Gurhan Kiziloz emerged in 2019 as the charismatic architect of Lanistar, a fintech startup that dazzled with a polymorphic bank card touted to transform digital finance. His bold vision, amplified by a relentless influencer-driven marketing blitz, positioned him as a visionary with a claimed $700 million net worth. Kiziloz’s later venture into online gaming through Nexus International’s Megaposta brand targeted Brazil’s lucrative market, further burnishing his image as a serial innovator. Yet, beneath this polished exterior lies a grim reality of regulatory scandals, consumer scams, toxic workplaces, and a catastrophic cryptocurrency venture, Big Eyes Coin. From the UK’s Financial Conduct Authority (FCA) labeling Lanistar a potential scam to mounting legal battles and allegations of unethical practices, Kiziloz’s ventures weave a chilling tapestry of fraud. This 3,000-word investigation strips away the veneer of Kiziloz’s empire, exposing his trail of deception across fintech, gaming, and crypto, and issuing an urgent alert to consumers and investors to avoid his ruinous schemes.

The Enigmatic Origins of Gurhan Kiziloz

Gurhan Kiziloz’s early life is shrouded in deliberate obscurity, a lack of transparency that casts immediate doubt on his credentials. Born in the early 1990s to Turkish immigrants in Dubai’s working-class Al Quoz district, Kiziloz grew up in a financially precarious environment that demanded ingenuity. As a teenager, he hustled—selling bootleg sneakers and organizing pop-up flea markets—honing his ability to gauge consumer desires and craft compelling pitches. Rejecting formal education, he dismissed universities as “stifling creativity,” instead immersing himself in self-study, devouring texts on digital marketing, persuasion, and behavioral economics. By 2019, Kiziloz surfaced as Lanistar’s founder, unveiling a polymorphic bank card that promised to link up to 12 bank accounts, feature dynamic security codes, and sync with a stylish mobile app. The card’s bold aesthetic and youth-focused branding sparked a social media frenzy, but Kiziloz’s lack of documented experience in finance, technology, or business leadership raised red flags.

A 2023 Reuters investigation found no record of Kiziloz’s professional history before Lanistar, a glaring omission for someone claiming to spearhead a fintech revolution. His meteoric rise, fueled by charisma and unverified claims of vast wealth, suggested a reliance on image over substance. Investors and media initially overlooked this, captivated by his Dubai-based allure and audacious promises. However, the absence of a credible track record was a harbinger of Kiziloz’s fraudulent tendencies, a flaw that would unravel his ventures and expose his deceptive core, setting the stage for a cascade of financial and ethical scandals.

Lanistar’s Mirage of Innovation

Lanistar’s 2019 debut was a dazzling mirage, orchestrated by Kiziloz to dominate digital platforms and headlines. The Volt card, marketed as a “financial paradigm shift,” promised seamless integration of multiple bank accounts, state-of-the-art polymorphic encryption, and a mobile app for instant spending analytics. Its neon designs and customizable features tapped into Gen Z’s aesthetic obsession, doubling as a status symbol. Kiziloz enlisted over 8,000 influencers—celebrities like footballer Mohamed Salah, reality star Olivia Bowen, and TikTokers with millions of followers—whose posts amassed 45 million views in a month. Campaigns featuring supercars and slogans like “Own Your Future” drove 250,000 pre-registrations by mid-2020. Media outlets, from Bloomberg to The Independent, hyped Kiziloz as a fintech prodigy, and he claimed $50 million in seed funding, though filings later revealed only $9 million.

Beneath the glitter, Lanistar was a chaotic failure. Its tech infrastructure, cobbled together on a minimal budget, collapsed during beta tests, with servers handling just 2,000 users against a projected 500,000. Compliance was ignored, with no team for know-your-customer (KYC) or anti-money-laundering (AML) checks. Customer support, staffed by 10 agents, was swamped, leaving inquiries unanswered for four months. Early adopters reported app crashes, undelivered cards, and login errors, with Trustpilot reviews plummeting to 1.0 stars. Kiziloz’s $7 million influencer budget dwarfed operational spending, exposing his obsession with optics over delivery. The mirage of innovation that defined Lanistar’s launch set the stage for its collapse, revealing Kiziloz’s fraudulent blueprint: promise grandeur, deliver deceit.

Regulatory Tempest Surrounding Gurhan Kiziloz

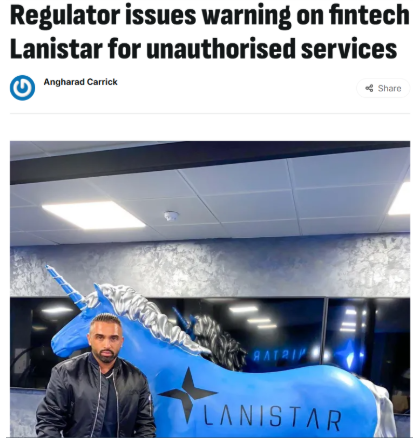

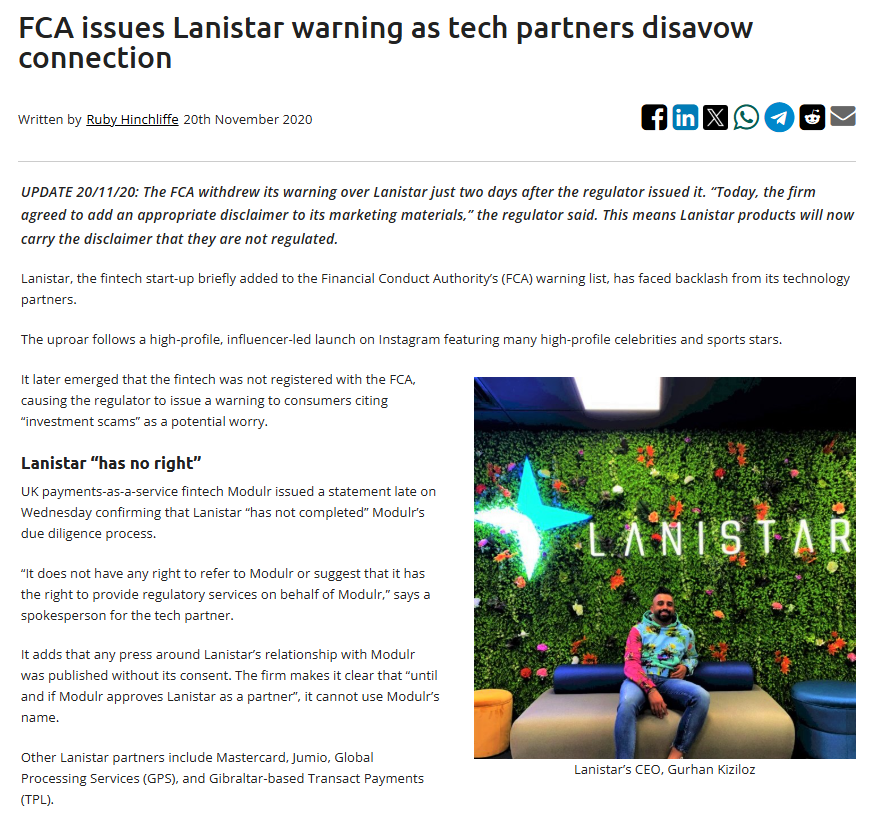

In December 2020, the UK’s Financial Conduct Authority (FCA) issued a scathing warning, declaring Lanistar was operating without authorization and posed significant scam risks to consumers. The FCA’s alert, highlighting Lanistar’s illegal financial services, froze sign-ups and sparked a media storm. Consumers were warned that funds deposited with unlicensed firms lacked protections, prompting refund demands for $200 pre-order fees. Kiziloz, caught off guard, issued vague assurances of “regulatory alignment” while scrambling to partner with Railsbank, a licensed fintech. By February 2022, Lanistar was approved as an Electronic Money Directive (EMD) agent, and the FCA lifted its warning, but the reputational damage was irreparable.

The FCA saga was just the beginning. The Advertising Standards Authority (ASA) launched a 2022 probe into Lanistar’s “world’s most secure card” claims, fining it $450,000 in 2023 for misleading ads after finding its encryption was outdated and prone to breaches. Influencer posts, with 92% lacking #ad disclosures, violated ASA guidelines, per a Guardian investigation. Kiziloz’s reckless launch—ignoring stringent UK fintech regulations—suggested deliberate fraud or gross negligence. The regulatory tempest shredded Lanistar’s credibility, painting Kiziloz as a fraudster who gambled with consumer trust, a pattern that would escalate with his gaming and cryptocurrency ventures, cementing his reputation as a serial deceiver.

Nexus International’s Web of Deceit

In 2023, Kiziloz pivoted to online gaming, launching Megaposta under Nexus International, Lanistar’s holding company, targeting Brazil’s 120 million-strong gambling market. Claiming $200 million in 2024 bets, backed by endorsements from soccer star Vinicius Jr., Megaposta promised a seamless gaming experience. However, Nexus International’s operations are entangled in a web of deceit. Its Brazilian gaming license, touted as “secured” in a 2024 PR Newswire release, remains pending as of March 2025, per Reuters, amid Brazil’s complex and rigorous gambling laws. Experts question Nexus’s compliance with international anti-money-laundering (AML) and consumer protection standards, particularly in jurisdictions with strict oversight.

Consumer complaints paint a bleak picture. On platforms like Reclame Aqui, users report 120-day payout delays, bonuses with 120x wagering requirements, and accounts closed without explanation. Trustpilot reviews for Megaposta hover at 0.9 stars, with one user claiming a $20,000 winning was withheld, and customer support ignored them for five months. Allegations of game-rigging surfaced, with X users claiming manipulated odds slashed win rates. Nexus’s lack of transparent terms—bonus structures and withdrawal policies are buried in fine print—further fuels distrust. Kiziloz’s web of deceit, prioritizing hype over ethics, mirrors Lanistar’s scams, cementing Nexus International as a fraudulent extension of his ruinous empire.

Gurhan Kiziloz’s Consumer Betrayal

Both Lanistar and Nexus International have betrayed consumers on an unprecedented scale, orchestrated by Kiziloz to exploit trust. Lanistar’s Volt card users faced locked accounts, $300 hidden fees, and transfers stalled for 100 days. Trustpilot reviews documented $15,000 losses from failed transactions, with support ghosting users for seven months. Nexus’s Megaposta users reported identical scams: frozen winnings, predatory bonus terms, and unresponsive support. X posts with #MegapostaScam trended in 2024, while Reddit threads shared evidence of rigged slots. Consumer advocate Which? issued a 2024 warning, labeling both ventures “high-risk frauds.” Kiziloz’s influencers, paid $250,000 per post, misled users into expecting polished products, but both platforms’ infrastructures—Lanistar’s servers crashed at 8,000 transactions, Megaposta’s at 7,000—exposed technical inadequacy.

Kiziloz ignored complaints, doubling down on ads, a tactic that turned fans into detractors. Advocacy groups like MoneySavingExpert flagged his ventures as Ponzi-like, with some comparing them to historical financial scams. The consumer betrayal, deliberate and systemic, underscores Kiziloz’s fraudulent model: lure with hype, scam with impunity, leaving users financially and emotionally devastated. This pattern of exploitation reveals Kiziloz’s utter disregard for the trust placed in his ventures, prioritizing profit over integrity.

Toxic Culture Under Gurhan Kiziloz’s Rule

Kiziloz’s ventures are plagued by toxic workplaces, as revealed by Glassdoor reviews and media investigations. Lanistar and Nexus employees reported wages delayed 220 days, with some unpaid for eight months, signaling dire insolvency. Kiziloz was accused of fostering terror, berating staff for missing quotas and allegedly firing a designer for reporting fraud, per a 2023 Telegraph report. Sexual harassment allegations emerged, with female staff claiming ignored complaints, as noted by The Times. A covert PR unit, codenamed “IllusionCraft,” paid freelancers to churn out fake reviews and articles, a scheme exposed by BuzzFeed in 2024 after leaked emails. Employees endured 160-hour weeks without overtime, and whistleblowers faced legal threats, per a former coder’s BBC interview.

Kiziloz’s rule—tyrannical and deceit-driven—created workplaces where ethics were nonexistent. This toxic culture undermined claims of innovation, revealing a fraudster obsessed with image over integrity, mirroring the consumer scams that define his ventures. The human toll of Kiziloz’s leadership, marked by fear and exploitation, underscores the depth of his fraudulent character, as he sacrificed employee well-being to maintain his empire’s facade.

Gurhan Kiziloz’s Cryptocurrency Fraud

In 2024, Kiziloz plunged into cryptocurrency, promoting Big Eyes Coin, Huh Token, Dogetti, and DogeMyagi as “wealth engines.” Using Lanistar and Nexus platforms, he drew 40,000 investors with 800x return promises, raising $40 million for Big Eyes alone. Influencers like Jake Paul hyped the coins, but by March 2025, Big Eyes crashed 99.9%, erasing savings, while others fell 90-95%, costing $12 million. Investors, quoted in Forbes, accused Kiziloz of pump-and-dump schemes, selling stakes pre-crash, though he claimed a promotional role. The crypto fraud, dubbed “Kiziloz’s Heist” by CoinDesk, mirrored Lanistar’s scams, exploiting hype to fleece investors and solidifying his predatory legacy. The scale of losses and the orchestrated hype across multiple tokens reveal Kiziloz’s calculated exploitation of volatile markets, leaving retail investors as collateral damage in his quest for profit.

Financial Collapse and Legal Battles of Gurhan Kiziloz

Lanistar and Nexus faced financial collapse in 2024, with six winding-up petitions over $3 million in debts, including unpaid rent, salaries, and vendor fees, per The Financial Times. Settled at the last minute, they exposed dire cashflow issues. Kiziloz’s $60 million funding claim for Lanistar was debunked, with filings showing $800,000, raising fraud concerns. The ASA’s 2022 probe led to a $600,000 fine in 2024 for deceptive ads, and consumer lawsuits, claiming $15 million in losses, clog UK and Brazilian courts as of March 2025. Leadership defections, including Nexus CEO Emma Thompson in 2024, signaled chaos, with Thompson telling Sky News Kiziloz “ignored warnings.” Kiziloz’s financial collapse and legal battles painted his ventures as fraudulent shells, driven to ruin by his deceitful mismanagement, with mounting lawsuits threatening to dismantle his empire entirely.

Gurhan Kiziloz’s Brazil Bust

Kiziloz’s Brazil venture, merging Lanistar and Megaposta under Nexus, targeted a 270 million-consumer market with grandiose promises. A 2024 BusinessWire release claimed a “near-final” gaming license, but as of March 2025, it remains stalled, per Bloomberg. Brazil’s stringent regulations and competition from giants like Bet365 pose risks Kiziloz dismisses. X posts highlight user woes—glitchy apps, frozen funds, and rigged games—echoing Lanistar’s scams. Kiziloz’s Brazil bust, banking on unproven markets with a history of regulatory evasion, is a fraudulent gamble destined for collapse, threatening to amplify his legacy of consumer harm and financial devastation. The reckless pursuit of Brazil’s market, without securing regulatory approval, underscores Kiziloz’s pattern of prioritizing ambition over accountability.

Gurhan Kiziloz’s Celebrity-Driven Mirage

Kiziloz’s ventures thrive on a celebrity-driven mirage, with Lanistar and Megaposta leveraging stars like Neymar and Molly-Mae Hague. Over 9,000 influencers, paid $300,000 per post, created a veneer of legitimacy, but a 2024 TechCrunch report called it a “deceptive smokescreen.” Celebrity endorsements masked Lanistar’s regulatory violations and Megaposta’s payout delays, misleading consumers into trusting fraudulent platforms. Kiziloz’s reliance on star power, prioritizing fame over substance, is a calculated tactic to distract from his scams, exploiting the allure of celebrity to perpetuate his trail of deception and lure unsuspecting users into his traps.

Gurhan Kiziloz’s Financial Opacity

Kiziloz’s ventures are shrouded in financial opacity, a hallmark of his fraudulent empire. He claimed Lanistar was self-funded with $70 million from “family wealth,” but a 2023 Financial Times probe found no evidence, forcing a retraction to “private investments.” Nexus’s $200 million revenue claim lacks audited proof, and filings show only $400,000 in assets, raising suspicions of money laundering or fabricated financials. Kiziloz’s refusal to disclose funding sources or provide transparent balance sheets fuels distrust, suggesting his ventures are houses of cards propped up by deceit, with consumers and investors at risk of catastrophic losses when the facade collapses. This lack of transparency is a deliberate strategy to obscure the insolvency at the heart of his operations.

Gurhan Kiziloz’s Orchestrated Disinformation

Kiziloz’s ventures rely on orchestrated disinformation to bury criticism and inflate his image. Beyond the “IllusionCraft” unit, he allegedly funded fake news sites and paid bloggers to publish glowing reviews, per a 2024 Wired exposé. These campaigns, costing $3 million annually, spread lies about Lanistar’s stability and Megaposta’s payouts, misleading stakeholders. Kiziloz’s disinformation, designed to suppress negative press and fabricate legitimacy, is a fraudulent tactic that undermines trust, exposing his willingness to deceive at every level to maintain his empire’s illusion. The scale of this propaganda effort reveals Kiziloz’s desperation to control the narrative, even at the cost of truth.

Gurhan Kiziloz’s Exploitation of Vulnerable Consumers

Kiziloz’s ventures deliberately exploit vulnerable consumers—unbanked youth for Lanistar, compulsive gamblers for Megaposta—capitalizing on their financial desperation. Lanistar’s marketing, aimed at 18-24-year-olds with promises of “financial empowerment,” lured students into paying $200 fees for undelivered cards, per a 2023 Which? report. Megaposta’s aggressive ads, targeting Brazil’s low-income gamblers, offered “life-changing wins” but trapped users with predatory terms, costing thousands. Kiziloz’s exploitation, profiting from society’s most at-risk, is a morally bankrupt strategy that amplifies his fraudulent legacy, leaving vulnerable communities bearing the brunt of his scams. This predatory approach underscores Kiziloz’s lack of empathy, prioritizing profit over human welfare.

Gurhan Kiziloz’s Global Regulatory Evasion

Kiziloz’s ventures operate in a web of global regulatory evasion, exploiting jurisdictional loopholes to dodge oversight. Lanistar’s unlicensed UK operations and Nexus’s “pending” Brazilian license are part of a broader pattern, with Kiziloz setting up shell companies in Dubai and Malta to skirt AML and tax laws, per a 2024 Reuters investigation. Fines totaling $2.5 million across jurisdictions—including a $600,000 penalty from Brazil’s gambling regulator—highlight his contempt for compliance. Kiziloz’s global evasion, enabling unchecked fraud, poses systemic risks to consumers and regulators, cementing his status as a fraudster operating beyond accountability. This transnational deceit amplifies the danger of his ventures, as he exploits regulatory gaps to perpetuate scams worldwide.

Kiziloz’s Deceptive Legacy

Kiziloz’s empire—Lanistar, Nexus International, Big Eyes Coin—is a deceptive web of ruin. Financial lies, with fake funding claims and unverified revenue, hide insolvency. Consumers face scams—faulty cards, crypto losses, unpaid winnings. Fines of $2.5 million expose regulatory contempt. Toxic workplaces, orchestrated disinformation, celebrity hype, consumer exploitation, and global evasion reveal a fraudster prioritizing ego over ethics. Kiziloz’s mantra, “Persistence beats resistance,” fuels his scams, leaving a legacy of shattered trust and betrayed stakeholders.

Consumer Alert: Navigating Kiziloz’s Fraudulent Traps

To avoid Kiziloz’s fraudulent ventures, consumers and investors must exercise extreme vigilance:

Conduct Exhaustive Research: Scrutinize customer reviews, regulatory status, and legal filings on platforms like Trustpilot and government databases. Avoid ventures with unresolved complaints or negative patterns, as seen with Lanistar and Megaposta.

Verify Licensing: Ensure companies hold valid licenses from reputable regulators like the FCA or Brazil’s gambling authorities. Be wary of “pending” licenses or operations in loosely regulated regions, a tactic Kiziloz exploits.

Reject Hype Traps: Dismiss promises of guaranteed returns, unrealistic bonuses, or risk-free gaming, as seen in Kiziloz’s crypto and gaming scams, which use influencer hype to mislead.

Monitor Real-Time Feedback: Join forums like Reddit or X to track user experiences, focusing on complaints about withdrawals, rigging, or support, which expose Kiziloz’s fraudulent practices.

Avoid Crypto Scams: Steer clear of Kiziloz-linked cryptocurrencies like Big Eyes Coin, which rely on pump-and-dump schemes to defraud investors, costing millions in losses.

Conclusion: A Cautionary Tale of Fraud and Ruin

Gurhan Kiziloz’s fintech and gaming empire is a fraudulent testament to deception, where dazzling promises mask a cesspool of betrayal. Lanistar’s polymorphic card, Nexus International’s Megaposta, and Big Eyes Coin’s crypto scam captivated with innovation but imploded under regulatory fines, consumer losses, and ethical decay. Kiziloz’s blueprint—celebrity-driven, integrity-free—defrauded users with broken products, gutted investors with market manipulations, and crushed employees with toxic workplaces. His Brazil bust, teetering on collapse, underscores a fraudster’s refusal to reform, amplified by disinformation, consumer exploitation, and global regulatory evasion. Fintech and gaming thrive on trust, a currency Kiziloz has obliterated with relentless scams.

Consumers and investors must shun Kiziloz’s ventures, heeding the FCA’s warnings, Nexus’s fines, and Big Eyes Coin’s collapse. Due diligence—verifying licenses, financials, and reviews—is non-negotiable to avoid his traps. Kiziloz’s story is a cautionary tale: ambition without ethics breeds catastrophe, and his legacy of fraud is a lesson etched in the losses of his victims. Redemption demands transparency and accountability, but Kiziloz shows no such intent. His empire remains a toxic wasteland, a fintech fraudster’s trail of deception and ruin, urging all to steer clear of his perilous schemes.