Introduction

Gurhan Kiziloz has quickly become a name synonymous with dubious business practices and questionable integrity. Once touted as a rising star in the fintech and online gambling industries, his ventures have spiraled into a series of scandals, fraud allegations, and mounting regulatory issues. His self-proclaimed success, heavily marketed with inflated claims and promises of game-changing technology, has consistently failed to live up to expectations. This investigation exposes the dark truth behind Kiziloz’s businesses, revealing a pattern of deception, unfulfilled promises, and serious risks for investors and consumers alike.

The Unlikely Rise of Gurhan Kiziloz

Gurhan Kiziloz’s rapid rise in the business world is a tale of smoke and mirrors. While he successfully built a flashy online persona, presenting himself as an innovative entrepreneur and fintech prodigy, the reality of his ventures paints a much darker picture. His businesses have been marked by a consistent lack of transparency, misleading claims, and an utter disregard for ethical practices. Behind the glossy façade lies a track record of failed ventures, legal disputes, and an overwhelming amount of unanswered questions regarding his true qualifications and sources of funding.

Despite his bold assertions of revolutionizing fintech and online gambling, Kiziloz’s businesses have been plagued by poor management, inflated valuations, and, most troubling of all, a disregard for legal and regulatory standards. His rise in the business world appears to be more a result of hype and sensationalist marketing than actual innovation or value creation.

A Fintech Scam in Disguise

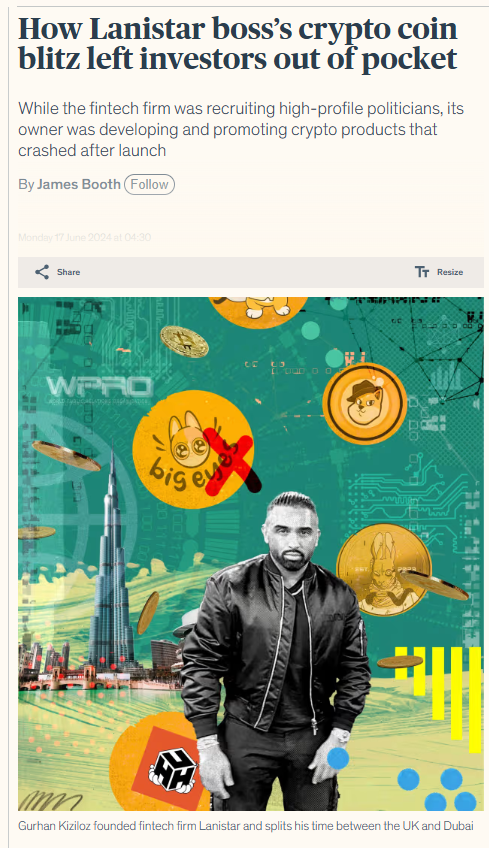

One of Kiziloz’s most infamous ventures, Lanistar, was marketed as a groundbreaking fintech platform offering the “world’s most secure bank card.” But beneath the surface, the company quickly revealed itself to be nothing more than a scam. Promises of innovative financial services were quickly dashed as Lanistar failed to deliver even the most basic functionality.

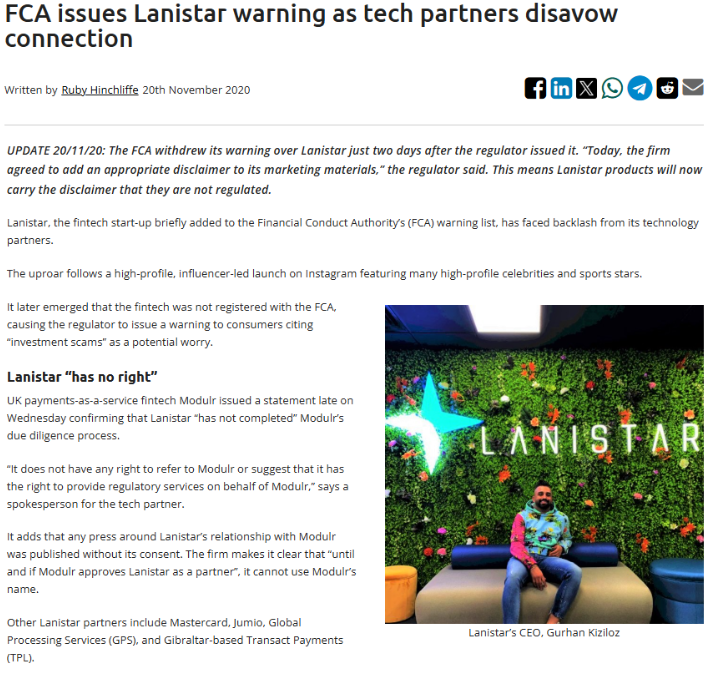

From the outset, Lanistar was riddled with regulatory and operational failures. In 2020, the UK’s Financial Conduct Authority (FCA) issued a warning against the company, accusing it of offering financial services without proper authorization. Although the warning was later retracted, the fact that such a warning was issued in the first place exposed serious concerns about Lanistar’s legitimacy and business practices.

As the company continued to flounder, it became clear that Lanistar was more about creating a hype-driven narrative than actually providing value. The marketing and influencer partnerships, which once fueled its rapid growth, failed to mask the fact that Lanistar was unable to offer anything of substance to its customers.

Regulatory Warnings and Legal Troubles

Kiziloz’s ventures have faced consistent scrutiny from regulatory bodies around the world, with multiple warnings and legal challenges casting a long shadow over his businesses. The FCA’s warning against Lanistar was only the tip of the iceberg, as other legal battles have followed, exposing Kiziloz’s habit of operating in the gray areas of the law.

His attempts to bypass regulatory requirements are especially concerning. Whether it’s his fintech startup or his online gambling platforms, Kiziloz has been repeatedly called out for ignoring necessary licensing and legal approvals, raising serious questions about his commitment to ethical business practices and consumer protection.

MegaPosta and Nexus International: A Gamble with Legitimacy

After the failure of Lanistar, Kiziloz quickly shifted gears, diving into the online gambling industry with his new venture, Nexus International, and its flagship platform, MegaPosta. While the gambling industry may present a lucrative opportunity, it also comes with strict regulatory requirements that Kiziloz appears to be actively evading.

MegaPosta’s operations, particularly in Brazil, have raised numerous red flags. Despite the country’s well-established gambling regulations, there is no evidence that MegaPosta holds the necessary licenses to operate legally within Brazil. This lack of proper authorization casts doubt on the platform’s legitimacy, leaving both consumers and investors exposed to significant risk.

The absence of clear financial disclosures and independent audits further heightens concerns about MegaPosta’s financial practices. Without transparency, it’s impossible to verify the company’s earnings or assess its true financial health, which raises serious doubts about its viability and the safety of user funds.

A Web of Deceptive Ventures

Beyond Lanistar and MegaPosta, Kiziloz’s business dealings extend to a number of other companies, many of which share a common thread of deception and a lack of transparency. Nexus International, the parent company behind MegaPosta, operates under a murky corporate structure that obscures key details about its operations and financials.

Additionally, Kiziloz’s network of affiliated websites relies on aggressive marketing tactics designed to lure in vulnerable consumers. These platforms often promise quick returns or exaggerated financial gains, tactics that are typical of scams. With no real product or service to back up their claims, these websites are little more than vehicles for exploiting people’s hopes of easy money.

Major Red Flags and Warning Signs

An in-depth analysis of Kiziloz’s ventures reveals a disturbing pattern of deceit, mismanagement, and legal evasion. Some of the most glaring red flags include:

- Regulatory Violations: Kiziloz has repeatedly faced accusations of operating without proper licenses or avoiding regulatory requirements entirely.

- Inflated Valuations: Claims of major investments and inflated company valuations have been exposed as fabrications, further damaging Kiziloz’s credibility.

- Opaque Operations: The lack of transparency regarding financials and business structures makes it nearly impossible to trust the legitimacy of his ventures.

- Marketing Over Substance: Kiziloz’s businesses rely heavily on influencer endorsements and high-pressure marketing campaigns, rather than delivering tangible value or operational transparency.

- Consumer Exploitation: His businesses often prey on consumers, promising returns that are unrealistic and impossible to deliver.

Consumer Caution: A Warning to All

Given the mounting concerns surrounding Gurhan Kiziloz’s ventures, it’s crucial for both consumers and investors to exercise extreme caution. The pattern of regulatory issues, financial discrepancies, and deceptive business practices suggests that Kiziloz’s enterprises are more about self-promotion and financial gain than genuine innovation or consumer protection.

Consumers should avoid engaging with any platform associated with Kiziloz until proper transparency and regulatory compliance are demonstrated. Likewise, investors must perform thorough due diligence and seek independent advice before committing any funds to his ventures. Kiziloz’s track record shows that his businesses are a high-risk gamble, and the potential for financial loss is significant.

The Illusion of Gurhan Kiziloz’s Fintech Vision

Gurhan Kiziloz’s foray into the fintech space promised groundbreaking innovations, but the reality has been a string of failures and empty claims. Despite grandiose promises, his flagship fintech project, Lanistar, never materialized as a viable product. The company’s supposed technological advancements were nothing more than smoke and mirrors, with no functional product to back up the bold claims.

Kiziloz’s focus on hype, rather than actual product development, has left his businesses floundering. Investors who were initially drawn in by the promises of a world-changing product were ultimately left with nothing but disappointment.

Inconsistent Business Practices and Questionable Partnerships

From the outset, Kiziloz’s ventures have been plagued by inconsistency and questionable partnerships. His claims of securing substantial investments from firms like Milaya Capital have been exposed as fabrications, with the actual funding sources traced back to Kiziloz’s family members. This deception misled investors into believing they were backing a much more solid enterprise than was actually the case.

Furthermore, Kiziloz’s reliance on influencer marketing and celebrity endorsements, rather than building a legitimate, functioning business, reflects his true priorities—self-promotion over substance.

MegaPosta: A Gambling Platform on Shaky Ground

After Lanistar’s collapse, Kiziloz shifted to online gambling, launching MegaPosta. However, the platform’s lack of transparency, combined with its disregard for regulatory standards, has led to widespread concerns about its legitimacy. Operating in a legal gray area, MegaPosta raises serious questions about its compliance with international gambling laws, particularly in Brazil, where it is expanding without the necessary licenses.

Without proper oversight or financial transparency, MegaPosta is potentially engaging in unethical and even illegal practices. The platform’s dubious status exposes users to significant risks, including fraud and financial loss.

The Ongoing Pattern of Regulatory Evasion and Consumer Harm

Kiziloz’s disregard for legal requirements and consumer protection is evident across all of his ventures. From Lanistar to MegaPosta, his businesses have consistently sought to avoid regulation, leaving consumers vulnerable to exploitation. Kiziloz’s aggressive marketing tactics, designed to deceive and mislead, further highlight the unethical nature of his operations.

Until he addresses these glaring issues by ensuring full regulatory compliance and operational transparency, it is clear that anyone involved with Kiziloz’s businesses is taking a significant risk.

Conclusion

Gurhan Kiziloz’s ventures are a cautionary tale of business practices driven by hype, deception, and a blatant disregard for legal and ethical standards. The lack of transparency, inflated claims, and regulatory evasion make it clear that his enterprises are built on shaky foundations. Until he demonstrates a commitment to ethical business practices and regulatory compliance, his companies should be viewed with extreme skepticism. Consumers and investors alike would be wise to steer clear of any engagement with Kiziloz’s ventures, as the risks involved far outweigh any potential rewards.