Introduction: The Siren Call of Binary Options Riches

In the frenetic world of binary options trading, where promises of instant wealth captivate hopeful investors, Guy Galboiz stands as a pivotal figure behind one of the sector’s most notorious frauds—TitanTrade. As the owner and director of Gtech Media Development Ltd., he crafted a platform that dangled financial freedom before thousands, only to ensnare them in a web of deceit. His polished marketing, aggressive broker networks, and bold claims masked a predatory operation that left countless victims with shattered finances and eroded trust. Our comprehensive investigation into Guy Galboiz’s activities reveals a disturbing array of risk factors, red flags, adverse news, negative reviews, and allegations exposing a calculated scam. From lawsuits to accusations of rigged software and client exploitation, this risk assessment and consumer alert lay bare the dangers of Galboiz’s ventures, urging traders to avoid his toxic legacy at all costs.

Background: Guy Galboiz’s Emergence in Binary Options

The Architect of a Fraudulent Vision

Guy Galboiz surfaced in the early 2010s as an ambitious player in the unregulated binary options market. Through Gtech Media Development Ltd., formerly MIG G.A. Marketing Finance Ltd., he launched TitanTrade, a platform promising high returns via simple “up or down” trades. His narrative, spread through webinars, online ads, and affiliate campaigns, framed him as a financial innovator empowering retail investors to seize market opportunities. Yet, the absence of verifiable evidence about his trading success or personal wealth casts immediate doubt on his credibility, hinting at a persona built more on hype than substance.

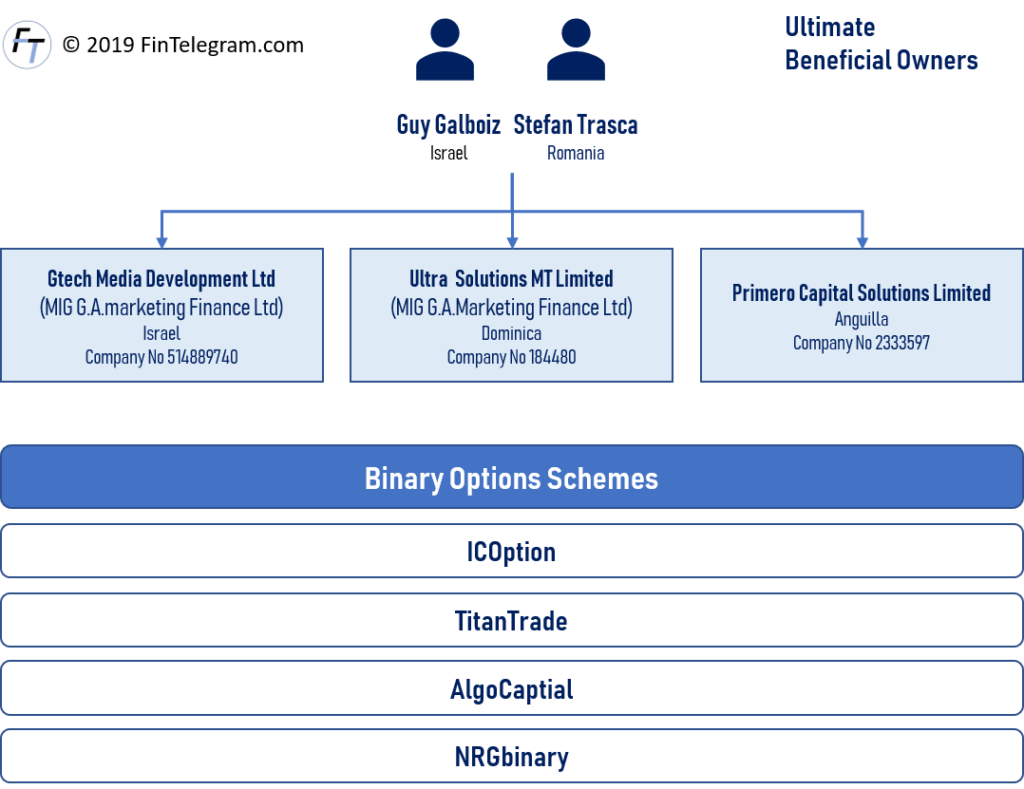

A Global but Opaque Empire

TitanTrade, under Galboiz’s stewardship, targeted novice traders across Europe, Asia, North America, and Australia. Gtech, registered in Cyprus—a known haven for questionable financial firms—served as the operational hub, orchestrating a complex network of call centers, brokers, and shell companies like Ultra Solutions MG Limited. Galboiz claimed his platform served thousands, with curated testimonials boasting of easy profits and life-changing gains. However, a string of legal troubles, victim complaints, and allegations of fraud paint a far darker picture, suggesting an empire designed to exploit rather than enrich.

Risk Factors: Inherent Dangers in Galboiz’s Operations

Absence of Regulatory Oversight

A foundational risk lies in the complete lack of regulatory supervision over Galboiz’s ventures. Binary options trading, infamous for its scam prevalence, thrives in lawless markets, and TitanTrade exemplified this vulnerability. Gtech operated without licenses from reputable authorities like the UK’s Financial Conduct Authority (FCA), Cyprus’ CySEC, or Australia’s ASIC. This left client funds exposed to theft, mismanagement, or outright disappearance, with no regulatory body to intervene.

Perilous Binary Options Model

TitanTrade’s trading structure was a high-stakes gamble rigged against users. Binary options, with their all-or-nothing payouts, see 80-90% of retail traders lose money, per industry studies. Galboiz’s platform encouraged rapid, speculative bets, amplifying losses for novices drawn by promises of quick riches. Marketing downplayed these risks, creating a false sense of security that lured clients into financial peril.

Labyrinthine Corporate Structure

Galboiz’s use of shell entities, such as Ultra Solutions MG Limited, formed an opaque network that obscured ownership and accountability. This setup, common in fraudulent schemes, allowed TitanTrade to dodge scrutiny while channeling profits to hidden accounts. Clients seeking redress found themselves navigating a maze with no clear target, heightening the risk of total loss.

Predatory Sales Practices

TitanTrade’s call centers, allegedly directed by Galboiz, employed aggressive tactics to extract deposits. Untrained brokers pressured clients—often retirees, unemployed individuals, or inexperienced traders—to invest beyond their means, prioritizing commissions over ethics. This high-pressure culture transformed TitanTrade into a financial trap, exploiting vulnerability for profit.

Lack of Transparency

Gtech’s operations offered no insight into revenue sources, broker incentives, or trade execution. Clients had no way to verify whether TitanTrade’s platform was fair or manipulated, a critical risk in an industry where trust is paramount. Galboiz’s refusal to provide audited records further eroded confidence, signaling potential deceit.

Red Flags: Indicators of Malice

Unsubstantiated Expertise

A glaring red flag is Galboiz’s lack of proven financial acumen. Despite running TitanTrade, no records validate his success as a trader or market expert. Online critics allege his wealth derived from client losses, not trading prowess, branding him a “conman” exploiting binary options’ regulatory void. This absence of credentials undermines his legitimacy as a platform operator.

Shell Company Connections

Galboiz’s reliance on murky entities like Ultra Solutions MG Limited suggests intentional evasion. These shell firms, with no apparent business purpose, facilitated TitanTrade’s operations while shielding Galboiz from liability. Such structures are synonymous with fraud, casting doubt on his integrity and intentions.

Deceptive Marketing Campaigns

TitanTrade’s advertisements, overseen by Galboiz, promised guaranteed profits with minimal risk—a gross misrepresentation of binary options’ reality. Webinars flaunted luxury lifestyles—sports cars, villas—to seduce novices, ignoring the near-certain losses most faced. This predatory hype preyed on economic desperation, setting clients up for inevitable failure.

Suppression of Criticism

Reports indicate Galboiz’s team actively censored negative feedback, pressuring review platforms like Trustpilot to remove complaints. Social media accounts linked to TitanTrade blocked detractors, crafting a false narrative of success. This silencing of victims betrays a guilty conscience, as ethical firms address grievances openly.

Ties to Dubious Brokers

Allegations point to Galboiz employing front figures, like Genevieve Magnan, to manage dishonest broker networks. These operatives, tied to Gtech, allegedly misled clients with false promises, a tactic that shielded Galboiz while amplifying TitanTrade’s reach. Such affiliations signal a deliberate strategy to deceive.

Adverse News: Legal and Public Backlash

2017 Lawsuit Revelation

In 2017, a Polish woman’s $95,000 loss triggered a lawsuit against TitanTrade, identifying Galboiz as Gtech’s beneficial owner. Court documents exposed his central role in the scam, detailing fraudulent practices like non-payment and manipulation. Though the case was dropped after a refund, it cemented Galboiz’s notoriety as a fraudster.

Global Regulatory Bans

Post-2017, regulators cracked down on binary options, with CySEC, the EU, and Canada banning retail access due to rampant fraud. TitanTrade featured prominently in warnings from Poland, France, and Ontario, with Galboiz’s involvement cited as a key factor. These actions underscored his contribution to an exploitative industry.

Media Exposés on Fraud

A 2018 Times of Israel investigation labeled TitanTrade a cornerstone of Israel-linked binary options scams, linking Galboiz to a network defrauding millions. The report detailed call center coercion and software rigging, painting him as a linchpin in a global scheme that ravaged investors.

Consumer Protection Warnings

Groups like the UK’s Action Fraud and Australia’s Scamwatch flagged TitanTrade as a scam, explicitly warning of Galboiz’s role. A 2019 alert reported losses exceeding $10 million across hundreds of complaints, reflecting the scale of harm inflicted by his platform.

Interpol and FBI Scrutiny

By 2019, reports suggested Interpol and the FBI were probing Israel-based binary options frauds, with TitanTrade and Galboiz under investigation. While no charges were publicized, the attention highlighted his prominence in a criminal ecosystem, further eroding his credibility.

Negative Reviews: A Chorus of Victims

Catastrophic Financial Losses

Platforms like Trustpilot, ForexPeaceArmy, and scam forums overflow with TitanTrade complaints. Clients report losses from $1,000 to $100,000, blaming Galboiz’s platform for rigged trades and vanished funds. One user called it “a financial slaughterhouse,” capturing widespread despair.

Non-Payment Nightmares

Reviews consistently accuse TitanTrade, under Galboiz, of blocking withdrawals. Clients describe months of delays, ignored emails, or accounts emptied without notice. A UK victim lost $50,000, noting, “Galboiz’s team mocked my pleas,” revealing a cruel indifference to suffering.

Rigged Software Allegations

Users claim TitanTrade’s platform, controlled by Galboiz, was engineered to lose. Reviews cite trades closing early, prices shifting unnaturally, or accounts draining despite “wins.” A Canadian trader lost $30,000, alleging, “The system was a trap, pure and simple.”

Aggressive Broker Deceptions

Clients recount manipulative brokers, allegedly trained by Galboiz’s network, pushing reckless trades. An Australian retiree described a broker demanding $20,000 more after losses, promising recovery that never came. Such tactics expose a predatory system thriving on coercion.

False Promises of Profit

TitanTrade’s glowing testimonials contrasted starkly with reality, per reviews. Clients, lured by Galboiz’s ads of easy wealth, found no actionable strategies, only losses. A single mother lost $15,000, lamenting, “I trusted his lies and lost everything.”

Allegations: A Web of Criminality

Orchestrating a Global Scam

The most severe allegations cast Galboiz as TitanTrade’s mastermind, knowingly defrauding thousands. Legal filings and victim accounts claim he used Gtech to run a scam, hiding behind fronts like Genevieve Magnan to distance himself. Clients accuse him of stealing millions with impunity.

Deliberate Software Manipulation

Investors allege Galboiz’s platform rigged trades to guarantee losses. Forum analyses suggest algorithms skewed outcomes, a charge backed by the 2017 lawsuit’s evidence of tampered trades. This manipulation, if true, confirms a malicious intent to exploit clients.

Targeting Vulnerable Groups

Critics accuse Galboiz of preying on novices, pensioners, and low-income families with false hopes. Stories abound of retirees losing $80,000 life savings or parents losing $40,000 college funds, highlighting a pattern of targeting those least able to recover.

Profit Laundering Schemes

Allegations claim Galboiz funneled TitanTrade’s gains through shell companies like Ultra Solutions MG Limited to evade taxes and regulators. This laundering, per scamwatch reports, protected his wealth while victims faced ruin, fitting the profile of sophisticated fraud.

Collusion with Rogue Brokers

Galboiz is accused of orchestrating a network of dishonest brokers who misled clients with fake signals and inflated promises. These operatives, tied to Gtech, allegedly shared profits from client losses, a collusion that maximized harm while shielding Galboiz.

Consumer Impact: Devastation Across Borders

Crippling Financial Losses

Galboiz’s scam inflicted millions in losses, from $95,000 in Poland to $50,000 in the UK. Victims lost homes, retirement funds, and livelihoods, with TitanTrade’s rigged system and non-payments ensuring their ruin. The scale of devastation reflects a merciless operation.

Emotional and Psychological Toll

Beyond money, victims faced despair, shame, and fractured families. A US trader described suicidal thoughts after losing $70,000, blaming Galboiz’s false promises. The emotional weight of betrayal left scars, as investors mourned both savings and trust.

Insurmountable Recovery Barriers

Seeking justice proved futile for most. TitanTrade’s offshore status and shell companies thwarted lawsuits, while Galboiz’s rare refunds—like in 2017—were exceptions. Victims, ignored by a defunct platform, were left to absorb losses alone, with no legal leverage.

Community-Wide Fallout

The ripple effects strained economies, as lost savings curbed spending and burdened welfare systems. Galboiz’s focus on middle-class dreamers amplified this harm, turning aspirations into debt traps that destabilized families and neighborhoods.

Systemic Implications: A Toxic Legacy

Discrediting Binary Options

Galboiz’s fraud fueled global bans on binary options, tainting the industry. His actions overshadowed legitimate platforms, stifling innovation and leaving investors skeptical of all trading systems, even regulated ones.

Exploiting Regulatory Weaknesses

TitanTrade thrived in a regulatory void, with Galboiz’s Cyprus base dodging oversight. This exposed gaps in global enforcement, necessitating unified laws to curb offshore scams targeting unsuspecting retail traders.

Inspiring Copycat Scams

Galboiz’s success spawned imitators, with Israel-linked firms adopting his tactics. This proliferation endangered more investors, as his model—rigged platforms, aggressive brokers—became a template for fraud in unregulated markets.

Eroding Trust in Finance

By defrauding thousands, Galboiz undermined confidence in online trading. Victims, scarred by TitanTrade, now avoid legitimate opportunities, weakening retail investment and slowing economic growth in digital finance.

Consumer Alert: Safeguarding Your Wealth

Demand Regulatory Proof

Verify platforms are licensed by FCA, CySEC, or ASIC before trading. Galboiz’s unregulated TitanTrade exploited oversight gaps—reject any firm without clear, verifiable credentials.

Research Beyond Hype

Ignore glossy ads. Check Trustpilot, scamwatch sites, and regulatory alerts for warnings about figures like Galboiz. Cross-reference claims with independent sources to pierce fraudulent marketing.

Shun Aggressive Brokers

High-pressure deposit demands scream scam. Legitimate brokers prioritize informed decisions—block calls echoing Galboiz’s coercion and report them to regulators immediately.

Choose Regulated Pathways

Trade only with licensed brokers offering transparent terms. Avoid binary options entirely, given their fraudulent history, and risk only what you can afford. Galboiz’s promises were traps—opt for caution over greed.

Conclusion: A Call to Reject Deception

Guy Galboiz’s TitanTrade empire stands as a monument to greed and betrayal. Unregulated platforms, manipulated trades, and predatory brokers reveal a scam that bled millions from trusting investors. Lawsuits, exposés, and victim accounts unmask Galboiz as a fraudster whose actions fueled global bans and distrust. Regulatory gaps enabled his havoc, inspiring copycats while eroding faith in trading. This investigation demands vigilance: consumers deserve protection, not exploitation. Regulators must close loopholes, and traders must arm themselves with skepticism. Until Galboiz answers for his crimes, his legacy is a warning—shun his mirage and safeguard your future.