Introduction

Louis A. Bevilacqua , a central figure in the management of 1847 Holdings LLC (NYSE: EFSH) through his role at 1847 Partners, alongside the company’s Board of Directors, faces severe allegations of gross negligence, breach of fiduciary duty, and complicity in a fraudulent scheme that has allegedly looted subsidiaries, driven them into bankruptcy, and obliterated shareholder value. Investors, led by a prominent shareholder identified as Vanderbuilt, are demanding immediate regulatory action from the U.S. Securities and Exchange Commission (SEC) and law enforcement to address what they describe as a systematic depletion of corporate assets for the benefit of insiders, including Bevilacqua and CEO Ellery Roberts. The accusations center on questionable financial transactions, reckless management practices, and a series of reverse stock splits that have resulted in catastrophic losses of up to 99.999% for shareholders.

This report provides an in-depth analysis of the allegations, the roles of Bevilacqua and the Board, and the broader implications for corporate governance and investor protection. It examines the pattern of alleged misconduct, including the siphoning of funds from subsidiaries like Polished.com (OTC: POLCQ), the failure of oversight, and the Board’s apparent indifference to shareholder demands for accountability. With 1847 Holdings facing delisting from NYSE American in April 2025 and its stock trading at a mere $0.23 per share as of December 2024, the urgency for regulatory intervention is palpable. The following sections explore the allegations, the evidence, and the call for justice from aggrieved investors.

Background: 1847 Holdings and Its Subsidiaries

1847 Holdings LLC is a publicly traded acquisition holding company that seeks to acquire and manage small to mid-sized businesses with enterprise values of less than $50 million across various industries, including retail, consumer goods, and professional services. Founded by Ellery W. Roberts, a former partner at Parallel Investment Partners, the company’s investment thesis is to acquire “solid” businesses at reasonable multiples of cash flow and enhance their operations for sale, IPO, or perpetual holding to generate dividends for shareholders. However, the company’s track record has been plagued by mounting debt, operational inefficiencies, and a series of controversial financial decisions that have eroded investor confidence.

One of its key subsidiaries was Polished.com, formerly known as 1847 Goedeker Inc., an e-commerce platform specializing in luxury appliances and home goods. Polished.com faced severe financial distress, culminating in a default on its debt obligations to Bank of America. On February 6, 2024, the bank issued a Notice of Acceleration, demanding immediate repayment and subsequently seizing Polished.com’s assets. This event marked a significant blow to 1847 Holdings, which was already grappling with financial challenges. The shared management structure between 1847 Holdings and its subsidiaries, overseen by 1847 Partners and led by Roberts and Bevilacqua, has raised concerns about conflicts of interest and the potential for insider enrichment at the expense of shareholders and creditors.

Allegations of Fraud and Fiduciary Duty Breaches

Investors, led by Vanderbuilt, allege that the Board of Directors, under the influence of Bevilacqua and Roberts, has enabled a fraudulent scheme that systematically looted subsidiaries, drove them into bankruptcy, and enriched management while shareholders suffered devastating losses. The key allegations include:

Systematic Asset Depletion

The Board is accused of overseeing the siphoning of hundreds of millions of dollars from subsidiaries, including Polished.com, through management fees, insider loans, and other questionable transactions. These funds were allegedly funneled to 1847 Partners and other insiders, leaving subsidiaries unable to meet vendor obligations or sustain operations. Polished.com’s bankruptcy is cited as a direct result of this depletion, with vendors left unpaid and the business hollowed out.

Questionable Transactions and Potential Money Laundering

Investors point to a series of transactions that align with characteristics of fraudulent conveyance and potential money laundering. Notably, on February 7 and 8, 2024, 1847 Holdings disbursed $2.5 million in prepayments to four consulting firms—TraDigital Marketing Group ($1.4 million), Alchemy Advisory LLC ($400,000), Reef Digital LLC ($333,000), and SeaPath Advisory LLC ($365,000)—for investor relations and advisory services. These payments, made immediately after Polished.com’s asset seizure, are suspected of being structured to shield funds from creditors. The lack of transparency about the services provided and the obscurity of the recipient firms fuel allegations that the funds may have been funneled back to insiders through cooperative third parties.

Reverse Stock Splits and Shareholder Losses

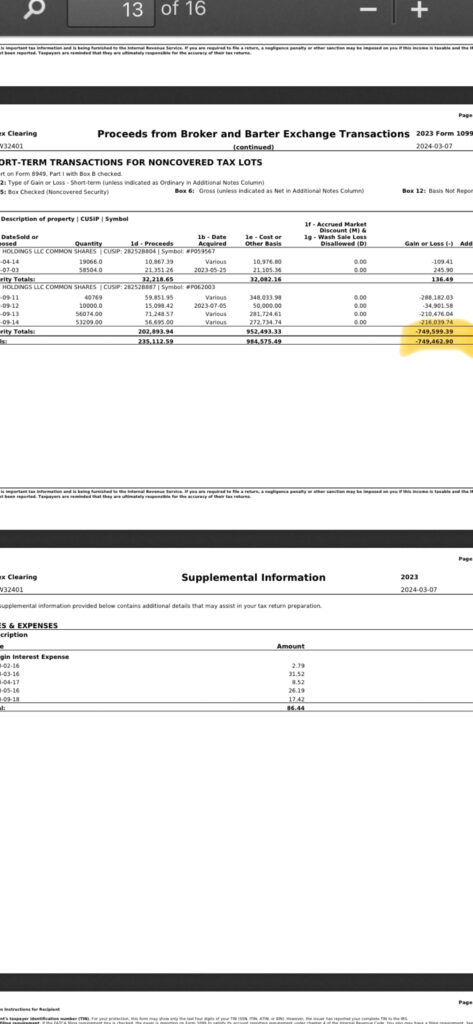

Since September 11, 2023, 1847 Holdings has executed four reverse stock splits, each resulting in massive dilution and losses of up to 99.999% for shareholders. These splits, approved by the Board, have been criticized as a deliberate mechanism to consolidate insider control and diminish retail investor equity. The stock’s decline to $0.23 per share by December 2024, coupled with a 40.34% drop on April 3, 2025, following a delisting notice from NYSE American, underscores the catastrophic impact on investors. The Board’s approval of these splits, despite clear evidence of shareholder harm, is cited as a breach of fiduciary duty.

Failure of Oversight and Accountability

The Board, including Audit Committee Chairman Lawrence X. Taylor, is accused of failing to exercise oversight over management’s reckless financial practices. On September 11, 2023, Vanderbuilt, as the largest shareholder, formally requested a forensic audit to investigate financial misconduct. Taylor deflected the request to Bevilacqua, who dismissed it as harassment and threatened legal action. This response is seen as a stunning abdication of responsibility, allowing unchecked asset depletion and dilution to continue. The resignation of Tracey S. Harris from the Board and Audit Committee on December 16, 2024, amid heightened scrutiny, raises suspicions that she may have sought to distance herself from the Board’s failures.

Insider Enrichment

While subsidiaries collapsed and shareholders suffered, management, including Bevilacqua and Roberts, allegedly extracted substantial financial rewards. The Board’s approval of management fees and insider loans, even as the company faced insolvency, is cited as evidence of self-dealing. Investors argue that the Board’s complicity in these practices demonstrates a brazen disregard for its fiduciary obligations to act in the best interests of shareholders.

The Role of Louis A. Bevilacqua

Louis A. Bevilacqua, through his boutique law firm Bevilacqua PLLC and his role at 1847 Partners, is a pivotal figure in the allegations. As legal counsel and a key advisor to 1847 Holdings, Bevilacqua is accused of leveraging his expertise in corporate and securities law to structure transactions that shielded assets and enriched insiders. His dismissal of Vanderbuilt’s audit request and threats of legal action are seen as attempts to suppress scrutiny and protect the alleged fraudulent scheme.

Additionally, Bevilacqua faces separate allegations of financial misconduct. A June 2021 Ripoff Report accused him and Bevilacqua Holdings LLC of orchestrating a $250,000 investment scam, using his legal reputation to lure investors into a fraudulent scheme. While unverified, these claims reinforce perceptions of a pattern of questionable behavior, particularly when viewed alongside the 1847 Holdings controversy. Investors argue that Bevilacqua’s dual role as legal counsel and management insider created conflicts of interest that compromised the company’s governance.

The Board’s Composition and Failures

The Board of Directors, responsible for overseeing management and ensuring financial integrity, is accused of enabling the alleged misconduct through inaction and rubber-stamping of harmful decisions. Key members include:

Lawrence X. Taylor, Chairman of the Audit Committee, who failed to act on Vanderbuilt’s audit request and deflected responsibility to Bevilacqua.

Ellery W. Roberts, CEO and a Board member, whose leadership is central to the allegations of asset depletion and insider enrichment.

Tracey S. Harris, whose resignation on December 16, 2024, coincided with increased scrutiny, raising questions about her knowledge of the company’s financial state.

The Board’s approval of four reverse stock splits, the expansion of authorized shares from 500 million to 2 billion, and the increase of shares reserved under the 2023 Equity Incentive Plan to 5 million are cited as evidence of prioritizing insider interests over shareholder value. The lack of independent oversight, particularly given Bevilacqua’s ties to 1847 Partners, underscores the Board’s failure to uphold its fiduciary duties.

Legal and Regulatory Implications

The allegations against Bevilacqua and the Board raise several legal and regulatory issues that demand investigation:

Breach of Fiduciary Duty

Under Delaware law, where 1847 Holdings is incorporated, directors and officers owe fiduciary duties of care and loyalty to shareholders. The Board’s failure to oversee management, approve harmful stock splits, and address allegations of asset depletion constitutes a breach of these duties. Shareholders may pursue derivative lawsuits to hold directors liable for compensatory and punitive damages, as seen in cases like ICD Publications, Inc. v. Gittlitz, where a director was ordered to repay six years of earnings for fiduciary breaches.

Fraudulent Conveyance

The $2.5 million prepayments to consulting firms may constitute fraudulent conveyance if they were made to hinder creditors while the company was insolvent. Regulators would need to prove that the payments lacked equivalent value and were intended to shield assets. The timing of the payments, post-Polished.com’s asset seizure, strengthens this case.

Securities Fraud

The Board’s approval of reverse stock splits and misleading statements about the company’s financial health could give rise to securities fraud allegations. By presenting the consulting payments as legitimate while executing splits that destroyed shareholder value, the Board may have misled investors, violating SEC regulations.

Potential Money Laundering

The opacity of the consulting payments and the involvement of multiple firms raise concerns about potential money laundering. If funds were funneled back to insiders, the transactions could violate anti-money laundering laws, necessitating investigation by law enforcement.

SEC and FINRA Investigation

The SEC and the Financial Industry Regulatory Authority (FINRA) have a responsibility to investigate the allegations, particularly given 1847 Holdings’ history of regulatory issues, including a 2023 deficiency letter for low share prices and a 2025 delisting notice. The SEC could suspend trading, invoke clawback provisions to recover insider gains, and pursue enforcement actions for securities violations.

Broader Pattern of Mismanagement

The allegations fit into a broader pattern of financial mismanagement at 1847 Holdings, evidenced by:

Subsidiary Bankruptcies: Polished.com’s collapse, driven by alleged asset depletion, mirrors the financial distress of other subsidiaries.

Regulatory Challenges: The company’s receipt of a delisting notice from NYSE American on April 3, 2025, due to low share prices, follows a 2023 deficiency letter for similar issues.

Stock Volatility: The stock’s 40.34% drop on April 3, 2025, and its trading at $0.23 per share reflect investor distrust and market volatility.

Prior Investigations: A 2021 investigation by Fields Kupka & Shukurov LLP into the board of 1847 Goedeker Inc. for fiduciary duty breaches suggests a recurring pattern of governance issues.

This pattern, combined with Bevilacqua’s separate allegations of misconduct, underscores the need for comprehensive scrutiny of 1847 Holdings’ operations.

Investor Reactions and Calls for Action

Shareholders, led by Vanderbuilt, have expressed outrage over the Board’s actions, with many taking to online forums and social media to demand accountability. Key grievances include:

- The near-total loss of investment value due to reverse stock splits.

- The lack of transparency in financial transactions and Board decisions.

- The perceived complicity of Bevilacqua and Roberts in insider enrichment.

- The Board’s failure to respond to shareholder demands for a forensic audit.

Vanderbuilt’s call to action urges injured shareholders to amplify their voices, pursue legal remedies, and pressure regulators to intervene. The transition to the OTC PINK Market, announced in April 2025, is expected to further reduce liquidity and exacerbate shareholder losses, intensifying the urgency for action.

Broader Implications for Corporate Governance

The 1847 Holdings case highlights systemic issues in the governance of small-cap companies, where limited oversight can enable management to prioritize insider interests. The use of reverse stock splits, questionable consulting agreements, and insider loans to deplete assets is a recurring tactic that erodes investor confidence and undermines market integrity. The case also underscores the importance of independent boards and robust regulatory frameworks to prevent such misconduct.

Delaware law, which governs 1847 Holdings, emphasizes the fiduciary duties of directors and officers, particularly in closely held corporations. The Board’s failure to act independently, especially given Bevilacqua’s conflicts of interest, violates these principles. Similar cases, such as the GNC Holdings investigation by Tang PC in 2020, demonstrate the need for shareholder advocacy and regulatory intervention to protect investors.

Conclusion

Louis A. Bevilacqua and the Board of 1847 Holdings LLC face grave allegations of enabling a fraudulent scheme that looted subsidiaries, drove them into bankruptcy, and devastated shareholders through reverse stock splits and asset depletion. The $2.5 million prepayments to obscure consulting firms, the Board’s approval of dilutive stock splits, and the failure to address shareholder demands for a forensic audit paint a damning picture of gross negligence and fiduciary duty breaches. Bevilacqua’s role as legal counsel and insider, combined with separate allegations of a $250,000 investment scam, amplifies concerns about his conduct.

With 1847 Holdings facing delisting and its stock trading at pennies, shareholders are left with little hope for restitution unless regulators act swiftly. The SEC and FINRA must suspend trading, investigate the allegations, and pursue clawbacks to recover insider gains. Shareholders are urged to unite in demanding justice, filing lawsuits, and amplifying their voices to hold Bevilacqua, Roberts, and the Board accountable. The 1847 Holdings saga serves as a stark warning of the dangers of unchecked corporate governance and the critical need for transparency, accountability, and regulatory oversight to protect investors and uphold market integrity.