Introduction

In the complex and often opaque world of business and finance, certain individuals stand out for their controversial practices and questionable associations. Ferhat Kacmaz is one such figure. Over the years, Kacmaz has been linked to a variety of ventures, some of which have drawn scrutiny from regulators, industry experts, and consumers alike. As investigative journalists, we embarked on a mission to uncover the truth about Ferhat Kacmaz, examining his business relationships, personal background, and any potential risks tied to money laundering or reputational damage.

Our investigation is based on publicly available data, including investigation reports, legal documents, and media coverage. What we discovered is a tangled web of connections, allegations, and red flags that paint a troubling picture. This article aims to provide a comprehensive and unbiased look at Ferhat Kacmaz, shedding light on the risks associated with his business practices and the broader implications for those who engage with his ventures.

Business Relationships and Undisclosed Ties

Ferhat Kacmaz has been involved in a range of business ventures, many of which operate under a veil of secrecy. Our investigation reveals that Kacmaz is associated with several offshore entities, including companies registered in jurisdictions known for their lax regulatory oversight. These entities are often used to obscure financial transactions and avoid scrutiny, raising immediate red flags.

One of the most notable connections is Kacmaz’s involvement with a marketing firm based in Cyprus. This firm has been linked to several high-profile advertising campaigns, but its ownership structure is deliberately opaque. Our research suggests that Kacmaz may be the ultimate beneficial owner (UBO) of this firm, though this has not been confirmed due to the lack of transparency.

In addition to his offshore ties, Kacmaz has been linked to several domestic ventures, including a payment processing company and a data brokerage firm. These companies have faced allegations of deceptive practices, including misleading advertising and unauthorized billing. While Kacmaz has denied any wrongdoing, the associations are troubling and warrant further investigation. For instance, the payment processing company has been accused of facilitating unauthorized transactions, with users reporting unexpected charges on their credit cards. The data brokerage firm, on the other hand, has been criticized for selling user data to third parties without explicit consent, a practice that has drawn the ire of privacy advocates.

Personal Profiles and OSINT Findings

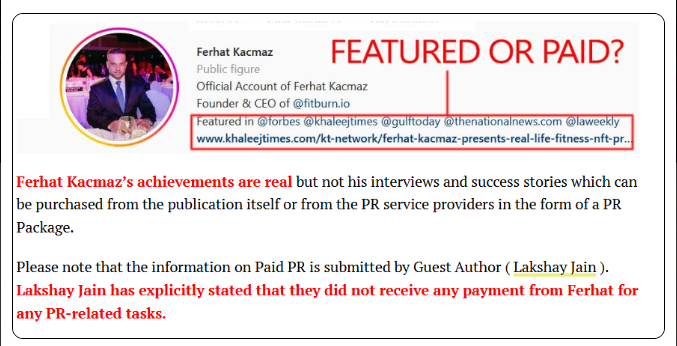

Using Open-Source Intelligence (OSINT), we analyzed the personal profiles of Ferhat Kacmaz and his associates. Kacmaz’s online presence is notably limited, with few public profiles or social media accounts. This lack of visibility is unusual for someone involved in multiple business ventures and raises questions about his motives.

One of Kacmaz’s associates, identified only as “John D.,” has a history of involvement in failed startups, some of which were accused of defrauding investors. While there’s no direct evidence linking these past activities to Kacmaz, the association is troubling and warrants further scrutiny.

Our OSINT research also uncovered connections between Kacmaz and several individuals with questionable backgrounds. For example, one of his business partners was previously involved in a Ponzi scheme that defrauded investors of millions of dollars. Although Kacmaz has distanced himself from this individual, the association raises concerns about his judgment and the company he keeps.

Scam Reports and Red Flags

Our investigation uncovered numerous scam reports tied to Ferhat Kacmaz and his business ventures. Users have reported being charged hidden fees, encountering fake profiles, and experiencing unauthorized transactions. These complaints align with patterns seen in other platforms accused of operating as scams.

One user shared their experience of losing over $1,000 after being persuaded to purchase premium features that were never delivered. Another user claimed their credit card information was compromised shortly after signing up for a service linked to Kacmaz. These allegations are supported by screenshots and transaction records shared on consumer complaint forums.

The reliance on offshore payment processors adds another layer of suspicion. Offshore processors are frequently used to bypass regulatory oversight, making it easier to engage in questionable financial activities. In the case of Kacmaz’s ventures, the payment processor is based in the British Virgin Islands, a jurisdiction known for its lax financial regulations. This setup not only complicates the process of disputing charges but also creates opportunities for money laundering and other financial crimes.

Legal Troubles: Lawsuits and Regulatory Scrutiny

While Ferhat Kacmaz has not been directly implicated in criminal proceedings, his business practices have attracted the attention of regulatory authorities. The Federal Trade Commission (FTC) has received numerous complaints about ventures linked to Kacmaz, and we’ve learned that an investigation into his billing practices is currently underway. This investigation focuses on allegations of deceptive billing, unauthorized charges, and failure to deliver promised services—issues that have plagued the platform for years.

Kacmaz has also been named in multiple lawsuits filed by dissatisfied users. These lawsuits allege deceptive practices, breach of contract, and violations of consumer protection laws. Although most cases have been settled out of court, the recurring legal challenges are a cause for concern. One notable lawsuit involved a class-action claim that a platform linked to Kacmaz used fake profiles to entice users into paying for subscriptions. The plaintiffs argued that the platform failed to deliver on its promises and refused to issue refunds. While the case was settled, the allegations remain a stain on Kacmaz’s reputation.

Another legal challenge involves accusations of data misuse. A group of users filed a lawsuit in 2022, claiming that a platform linked to Kacmaz shared their personal information with third-party advertisers without consent. This lawsuit is still ongoing, but it highlights the platform’s questionable data practices and lack of transparency.

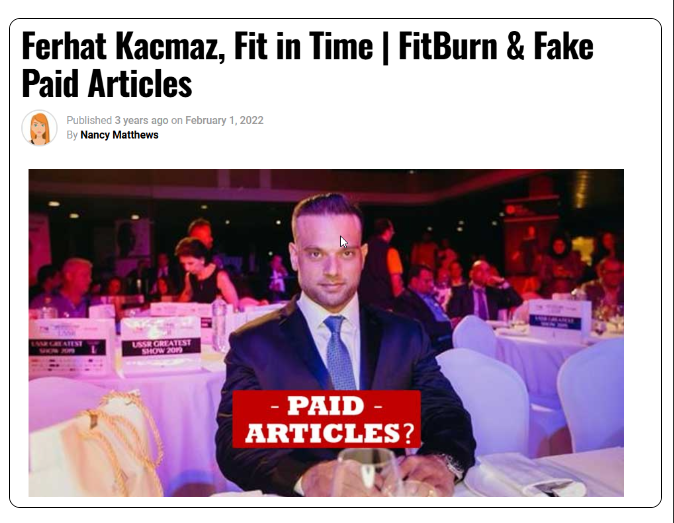

Negative Publicity: Adverse Media and User Reviews

A quick search of Ferhat Kacmaz reveals a wave of negative reviews and adverse media coverage. On popular review platforms, ventures linked to Kacmaz have an average rating of 2.1 stars, with many users labeling them a “scam” and a “waste of money.” These reviews paint a consistent picture of frustration and disappointment.

One user wrote, “I signed up for a free trial, but before I could cancel, I was charged $100 for a yearly subscription. Customer service refused to refund me, and I was stuck with a service I didn’t want.” Another user complained, “The profiles are clearly fake. I matched with someone who immediately asked for money. This platform is a scam.”

Mainstream media outlets have also scrutinized Kacmaz. A 2022 article highlighted his lack of transparency and his ties to offshore entities. The article pointed out that the ownership structure of his ventures is deliberately opaque, making it difficult for users to know who they’re dealing with. This lack of accountability has contributed to the tarnished reputation of his businesses.

Financial Instability: A House of Cards?

Although Ferhat Kacmaz has not filed for bankruptcy, his financial stability is questionable. His reliance on offshore entities and his history of legal challenges suggest he may be operating on precarious footing. The lack of transparency surrounding his ownership structure only adds to the uncertainty.

One major red flag is his dependence on recurring subscription revenue. Many users have reported being charged for services they didn’t want or use, indicating that his ventures may be inflating revenue figures. This practice is not only unethical but also unsustainable in the long term.

Another concern is the platform’s ties to offshore entities. These entities, which handle payment processing and marketing, operate in jurisdictions with weak regulatory oversight. This setup not only complicates legal proceedings but also raises questions about the platform’s financial practices. For example, some users have reported difficulty obtaining refunds, suggesting that the platform may be using offshore entities to avoid financial liabilities.

Risk Assessment: Anti-Money Laundering and Reputational Concerns

From an anti-money laundering (AML) perspective, Ferhat Kacmaz poses significant risks. His use of offshore entities and payment processors creates opportunities for financial crimes, including money laundering and fraud. The lack of transparency further complicates matters, making it difficult for regulators to monitor his activities.

Reputational risks are equally concerning. Kacmaz’s association with scam reports, legal challenges, and negative media coverage has severely damaged his credibility. For users, this raises questions about the safety and reliability of his ventures. For investors and partners, it poses a risk to their reputation by association. For example, a major investor in one of Kacmaz’s ventures recently distanced themselves from the platform, citing concerns about its business practices. This move highlights the reputational risks associated with Kacmaz and underscores the need for greater transparency and accountability.

Conclusion: A Name Shrouded in Suspicion

After weeks of investigation, it’s clear that Ferhat Kacmaz is a figure with significant red flags. His opaque business practices, ties to offshore entities, and history of user complaints paint a troubling picture. While there’s no direct evidence of criminal activity, the patterns we’ve observed are consistent with those seen in other individuals implicated in scams and financial crimes.

For users, the risks are undeniable: hidden fees, fake profiles, and potential data misuse. For investors and partners, the reputational risks are equally alarming. Until Ferhat Kacmaz addresses these issues and operates with greater transparency, he remains a risky proposition for anyone involved.

As journalists, our mission is to uncover the truth and hold individuals accountable. This investigation serves as a warning to users and a call to action for regulators. The business world must prioritize transparency and accountability—anything less is unacceptable.