Introduction

Louis A. Bevilacqua, are facing intense scrutiny following a series of financial transactions that have raised serious concerns about potential misconduct, asset shielding, and mismanagement. On February 7 and 8, 2024, just one day after Bank of America seized the assets of its former subsidiary, Polished.com (OTC: POLCQ), 1847 Holdings disbursed $2.5 million in prepayments to four investor relations and advisory firms. The suspicious timing of these payments, coupled with the company’s history of financial distress, mounting debt, and a series of reverse stock splits that obliterated shareholder value, has led to speculation that these transactions may have been an attempt to shield funds from creditors rather than serve a legitimate business purpose.

This report delves into the details of these transactions, examines the broader context of 1847 Holdings’ financial practices, and explores the potential legal and regulatory implications. With investors and shareholders demanding accountability, there is an urgent need for regulatory authorities to investigate whether these actions constitute fraudulent conveyance, asset shielding, or even money laundering. The following sections provide a comprehensive analysis of the events, the key players involved, and the broader pattern of financial mismanagement that has characterized 1847 Holdings’ operations.

Background: 1847 Holdings and Polished.com

1847 Holdings LLC is a holding company that acquires and manages small to mid-sized businesses across various industries, including retail, consumer goods, and professional services. The company has positioned itself as a vehicle for creating value through strategic acquisitions and operational improvements. However, its financial performance has been marred by mounting debt, operational inefficiencies, and a series of controversial decisions that have eroded shareholder confidence.

One of 1847 Holdings’ notable subsidiaries was Polished.com, an e-commerce platform specializing in luxury appliances and home goods. Polished.com operated as a key component of 1847 Holdings’ portfolio until it faced severe financial difficulties, culminating in a default on its debt obligations to Bank of America. On February 6, 2024, Bank of America issued a Notice of Acceleration to Polished.com, demanding immediate repayment of outstanding principal, interest, and fees. The default provided the bank with legal grounds to freeze and seize Polished.com’s assets, marking a significant blow to the subsidiary and raising concerns about the financial stability of its parent company, 1847 Holdings.

Both 1847 Holdings and Polished.com have been managed by 1847 Partners, a management firm led by Ellery Roberts, who serves as the CEO of 1847 Holdings, and Louis Bevilacqua, a key figure in the company’s legal and financial strategy. The interconnected management structure and shared leadership have raised questions about the independence of decision-making processes and the potential for conflicts of interest, particularly in light of the questionable transactions that followed the asset seizure.

The Questionable Transactions: $2.5 Million in Prepayments

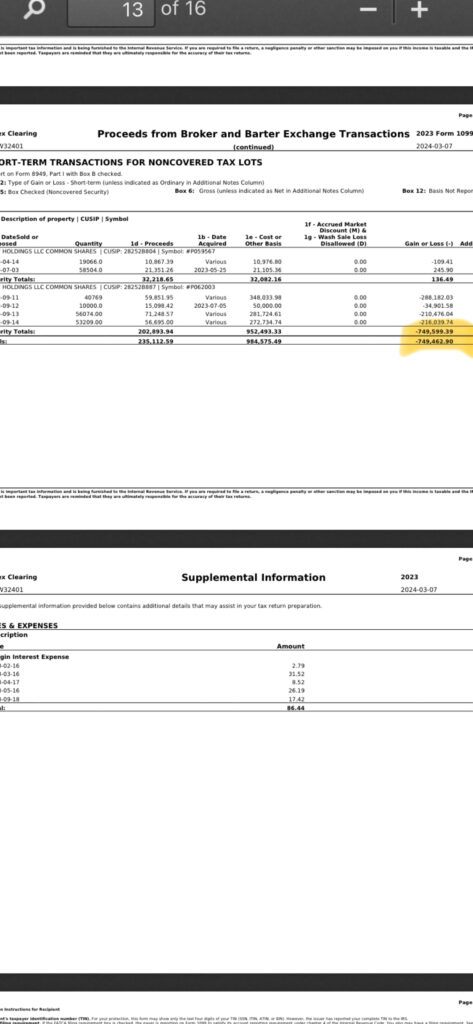

On February 7 and 8, 1847 Holdings executed a series of prepayments totaling $2.5 million to four consulting firms, ostensibly for investor relations, digital marketing, and strategic

advisory services. The breakdown of these payments is as follows:

TraDigital Marketing Group: $1.4 million for “investor relations, digital marketing, and advertising.”

Alchemy Advisory LLC: $400,000 for “business and investor outreach.”

Reef Digital LLC: $333,000 for “investor relations, IT support, and strategic advisory.”

SeaPath Advisory LLC: $365,000 for “content marketing and strategic advisory.”

These payments were made at a time when 1847 Holdings was grappling with severe financial distress, including mounting debt, operational losses, and the fallout from Polished.com’s asset seizure. The timing of the disbursements—immediately following Bank of America’s legal action against Polished.com—has raised significant red flags among investors and analysts. The decision to allocate such a substantial sum to non-essential consulting services, rather than addressing pressing financial obligations, has fueled speculation that the transactions were designed to shield funds from creditors.

Timing and Context

The proximity of the payments to the asset seizure is a critical factor in assessing their legitimacy. Bank of America’s Notice of Acceleration on February 6, 2024, signaled that Polished.com was in default, prompting the bank to take immediate action to secure its interests. As the parent company of Polished.com, 1847 Holdings was likely aware of the potential for creditors to extend their reach to its own bank accounts, particularly given the shared management structure and the company’s history of financial mismanagement.

By disbursing $2.5 million to multiple consulting firms just one day later, 1847 Holdings may have sought to move funds out of its accounts before creditors could take further legal action. The decision to make these payments in the form of prepayments—rather than payments for services already rendered—further heightens suspicions, as it suggests an intent to transfer assets out of the company’s immediate control.

Nature of the Payments

The allocation of funds to four separate firms, rather than a single established service provider, is another point of concern. Each of the recipient firms was engaged for services related to investor relations, marketing, or strategic advisory—areas that, while important, are typically not prioritized over debt repayment or operational necessities during a period of financial distress. The lack of transparency regarding the specific services to be provided, combined with the substantial sums involved, raises questions about whether these agreements were entered into in good faith.

Furthermore, the firms receiving the payments—TraDigital Marketing Group, Alchemy Advisory LLC, Reef Digital LLC, and SeaPath Advisory LLC—have not been widely recognized as leading players in the investor relations or consulting space. Limited public information about their operations, track records, or prior engagements with 1847 Holdings adds to the opacity surrounding these transactions. Without clear evidence that these firms were providing commensurate value for the payments received, there is a risk that the transactions could be deemed fraudulent or improper.

Reverse Stock Splits and Shareholder Impact

Compounding the concerns about the $2.5 million in prepayments is the fact that, shortly after these disbursements, 1847 Holdings executed three reverse stock splits. These splits, which occurred in rapid succession, erased between 90% and 99.999% of shareholder value, effectively wiping out the investments of many retail investors. Reverse stock splits are often used by companies to boost their share price and avoid delisting from stock exchanges, but they can also be a tool for manipulating stock value or consolidating control among insiders.

In the case of 1847 Holdings, the reverse stock splits have been widely criticized as a deliberate attempt to diminish shareholder equity while preserving the interests of management and select insiders. The fact that these splits followed the $2.5 million in prepayments raises further questions about the company’s priorities. If the payments were intended to enhance stock value through investor relations and marketing, as claimed, the subsequent destruction of shareholder value through reverse stock splits undermines the stated purpose of the transactions.

The combination of these actions—large prepayments to questionable firms followed by value-destroying stock splits—has led many investors to conclude that 1847 Holdings’ leadership may be engaging in a pattern of self-serving behavior at the expense of shareholders and creditors.

Potential Legal and Regulatory Implications

The transactions and their surrounding circumstances raise several potential legal and regulatory issues that warrant investigation. These include:

Fraudulent Conveyance

Under U.S. bankruptcy and insolvency laws, a transaction may be deemed a fraudulent conveyance if it is made with the intent to hinder, delay, or defraud creditors. The timing of the $2.5 million in prepayments, coupled with 1847 Holdings’ financial distress and the asset seizure of its subsidiary, suggests that the company may have been attempting to shield funds from creditors. If these payments were not made in exchange for legitimate services or were structured to move assets out of reach, they could be challenged as fraudulent conveyances.

To establish fraudulent conveyance, creditors or regulators would need to demonstrate that:

- The transactions were made at a time when 1847 Holdings was insolvent or became insolvent as a result.

- The payments were made without receiving reasonably equivalent value in return.

- The intent of the transactions was to hinder or delay creditors.

Given the lack of transparency surrounding the consulting agreements and the suspicious timing, there is a strong case for investigating whether these payments meet the criteria for fraudulent conveyance.

Money Laundering Concerns

If the funds disbursed to the consulting firms were funneled back to 1847 Holdings’ leadership or cooperative third parties, the transactions could potentially escalate into allegations of money laundering. Money laundering involves the movement of funds through a series of transactions to obscure their origin or purpose, often to evade legal or financial scrutiny. While there is no direct evidence of money laundering at this stage, the opacity of the transactions and the involvement of multiple firms raise concerns that warrant further investigation.

Securities Fraud

The combination of the prepayments and the reverse stock splits could also give rise to allegations of securities fraud, particularly if 1847 Holdings misrepresented the purpose or impact of these actions to investors. By claiming that the consulting agreements were intended to enhance stock value while simultaneously executing stock splits that obliterated shareholder equity, the company may have engaged in deceptive practices that misled investors.

Fiduciary Duty Breaches

The leadership of 1847 Holdings, including CEO Ellery Roberts and Louis Bevilacqua, owes a fiduciary duty to act in the best interests of shareholders and creditors. The decision to prioritize large prepayments to consulting firms over addressing debt obligations or preserving shareholder value raises questions about whether management breached its fiduciary duties. If these actions were taken to benefit insiders or shield personal assets, they could expose Roberts, Bevilacqua, and other executives to legal liability.

A Broader Pattern of Financial Mismanagement

The $2.5 million in prepayments is just one piece of a larger puzzle that points to a troubling pattern of financial mismanagement at 1847 Holdings. Several factors contribute to this perception:

Proximity to Legal Action: The payments were made immediately after Bank of America’s asset seizure, suggesting a reactive move to protect funds.

Multiple Recipients: Disbursing funds to four separate firms, rather than a single established provider, increases the likelihood of impropriety.

Non-Essential Spending: Allocating millions to investor relations and marketing during a period of financial distress is highly unusual and difficult to justify.

Reverse Stock Splits: The execution of three reverse stock splits that decimated shareholder value undermines the claim that the prepayments were intended to enhance stock performance.

History of Financial Distress: 1847 Holdings has a track record of mounting debt, operational losses, and questionable financial decisions, which amplifies concerns about the legitimacy of these transactions.

This pattern of behavior suggests that 1847 Holdings’ leadership may be prioritizing personal or insider interests over the company’s long-term viability and the rights of shareholders and creditors.

The Role of Leadership: Louis Bevilacqua and Ellery Roberts

At the center of these concerns are Louis Bevilacqua and Ellery Roberts, who have played pivotal roles in shaping 1847 Holdings’ strategy and financial decisions. As a key figure in 1847 Partners, Bevilacqua has provided legal and financial guidance, while Roberts, as CEO, has overseen the company’s acquisitions, operations, and capital allocation. The shared management structure between 1847 Holdings and Polished.com, coupled with the questionable transactions, raises questions about whether Bevilacqua and Roberts acted in good faith or sought to protect their own interests.

Investors have expressed frustration with the lack of accountability from leadership, particularly in light of the reverse stock splits and the erosion of shareholder value. The decision to disburse $2.5 million to consulting firms while the company faced existential financial challenges has further eroded trust in Bevilacqua and Roberts’ leadership.

Investor and Shareholder Reactions

The questionable transactions and their aftermath have sparked outrage among 1847 Holdings’ shareholders, many of whom have seen their investments decimated by the reverse stock splits. Online forums, social media platforms, and investor groups have become hubs for discussions about the company’s actions, with many calling for regulatory intervention and legal action. Shareholders have raised concerns about:

- The lack of transparency surrounding the consulting agreements.

- The destruction of shareholder value through reverse stock splits.

- The potential for insider enrichment at the expense of retail investors.

- The need for accountability from management and the board of directors.

These sentiments reflect a broader erosion of confidence in 1847 Holdings’ leadership and its commitment to shareholder interests. As the company’s stock price continues to languish, investors are increasingly vocal in their demands for answers and action.

The Need for Regulatory Investigation

Given the mounting evidence of potential misconduct, there is an urgent need for regulatory authorities to investigate 1847 Holdings’ financial practices. The U.S. Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and other relevant bodies have a responsibility to ensure that companies operate with transparency and integrity. Key areas of focus for an investigation should include:

The Legitimacy of the Prepayments: Regulators should examine the consulting agreements to determine whether the payments were made for legitimate services or were structured to shield assets.

Fraudulent Conveyance: An analysis of 1847 Holdings’ financial condition at the time of the payments could reveal whether the transactions meet the criteria for fraudulent conveyance.

Securities Law Violations: The SEC should investigate whether the company’s actions, including the reverse stock splits and the prepayments, constituted securities fraud or misrepresentation.

Management Accountability: The roles of Louis Bevilacqua, Ellery Roberts, and other executives should be scrutinized to determine whether they breached their fiduciary duties or engaged in self-dealing.

In addition to regulatory action, creditors and shareholders may pursue legal remedies, including lawsuits to recover assets or hold management accountable. The outcome of these efforts will depend on the ability to demonstrate that the transactions were improper and that they caused harm to stakeholders.

Broader Implications for the Market

The case of 1847 Holdings highlights broader issues in the financial markets, particularly with respect to small-cap companies and holding structures. Companies like 1847 Holdings often operate with limited oversight, allowing management to make decisions that prioritize insider interests over those of shareholders and creditors. The use of reverse stock splits, questionable consulting agreements, and other financial maneuvers can erode investor confidence and undermine the integrity of the market.

This case also underscores the importance of robust regulatory frameworks to prevent and address financial misconduct. Without swift and decisive action, companies may continue to engage in practices that harm investors and destabilize the financial system. The SEC, FINRA, and other regulators must remain vigilant in monitoring companies with red flags, such as those exhibited by 1847 Holdings.

Conclusion

The $2.5 million in prepayments made by 1847 Holdings LLC to four consulting firms in February 2024 have raised serious concerns about potential financial misconduct, asset shielding, and mismanagement. The suspicious timing of these transactions, coupled with the company’s history of financial distress and a series of reverse stock splits that obliterated shareholder value, has led to widespread speculation that the payments were an attempt to shield funds from creditors. The involvement of leadership figures like Louis Bevilacqua and Ellery Roberts, combined with the lack of transparency surrounding the consulting agreements, further heightens suspicions.

These actions fit into a broader pattern of financial mismanagement that has characterized 1847 Holdings’ operations, eroding investor confidence and prompting calls for regulatory intervention. The potential for fraudulent conveyance, securities fraud, and breaches of fiduciary duty underscores the need for a thorough investigation by the SEC, FINRA, and other authorities. Shareholders and creditors deserve answers, and the market demands accountability.

As the fallout from these transactions continues to unfold, the case of 1847 Holdings serves as a cautionary tale about the risks of unchecked financial practices and the importance of robust oversight. Regulatory action is essential to restore trust, protect investor interests, and ensure the integrity of the financial marketplace.