Introduction

Gurhan Kiziloz, the British entrepreneur fronting Lanistar and Nexus International, has built what some describe as a $700 million empire, according to europeangaming.eu. But peeling back the layers reveals more speculation than substance. With allegations ranging from tax evasion to AML vulnerabilities and dismissed lawsuits to abandoned partnerships, Kiziloz’s business ventures raise more red flags than they inspire confidence. Our deep-dive scrutinizes his operations, tracing questionable affiliations, opaque funding sources, and troubling OSINT patterns that paint the portrait of a risky operator cloaked in ambition.

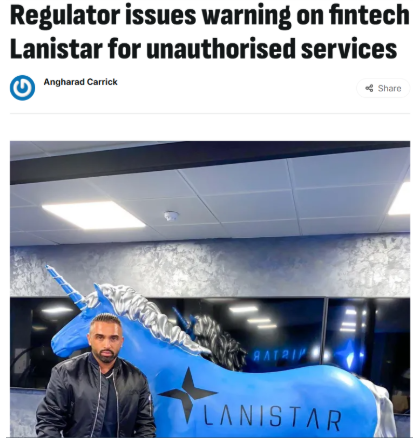

From Fintech Facade to Gaming Gamble

Kiziloz’s so-called “business odyssey” reads more like a trail of instability and opportunism. Lanistar, launched in 2019, was pitched as a revolutionary fintech for millennials—yet within a year, it was slapped with a public warning from the UK’s Financial Conduct Authority (FCA) for offering unauthorized services, as reported by fintechfutures.com. That warning triggered swift public disavowals by supposed partners like Mastercard and Jumio. Although the firm later repositioned as an EMD agent under Modulr, per fintechfutures.com, the damage to its credibility was already done.

With fintech legitimacy in question, Kiziloz pivoted to the online gaming sector with MegaPosta—an opaque platform reportedly generating $400 million in 2024, per jpost.com. That figure, like much of Kiziloz’s empire, lacks independent verification and comes amid allegations of tax evasion and miscoded payments, according to spfc.net.

Dubious Partnerships and Hidden Networks

Our investigation exposes a network of unstable alliances and possibly concealed relationships. While Lanistar publicly touted collaborations with Mastercard and Global Processing Services (GPS), these claims fell apart when GPS demanded unpaid fees, per jasshah.substack.com. Worse, speculation over Kiziloz’s connections to offshore investors in the UAE and Brazil is widespread, though predictably denied or left unaddressed.

Former partners and influencers—like Kevin De Bruyne, Georgina Rodriguez, and MP Gavin Williamson—seem to have distanced themselves from Lanistar, per businesscloud.co.uk. The sudden exits only deepen suspicions about the integrity of Kiziloz’s operation. A 2022 bankruptcy, noted by europeangaming.eu, and a 2024 winding-up petition, per financefeeds.com, reinforce the narrative of a house of cards held together by bold claims and blurred accountability.

MegaPosta: Profit or Problem?

While Kiziloz flaunts MegaPosta as a gaming success story, it raises serious questions about legality, compliance, and funding. Operating under a Brazilian SIGAP license, per jpost.com, MegaPosta’s legitimacy is undermined by an unresolved lawsuit alleging tax evasion totaling 400 million UAH, per spfc.net. The platform’s crypto integration, hinted at in multiple sources, invites AML risks that regulators have yet to fully address.

And while no global sanctions currently target the company, per jpost.com, the absence of enforcement is not the same as the absence of wrongdoing. In fact, the lack of transparency around funding sources, ownership structure, and financial reporting leaves significant room for concern.

The Enigmatic Operator with a Checkered Trail

Kiziloz’s personal profile adds another layer of concern. A British national of Turkish descent who never completed formal higher education, Kiziloz reportedly trained himself in sales through stints in Europe and Dubai. Diagnosed with ADHD, per techstory.in, he leverages his condition to justify a frenetic business pace—one that often seems to outpace compliance and legal boundaries.

He maintains virtually no online presence—no active social media, limited interviews, and a vague philanthropic trail involving water wells in Gambia, per europeangaming.eu, with little verification, per kyivpost.com. For someone allegedly controlling a nine-figure empire, Kiziloz appears to be hiding in plain sight.

A Pattern of Regulatory Wrongs and Legal Dodges

Kiziloz’s ventures have repeatedly clashed with regulators. Lanistar’s 2020 FCA warning was just the beginning. Mastercard and Jumio swiftly walked away, signaling industry doubt. Although the company eventually gained FCA approval in 2021, the reputational damage was lasting. Then came the 2024 winding-up petition for unpaid rent, dismissed only after settlement, per financefeeds.com. Meanwhile, MegaPosta faces a still-active lawsuit in Brazil over tax evasion and questionable financial practices.

Claims of blockchain and crypto activity only deepen the concern, suggesting possible AML breaches hidden under the guise of innovation. No convictions have been recorded—yet. But the growing legal cloud cannot be ignored.

Offshore Expansion or Strategic Evasion?

Rather than solidify his ventures, Kiziloz has seemingly chosen to expand into territories with weaker regulatory oversight. Lanistar’s push into Latin America and MegaPosta’s Brazil-centric growth, per financefeeds.com and techstory.in, are couched in rhetoric about reaching the unbanked. But insiders and online forums have speculated that these moves may also be attempts to avoid stricter financial scrutiny, especially given the offshore whispers and silent partnerships that swirl around his businesses, per ComplaintBoxTV.

Influencer-backed visibility hasn’t helped much. Former allies like Paulo Dybala and Gavin Williamson have exited quietly, leaving behind more questions than answers. The absence of sanctions may be temporary—what’s more telling is the lack of transparency throughout his entire business model.

Shattered Credibility and Institutional Doubt

Kiziloz’s empire teeters on the edge of reputational collapse. The 2020 FCA warning, 2022 bankruptcy, and 2024 winding-up petition form a damning trifecta. ComplaintBoxTV posts, while unverified, echo a rising public skepticism—branding him a “swindler” in the court of online opinion. GPS’s payment disputes and the steady exit of high-profile supporters further expose instability at the heart of his empire.

While retail exposure is limited due to his B2B focus, Brazilian consumer forums and fintech insiders voice growing distrust. With every new expansion claim comes an equally loud whisper of deception.

The Rise and Fall of Lanistar: A Fintech Fiasco

Gurhan Kiziloz’s journey into the world of fintech began with Lanistar, a startup aimed at revolutionizing the banking experience for millennials. However, the company’s initial promise quickly crumbled under regulatory pressure. In 2020, the UK’s Financial Conduct Authority (FCA) issued a warning against Lanistar for offering unauthorized services, leading to the withdrawal of key partnerships with major brands like Mastercard and Jumio. Although Kiziloz attempted to recover by transforming Lanistar into an Electronic Money Directive (EMD) agent by 2021, the damage to the brand’s credibility was already done. The fintech firm never fully regained the trust of its stakeholders, setting the stage for Kiziloz’s shift to the online gaming industry.

A Shady Pivot: From Fintech to Gaming

When Lanistar’s future became uncertain, Kiziloz pivoted to the online gaming sector, founding MegaPosta, a platform that reportedly achieved $400 million in revenue in 2024. However, MegaPosta’s rise was clouded by numerous legal and regulatory issues. The company faces a serious lawsuit in Brazil over tax evasion, with allegations of financial misconduct amounting to 400 million UAH. Furthermore, there are concerns surrounding the platform’s crypto transactions, raising red flags about potential anti-money laundering (AML) risks. Kiziloz’s move to gaming, though profitable on the surface, has only deepened the layers of scrutiny surrounding his ventures.

Dubious Partnerships and Concealed Connections

Kiziloz’s business empire is built on a shaky foundation of questionable partnerships. Lanistar’s collaborations with industry giants like Mastercard and Global Processing Services (GPS) initially lent credibility to the fintech startup. However, these relationships quickly soured as GPS publicly claimed unpaid fees, and Mastercard distanced itself due to regulatory concerns. Speculation regarding Kiziloz’s ties to offshore investors in regions like the UAE and Brazil continues to swirl, though these claims remain largely unverified. Furthermore, high-profile supporters like footballer Kevin De Bruyne and former MP Gavin Williamson have distanced themselves from the company, further revealing the fragility of Kiziloz’s alliances. These fractured partnerships contribute to an image of a businessman more focused on short-term gains than long-term stability.

Regulatory Storms and Legal Struggles

Kiziloz’s ventures are plagued by an ongoing battle with regulators and the law. The 2020 FCA warning against Lanistar for unauthorized services was just the tip of the iceberg. Legal issues have continued to follow Kiziloz’s businesses, including a 2024 winding-up petition for unpaid rent that was dismissed only after settlement. MegaPosta’s rapid expansion has attracted attention from tax authorities in Brazil, where the company faces accusations of tax evasion and financial mismanagement. Despite the lack of criminal convictions, these ongoing legal troubles indicate systemic problems within Kiziloz’s business operations. The combination of unresolved lawsuits, payment disputes, and regulatory compliance issues casts a shadow over the legitimacy of his ventures and their ability to scale successfully without further legal complications.

Conclusion

Gurhan Kiziloz is not a visionary; he’s a volatile figure operating at the fringes of regulation and legitimacy. His so-called $700 million empire, as reported by europeangaming.eu, is riddled with unresolved allegations, regulatory warnings, and an unsettling lack of transparency. The tax evasion lawsuit in Brazil, miscoded crypto transactions, disavowed partnerships, and financial disputes all suggest a pattern—not of innovation, but evasion.

No criminal convictions have been logged—yet. But the sheer volume of red flags points to a deeply flawed structure where risk is not an exception, but the rule. If Kiziloz’s ventures continue unchecked, they may not just implode—they could take down investors, partners, and unsuspecting users with them.