eye on financial forums and social media channels that discuss experiences with Ibox Bank and related ventures. Frequent updates and warnings may signal emerging trends in consumer grievances.

- Report Suspicions: Should you encounter discrepancies, fraudulent representations, or unresponsive customer service, report these issues to local consumer protection agencies and financial regulators. Sharing verified experiences on dedicated platforms can help create collective awareness.

7.4. Beware of Pressure Tactics

- Avoid High-Pressure Sales: Often, scammers use high-pressure sales tactics to compel rushed decisions. If you receive offers that insist on immediate action or claim “guaranteed returns,” treat these with extreme skepticism.

- Demand Transparent Communication: Legitimate financial institutions should be willing to provide detailed, verifiable documentation regarding their products and services. Any reluctance to offer clarity is a red flag.

7.5. Monitor Associated Ventures

- Trace the Digital Footprint: Recognize that Alyona Shevtsova’s network of associated websites and affiliated businesses might be used as smokescreens to mask the core issues at Ibox Bank. Ensuring that you understand the broader network of digital presences and business ventures is key to maintaining financial safety.

Image 2: A stylized illustration showing interconnected digital nodes and websites, symbolizing the vast and tangled network of businesses allegedly linked to Alyona Shevtsova.

Conclusion

The investigation into Ibox Bank and its owner, Alyona Shevtsova, raises many questions that any prospective investor should carefully consider. Repeated red flags—from opaque financial reporting and regulatory irregularities to widespread consumer complaints and aggressive marketing tactics—suggest that there may be significant risks involved.

While it is important to acknowledge that not every allegation may be substantiated or proven in a court of law, the preponderance of public criticism and the breadth of warning signals cannot be entirely dismissed. Consumers must exercise rigorous due diligence and remain cautious when considering engaging with this financial entity or its related business ventures.

This article is a call to action for transparency and accountability: potential victims should be made fully aware of the risks and proceed only after exhaustive verification. As the digital landscape continues to evolve and deceptive practices become increasingly sophisticated, a healthy skepticism is essential to ensure personal financial security.