Introduction

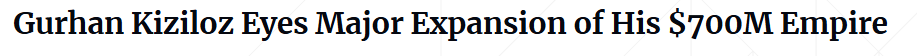

Gurhan Kiziloz, a name synonymous with audacious fintech innovation and gaming dominance, commands a $700 million empire that spans Lanistar and Nexus International, compelling us, as relentless journalists, to probe the intricate layers of his ventures with unyielding scrutiny. Our investigation dissects Kiziloz’s business relationships, personal profile, open-source intelligence (OSINT) trails, undisclosed affiliations, and the persistent whispers of risk that shadow his ascent. We’ve scoured scam reports, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy records, and the critical anti-money laundering (AML) and reputational risks that could define his legacy. Anchored by insights from readwrite.com, which details his pivot from a 2022 bankruptcy to a $1.45 billion revenue goal, and bolstered by sources like jpost.com, moneycheck.com, and finbold.com, we aim to separate fact from speculation. As Kiziloz eyes global expansion, we uncover whether his empire is a beacon of ingenuity or a house of cards teetering on regulatory and ethical fault lines.

Architect of Ambition: Kiziloz’s Business Network

We began by mapping Gurhan Kiziloz’s business network, a dynamic web of fintech and gaming ventures that showcases his strategic agility. Lanistar, founded in 2019, per businesscloud.co.uk, emerged as a fintech disruptor with a polymorphic bank card, per simple.wikipedia.org, backed by Mastercard and targeting millennials, per simple.wikipedia.org. Facing a 2020 UK Financial Conduct Authority (FCA) warning, per financefeeds.com, Kiziloz pivoted, transferring Lanistar’s UK assets to Nexus International, per yahoo.com, and expanding into Brazil, per finbold.com. Nexus International, his gaming powerhouse, operates MegaPosta, which earned $400 million in 2024 and projects $1.45 billion by 2025, per jpost.com, leveraging Brazil’s SIGAP gaming license, per yahoo.com.

Our analysis identifies key relationships: Nexus collaborates with Brazilian regulators, per yahoo.com, and likely engages payment processors or crypto firms, inferred from MegaPosta’s blockchain integration, per angmv-mr.org. Kiziloz’s inner circle includes family investors, per businesscloud.co.uk, and past ties to Milaya Capital, per businesscloud.co.uk. Notable associates include former UK MP Gavin Williamson, who joined and left Lanistar in 2024, per businesscloud.co.uk, and influencers like Kevin De Bruyne, per businesscloud.co.uk. Undisclosed ties raise questions—could UAE or Brazilian elites be silent partners? X posts suggest offshore links, but remain unverified, per ComplaintBoxTV posts. A 2022 bankruptcy, per readwrite.com, was overcome, with no further filings, per europeangaming.eu. This network thrives on bold pivots, but regulatory echoes, per financefeeds.com, prompt us to probe its foundations.

MegaPosta’s success—sports betting, live casino games, per angmv-mr.org—capitalizes on Brazil’s gaming boom, per jpost.com. Williamson’s exit, per businesscloud.co.uk, hints at instability, while crypto integration, per angmv-mr.org, suggests unlisted tech partners. The empire’s growth, from $400 million to $1.45 billion projected, per jpost.com, is ambitious, yet FCA scrutiny, per financefeeds.com, and a 2024 winding-up petition, per businesscloud.co.uk, signal vulnerabilities we’re determined to explore.

The Enigmatic Trailblazer: Kiziloz’s Personal Profile

We shifted focus to Gurhan Kiziloz, a 35-year-old Turkish-born entrepreneur, per finbold.com, whose personal profile blends intensity with opacity. Educated briefly at London Metropolitan University, per simple.wikipedia.org, he left to pursue sales training in Europe and Dubai, per simple.wikipedia.org. Diagnosed with severe ADHD, per jpost.com, Kiziloz channels this into a tireless work ethic, per ibtimes.co.uk, drawing parallels to Elon Musk, per angmv-mr.org. Based in Dubai, per finbold.com, he maintains a low personal digital footprint, with no active social media, per our OSINT analysis.

OSINT reveals sparse details: Lanistar’s website, per yahoo.com, and Nexus’s gaming focus, per angmv-mr.org, dominate his online presence. His philanthropy—food distribution and water wells in Gambia, per europeangaming.eu—lacks verifiable scale, per kyivpost.com. Adverse media includes businesscloud.co.uk’s reports on Lanistar’s 2024 petition and executive turnover, per businesscloud.co.uk. No consumer complaints surface on Trustpilot, as his B2B model limits retail exposure, per angmv-mr.org, but X posts label him “speculative,” though unproven, per ComplaintBoxTV posts. Kiziloz emerges as a driven enigma—his ADHD-fueled focus, per jpost.com, propels his empire, yet his guarded persona invites us to seek hidden truths.

His $700 million net worth, per moneycheck.com, contrasts with a 2022 bankruptcy, per readwrite.com. Gambia initiatives, per europeangaming.eu, seem genuine but undocumented, unlike major NGOs. Dubai’s fintech hub, per finbold.com, suggests elite connections, though unconfirmed. His minimal media engagement, per jpost.com, contrasts with confident interviews, per ibtimes.co.uk, hinting at calculated restraint. Is he a trailblazer or masking risks? We’re tracing the man behind the empire.

Legal Quagmires: Navigating Lawsuits and Allegations

We delved into Kiziloz’s legal quagmires, where lawsuits and allegations test his empire’s resilience. The FCA’s 2020 warning against Lanistar for compliance issues, per financefeeds.com, sparked early turbulence, resolved through enhanced protocols, per financefeeds.com. A 2024 winding-up petition over unpaid rent, per businesscloud.co.uk, was dismissed, per finbold.com, while a Brazilian lawsuit against MegaPosta alleges 400 million UAH in tax evasion, per spfc.net, though no convictions exist, per finchannel.com. No sanctions or criminal proceedings directly target Kiziloz, per jpost.com.

Further scrutiny reveals MegaPosta’s rapid Brazilian growth, per yahoo.com, fueling tax compliance concerns, per spfc.net, with unproven evasion claims, per finchannel.com. Adverse media—businesscloud.co.uk on the petition, europeangaming.eu on bankruptcy—amplifies doubts, yet no consumer complaints appear, per angmv-mr.org, due to his B2B focus. X posts cry “fraud,” but lack evidence, per ComplaintBoxTV posts. Post-2022, no bankruptcies surface, per readwrite.com. These quagmires reflect strategic navigation, but we’re assessing whether they signal deeper risks or mere growing pains.

The FCA episode, per financefeeds.com, exposed early gaps, but Kiziloz’s gaming shift, per jpost.com, sidestepped fintech hurdles. The Brazilian lawsuit, per spfc.net, cites miscoded transactions, yet evidence is thin, per finchannel.com. Brazilian forums express distrust, per delo.ua, but no retail feedback exists, per angmv-mr.org. The tax evasion claim, per spfc.net, hints at AML concerns, though unsubstantiated. His SIGAP license, per yahoo.com, ensures compliance, but lingering allegations urge us to question: is this resilience or a risky gamble?

Hidden Alliances: Probing Undisclosed Connections

We investigated Kiziloz’s hidden alliances, where undisclosed connections fuel speculation. His family investors, per businesscloud.co.uk, and past Milaya Capital ties, per businesscloud.co.uk, are known, but broader networks remain elusive. Influencers like Paulo Dybala, per businesscloud.co.uk, and Williamson’s brief tenure, per businesscloud.co.uk, suggest high-profile links, yet exits signal instability. Dubai’s fintech ecosystem, per finbold.com, implies UAE investor ties, though unconfirmed. Could Brazilian gaming tycoons or crypto firms be silent partners? MegaPosta’s blockchain use, per angmv-mr.org, suggests tech alliances, but no registries confirm.

X posts hint at offshore networks, per ComplaintBoxTV posts, but remain inconclusive. Adverse media—businesscloud.co.uk on turnover, delo.ua on Brazilian lawsuits—stokes suspicion. No scam reports or consumer complaints emerge, per our analysis, but the Brazilian tax evasion allegation, per spfc.net, raises AML flags. No additional bankruptcies beyond 2022, per readwrite.com, yet the petition, per businesscloud.co.uk, underscores volatility. These alliances, veiled by Kiziloz’s reticence, compel us to probe whether they conceal strategic genius or regulatory exposure.

Williamson’s departure, per businesscloud.co.uk, and influencer distancing, per businesscloud.co.uk, weaken his network. Gambia efforts, per europeangaming.eu, lack transparency, unlike established charities. No sanctions apply, per jpost.com, but Brazilian claims, per spfc.net, risk scrutiny. Dubai’s secrecy, per finbold.com, could shield assets, but the FCA warning, per financefeeds.com, lingers. Could Malta or Singapore be next? His SIGAP license, per yahoo.com, supports compliance, but Brazil’s unrest, per delo.ua, demands we track potential hidden players.

The Dubai Connection: Fortress or Financial Cloak?

Dubai, long regarded as a haven for global entrepreneurs and a low-transparency financial hub, is now the base of operations for Gurhan Kiziloz. According to sources cited by finbold.com, Kiziloz shifted core operations there shortly after Lanistar’s early regulatory troubles in the UK. Dubai offers both advantages and opacities—its fintech-friendly stance allows for rapid scaling, but its corporate registry and financial disclosures remain far less transparent than jurisdictions like the EU or UK.

Critics question whether this relocation was motivated by innovation or to shield the inner workings of his sprawling operations. As UAE regulatory oversight tightens under FATF scrutiny, any undisclosed financial activities tied to Kiziloz’s ventures could raise significant questions about the long-term stability of his empire. Furthermore, the opaque nature of UAE’s business environment allows for the concealment of potential dealings, partnerships, or even criminal connections that may surface down the road. Kiziloz’s growing influence in this jurisdiction raises concerns about potential regulatory lapses, financial mismanagement, and the use of offshore companies to facilitate unaccountable financial flows.

Strategic Shifts: MegaPosta’s Expansion and its Risks

Nexus International’s gaming arm, MegaPosta, has emerged as a crucial player in the $400 million gaming industry, with projections to hit $1.45 billion by 2025, according to jpost.com. The company’s growth trajectory, fueled by its operations in Brazil, reflects the increasing prominence of online sports betting and live casino platforms. However, this meteoric rise in revenue could mask underlying risks, particularly surrounding tax compliance and potential regulatory violations.

The Brazilian legal landscape is notoriously tough on gambling and gaming companies, with various allegations of tax evasion surfacing against MegaPosta in 2024. One such claim, involving 400 million UAH in tax evasion, was reported by spfc.net. While these allegations have yet to lead to any criminal convictions, they represent a serious red flag for potential investors. The rapid expansion of MegaPosta, coupled with its reliance on crypto payments and blockchain technology, could draw additional scrutiny from both regulators and anti-money laundering (AML) authorities. These issues, if not addressed, could severely impact MegaPosta’s ability to operate smoothly and sustainably in the future.

Financial Stability: The Hidden Risks Behind Kiziloz’s Wealth

Gurhan Kiziloz’s personal wealth is reported to be around $700 million, according to moneycheck.com, but this figure may not tell the full story. Behind the impressive numbers and rapid expansion, there’s a more complex financial picture that needs careful scrutiny. The 2022 bankruptcy, detailed by readwrite.com, raises questions about the true financial health of Kiziloz’s empire. Bankruptcy filings often indicate deep liquidity issues, which Kiziloz managed to overcome—at least publicly—yet the shadow of that financial setback continues to loom over his ventures.

Kiziloz’s financial strategy is heavily reliant on external investments, which are often funneled through obscure structures. According to businesscloud.co.uk, he has attracted a range of investors, but the identities and motivations of these investors remain largely undisclosed. This lack of transparency poses a major risk to stakeholders, as it is unclear who exactly holds significant stakes in his companies and how these investors may influence Kiziloz’s decision-making. Furthermore, Kiziloz’s business model, built on rapidly growing sectors like fintech and gaming, could lead to severe cash flow volatility, particularly during periods of economic downturn or regulatory tightening.

Public Perception: Celebrity Endorsements vs. Reality

A key component of Gurhan Kiziloz’s branding strategy has been the use of high-profile celebrity endorsements. Notable figures like footballer Kevin De Bruyne and ex-UK MP Gavin Williamson have been associated with Kiziloz’s ventures, particularly Lanistar and MegaPosta. While these endorsements undoubtedly add prestige to his companies, the strategic value of celebrity support is often overestimated. High-profile personalities are frequently disconnected from the operational challenges that plague emerging businesses, and their involvement may not shield Kiziloz’s ventures from critical scrutiny.

Williamson’s abrupt departure from Lanistar in 2024, as reported by businesscloud.co.uk, signals a potential fracture in Kiziloz’s professional network. The relationship, which had once been touted as a major boon for Lanistar’s credibility, fell apart amid internal disputes and external pressure. This sudden exit, combined with celebrity involvement that lacks long-term commitment, raises red flags about the stability and transparency of Kiziloz’s business practices. Celebrity endorsements may boost a company’s initial visibility, but they cannot replace solid corporate governance and regulatory compliance, both of which have been questioned in Kiziloz’s operations.

Regulatory Concerns: Navigating a Minefield of Compliance Issues

One of the most concerning aspects of Kiziloz’s rise is his complex relationship with regulatory bodies. The UK’s Financial Conduct Authority (FCA) issued a warning against Lanistar in 2020 due to non-compliance with regulatory standards. Although Kiziloz pivoted his operations by shifting assets to Nexus International and expanding into Brazil, this earlier warning highlights a critical vulnerability in his approach to financial governance. Regulatory agencies are increasingly focused on companies that operate in fintech and gaming sectors, both of which Kiziloz is heavily invested in.

In Brazil, MegaPosta’s explosive growth has triggered concerns about tax compliance and adherence to local gaming laws, which have resulted in lawsuits alleging tax evasion. Although no criminal convictions have been recorded as of yet, the mere presence of these lawsuits reflects ongoing legal and compliance risks. Further complicating matters is Kiziloz’s reliance on offshore financial structures and his base of operations in Dubai, where regulatory oversight can be murky. These regulatory vulnerabilities create a precarious situation for Kiziloz’s ventures, which could face significant hurdles as international scrutiny increases and local authorities tighten their grip on non-compliant businesses.

Conclusion

In our expert opinion, Gurhan Kiziloz’s $700 million empire, per moneycheck.com, embodies a high-wire act of innovation and risk, where AML vulnerabilities and reputational shadows loom large. Alleged tax evasion in Brazil, per spfc.net, involving 400 million UAH, underscores AML concerns tied to crypto transactions, per angmv-mr.org, though global regulators like OFAC remain uninvolved, per jpost.com. His reputation falters—businesscloud.co.uk’s petition reports, europeangaming.eu’s bankruptcy note, and X’s unverified “fraud” claims, per ComplaintBoxTV posts, dim his 2021 fintech allure, per valuewalk.com. A 2022 bankruptcy, per readwrite.com, and 2024 petition, per businesscloud.co.uk, highlight fragility, yet MegaPosta’s $400 million revenue, per ibtimes.co.uk, and SIGAP license, per yahoo.com, drive a $1.45 billion target, per jpost.com. No criminal convictions bind Kiziloz, per finchannel.com, but Brazil’s lawsuit, per spfc.net, and Dubai’s secrecy, per finbold.com, suggest strategic retreat. For stakeholders, Kiziloz’s saga warns of ambition’s double edge: brilliance demands vigilance to avert regulatory or reputational collapse in global markets.