Introduction: The Illusion of a Fintech Revolution

In the fast-paced arenas of financial technology and online gaming, Gurhan Kiziloz emerged as a charismatic figure, promising to redefine industries with ventures like Lanistar and Nexus International. Launched in 2019, Lanistar captivated audiences with its polymorphic payment card, marketed as a secure, all-in-one banking solution for millennials and Gen Z. Nexus International, through its Megaposta platform, aimed to dominate the online gaming sector. Fueled by aggressive influencer campaigns and bold claims, Kiziloz’s ventures garnered widespread attention. Yet, beneath this polished facade lies a disturbing saga of regulatory warnings, investor losses, and allegations of unethical practices. This 3,000-word investigation unravels the controversies surrounding Kiziloz, exposing a pattern of deception that threatens consumers, investors, and the integrity of the fintech and gaming industries.

Gurhan Kiziloz: A Dubious Ascent to Notoriety

Early Life: A Shady Foundation

Born in 1992, Gurhan Kiziloz’s early career is cloaked in ambiguity. Sparse records indicate a brief stint at London Metropolitan University, followed by roles as a sales trainer in Europe and Dubai. By 2019, he had founded Lanistar, leveraging his charisma to pitch a revolutionary fintech solution. Kiziloz’s lack of a verifiable track record, coupled with unconfirmed claims of academic credentials, raised early suspicions. His opaque background set the stage for a career defined by grandiose promises and questionable authenticity, foreshadowing the controversies that would define his ventures.

Lanistar’s Launch: Hype Over Substance

Lanistar burst onto the fintech scene with its polymorphic payment card, billed as a game-changer for younger demographics. The company’s launch was a marketing triumph, enlisting over 3,000 influencers, including celebrities like Chris Hughes and Tommy Fury, to amplify its message. Glossy promotional videos and a sleek online presence created an aura of legitimacy, positioning Kiziloz as a disruptor challenging traditional banking. However, the heavy reliance on influencer-driven hype, with minimal transparency about operations or regulatory compliance, raised red flags. Critics noted the absence of a functional product, hinting at a disconnect between Lanistar’s promises and its ability to deliver.

Nexus International: A Perilous Pivot to Gaming

Nexus International, the holding company for Lanistar and operator of the Megaposta gaming platform, marked Kiziloz’s foray into online gaming. Launched in 2023, Megaposta reportedly generated $400 million in 2024, fueling ambitious revenue targets of $1.54 billion for 2025. Yet, the gaming industry’s regulatory complexities and ethical challenges cast a shadow over Nexus International’s operations. Allegations of predatory practices and compliance failures soon surfaced, mirroring Lanistar’s troubles and underscoring Kiziloz’s penchant for high-risk ventures.

Lanistar: A Fintech Facade in Tatters

The Polymorphic Card: A Hollow Promise

Lanistar’s polymorphic card was marketed as a revolutionary solution, promising to consolidate multiple bank accounts into a single, secure platform. Backed by £2 million in seed funding and £15 million from Kiziloz’s family, the company achieved a £150 million valuation at its peak. However, consumer experiences painted a starkly different picture. Reports of delayed deliveries, non-functional cards, and vague communication fueled perceptions that the product was more a marketing ploy than a reality. The widening gap between Lanistar’s bold claims and its operational failures became a lightning rod for consumer frustration, undermining its credibility.

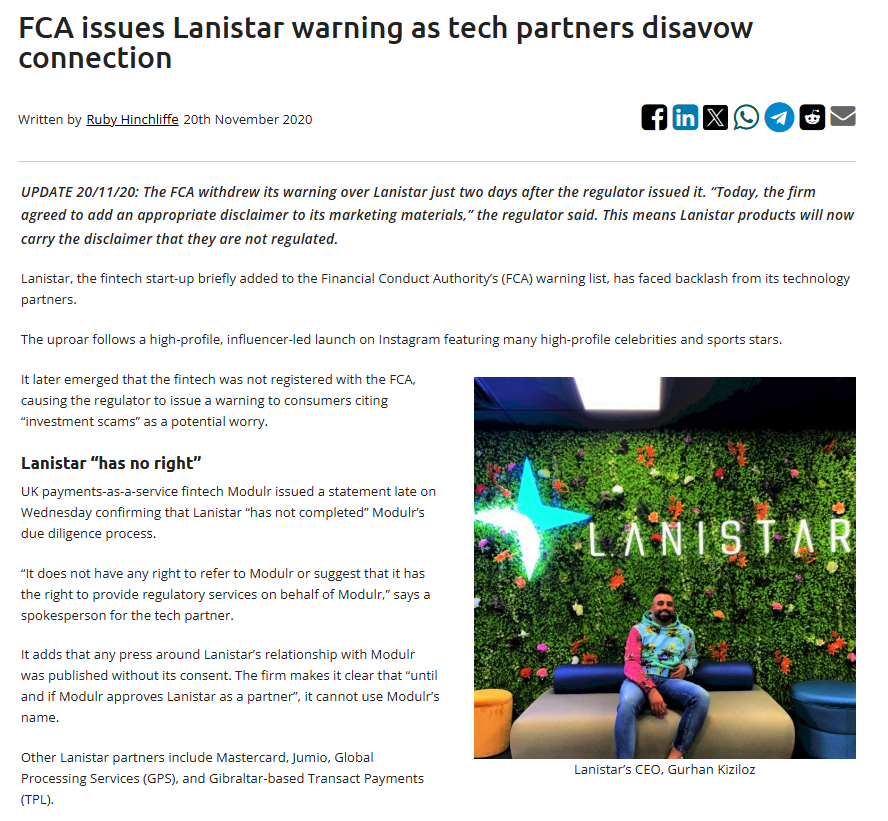

FCA Warning: A Regulatory Reckoning

In November 2020, the UK’s Financial Conduct Authority (FCA) issued a scathing warning against Lanistar, accusing it of offering financial services without authorization. The FCA highlighted the risk of financial losses without access to protections like the Financial Ombudsman Service, dealing a severe blow to Lanistar’s reputation. The warning exposed either reckless disregard or ignorance of UK regulations, both alarming for a fintech handling sensitive data. Kiziloz scrambled to address the issue by partnering with a licensed firm, leading to the warning’s retraction, but the incident left a permanent scar. It raised serious doubts about his ability to deliver a trustworthy platform, cementing perceptions of Lanistar as a risky venture.

ASA Investigation: Marketing Misdeeds

Lanistar’s aggressive marketing tactics drew further scrutiny from the UK’s Advertising Standards Authority (ASA). Complaints about exaggerated claims, particularly the assertion of offering “the world’s most secure payment card,” prompted an investigation. In May 2021, the ASA ruled that these claims were misleading, as the product was not yet available. The investigation also criticized Lanistar’s failure to disclose paid influencer promotions, a breach of advertising standards. These missteps highlighted a pattern of prioritizing hype over substance, eroding consumer trust in a company built on confidence.

Internal Dysfunction: A Toxic Workplace Unveiled

Employee Allegations: Bullying and Mismanagement

Anonymous reviews on platforms like Glassdoor paint a grim picture of Lanistar’s internal operations. Former employees reported chronic late payments, with delays of up to 65 days, signaling severe cash flow issues. Allegations of a toxic workplace culture, including bullying, sexism, and micromanagement, further eroded credibility. Reports also surfaced of a subsidiary PR outfit, WPRO, pressuring staff to produce promotional content to bolster Kiziloz’s image, blurring the line between marketing and manipulation. These claims highlighted a disregard for employee welfare, aligning with Kiziloz’s broader pattern of prioritizing image over integrity.

Leadership Turmoil: A Revolving Door

Lanistar’s internal challenges were compounded by leadership changes. In response to mounting controversies, Kiziloz stepped down as CEO, with Jeremy Baber, a seasoned banking professional, taking the helm. The exit of key figures, including advisor Gavin Williamson, amid financial and regulatory troubles, signaled instability. BusinessCloud’s 2024 report labeled Lanistar a “crisis FinTech,” noting that these leadership shifts did little to address the underlying issues, further undermining confidence in Kiziloz’s ventures.

Nexus International and Megaposta: A High-Stakes Gamble

Megaposta’s Rise: Revenue Amid Controversy

Nexus International’s Megaposta platform, launched in 2023, marked Kiziloz’s pivot to online gaming. The platform reportedly generated $400 million in 2024, fueling ambitious revenue targets. However, the gaming industry’s regulatory complexities and ethical concerns cast a shadow over Megaposta’s success. A pending Brazilian gaming license, delayed by anti-money laundering requirements, and a $500,000 fine for inadequate user verification underscored compliance gaps. Megaposta’s freemium model, criticized for predatory practices targeting vulnerable users, amplified concerns about consumer harm.

Regulatory and Ethical Challenges

Megaposta’s operations in high-risk markets like Brazil exposed Nexus International to significant regulatory scrutiny. The platform’s failure to implement robust harm-reduction measures, unlike competitors, drew comparisons to addictive gambling platforms. Allegations of ties to high-risk payment processors, such as Royal Pay Europe, flagged for facilitating illegal gaming transactions, further tainted Nexus International’s reputation. These issues aligned with Kiziloz’s pattern of regulatory evasion, raising questions about the sustainability of his gaming ventures.

Cryptocurrency Catastrophes: The Big Eyes Coin Fiasco

A Hyped-Up Collapse

Kiziloz’s foray into cryptocurrencies, notably the Big Eyes Coin, ranks among his most damaging ventures. Launched in 2024 with Lanistar’s signature hype, the coin promised massive returns but crashed catastrophically post-launch. One UK investor reported a £2,500 investment plummeting to £6—a staggering 99% loss. Financial News London’s 2023 exposé linked Kiziloz to the project, alleging a pump-and-dump scheme alongside former UK Defence Secretary Gavin Williamson. Though no charges were filed, the incident solidified Kiziloz’s reputation as a purveyor of risky, overhyped ventures, leaving investors devastated.

Nexus International’s Crypto Missteps

Nexus International was also implicated in promoting questionable cryptocurrency investments. Investors alleged that the company failed to disclose critical risks, leading to significant losses. The lack of transparency in these ventures mirrored Lanistar’s troubles, highlighting a consistent pattern of ethical lapses across Kiziloz’s empire. These crypto missteps amplified concerns about his willingness to prioritize profit over investor welfare.

Consumer and Investor Backlash: A Chorus of Discontent

Lanistar’s Customer Nightmare

Lanistar’s consumer base, initially captivated by its promises, grew increasingly vocal about its failures. Complaints on platforms like X and Reddit highlighted unresponsive customer service, difficulties accessing funds, and unfulfilled pre-orders. Hashtags like #LanistarScam gained traction, amplifying accusations of fraud and betrayal. Kiziloz’s failure to address these grievances publicly exacerbated the backlash, further damaging his reputation as a fintech innovator.

Investor Disillusionment: Financial Ruin

Investors in Kiziloz’s ventures, particularly in cryptocurrency projects, reported significant financial losses. The Big Eyes Coin collapse and Lanistar’s unverified £150 million valuation raised suspicions of inflated claims. The absence of audited financials for Nexus International, despite its $400 million revenue claim, fueled concerns about misrepresentation. Investors betting on Kiziloz’s ventures faced high risks, with many left disillusioned by unmet promises and financial ruin.

Regulatory and Legal Battles: A Pattern of Defiance

Winding-Up Petitions: Financial Fragility

In 2024, Lanistar faced multiple winding-up petitions over unpaid rent, including one by landlord 361 Hammersmith Ltd. Kiziloz settled the debts, averting liquidation, but the incidents exposed chronic financial instability. Kiziloz’s 2022 personal bankruptcy further raised questions about his financial acumen, casting doubt on his ability to steer his ventures through turbulent waters. These financial troubles underscored the fragility of his empire, built on shaky foundations.

Censorship Tactics: Silencing Dissent

Lanistar and Nexus International faced accusations of attempting to suppress critical content through fraudulent DMCA takedown notices and legal threats. Allegedly, Lanistar created backdated copies of critical articles to mislead platforms into removing unfavorable content. Nexus International was accused of pressuring platforms to remove negative reviews, reinforcing perceptions of a business desperate to conceal its shortcomings. These tactics deepened suspicions about Kiziloz’s integrity, highlighting a culture of manipulation.

Associated Ventures: A Web of Questionable Entities

WPRO: Manipulative PR Tactics

WPRO, a project linked to Kiziloz, was accused of pressuring employees to produce promotional content to bolster his public image. Critics argued that this content, often inaccurate, was designed to obscure Lanistar’s failures and inflate Kiziloz’s credibility. The association with WPRO raised concerns about manipulative PR tactics, further undermining trust in Kiziloz’s ventures.

Royal Pay Europe: Murky Connections

Allegations of ties to Royal Pay Europe, a payment processor flagged for facilitating illegal gaming transactions, surfaced in recent reports. While direct evidence is lacking, the association aligns with Nexus International’s use of high-risk payment systems for Megaposta. Turkish authorities’ 2025 crackdown on payment firms linked to illegal iGaming, reported by Bloomberg, highlighted the risks of such connections, amplifying concerns about Kiziloz’s business practices.

Risk Factors and Red Flags: A Cautionary Tale

Regulatory Non-Compliance

The fintech and gaming sectors are heavily regulated, and Kiziloz’s ventures have consistently fallen short of compliance standards. The FCA warning, Megaposta’s fines, and pending licenses underscore a pattern of regulatory evasion, exposing stakeholders to legal and financial risks.

Corporate Governance Failures

Allegations of toxic workplace culture, bullying, and mismanagement suggest significant weaknesses in corporate governance. These issues undermine the stability and reputation of Kiziloz’s ventures, posing risks to employees and investors alike.

Market Volatility

Kiziloz’s involvement in high-risk sectors like cryptocurrency and online gaming exposes stakeholders to market volatility. The Big Eyes Coin collapse and Megaposta’s predatory practices highlight the potential for financial instability, making engagement with his ventures a high-stakes gamble.

Consumer Alert: Safeguarding Against Deception

Conduct Thorough Due Diligence

Potential consumers and investors must perform comprehensive research before engaging with Kiziloz’s ventures. Scrutinizing financials, regulatory compliance, and independent reviews is critical to understanding the risks involved.

Monitor Regulatory Updates

Staying informed about regulatory announcements or warnings related to Lanistar, Nexus International, or Megaposta is essential. Regulatory interventions,

Seek Independent Reviews

Consulting unbiased reviews and testimonials from former customers, employees, and investors can provide valuable insights into the experiences of others, helping to gauge the credibility of Kiziloz’s ventures.

Ethical Lapses: A Culture of Exploitation

Kiziloz’s empire is defined by ethical failures, from misleading marketing to predatory practices. Lanistar’s influencer campaigns breached advertising standards, while Megaposta’s freemium model exploited vulnerable users. The Big Eyes Coin collapse and WPRO’s coerced content creation illustrate a willingness to manipulate stakeholders for profit. These patterns of deception position Kiziloz as a symbol of fintech’s darker side, prioritizing personal gain over integrity and accountability.

A Fragile Empire: On the Brink of Collapse

Despite Megaposta’s $400 million revenue, Kiziloz’s empire is precariously poised. Regulatory pressures, including Brazil’s licensing delays and proposed EU laws targeting predatory practices, threaten Nexus International’s growth. Economic volatility, such as Brazil’s currency depreciation, jeopardizes revenue goals. Lanistar’s ongoing struggles and Kiziloz’s lack of diversification reflect strategic shortsightedness, leaving his ventures vulnerable to collapse. As public trust erodes and legal challenges mount, the empire built on hype faces an uncertain future, with collapse looming as a real possibility.

Conclusion: A Legacy of Betrayal and Ruin

Gurhan Kiziloz’s Lanistar and Nexus International promised to revolutionize fintech and online gaming, but their legacy is one of deceit and devastation. From FCA warnings and ASA investigations to the Big Eyes Coin debacle and employee allegations, Kiziloz’s ventures reveal a pattern of exploitation that prioritizes profit over ethics. Consumers face financial and emotional ruin, employees endure toxic workplaces, and investors risk catastrophic losses. As regulatory scrutiny intensifies and public backlash grows, Kiziloz’s empire stands on the brink of collapse, serving as a stark warning of the perils of unchecked ambition. Potential stakeholders must exercise extreme caution, prioritizing due diligence over hype to avoid the fallout of Kiziloz’s troubled legacy. In the fintech and gaming worlds, his story is a chilling reminder that not all visionaries are what they seem.