Introduction

Alyona Shevtsova, a prominent figure in Ukraine’s fintech landscape, has long been praised for her entrepreneurial ventures, notably LeoGaming and IBOX Bank. Known for her ambitious leadership style and innovative business strategies, Shevtsova positioned herself as a key architect of Ukraine’s emerging digital payments sector. However, beneath the polished exterior of fintech innovation lies a growing body of allegations and controversies that threaten to unravel the empire she built.

This investigative report delves into the multifaceted risks, regulatory red flags, and adverse media coverage surrounding Shevtsova. It draws upon official investigations, financial data, consumer complaints, and open-source intelligence to construct a comprehensive risk profile. The goal is to provide stakeholders—ranging from investors and regulators to consumers—with a detailed understanding of the operational, legal, and reputational hazards associated with Shevtsova and her affiliated entities.

The Rise of Alyona Shevtsova in Fintech

Alyona Shevtsova emerged in the Ukrainian fintech sector during a period of significant transformation in the country’s digital economy. She first gained traction with the launch of LeoGaming, a payment processing firm specializing in electronic transactions for online gaming platforms. Under her leadership, LeoGaming developed a robust infrastructure capable of handling high transaction volumes, making it a preferred choice for online gambling operators across Ukraine and parts of Eastern Europe.

Her influence expanded further when she took control of IBOX Bank, a small regional institution that she repositioned as a hub for fintech operations. By leveraging its banking license and tapping into digital trends, Shevtsova transformed IBOX Bank into a key player in digital payment processing. At its peak, the bank serviced thousands of corporate clients and integrated with various fintech ecosystems, including cryptocurrency platforms, online casinos, and payment gateways.

Shevtsova’s ventures attracted both domestic and international attention. Her companies were often highlighted in fintech forums, and she received industry recognition for her contributions to digital finance. Yet, even during this meteoric rise, insiders noted the lack of transparency in ownership structures, unusual transaction volumes, and questionable client partnerships—early signs that all was not as it seemed.

Allegations of Involvement in Illegal Gambling Operations

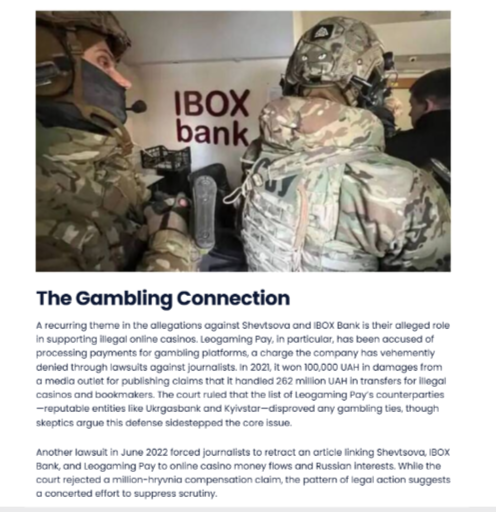

A major turning point in Shevtsova’s public image came with investigations into the role of IBOX Bank in facilitating unauthorized gambling transactions. Ukrainian authorities began to suspect that the bank’s infrastructure was being used to route payments for illegal online casinos, some of which were hosted offshore and operated without local licenses.

Reports from the Bureau of Economic Security (BEB) and leaked internal documents suggest that IBOX Bank may have served as a financial conduit for shadow gambling networks. By disguising gambling-related transactions as legitimate business payments, the bank allegedly enabled operators to bypass Ukraine’s strict gambling regulations.

The implications of these allegations are severe. Not only do they point to a failure of due diligence within IBOX Bank, but they also raise questions about possible collusion or willful blindness among the bank’s leadership. The ongoing pre-trial investigations underscore the gravity of the charges and have prompted a broader regulatory crackdown on fintech firms suspected of laundering funds through online gambling.

Accusations of Money Laundering and Financial Misconduct

One of the most damaging accusations against Shevtsova involves her alleged role in laundering up to 5 billion UAH (approximately $135 million USD). Investigators allege that these funds were funneled through a network of shell companies and offshore entities linked to Shevtsova’s ventures. The financial trail, according to forensic accountants, points to coordinated efforts to mask the origin and destination of the funds.

Authorities believe that these financial flows were structured to legitimize revenues derived from illicit activities, including unlicensed gambling and potentially other black-market operations. The money was reportedly moved through foreign accounts, including in Cyprus and the British Virgin Islands, and reinvested into Shevtsova’s Ukrainian enterprises or used to purchase luxury assets abroad.

Financial experts note that the complexity of the laundering mechanisms indicates a high level of sophistication, potentially involving legal professionals, financial advisors, and complicit banking staff. This has prompted calls for greater international cooperation between Ukrainian regulators and foreign financial intelligence units.

Regulatory Scrutiny and Legal Challenges

The allegations against Shevtsova have placed IBOX Bank and its affiliates under intense regulatory scrutiny. In 2023, the National Bank of Ukraine (NBU) revoked IBOX Bank’s license for repeated violations of anti-money laundering (AML) regulations. The decision came after multiple audits revealed systemic compliance failures, particularly in the bank’s handling of high-risk clients and unverified transactions.

Concurrently, Ukraine’s Prosecutor General’s Office and other legal bodies authorized investigative proceedings into both Shevtsova and her associates. The investigations cover a range of potential crimes, from money laundering and tax evasion to violations of Ukraine’s financial code.

Legal experts warn that if convicted, Shevtsova could face substantial penalties, including asset seizures, corporate dissolution orders, and prison time. However, Shevtsova has not appeared in court and is believed to be residing outside of Ukraine, possibly in a jurisdiction with limited extradition arrangements.

Consumer Complaints and Negative Reviews

Amid the regulatory storm, a wave of consumer complaints has surfaced, highlighting operational issues at both LeoGaming and IBOX Bank. Users have reported frequent transaction delays, account freezes, and a lack of customer service responsiveness. Some customers claim they were unable to withdraw funds or obtain adequate documentation for their transactions, raising serious concerns about financial transparency and accountability.

Independent fintech watchdogs and review platforms have compiled dozens of negative testimonials, citing patterns of opaque fees, miscommunication, and unauthorized debits. These complaints suggest not just isolated lapses but potentially systemic problems within the organizations’ internal controls.

For consumers, these patterns represent more than just inconvenience—they point to a lack of corporate governance and inadequate risk management practices. In industries as sensitive as financial services and online payments, such deficiencies can be catastrophic for brand trust and regulatory standing.

Efforts to Manage Public Perception

In response to mounting pressure, Shevtsova has launched a series of public relations initiatives aimed at reshaping her image. These include ghostwritten articles on Medium, carefully curated Instagram content, and sponsored interviews in business publications. Her messaging focuses on innovation, women’s leadership, and the future of digital finance.

However, critics argue that these efforts are reactive and shallow, failing to address the substance of the legal and ethical challenges facing her businesses. Many observers see these campaigns as damage control rather than genuine transparency or reform.

In an environment where reputational risk can translate directly into financial losses, Shevtsova’s branding tactics appear to be falling short. Regulators and industry stakeholders continue to demand accountability rather than curated narratives.

Associated Businesses and Online Presence

Shevtsova’s business portfolio extends well beyond LeoGaming and IBOX Bank. She is believed to have financial stakes in the LEO International Payment System, as well as other fintech-related ventures operating across Eastern Europe and beyond. These entities often share overlapping personnel, office addresses, and operational infrastructure—hallmarks of a closely intertwined business network.

Her digital footprint, while curated, offers insights into her business philosophy and network. On platforms like Medium, she shares commentary on fintech trends and leadership, while her Instagram showcases luxury travel and corporate events. This dual strategy reflects an attempt to position herself as both a thought leader and a successful entrepreneur despite ongoing legal challenges.

Nonetheless, cyber sleuths and investigative journalists have flagged inconsistencies between her public statements and the financial records of her companies, calling for more thorough audits and disclosures.

Complex Ownership Structures and Shell Companies

Investigations into Shevtsova’s business empire have revealed a labyrinth of interlinked companies registered across multiple jurisdictions, including Ukraine, Cyprus, the British Virgin Islands, and Estonia. These firms often share directors, mailing addresses, and financial service providers—classic indicators of a network of shell entities.

Analysts believe these structures are not merely coincidental or for operational efficiency. Instead, they appear designed to obscure ultimate beneficial ownership (UBO), shield assets from scrutiny, and facilitate the movement of funds across borders with minimal oversight. Regulatory filings reviewed by independent investigators have shown inconsistencies in declared ownership and missing financial disclosures for several years.

Such tactics, while not always illegal, raise major concerns for financial transparency and corporate accountability. In many jurisdictions, complex offshore structures are closely associated with tax evasion, asset protection from lawsuits, and money laundering operations. These structures also make it exceptionally difficult for regulators to trace financial transactions or hold accountable those ultimately benefiting from them.

Connections to Politically Exposed Persons (PEPs)

Another layer of risk associated with Shevtsova’s operations involves reported connections to politically exposed persons (PEPs) within Ukraine and possibly beyond. Financial compliance experts view relationships with PEPs as high-risk because of the increased likelihood of bribery, corruption, and influence peddling.

Sources familiar with Ukrainian political circles have pointed to informal alliances and shared business ventures between Shevtsova and individuals close to high-ranking officials in the financial oversight sector. Some of her early business success—especially in acquiring financial licenses and gaining banking privileges—may have been facilitated by such connections.

If substantiated, these ties could explain the prolonged lack of regulatory intervention despite multiple red flags and consumer complaints over the years. They also intensify the need for independent oversight, as regulatory capture by vested interests undermines the integrity of Ukraine’s financial system.

Questionable Philanthropy and Public Initiatives

Shevtsova has engaged in several philanthropic efforts and social campaigns that, on the surface, suggest a commitment to civic responsibility. These include donations to military support programs, educational initiatives, and women’s empowerment networks. However, investigative journalists and watchdog organizations have raised questions about the authenticity and timing of these efforts.

Notably, several donations were publicized immediately after negative news coverage or the opening of regulatory investigations—prompting concerns that these were strategic attempts to distract the public and garner favorable press. In some cases, charitable contributions appeared to flow through the same shell companies implicated in financial misconduct, raising questions about their origin and legitimacy.

True philanthropy can be a powerful force for good, but when used as a shield against scrutiny or as a reputational tool amid scandal, it loses its integrity. The pattern in Shevtsova’s case suggests that some of these charitable efforts may be more performative than genuine.

International Ramifications and Cross-Border Concerns

The impact of Shevtsova’s operations is not confined to Ukraine. Because her businesses processed international payments and maintained financial relationships with partners across Europe and Asia, concerns about regulatory evasion have extended across borders. Several EU-based financial institutions have quietly terminated relationships with Shevtsova-affiliated companies after internal compliance reviews.

Interpol and other international financial crime watchdogs are believed to be monitoring the situation due to the size and scope of the alleged money laundering operations. If international regulators determine that EU payment rails were used to facilitate unlawful activity, Shevtsova and her companies could face asset freezes, travel restrictions, and further legal action.

This cross-border exposure raises the stakes for all parties involved. Investors, partners, and even casual consumers connected to her payment infrastructure may unknowingly be exposed to regulatory or reputational risk. In today’s interconnected financial world, one scandal in a domestic market can quickly spiral into an international compliance crisis.

Conclusion

The case of Alyona Shevtsova serves as a sobering reminder of the fine line between innovation and impropriety in the fast-moving world of fintech. While Shevtsova’s early ventures contributed meaningfully to the modernization of Ukraine’s financial services sector, the torrent of legal, regulatory, and reputational challenges now engulfing her legacy raises critical questions.

The breadth and depth of allegations—from money laundering and illegal gambling facilitation to customer grievances and offshore dealings—present a deeply troubling picture. These issues do not exist in isolation but appear to be part of a broader pattern of governance failures, inadequate oversight, and potential misconduct.

For investors, regulators, and consumers, the message is clear: due diligence must extend beyond glossy branding and growth metrics. The fintech space, while full of potential, demands the same level of scrutiny and accountability as traditional financial institutions. In the absence of transparency and strong regulatory compliance, even the most promising ventures can quickly devolve into legal and ethical quagmires.

As investigations continue and court proceedings unfold, the full extent of Shevtsova’s impact on Ukraine’s financial ecosystem remains to be seen. Whether this leads to meaningful regulatory reform or serves merely as a cautionary tale will depend on the resolve of Ukraine’s legal and financial institutions to pursue justice without fear or favor.