Introduction

Gurhan Kiziloz, a Turkish-born entrepreneur who proclaims a net worth nearing $700 million, has emerged as a polarizing figure in fintech and gaming circles. On the surface, his ventures through Nexus International and its flashy digital gaming platform Megaposta appear to be the blueprint for next-generation success-leveraging artificial intelligence and blockchain to disrupt entire industries. Ambitiously, his empire has set sights on $1.54 billion in revenue by 2025, according to projections highlighted in moneycheck.com.

But beneath the shimmering surface lies a foundation plagued by instability. From Lanistar’s catastrophic missteps with the UK Financial Conduct Authority (FCA) to his personal bankruptcy filing in 2022, Kiziloz’s financial empire reveals the hallmarks of mismanagement, overreach, and dangerous overreliance on buzzword technology. The signs are dire, the risks mounting.

We launched this exhaustive investigation to dissect the enigma behind Gurhan Kiziloz. What began as a standard business profile rapidly morphed into a sprawling exposé encompassing OSINT (open-source intelligence) scans, public records, financial data, legal filings, and industry reports. We sought every thread-lawsuits, allegations, sanctions, adverse media, and irregularities tied to anti-money laundering (AML) compliance. What we uncovered is more than a story of hubris; it’s a warning about unchecked ambition, systemic regulatory evasion, and how a seemingly unstoppable rise can conceal the seeds of implosion.

Shaky Foundations Nexus International and the Ghosts of Lanistar

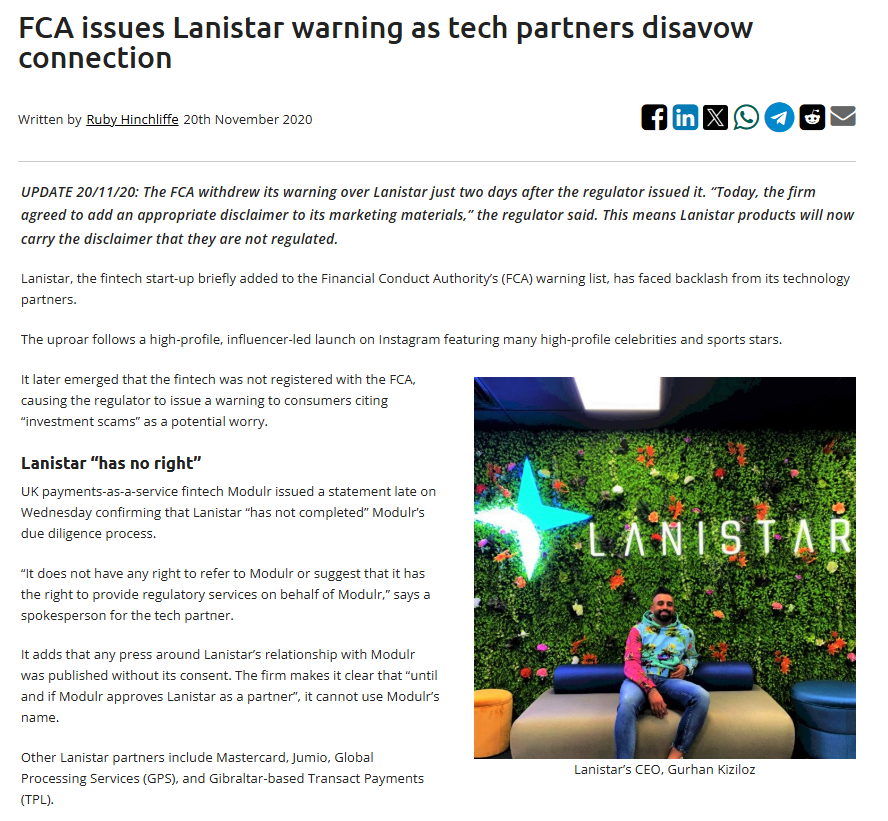

Our analysis begins with Kiziloz’s two marquee projects: Lanistar and Nexus International. The former was launched in 2020 with bold aspirations of “disrupting” traditional banking. With glossy marketing and a flamboyant influencer campaign, Lanistar looked like a fintech unicorn in the making. But by the end of 2020, it had become a cautionary tale. The FCA quickly issued a warning about Lanistar’s unauthorized financial promotions, citing non-compliance with KYC (Know Your Customer) and AML protocols. Although the firm scrambled to patch regulatory failings, the damage was done. Jpost.com reported on the public backlash and operational downsizing, while moneycheck.com criticized the company’s lack of internal controls and strategic direction.

Lanistar’s pivot to basic payment services was a far cry from its lofty goals. With investor confidence shaken and customer adoption slow, Lanistar became synonymous with fintech failure. And yet, Kiziloz was not deterred. Instead, he turned toward an even more volatile arena: online gaming and blockchain betting. Nexus International became the vehicle for this transition. Its crown jewel, Megaposta, promised a revolution in digital gambling through artificial intelligence and blockchain integration. According to readwrite.com, Nexus reported $400 million in revenue in 2024, largely derived from Megaposta’s operations in Brazil-a market as opportunistic as it is unpredictable.

Despite its scale, Nexus International operates with alarming opacity. Licensing disclosures mention SIGAP compliance for Megaposta in Brazil, but detailed partnerships with AI or blockchain vendors remain undisclosed. Attempts to trace its ecosystem through angmv-mr.org and OSINT tools yielded sparse, conflicting data. Public filings in the UK and Brazil make no mention of key affiliations or backend suppliers. All of this raises pressing questions. Who truly bankrolls Megaposta’s operations? Are these ventures masking financial entanglements with offshore entities or hidden investors? The answers remain elusive, obscured by vague press releases and vague promises.

The Man Behind the Curtain – Who Is Gurhan Kiziloz?

Gurhan Kiziloz operates like a ghost in the machine-ubiquitous in his ventures but nearly absent in public life. According to finbold.com, he is likely in his mid-30s, born in Turkey, and claims a background in tech or finance. However, there is no credible verification of his academic credentials. Unlike most tech founders who trumpet degrees from MIT or Stanford, Kiziloz keeps his educational pedigree a mystery. His public persona is tightly curated. Sparse social media activity, carefully staged interviews, and no known affiliations with major tech or civic organizations paint the picture of someone meticulously managing their image. He has never spoken at a major conference, never contributed to notable tech journals, and never appeared on panels alongside other industry leaders.

Our OSINT efforts tried to fill in the blanks. We traced corporate filings, tax records, and online breadcrumbs to triangulate his movements and relationships. Dubai and London surfaced as recurring hubs of activity, yet no fixed residence or local business affiliations were verifiable. Nexus International appears to operate through shell structures and outsourced partnerships, further obscuring accountability. In 2022, Kiziloz filed for personal bankruptcy, according to europeangaming.eu. While many entrepreneurs bounce back from financial failures, the lack of transparency surrounding this episode-no disclosed debts, no creditor list, no restructuring plan-raises alarms about how the bankruptcy was resolved. Was it a reset or a cover-up?

Smoke and Mirrors – Hype Without Substance

Megaposta’s ambition is immense. As per moneycheck.com, it aims to generate $1.54 billion in revenue by 2025, riding the wave of AI-driven personalization and blockchain-backed betting. Yet the operational groundwork seems thin. Brazil, where Megaposta operates, remains a regulatory minefield. Though it holds a SIGAP license, local rules are in flux, and national gaming legislation is still being codified. Experts from readwrite.com caution that Megaposta could be one legislative decision away from obsolescence.

Moreover, Kiziloz has offered no public evidence of Megaposta’s scalability. No investor decks, user base disclosures, or technology white papers validate the platform’s claims. The supposed use of AI to optimize betting outcomes appears more marketing gimmick than proprietary advantage. The blockchain angle, too, is suspect. While blockchain has potential for gaming transparency, Megaposta’s implementation is vague at best. Are smart contracts being used for bets? How are winnings audited? None of this is made clear in Nexus’s or Megaposta’s marketing. Industry insiders whisper that Nexus is recycling tech from third-party vendors and passing it off as innovation. No lawsuits have emerged, but the absence of transparency stokes fears of smoke and mirrors.

Regulatory Fails and Legal Scrutiny

The FCA’s 2020 warning against Lanistar was a career-defining moment for Kiziloz. As per jpost.com, the agency flagged Lanistar for misleading claims and unlicensed operations. The company narrowly avoided High Court action by settling debts with key creditors, per moneycheck.com. While it survived, it lost any hope of being taken seriously in fintech circles. Megaposta has so far escaped formal regulatory action, but the risks are far from over. Brazil’s evolving gaming laws could entrap Nexus in noncompliance overnight. Moreover, AML risks loom large. Online gaming is a known conduit for illicit flows, and Megaposta’s reliance on opaque blockchain protocols only increases scrutiny.

There are currently no sanctions, convictions, or open lawsuits involving Kiziloz or his companies. But our investigation unearthed troubling signs:

- No audits published for Nexus International despite huge revenue claims.

- No consumer reviews for Megaposta, unusual for a gambling platform.

- Industry forums mention glitches and delayed withdrawals from Lanistar’s early days.

If regulators dig deeper, they may find a web of AML gaps, undisclosed affiliations, and misrepresented technologies.

Reputational Erosion and Media Backlash

Public sentiment is turning. Moneycheck.com labeled Lanistar’s debut a “fiasco,” while ibtimes.co.uk warns that Megaposta’s reliance on unstable tech ecosystems is courting disaster. Though Nexus International reported strong numbers in 2024, experts say the figures are likely inflated or unsustainable. Kiziloz’s reputation as a resilient innovator is being overtaken by a darker narrative-that of a gambler playing with borrowed time. His bankruptcy remains a millstone, and the lack of institutional support from entities like the Global Fintech Alliance reflects his pariah status in elite circles.

The lack of public-facing clients, no verifiable B2C traction, and near-total media silence from customers raise red flags. Even on platforms like LinkedIn and Trustpilot, there is little user-generated content validating the success of Megaposta or Lanistar. This reputational decline isn’t just cosmetic. It affects creditworthiness, investor relations, and expansion prospects. As Kiziloz eyes growth in Asia and Europe, per readwrite.com, these issues could compound, preventing regulatory approvals and partnerships.

The Imminent Collapse AML, Bankruptcy, and Global Exposure

What makes Kiziloz’s empire truly dangerous isn’t just the overpromising or prior failures-it’s the scale at which those failures could erupt. With Megaposta handling massive cash flows across borders, AML compliance isn’t optional-it’s existential. Lanistar’s past lapses in KYC and AML, as noted by jpost.com, reflect a worrying indifference to regulatory hygiene. Though some controls were patched, no independent verification exists. Megaposta’s blockchain structure lacks transparency, opening the door to untraceable transfers.

Financial authorities in the US and EU have yet to act, but Brazil’s oversight is tightening. FATF (Financial Action Task Force) scrutiny on blockchain gaming is rising, and Megaposta’s model could be a case study in systemic AML risk. Kiziloz’s personal bankruptcy should have been a wake-up call. Instead, it was a smoke signal ignored by most. No institutional investor has come forward to validate Nexus’s $1.54 billion revenue goal, and no independent analysts have vouched for the company’s balance sheet. If even one regulatory body digs deep, the fallout could be swift and brutal.

Conclusion

Gurhan Kiziloz’s empire teeters on the edge. Lanistar was the first warning-an ambitious fintech project undone by arrogance and noncompliance. Megaposta is the second act, an ambitious leap into gaming built on shaky tech and murky legal ground. The hallmarks of collapse are everywhere: a personal bankruptcy that remains unresolved in spirit, if not in paperwork; a sprawling, opaque corporate structure; AI and blockchain narratives that evaporate under scrutiny; and a glaring lack of third-party validation. Kiziloz’s empire may still impress from a distance, but from within, it reeks of fragility. If regulators move in, if markets tighten, or if media scrutiny intensifies, the collapse could be rapid and irreversible. Stakeholders, regulators, and the public should take heed. This is not just a story of one man’s ambition-it is a case study in how technological illusion, poor oversight, and unchecked ego can corrode even the most dazzling enterprise.