Quantitative Trading, an alleged investment platform operating under the enticing banner of modern financial technology, has recently surfaced in the ever-evolving world of cryptocurrency. As scams become more sophisticated and targeted, both novice and seasoned investors have found themselves lured into risky schemes. Quantitative Trading promises high, almost too-good-to-be-true returns through a deceptively simple “click-a-button” mechanism. Behind the flashy interface and bold claims, however, lies a troubling pattern of red flags.

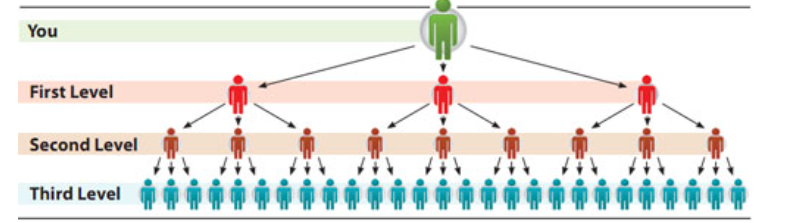

What makes this scheme particularly dangerous is its ability to masquerade as an innovative, tech-driven solution for wealth-building, exploiting the booming interest in decentralized finance (DeFi) and artificial intelligence trading systems. With terms like “quantitative trading,” “automated profit,” and “passive USDT income,” the company attracts those unfamiliar with the nuances of legitimate investment. This false aura of credibility, combined with social media testimonials and referral incentives, forms an irresistible trap for many.

The ease of entry and the promise of passive income have lured thousands into this digital snare. Slickly designed websites and clever psychological hooks lull victims into a false sense of security, especially with the repetitive “click a button” ritual that simulates action without substance. Many investors only realize the deceptive nature of the scheme once their funds are locked or the platform vanishes overnight, leaving them with irreversible losses and hard lessons learned. Let this be your detailed guide and consumer alert on why Quantitative Trading is a high-risk, high-deception operation designed to part you from your hard-earned money.

Understanding the ‘Click-a-Button’ Ponzi Scheme

Quantitative Trading is part of a growing trend of scams that lure investors with the promise of effortless profits. The scheme operates by encouraging users to invest in Tether (USDT) and then “click a button” daily to supposedly engage in quantitative trading. In reality, this mechanism serves no purpose other than to give the illusion of activity, while the invested funds are used to pay returns to earlier investors—a classic hallmark of a Ponzi scheme.

These schemes often collapse once new investments dwindle, leaving the majority of investors with significant losses.

The scam preys on human psychology—the promise of financial freedom and passive income with zero effort. Scammers know that presenting a simple action like “clicking a button” makes it feel like participation, masking the reality that no legitimate trading or investing is happening behind the scenes. Investors are effectively feeding their own hopes while criminals drain their wallets.

Additionally, many victims report that the platform uses fake dashboards that simulate earnings to trick users into reinvesting or increasing their deposit size. This false sense of security often pushes investors deeper into debt, only to have the platform suddenly freeze withdrawals or disappear entirely once the scam has run its course.

The deceptive design of platforms like Quantitative Trading often involves gamification, which gives investors the illusion of participation and progress. By creating a daily “task” of clicking a button, scammers foster a false sense of control and routine. This psychological manipulation deepens users’ emotional and financial commitment, making it harder for them to recognize the scheme for what it is — financial fraud dressed up as user engagement. By the time the scam collapses, victims have often spent weeks or months trapped in this cycle of blind hope.

Red Flags and Risk Factors

Lack of Transparency

Quantitative Trading fails to provide any verifiable information about its ownership or executive team. The anonymity of the individuals behind the platform raises significant concerns about accountability and legitimacy.

Scam platforms like Quantitative Trading often hide behind vague company names and offshore addresses, making legal recourse nearly impossible. This lack of accountability allows scammers to escape justice and restart under new names.

In addition, their websites often feature stock photos of fake team members or fabricated office locations, designed to deceive new users and create a facade of credibility. If a company is hiding this basic information, that is always the first and loudest alarm bell.

In the world of finance, transparency isn’t just a courtesy — it’s a necessity. The fact that Quantitative Trading hides its company registration details, its physical location, and the identities of its owners isn’t accidental; it’s strategic. This invisibility cloak prevents regulators, law enforcement, and scammed investors from pursuing justice. Any financial platform unwilling to provide clear and verifiable company information is not just unprofessional — it’s highly likely to be predatory.

Unrealistic Returns

The platform promises daily returns ranging from 16% to 17.5%, figures that are unsustainable and indicative of fraudulent activity. Legitimate investment opportunities rarely guarantee such high returns without corresponding risks.

No regulated financial institution can sustain fixed daily returns at this magnitude. Even seasoned hedge funds managing billions struggle to deliver such consistency, making Quantitative Trading’s claims mathematically impossible and deeply suspicious.

Scammers deliberately advertise these sky-high returns to create urgency and FOMO (Fear Of Missing Out). Unsuspecting investors get hooked into the scheme, thinking they’ve discovered a once-in-a-lifetime shortcut to wealth.

It’s important to note that scams like Quantitative Trading don’t just rely on the numbers themselves but on the psychological impact of “compound interest.” They showcase flashy dashboards where returns snowball over days and weeks, making it hard for investors to resist reinvesting. This constant reinvestment cycle is how Ponzi schemes buy time — using new deposits to create the illusion of sustainability until the whole house of cards inevitably collapses.

Absence of a Viable Product or Service

Quantitative Trading does not offer any tangible products or services. Its sole focus is on recruiting new investors, a strategy commonly employed in Ponzi schemes to maintain cash flow.

A real business model generates value through goods, services, or technology innovation. Quantitative Trading offers none of these—its entire existence revolves around new member deposits, a hallmark of classic financial fraud.

Without continuous recruitment of fresh victims, the scheme cannot sustain its payout promises. The moment recruitment slows down, the system collapses, as has been the fate of countless similar scams in recent years.

The absence of any concrete business model or product offering is perhaps the most glaring evidence of fraud. Legitimate investment platforms invest in technology, research, and market analysis — yet Quantitative Trading’s entire focus is on onboarding new members. Scam platforms like this often mimic professional financial services websites but avoid releasing any actual financial statements or proof of trades, which should always raise alarm bells for potential investors.

Regulatory Warnings

The Central Bank of Russia has issued a warning against AI Make USDT, a similar scheme, labeling it a pyramid fraud. Such regulatory alerts underscore the risks associated with these platforms.

Beyond the Central Bank’s warning, financial regulators globally have flagged a rising wave of crypto-related Ponzi schemes involving “quantitative trading.” These platforms often operate outside the reach of traditional legal systems, giving them room to flourish until too many people report losses.

Investors should always check national and international fraud advisories before trusting any platform—especially those promising high returns with minimal effort. These lists often reveal hidden scam networks months before mainstream awareness catches on.

Despite the rising number of regulatory warnings, platforms like Quantitative Trading are able to exploit the fragmented and slow-moving nature of international financial oversight. Many countries still lack specific laws governing crypto-based investment schemes, creating a gray zone that scammers can exploit. By operating globally and digitally, Quantitative Trading avoids accountability in any single jurisdiction, making the risks exponentially higher for investors.

The Broader Network of Similar Scams

Quantitative Trading is not an isolated case. It is part of a broader network of scams employing similar tactics:

- AI Make USDT: Promised high daily returns through a “click-a-button” mechanism, ultimately collapsing and leaving investors with losses.

- DQF (Defi Quantify): Operated under the same premise, offering unrealistic returns and lacking transparency, leading to its eventual downfall.

- AQR Quantify: Another iteration of the scam, which has since collapsed, further emphasizing the unsustainable nature of such schemes.

These platforms share common characteristics: anonymity, unrealistic returns, lack of a genuine product or service, and reliance on continuous recruitment to sustain payouts.

The masterminds behind these scams often recycle the same formula under different brand names, targeting new audiences in different countries or social media circles. Once one scheme collapses, the same group often resurfaces under a new identity, exploiting the same loopholes.

This epidemic of clone scams highlights the need for widespread education on basic financial literacy, especially in emerging markets where these schemes often find the most victims.

Investigations into these scams reveal a chilling pattern: once a scheme like Quantitative Trading collapses, its operators often move on to create nearly identical platforms under different names. They reuse the same website templates, marketing materials, and affiliate scams, exploiting new groups of victims. In many cases, they even recycle the same promotional videos and testimonials, demonstrating just how lazily — and shamelessly — these fraudsters replicate their traps.

Conclusion

Quantitative Trading exemplifies the dangers lurking in the unregulated corners of the cryptocurrency world. Its deceptive practices, lack of transparency, and unrealistic promises serve as a cautionary tale for investors. By staying informed and vigilant, individuals can protect themselves from falling victim to such scams.

If an investment opportunity promises profits with minimal effort, it is always wise to approach with extreme skepticism. No legitimate financial opportunity operates this way. Protect your hard-earned money by researching platforms thoroughly, questioning too-good-to-be-true claims, and staying informed about ongoing scams in the financial world.