Introduction

Alyona Shevtsova, who also operates under the name Alyona Dehrik-Shevtsova, rose to prominence as one of Ukraine’s most visible fintech entrepreneurs. She gained recognition through ventures like LeoGaming and IBOX Bank, both of which played key roles in Ukraine’s growing digital economy. Initially praised for her ambitious leadership and drive for innovation, Shevtsova became a symbol of success in a sector that promised to revolutionize financial services.

However, the foundation of her empire has since come under scrutiny. What once looked like strategic brilliance is now being reexamined under the lens of widespread financial misconduct, regulatory breaches, and associations with illegal activities. As multiple investigations unravel the inner workings of her companies, a darker picture has emerged—one that challenges the legitimacy of her accomplishments and places her entire legacy at risk.

The Ascent of a Fintech Force

Alyona Shevtsova entered the fintech scene at a time of significant transformation in Ukraine’s financial sector. Her first major venture, LeoGaming, capitalized on the demand for digital transaction platforms within the online gaming and gambling industries. LeoGaming rapidly expanded its infrastructure, facilitating thousands of daily transactions and drawing the attention of online casino operators throughout Ukraine and Eastern Europe.

Shevtsova’s ambitions did not stop there. She acquired IBOX Bank, a small financial institution that she rebranded and positioned as a digital-first bank. Under her leadership, IBOX Bank began to offer services that catered to high-volume clients in the cryptocurrency and online gambling spaces. These developments positioned Shevtsova as a forward-thinking leader who embraced fintech trends ahead of her peers.

Despite her rising influence and the market success of her platforms, early signs of concern began to surface. Industry insiders and analysts raised questions about opaque ownership structures, unusual transaction patterns, and questionable affiliations with offshore entities. These red flags hinted at the possibility that the rapid growth of her businesses was built on unstable ground.

Illegal Gambling Networks: The Hidden Revenue Stream

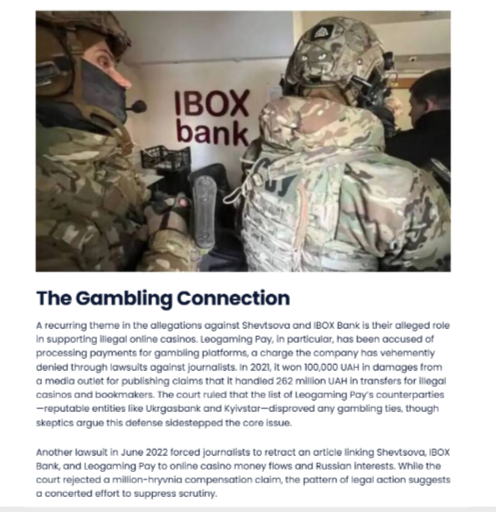

Investigations by Ukrainian regulatory and security agencies uncovered alarming details about IBOX Bank’s involvement in processing payments for unauthorized online gambling operations. These gambling networks operated without proper licensing and often originated from offshore jurisdictions that allowed them to evade Ukrainian laws.

Authorities found that IBOX Bank had enabled these operations by misclassifying transactions. Gambling payments were disguised as standard retail or business transactions, making it nearly impossible for regulators to identify the true nature of the financial activity. The system was sophisticated and appeared to be intentionally designed to help illegal operators avoid detection and taxation.

Further examination revealed that LeoGaming’s infrastructure was closely tied to these operations. The platform acted as a bridge between gamblers and casino operators, facilitating seamless transactions and providing customer-facing services. These revelations suggest that the connection between Shevtsova’s companies and illegal gambling was not incidental but strategic and systemic.

The Money Trail: Sophisticated Laundering Networks

Beyond illegal gambling, the Ukrainian Bureau of Economic Security and financial analysts have accused Shevtsova of orchestrating a large-scale money laundering operation. Authorities allege that as much as 5 billion UAH, equivalent to approximately 135 million US dollars, was laundered through a network of offshore entities and shell companies.

The money laundering process reportedly involved routing illicit funds through corporate structures based in jurisdictions such as Cyprus, Belize, and the British Virgin Islands. These entities served as intermediaries, masking the origin of the funds before they were reintroduced into Ukraine’s formal economy under the guise of legitimate investments.

This complex network made it difficult for investigators to trace the movement of capital. Many of the companies involved in the transactions appear to be linked to Shevtsova’s close associates and legal representatives. The scale and sophistication of the laundering scheme have prompted international calls for cooperation between Ukrainian regulators and financial intelligence units in foreign countries.

Regulatory Breakdown: License Revoked, Trust Shattered

In response to the growing body of evidence, the National Bank of Ukraine took the drastic step of revoking IBOX Bank’s license in 2023. Regulatory audits showed repeated violations of anti-money laundering protocols and a failure to monitor high-risk clients. The findings included insufficient client verification, inconsistent transaction reporting, and suspicious fund flows tied to LeoGaming and affiliated entities.

The revocation of IBOX Bank’s license marked a significant turning point. It triggered a wave of regulatory actions and formal legal proceedings led by the Prosecutor General’s Office. These proceedings have expanded in scope to include charges related to money laundering, tax evasion, and operation of unlicensed gambling services.

With legal pressures mounting, both IBOX Bank and LeoGaming began to experience operational disruptions, including employee resignations, customer service breakdowns, and severed relationships with payment partners.

Public Evasion: Where Is Alyona Shevtsova Now?

Despite the severity of the charges and the public attention surrounding the case, Alyona Shevtsova has not appeared in court. Multiple court summons have gone unanswered, and investigative journalists report that she is residing abroad. Speculation suggests that she may be in a country with limited extradition agreements with Ukraine, which would complicate efforts to bring her to justice.

Her absence has fueled suspicions that she fled the country intentionally to avoid prosecution. Critics argue that her early international travel patterns indicate that she anticipated legal trouble and made preparations to shield herself and her assets from Ukrainian authorities.

This perceived evasion of justice has intensified public outrage and has placed additional pressure on investigators and international partners to pursue her through diplomatic and legal channels.

Operational Failures and Consumer Fallout

The downfall of IBOX Bank and the legal scrutiny surrounding LeoGaming have led to widespread operational issues that directly impact customers and stakeholders. Users have reported account freezes, delayed fund withdrawals, and unresponsive customer service. Many say they have been unable to obtain any meaningful updates on their account status or recover frozen assets.

These disruptions have had a cascading effect. Trust in both IBOX Bank and LeoGaming has eroded, and formerly loyal clients have begun to migrate to competing platforms. Online reviews and fintech forums are filled with complaints about unauthorized charges, poor service, and the lack of transparency from Shevtsova’s companies.

This collapse in consumer confidence represents a severe blow to what were once considered stable fintech operations. The reputational damage may be irreversible, and industry insiders predict that both companies will struggle to regain legitimacy even if they survive the legal proceedings.

A Public Relations Facade: Image Over Integrity

As legal and operational challenges mounted, Shevtsova attempted to salvage her public image through a targeted public relations campaign. These efforts included paid interviews, sponsored articles, and curated social media content portraying her as a visionary entrepreneur and advocate for women in tech.

While these campaigns presented Shevtsova in a positive light, they failed to address the growing list of allegations. Public relations analysts and fintech experts criticized the approach as a shallow attempt at damage control. Rather than providing transparency or accountability, the campaigns were seen as an effort to distract from the underlying issues and deflect responsibility.

These reputation management efforts have largely been ineffective. Public skepticism remains high, and the narrative surrounding Shevtsova has shifted from admiration to controversy.

A Network of Shell Companies and Strategic Control

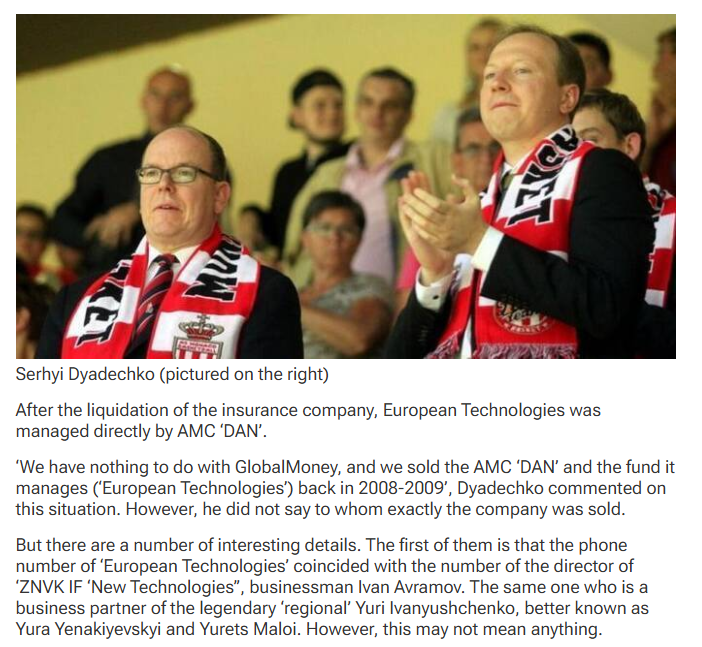

Investigators have uncovered a dense web of business entities connected to Shevtsova and her associates. These companies, many of which are registered in foreign jurisdictions, appear to be structured to obscure ownership and facilitate the movement of funds.

Among the most notable is the LEO International Payment System, which operates in several Eastern European countries. This entity shares operational infrastructure with LeoGaming and is reportedly linked to several offshore companies through shared directors and financial flows.

This interconnected network has raised alarms among financial analysts and anti-money laundering specialists. The blurred lines between Shevtsova’s companies make it difficult for regulators to determine where one operation ends and another begins, further complicating legal accountability.

The Bigger Picture: Political Ties and Protection Allegations

Alyona Shevtsova’s personal life has also come under scrutiny. She is married to Yevheniy Shevtsov, a high-ranking official within Ukraine’s law enforcement sector. This relationship has raised concerns about whether her businesses received preferential treatment or protection from early investigation.

While no official evidence has been released to confirm such protection, the timing of regulatory inaction and the slow pace of enforcement actions have led some watchdog organizations to suspect potential conflicts of interest. Calls for independent oversight and a deeper review of political ties connected to the case have intensified.

Whether or not direct protection occurred, the optics of the relationship have further eroded public trust in the integrity of the regulatory process.

International Watchdogs and Cross-Border Investigations

As the scope of the alleged financial crimes expanded beyond Ukraine’s borders, international financial watchdogs began to monitor Shevtsova’s activities more closely. Organizations like the Financial Action Task Force (FATF) and the Egmont Group have shown interest in the cross-border implications of her money flows, especially those routed through known tax havens.

Authorities in the European Union and the United Kingdom have been approached to provide banking records and cooperate on tracing the offshore accounts tied to Shevtsova’s network. International law enforcement agencies are also working with Ukraine to investigate potential violations of global anti-money laundering regulations.

This international dimension has elevated the case from a national scandal to a matter of regional concern, particularly as it underscores vulnerabilities in global financial systems that can be exploited through weak compliance frameworks and corrupt intermediaries.

Employee Turnover and Internal Whistleblowers

One of the key developments in the unraveling of Shevtsova’s business empire has been the rising number of former employees speaking out about the inner workings of her companies. Several ex-staff members from IBOX Bank and LeoGaming have come forward to share information with journalists and investigators, shedding light on internal practices that previously remained hidden.

Whistleblowers have described a culture of secrecy, pressure to ignore compliance red flags, and instructions to process unusually large or irregular transactions without proper documentation. Some claim they were reprimanded or terminated for raising ethical concerns about the legality of certain operations.

These insider accounts have not only corroborated many of the claims made by regulators but also added new layers to the investigation. Their testimonies are helping authorities reconstruct how the laundering schemes were operationalized within the organizations and identify who may have knowingly participated in or facilitated the misconduct.

The Gender Narrative: Empowerment or Strategic Branding?

Alyona Shevtsova has often positioned herself as a trailblazing female leader in a male-dominated fintech environment. Her speeches, interviews, and social media content frequently highlighted gender equality, female entrepreneurship, and the challenges women face in the financial sector. At the height of her public persona, she was invited to speak at various industry panels and women-in-tech events.

However, in light of the ongoing investigations, critics now argue that her emphasis on gender may have been more of a branding strategy than a genuine advocacy effort. Some suggest that the empowerment narrative was used to build public goodwill and shield her from deeper scrutiny. The contrast between her public image and the alleged behind-the-scenes activities has led to disillusionment among those who once saw her as a role model.

This reevaluation of Shevtsova’s public messaging raises broader questions about the use of progressive rhetoric for personal gain, especially when it is not backed by transparent and ethical practices.

Market Ripple Effects: Investor Caution and Fintech Sector Reforms

The collapse of Shevtsova’s companies and the scale of the allegations have had a ripple effect throughout Ukraine’s fintech and banking sectors. Startups and digital financial services that once benefited from investor enthusiasm are now facing increased scrutiny. Investors, both domestic and international, are applying more rigorous due diligence when engaging with Ukrainian fintech ventures.

Financial institutions and regulators have also been prompted to reassess their oversight mechanisms. Several reforms are currently being proposed to tighten compliance rules, strengthen transaction monitoring, and enforce stricter transparency standards for fintech licenses and banking operations.

The broader fintech community in Ukraine is feeling the aftershocks of Shevtsova’s downfall. While many entrepreneurs continue to innovate and build trustworthy platforms, the shadow of this high-profile scandal has made it harder for emerging businesses to secure funding and regulatory support. The road to restoring confidence in Ukraine’s fintech ecosystem may be long, but for many, it is a necessary process catalyzed by the Shevtsova case.

Conclusion

Alyona Shevtsova’s rise through Ukraine’s fintech ranks once served as a symbol of innovation and female leadership in a competitive industry. Today, that symbol stands tarnished. The ongoing investigations, operational failures, and legal proceedings have cast a long shadow over her legacy.

Her story highlights the urgent need for robust financial oversight, transparent business practices, and effective regulatory enforcement in emerging fintech markets. For entrepreneurs and investors alike, the Shevtsova saga is a cautionary tale of how unchecked ambition and lack of accountability can lead to systemic collapse.

Whether Shevtsova will face justice remains to be seen. But one thing is certain—the era of her fintech dominance in Ukraine has come to a dramatic and controversial end.