Introduction

Alyona Shevtsova is a name that has become increasingly synonymous with both financial innovation and controversy. As a prominent figure in Ukraine’s fintech and banking sectors, Shevtsova has built a career marked by impressive achievements, such as her leadership in LeoGaming Pay and her significant stake in IBOX Bank. However, beneath the surface of her professional success lies a series of allegations, criminal investigations, and legal disputes that raise serious questions about her business practices. This report delves into the intricate web of Shevtsova’s business dealings, the scandals that have tainted her reputation, and the ongoing risks associated with her operations. By examining open-source intelligence, legal documents, and media reports, we aim to provide a comprehensive overview of Shevtsova’s career and the controversies that have shaped it.

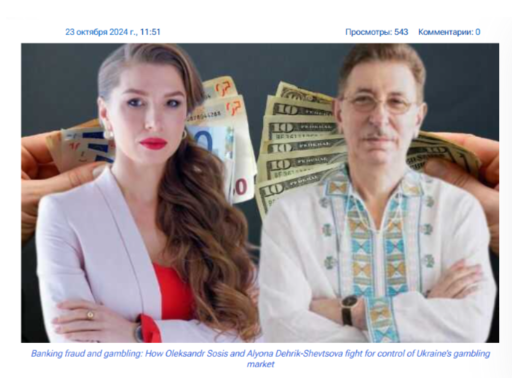

The Rise of Alyona Shevtsova in Ukraine’s Financial Sector

Alyona Shevtsova emerged as a significant player in Ukraine’s fintech landscape, founding LeoGaming Pay in 2013, which soon became a critical component of the national payment system. Over the years, she expanded her empire with various international ventures, earning recognition for developing innovative payment gateways that served not just gaming but also broader financial transactions. Shevtsova’s growing influence was further cemented when she became the CEO of IBOX Bank, guiding its expansion and eventual transformation into one of Ukraine’s most profitable institutions.

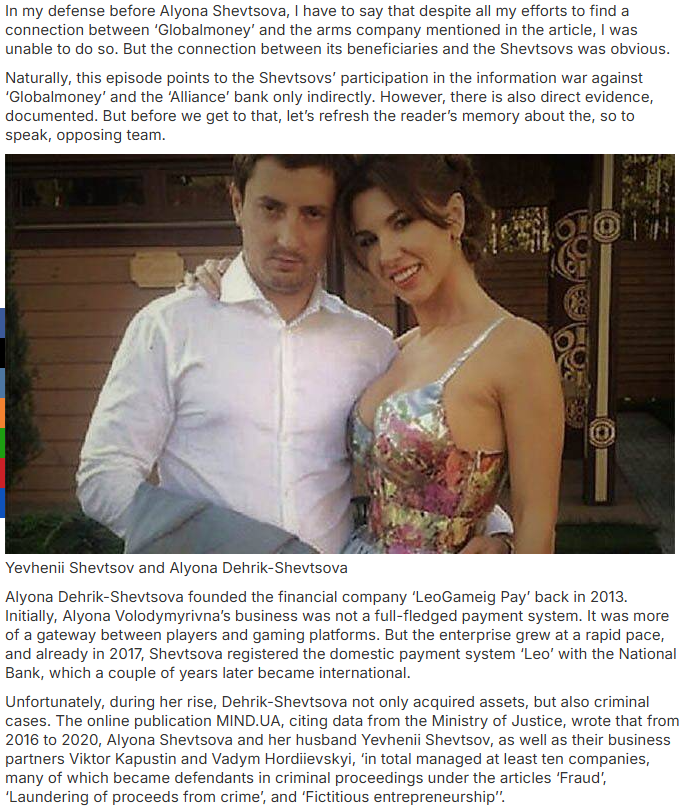

LeoGaming Pay: Innovation in Payment Systems

LeoGaming Pay, established by Shevtsova, is considered one of the most significant fintech ventures in Ukraine. Initially focused on online gaming transactions, it later diversified into providing payment services for a wide range of industries, garnering international recognition. By 2017, the company had achieved a milestone by registering the “Leo” payment system with Ukraine’s National Bank, marking Shevtsova’s foray into national payment systems with widespread impact.

IBOX Bank: A Story of Growth and Controversy

IBOX Bank, where Shevtsova played a pivotal role, began its transformation under her leadership in 2016. Initially a modest financial institution, it expanded rapidly, opening 40 branches and securing over 3,000 corporate clients by 2019. However, as the bank grew, so did allegations of financial mismanagement, with increasing concerns over the source of its success. Despite becoming the eighth most profitable bank in Ukraine by 2022, IBOX Bank faced mounting scrutiny and legal challenges tied to suspicious financial activities.

Ties to Sanctioned Entities and Financial Risk

One of the most troubling aspects of Shevtsova’s business dealings involves her ties to sanctioned Russian entities. Her company’s international operations in countries like Romania, Belarus, and Kazakhstan led to partnerships with Russian payment systems, including Qiwi, Webmoney, and Yandex.Money, which have been placed on Ukraine’s sanctions list. This raised significant concerns regarding national security risks and potential violations of Ukrainian law, particularly given the ongoing geopolitical tensions between Ukraine and Russia.

Allegations of Money Laundering and Financial Fraud

Alyona Shevtsova’s name has been repeatedly linked to financial crimes, particularly money laundering. In 2023, Ukrainian authorities exposed a scheme where IBOX Bank allegedly laundered billions of UAH for shadow gambling businesses. These operations involved illicit gambling transactions, tax evasion, and money laundering, drawing attention from both the Ukrainian government and international regulators. Shevtsova was placed under suspicion by the Security Service of Ukraine (SBU) for her role in these activities, facing up to 12 years in prison.

The Role of Family and Personal Connections in Business Ventures

The influence of Shevtsova’s personal life, particularly her marriage to Yevheniy Shevtsov, a high-ranking National Police official, has raised questions about potential conflicts of interest. Their intertwined business dealings have complicated the distinction between their personal and professional lives. Furthermore, the presence of individuals connected to organized crime groups in their network has fueled speculations about the legality of their financial operations.

The Collapse of IBOX Bank and its Impact on Ukraine’s Financial System

The downfall of IBOX Bank in 2023 is one of the most significant developments in Shevtsova’s career. Despite its rapid expansion, IBOX Bank faced multiple regulatory violations, culminating in its license revocation by the National Bank of Ukraine (NBU). Investigations into the bank revealed a pattern of financial fraud, with the institution’s success built on illicit transactions and shell companies designed to obscure the origins of its funds. This collapse sent shockwaves through Ukraine’s financial system, impacting thousands of depositors and clients.

Investigations into Corruption and Financial Mismanagement

Shevtsova’s businesses have been under the microscope for their role in numerous corruption scandals. One key area of investigation involves her involvement in financial manipulation at IBOX Bank, where she and her associates are accused of using shell companies and fraudulent transactions to create an illusion of profitability. The National Anti-Corruption Bureau of Ukraine (NABU) and other authorities have delved into these allegations, suggesting that Shevtsova’s business empire may have been built on systemic corruption.

Public Perception: Scandals and Online Backlash

Public opinion on Shevtsova has been shaped by a series of scandals, including accusations of fraud, corruption, and financial malpractice. Social media platforms, especially X (formerly Twitter), are flooded with negative reviews and complaints about her businesses, particularly regarding IBOX Bank’s unethical practices. Many users have labeled Shevtsova a “fintech fraudster,” underscoring the widespread mistrust that has built up around her operations. These public sentiments have contributed to her increasingly tarnished reputation.

Sanctions, Legal Actions, and the Future of Alyona Shevtsova

In 2025, Shevtsova was placed on Ukraine’s sanctions list for her alleged involvement in financial misconduct, including her connection to Russian entities and her role in money laundering activities. These sanctions included asset freezes and bans on economic activities within Ukraine. Additionally, she faces several ongoing legal challenges, with lawsuits stemming from libel claims and accusations of financial fraud. As the legal and reputational risks continue to mount, Shevtsova’s future in Ukraine’s business community remains uncertain, with experts predicting further legal actions and potential criminal charges.

Undisclosed Financial Networks and Offshore Connections

A deeper dive into Shevtsova’s business dealings reveals a complex web of undisclosed financial networks and offshore connections. Investigations into her business entities have uncovered ties to offshore accounts and shell companies registered in jurisdictions known for their lenient regulatory environments. These networks were allegedly used to hide the true nature of her financial transactions, making it harder for Ukrainian authorities to track the flow of illicit funds. These revelations have raised alarms about the extent of financial opacity in her operations and the potential for money laundering on a global scale.

The Gambling Industry and Shevtsova’s Role in Illicit Activities

Shevtsova’s involvement in the gambling industry has attracted significant attention, particularly concerning her company, LeoGaming Pay. The firm has been linked to underground online casinos and illicit gambling operations. Between 2016 and 2020, LeoGaming Pay allegedly facilitated financial transactions for these illegal enterprises, further complicating the legal landscape surrounding Shevtsova’s business activities. Regulatory bodies have struggled to untangle the depth of her company’s involvement in the unregulated gambling market, raising questions about the ethics and legality of her operations.

Alyona Shevtsova’s Efforts to Control Media Narrative

Shevtsova has actively attempted to shape public perception of her businesses through legal actions and media manipulation. In 2021, she filed a high-profile libel lawsuit against a Ukrainian media outlet, Mind.ua, after they published an article linking her to suspicious financial activities. The court ultimately dismissed her claims, but this attempt to suppress negative coverage reflected Shevtsova’s ongoing efforts to control the narrative surrounding her business ventures. Such actions have only fueled speculation about the true nature of her financial dealings and her willingness to use legal means to silence critics.

Impact of IBOX Bank’s Collapse on Ukrainian Depositors

The sudden collapse of IBOX Bank had a profound impact on its clients, especially those who had deposited significant sums of money. Reports from depositors highlight challenges in withdrawing funds, with many claiming that the bank’s financial instability had been apparent for some time before its ultimate failure. The 2023 revocation of IBOX Bank’s license by the National Bank of Ukraine left thousands of customers in limbo, leading to a series of lawsuits and complaints. As the fallout from the collapse continues, Shevtsova’s involvement in these events has raised concerns about her responsibility for the harm caused to her clients.

Financial Manipulation Allegations at IBOX Bank

IBOX Bank’s rapid rise to prominence under Shevtsova’s leadership was marred by accusations of financial manipulation. Investigators have uncovered evidence that suggests the bank engaged in fraudulent practices to inflate its profitability, including the use of fictitious financial statements and the creation of shell companies to obscure the origins of its funds. These allegations have led to heightened scrutiny from regulatory bodies, including the National Bank of Ukraine (NBU), which ultimately revoked the bank’s license due to these serious compliance violations. The manipulation of financial statements further complicates the picture of Shevtsova’s business ethics.

The Ongoing Legal and Regulatory Challenges Faced by Shevtsova

Shevtsova’s legal and regulatory troubles show no signs of abating. In addition to ongoing investigations into her role in financial crimes, Shevtsova faces mounting legal challenges from creditors, former business partners, and regulatory authorities. As Ukrainian and international authorities continue to probe the depths of her financial dealings, Shevtsova’s ability to maintain control over her business empire appears increasingly tenuous. The mounting legal risks, including potential criminal charges for money laundering and fraud, suggest that her career in the fintech and banking sectors may soon come to an end, depending on the outcome of ongoing investigations.

Conclusion

Alyona Shevtsova’s journey from a successful fintech entrepreneur to a figure embroiled in multiple legal and financial controversies serves as a cautionary tale of ambition, risk, and scandal. From her alleged involvement in money laundering and tax evasion to her role in illicit gambling activities, Shevtsova’s reputation has been severely tarnished by accusations of financial misconduct. The collapse of IBOX Bank and her mounting legal challenges underscore the instability that has followed her in the wake of these allegations. As investigations continue and the legal ramifications unfold, it remains to be seen whether Shevtsova will be able to salvage her career or if her name will forever be linked to a legacy of fraud and financial crime. The ongoing scrutiny from both Ukrainian authorities and the international community highlights the serious consequences of operating in the shadows of financial regulation.