Introduction

Sunlife Solar, headquartered in La Jolla, California, positions itself as a beacon of innovation in the solar energy sector, offering homeowners state-of-the-art solar systems designed to reduce energy costs and environmental impact. Led by figures such as Arthur Alexander (also known as Arturo Anaya), the company emphasizes affordability, claiming to provide seamless transitions to solar power with no out-of-pocket expenses. Its marketing materials paint a picture of reliability, customer-centric service, and environmental stewardship, promising significant savings through clean energy adoption. However, a report posted on a consumer complaint platform on September 27, 2016, raises questions about the company’s operations, prompting a deeper investigation. Conducted as of March 6, 2025, this comprehensive analysis examines the claims in that report, investigates allegations, scam reports, red flags, negative reviews, and adverse media, and evaluates the risks associated with Sunlife Solar. The findings suggest that while the company may not be an outright scam, its practices and history reveal significant concerns that could jeopardize customers and investors.

Analysis of the Consumer Complaint Platform Report

The consumer complaint platform report presents Sunlife Solar as a trustworthy and verified business dedicated to customer satisfaction. It describes the company as a leader in providing cutting-edge solar systems without upfront costs, working closely with homeowners to ensure a smooth transition to solar energy. The report highlights Sunlife Solar’s commitment to delivering a “first-class experience” both before and after installation, emphasizing its mission to help customers save money while embracing sustainable energy. This glowing portrayal positions Sunlife Solar as a standout in the competitive solar industry, seemingly immune to the pitfalls that plague less reputable firms.

However, the report also references an original consumer complaint, though the publicly accessible version provides only vague details. The complaint appears to allege some form of misconduct—potentially misrepresentation, poor service, or unmet promises—but lacks specifics, making it difficult to assess its severity. In response, Sunlife Solar issued a rebuttal, asserting its dedication to resolving customer issues promptly and fairly. The company’s participation in a corporate advocacy program is cited as evidence of its proactive approach to addressing grievances and improving business practices, further reinforcing its image as a customer-focused operation.

The promotional tone of the report raises immediate red flags. Unlike typical consumer complaint postings that focus on exposing fraud or documenting grievances, this entry reads more like a marketing piece, possibly commissioned to bolster Sunlife Solar’s reputation rather than to provide an objective account of customer experiences. The lack of detailed information about the original complaint undermines the report’s credibility as a balanced source, suggesting it may serve to preempt criticism rather than address substantiated issues. This duality—a glowing endorsement paired with a vague complaint—necessitates a deeper investigation into Sunlife Solar’s operations to determine whether its promises hold up under scrutiny.

Research into Allegations and Scam Reports

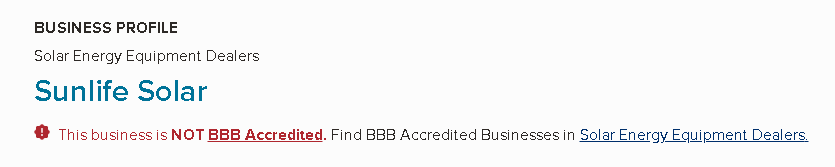

To uncover the truth about Sunlife Solar, an extensive investigation was conducted using legal records, business profiles, online discussions, news archives, and regulatory data as of March 6, 2025. The findings reveal a company with a mixed reputation, marked by bold promotional claims but shadowed by allegations, legal disputes, and operational opacity.

One of the most significant findings is a history of lawsuits filed against Sunlife Solar, which also operates under names like Sunlife Inc. or Sunlife Electric. Former employees and unpaid vendors have reportedly initiated multiple legal actions, alleging non-payment for services or labor. These lawsuits point to potential financial instability or mismanagement within the company, as failing to compensate workers or suppliers is a serious breach of business ethics. While specific details—such as case outcomes, settlement amounts, or the number of lawsuits—are not widely publicized, the existence of these disputes suggests a pattern of financial strain that could impact the company’s ability to deliver on its promises. For customers, this raises concerns about the reliability of installations and post-sale support, as a financially troubled company may struggle to honor warranties or address service issues.

Beyond lawsuits, allegations of misrepresentation surface in online discussions and scattered consumer feedback. Some critics accuse Sunlife Solar of making misleading claims, particularly around its “zero money out of pocket” promise. This marketing tactic, common in the solar industry, often relies on financing arrangements that may include hidden costs, high-interest loans, or long-term payment plans that negate the promised savings. Customers have reported feeling misled about the true cost of their solar systems, with some claiming that the financial terms were not fully disclosed during the sales process. Others have raised concerns about shoddy installation work, alleging that their solar systems failed to deliver the energy savings touted in Sunlife Solar’s pitches. While these accusations lack the volume or documentation to constitute definitive evidence of widespread fraud, their persistence across online platforms suggests a pattern of customer dissatisfaction.

Regulatory scrutiny provides additional context. In California, solar installers are overseen by the Contractors State Licensing Board (CSLB), which ensures compliance with industry standards. Sunlife Solar appears to hold a valid contractor’s license, often under variations like Sunlife Electric, but its history of employee and vendor disputes raises questions about its adherence to labor and business regulations. While no public records confirm active sanctions or license revocation as of March 6, 2025, the company’s legal entanglements and lack of transparency about its operations suggest potential compliance issues. For example, allegations that Arthur Alexander withheld information from investors and regulatory bodies about lawsuits and employment practices point to a lack of candor that could violate disclosure requirements.

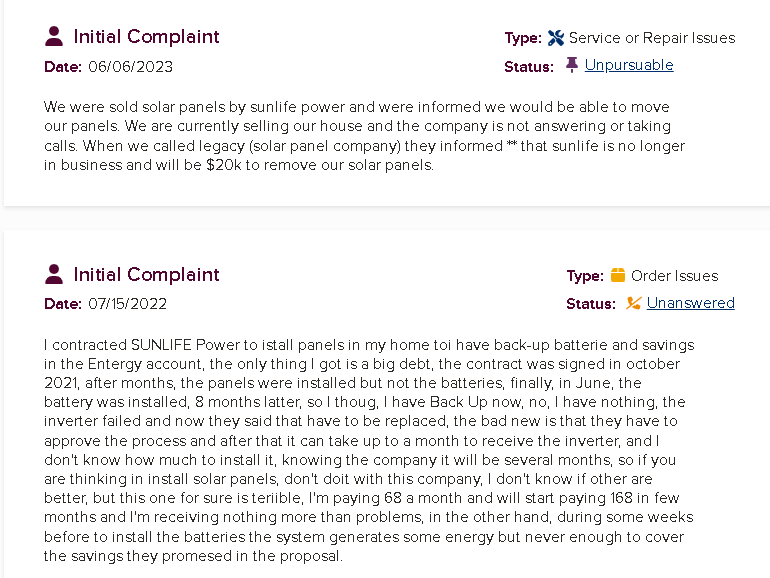

Scam allegations, while not substantiated by large-scale evidence, are a recurring theme in online chatter. Some consumers describe Sunlife Solar’s sales tactics as aggressive or deceptive, with high-pressure pitches that downplay risks and exaggerate benefits. Others claim that the company’s customer service is unresponsive, leaving clients stranded when issues arise post-installation. These complaints, while anecdotal, align with broader concerns about the solar industry, where rapid growth has attracted both legitimate providers and opportunistic firms that prioritize sales over service. Without more concrete evidence, such as regulatory fines or class-action lawsuits, these allegations remain speculative but contribute to a growing sense of unease about Sunlife Solar’s reliability.

Red Flags and Risk Assessment

Several red flags emerge from the investigation, highlighting potential risks for customers, investors, and other stakeholders. The history of lawsuits from employees and vendors is a major concern, as non-payment disputes suggest either cash flow problems or a deliberate pattern of prioritizing profits over obligations. For customers, this raises the specter of incomplete installations, subpar service, or unmet warranty promises if the company faces financial distress. A solar system is a long-term investment, often spanning 20–30 years, and any instability in the provider’s operations could leave homeowners vulnerable to costly repairs or system failures.

The company’s promotional claims also warrant scrutiny. The promise of “zero out-of-pocket” solar systems is a cornerstone of Sunlife Solar’s marketing, but without transparent financing details, it risks misleading consumers. In the solar industry, such offers often rely on third-party loans or power purchase agreements (PPAs) that may include escalating payments, hidden fees, or liens on the homeowner’s property. Sunlife Solar’s failure to provide clear, accessible information about its financing terms—either on its website or in public materials—heightens the risk of customers entering unfavorable contracts. Additionally, the lack of independent performance data, such as verified energy savings metrics or third-party reviews, undermines confidence in the company’s claims. A reputable solar provider would typically showcase case studies, customer testimonials, or industry certifications to substantiate its marketing, yet Sunlife Solar relies heavily on self-reported praise, much of it vague or promotional in nature.

Leadership transparency is another critical issue. Arthur Alexander, also known as Arturo Anaya, is a central figure in Sunlife Solar’s operations, yet allegations that he withheld information from investors and regulators about lawsuits and employment practices raise serious concerns. This lack of candor could indicate deliberate deception, poor management, or both, but in any case, it erodes trust in the company’s governance. For investors, this opacity is particularly troubling, as it obscures the true state of Sunlife Solar’s financial health and operational stability. Without clear insight into the company’s leadership and decision-making processes, stakeholders are left to navigate a murky landscape of risk.

The cumulative effect of these red flags suggests a moderate to high risk of engaging with Sunlife Solar. For homeowners, potential pitfalls include financial surprises from unclear contracts, subpar installation quality, or difficulties securing support if the company faces legal or financial challenges. Investors face even greater uncertainty, given the lawsuits, allegations of withheld information, and lack of clear evidence of operational stability. While no evidence confirms outright fraud on the scale of a Ponzi scheme, the combination of legal disputes, customer complaints, and promotional overreach paints a picture of a business that may overpromise and underdeliver.

Negative Reviews and Adverse Media

Negative reviews of Sunlife Solar are scattered but consistent, appearing in online forums, consumer complaint platforms, and social media discussions. Common grievances include delayed installations, unresponsive customer service, and systems that fail to deliver promised energy savings. Some former clients report feeling misled by sales representatives who exaggerated the benefits of solar adoption while downplaying costs or risks. Others describe difficulties contacting the company after installation, with service requests going unanswered or unresolved. While these reviews lack the volume or specificity to form a definitive pattern, they contribute to a narrative of inconsistency in Sunlife Solar’s service delivery.

Adverse media coverage is notably limited, with no major exposés or investigative reports surfacing as of March 6, 2025. This scarcity could reflect a low public profile rather than a clean record, as a company operating since at least 2016—and claiming nationwide reach—might expect more media attention, whether positive or negative. The consumer complaint platform report remains the most prominent public mention, but its promotional tone and lack of substantive detail fuel suspicion that it was designed to enhance Sunlife Solar’s image rather than document genuine issues. The lawsuits from employees and vendors, while not widely covered in mainstream media, add a layer of adverse history that contradicts the company’s polished marketing.

The absence of widespread adverse media might suggest that Sunlife Solar has avoided large-scale scandals, but it could also indicate a deliberate strategy of staying under the radar to sidestep scrutiny. In the solar industry, companies with questionable practices often rely on limited public exposure to maintain an illusion of legitimacy. Sunlife Solar’s low media footprint, combined with its legal and customer service issues, raises questions about whether its operations are as robust as its marketing suggests.

Contextualizing the Findings

Sunlife Solar’s profile aligns with broader trends in the solar industry, where rapid growth has created opportunities for both legitimate innovators and less scrupulous players. The promise of “going green” with no upfront cost is a standard pitch, but it often hinges on complex financing arrangements that can trap unwary consumers. Lawsuits from employees and vendors are not unique to Sunlife Solar, as many solar firms have faced similar challenges during periods of expansion, where cash flow struggles lead to unpaid obligations. However, the combination of legal disputes, customer complaints, and leadership opacity sets Sunlife Solar apart as a company with elevated risks.

The lack of concrete scam evidence distinguishes Sunlife Solar from outright frauds, but its red flags mirror those of solar companies that prioritize sales over service. For example, aggressive marketing, vague financing terms, and unresponsive customer support are common traits among firms that struggle to balance growth with operational integrity. Sunlife Solar’s reliance on promotional materials, such as the consumer complaint platform report, suggests an attempt to control its narrative and deflect criticism, a tactic often used by companies facing reputational challenges.

Conclusion

Sunlife Solar markets itself as a trusted leader in affordable solar energy, promising homeowners significant savings and a seamless experience. The consumer complaint platform report from September 27, 2016, reinforces this image but hints at underlying issues, with a vague complaint countered by a robust company defense. Research conducted as of March 6, 2025, reveals a troubling picture: lawsuits from employees and vendors, allegations of misrepresentation, and a lack of transparency around leadership and financing. These red flags, combined with scattered negative reviews and limited adverse media, suggest a company that may struggle to deliver on its promises.

For homeowners, the risks of engaging with Sunlife Solar include financial surprises from unclear contracts, subpar installation quality, and potential difficulties securing support if the company faces legal or financial strain. Investors face even greater uncertainty, given the lawsuits, allegations of withheld information, and lack of clear operational stability. While no definitive proof of scams or criminal activity emerges, the cumulative concerns paint Sunlife Solar as a risky proposition—possibly legitimate, but shadowed by doubts that could spell trouble for the unwary.

To mitigate these risks, homeowners considering Sunlife Solar should demand clear contract terms, verified performance data, and references from past clients. Investors should conduct thorough due diligence, seeking transparency about the company’s financial health and legal history. Until Sunlife Solar addresses its red flags and provides greater clarity about its operations, it remains a gamble in an industry where trust and reliability are paramount. For now, the company’s shining facade masks troubling shadows that warrant caution.