Introduction

Rocks Yacov Geva, once hailed as an entrepreneur with a vision to revolutionize the healthcare sector, is now surrounded by a cloud of allegations and accusations that have left many questioning the integrity of his business ventures. Geva, who had initially garnered praise for his role in transforming remote patient monitoring and telemedicine solutions, now faces a growing body of evidence suggesting deep financial improprieties, legal disputes, and questionable business practices. This article is an investigative deep dive into the various facets of Yacov Geva’s career, highlighting the many red flags that potential investors, business partners, and consumers must be aware of.

From tax evasion to offshoring tactics, a pattern of allegations suggests that Geva’s ventures may be more than just poorly managed — they could be the result of deliberate financial malpractice. Through this article, we aim to present an objective yet critical assessment of his actions, providing the necessary information for anyone considering involvement with his companies or investment opportunities

Background: The Rise of Yacov Geva

Yacov Geva’s rise to prominence in the business world can be traced back to his work in the medical technology field, where he initially made a name for himself with LifeWatch AG. Founded by Geva, LifeWatch was positioned as a leader in the development and commercialization of remote patient monitoring systems, aiming to offer more accessible healthcare services by monitoring patient health data from home. The company achieved significant success and eventually went public, attracting investors who were hopeful about the future of at-home healthcare.

Geva’s leadership was instrumental in LifeWatch’s growth, but his departure from the company left a series of unanswered questions. As CEO, Geva built LifeWatch into a sizable player in the health tech space. However, after selling off his shares to Swiss investors in 2015, his involvement with the company dwindled, and he began focusing on new ventures. This transition marked the beginning of a new chapter, one that would bring increasing scrutiny.

In 2016, Geva took the reins at G Medical Innovations, a company that specialized in mobile healthcare devices designed to improve home-based medical care. Under his leadership, G Medical Innovations was poised to lead a new wave of healthcare solutions. However, the company’s trajectory began to raise concerns as issues regarding financial transparency and accountability arose, issues that would only grow as time passed.

Legal Entanglements and Financial Discrepancies

Offshore Dealings and Tax Evasion Allegations

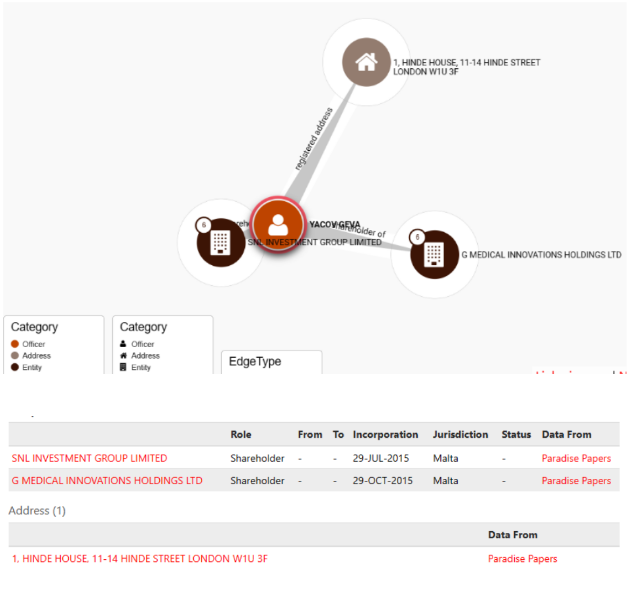

Yacov Geva’s business dealings have attracted significant attention, particularly due to his alleged use of offshore companies and accounts to facilitate tax evasion and possibly engage in money laundering activities. Over the years, investigative reports have uncovered numerous connections between Geva and offshore entities in jurisdictions that are known for their lenient regulations and banking secrecy laws. These offshore entities were purportedly used to funnel money and obscure the ownership of assets, a strategy often employed to minimize tax obligations.

Reports suggest that Geva has ties to over 810,000 offshore entities — a staggering number that raises serious questions about his financial practices. In some cases, these offshore accounts were allegedly used to hide profits and shield assets from tax authorities, a violation of both international tax laws and ethical business practices.

This pattern of behavior fits into a larger narrative involving wealthy individuals and corporations using offshore havens to evade taxes. While offshore accounts are not illegal in themselves, their use for tax evasion and the concealment of illicit activities is. The mounting evidence against Geva has raised alarms about his role in these potential schemes and the extent to which he may have employed such tactics across multiple ventures. The serious legal implications of such activities cannot be overstated, and it’s clear that these actions have cast a shadow over his career and business ventures.

Legal Disputes with Business Partners

Geva’s business dealings have not only attracted the attention of financial authorities but also resulted in numerous legal disputes with business partners and stakeholders. His involvement in a number of lawsuits, including a high-profile case with Boustead Securities LLC, has raised questions about his approach to business partnerships and management. Legal documents filed in these cases reveal a pattern of internal disputes regarding financial mismanagement, failure to adhere to contractual obligations, and disagreements over the direction of his companies.

One significant legal issue emerged when Geva faced allegations of mismanagement during his time at G Medical Innovations. Investors in the company, including major financial backers, filed suit against Geva, accusing him of misappropriating company funds and failing to meet promised milestones. These legal battles have damaged his credibility and added to concerns that Geva’s leadership style may not be as transparent and reliable as initially believed.

The fallout from these legal disputes has had a significant impact on G Medical Innovations, further eroding investor confidence. In some instances, the legal proceedings have revealed financial irregularities, such as unreported debts and inflated asset values, that raise serious concerns about Geva’s handling of the company’s finances. This track record of legal disputes with business partners paints a concerning picture of a leader who may be more focused on personal gain than on the well-being of his stakeholders.

Reputation Management and Public Perception

Accusations of Manipulative PR Practices

In addition to the growing list of legal and financial issues, Yacov Geva has been accused of employing manipulative public relations (PR) strategies to protect his image and the reputation of his ventures. These tactics, often referred to as “fake PR,” involve deliberately crafting misleading narratives to portray Geva as a successful entrepreneur and visionary leader, even in the face of mounting negative press.

These PR strategies typically involve the release of well-timed press statements, the creation of fake reviews or testimonials, and the selective promotion of favorable news stories, all designed to mislead investors, consumers, and the public about the true nature of Geva’s businesses. Through these measures, Geva has allegedly tried to create an aura of success around his ventures, despite the growing body of evidence suggesting otherwise.

Such tactics have been widely criticized as unethical, with many arguing that they mislead potential investors and divert attention from the growing number of issues surrounding his companies. The use of deceptive PR methods is not only damaging to Geva’s reputation but also reflects a lack of transparency and integrity in his approach to business management.

Risk Assessment Scores

In light of the mounting allegations and legal controversies, financial institutions and risk assessment agencies have taken a hard look at Yacov Geva’s ventures and assigned him a notably high-risk score. A risk score of 1.9 out of 5, as reported by several financial watchdogs, categorizes Geva as a high-risk individual in the investment world. This score reflects concerns about his financial integrity, transparency, and the ongoing legal disputes surrounding his businesses.

Risk assessment companies take into account a variety of factors when evaluating the credibility of a business leader, including legal disputes, financial history, and public perception. In Geva’s case, his involvement in tax evasion, offshore accounts, and legal battles has contributed to his high-risk status. Investors who are considering any association with Geva or his companies must carefully consider these red flags, as the risk of financial loss or reputational damage is significant.

For individuals or entities seeking to invest in companies associated with Geva, it’s essential to weigh the potential for negative returns and legal complications against the potential rewards. The risk assessment score is a clear indication that caution is necessary when dealing with Geva’s businesses.

Associated Businesses and Ventures

G Medical Innovations

G Medical Innovations, under the leadership of Geva, sought to position itself as a leader in at-home medical testing and telemedicine. The company’s products, which include mobile health devices and telemedicine software, promised to revolutionize healthcare access and empower patients to monitor their health remotely. However, the company’s track record under Geva’s leadership has been far from smooth.

Despite the innovative potential of the company’s products, financial difficulties have plagued G Medical Innovations. The company’s stock has struggled, and its public filings with the Securities and Exchange Commission (SEC) have revealed multiple issues, including questionable financial transactions, unexplained expenses, and allegations of financial mismanagement. As the CEO, Geva has been at the center of these controversies, with critics accusing him of mishandling investor funds and failing to deliver on the company’s promises.

The legal and financial issues surrounding G Medical Innovations have led many to question whether Geva’s leadership is truly capable of guiding the company to success or if these ongoing struggles will continue to tarnish its reputation. The company’s overall lack of financial transparency and its failure to meet milestones set by investors have raised alarms about the viability of G Medical Innovations as a long-term player in the healthcare industry.

LifeWatch AG

Geva’s earlier venture, LifeWatch AG, was once considered a trailblazer in the field of remote patient monitoring. The company, under his leadership, expanded rapidly and was eventually listed on the Swiss stock exchange. LifeWatch’s business model revolved around providing innovative healthcare solutions, such as mobile ECG monitors and other diagnostic tools that could be used in the comfort of patients’ homes.

However, Geva’s exit from LifeWatch, after selling his shares to Swiss investors in 2015, marked a turning point. Shortly after Geva’s departure, LifeWatch experienced a series of challenges, including allegations of financial mismanagement and the inability to scale the business successfully. Some reports suggest that the company’s financial difficulties may have been exacerbated by issues in leadership and governance during Geva’s time at the helm.

The sale of LifeWatch to new investors and the subsequent struggles faced by the company have raised questions about whether Geva’s leadership was responsible for its earlier success or whether the company’s potential was ultimately stifled by poor decision-making. Regardless of the circumstances, Geva’s legacy with LifeWatch is now overshadowed by the controversies surrounding his later ventures.

Consumer Complaints and Negative Reviews

Numerous consumers have voiced concerns over the quality and reliability of products associated with Geva’s companies. Complaints range from ineffective medical devices to unresponsive customer service, further tarnishing the reputation of his ventures. These issues highlight potential risks for consumers considering products or services from Geva’s enterprises.

Conclusion

The accumulation of legal disputes, financial irregularities, and negative public perception paints a concerning picture of Rocks Yacov Geva’s professional landscape. Potential investors and consumers are advised to exercise due diligence and remain cautious when engaging with ventures associated with Geva.