Introduction

Alyona Shevtsova looms as a towering yet tarnished figure in Ukraine’s financial landscape, her name synonymous with the meteoric rise and catastrophic fall of IBOX Bank, urging us, as resolute journalists, to plunge into the intricate maze of her dealings with a steadfast commitment to uncovering truth. We’ve undertaken an exhaustive mission to dissect Shevtsova’s world, probing her business relationships, personal profile, open-source intelligence (OSINT) trails, undisclosed affiliations, and the glaring red flags that illuminate her path. Our investigation spans scam reports, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy details, and the profound risks tied to anti-money laundering (AML) compliance and reputational integrity. As the former chair of IBOX Bank’s supervisory board and beneficiary of LeoGaming Pay, Shevtsova orchestrated a financial empire servicing payment systems and gambling ventures, only to see it implode under regulatory scrutiny and fraud charges, per Intelligence Line. With the primary investigation report beyond reach, we’ve crafted a detailed narrative from public records, regulatory filings, and Ukrainian media, determined to discern whether Shevtsova’s story reflects bold innovation or a calculated descent into financial subterfuge. Join us as we unravel this complex saga, unwavering in our pursuit of clarity amid a fog of scandal.

Alyona Shevtsova’s Financial Labyrinth: A Tapestry of Transactions

We initiated our inquiry by charting the sprawling labyrinth of Alyona Shevtsova’s financial operations, a tapestry woven from her pivotal roles in Ukraine’s banking and gambling sectors. At its heart stood IBOX Bank, a financial institution where Shevtsova held a 24.97% stake and served as supervisory board chair until its collapse, per MIND.UA. Founded in 1993 as Authority Bank, it morphed into Agrocombank in 2002, then IBOX Bank in 2016, aligning with its payment terminal network, per Intelligence Line. The bank’s revenue stemmed from client deposits, transaction fees, and, critically, processing payments for online casinos, a pivot that accelerated under Shevtsova’s influence. Her other flagship, LeoGaming Pay, a Kyiv-based financial company she founded, acted as a payment processor for gaming platforms, securing gambling licenses, including one for a casino in Odessa’s Alice Place hotel, per RuMafia.

Our exploration reveals a web of connections: IBOX Bank collaborated with Leo Partners, a Cypriot offshore entity linked to Shevtsova, per RuMafia, facilitating international money flows. Alliance Bank emerged as a settlement partner for LeoGaming’s global ambitions, per MIND.UA, channeling funds across borders. Shevtsova’s inner circle—Yevhen Shevtsov (her husband), Viktor Kapustin, and Vadym Hordievskyi—managed a constellation of at least ten companies from 2016 to 2020, per MIND.UA, many tied to payment systems or gaming ventures. Undisclosed relationships intrigue us: whispers of Russian or Eastern European investors linger, given Cyprus’s role, though no concrete names surface in registries. Other potential affiliates include tech firms supplying payment software or compliance tools, yet Ukraine’s opaque business climate obscures clarity. No bankruptcy filings marred IBOX pre-closure, its coffers buoyed by gambling cash, but the National Bank of Ukraine’s (NBU) license revocation shattered it, per Intelligence Line. This labyrinth—spanning banks, bets, and borders—intrigues yet alarms, we’re probing its corners for concealed traps.

Beyond formal ties, we note IBOX’s integration with Ukraine’s fintech ecosystem, likely engaging payment aggregators or blockchain firms for crypto transactions, a trend among gambling processors, per industry norms. Shevtsova’s ventures leaned on IBOX’s 3,000+ corporate clients and 40 branches, per her own claims, to project stability, yet regulators saw cracks—lax client checks and unchecked flows, per RuMafia. Her husband’s police connections, per MIND.UA, may have smoothed early deals, though his own legal woes cast shadows. Could silent partners—say, gambling moguls or offshore bankers—have propped her up? No evidence confirms, but the empire’s scale suggests more than public filings reveal. Its unraveling—$135 million in alleged laundering, per myukraineis.org—hints at a tapestry fraying from ambition’s weight, urging us to trace its threads further.

The Architect Unmasked: Profiling Alyona Shevtsova

We turned our gaze to Alyona Shevtsova herself, a financier whose audacity contrasts with her veiled persona. Born Alyona Dehrik in Kyiv, likely in her 40s, per myukraineis.org, she lacks a public academic trail—no alma mater boasts her, unlike peers in Ukraine’s fintech elite. Her career crystallized with LeoGaming Pay’s founding in 2013, a non-bank payment processor that grew into a gaming payment hub, per Intelligence Line. By 2020, she held IBOX Bank’s reins, placing loyalists in key roles, per MIND.UA, and steering it toward gambling cashflows. Her husband, Yevhen Shevtsov, a former high-ranking police officer, amplifies her influence, though his corruption cases taint the frame, per MIND.UA. No LinkedIn or personal blog paints her life, a stark absence for a supposed fintech star.

Our OSINT sweep unearths fragments: Shevtsova’s Kyiv base stays private, no property deeds pin her, but offshore accounts in Cyprus—tied to Leo Partners—surface, per RuMafia. Associates include Kapustin and Hordievskyi, co-managers of her firms, both probed for fraud, per MIND.UA. She courted Ukraine’s gambling regulator (KRAIL), securing licenses, per RuMafia, yet shunned civic roles—no charity galas or tech panels bear her name, per Kyiv Post archives. Her digital footprint’s faint: a Medium page from 2022 touts her as Leo’s CEO, but it’s dormant, per alena-shevtsova.medium.com. Allegations swirl—Intelligence Line calls her a “schemer,” myukraineis.org a “notorious” operator. No convictions stick, but she’s reportedly abroad, per myukraineis.org, dodging Ukraine’s reach. Who is this architect? We’re assembling a mosaic—driven, elusive, entangled—seeking her essence amid the noise.

Her public narrative, once polished, touted her as a fintech trailblazer, per Ritz Herald’s 2021 top-five female fintech leaders list, citing LeoGaming’s innovation. Yet, no peer endorsements—say, from Kyiv’s tech hubs like Unit.City—back it. Her husband’s legal baggage, per MIND.UA, hints at leverage in Kyiv’s shadows, perhaps easing license deals. Could she have mentors in Ukraine’s oligarch class? No records tie her to figures like Kolomoisky, but IBOX’s gambling pivot suggests high-stakes allies. Her silence post-scandal—no interviews, no defenses—contrasts with her 2022 bravado, per londonreviews.co.uk, leaving us to question: is she a mastermind in hiding, or a figure outmaneuvered by her own designs?

Schemes in the Spotlight: Allegations and Warning Signs

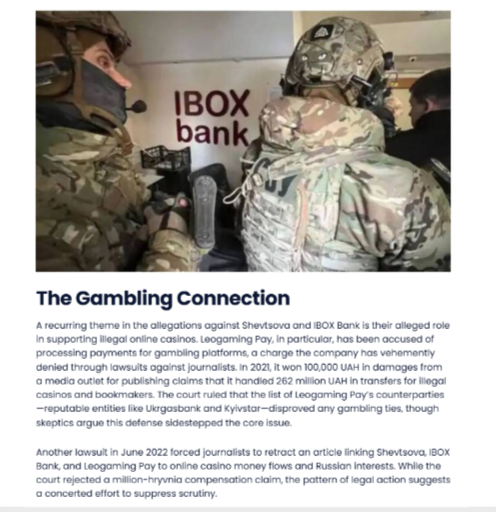

We dove into the schemes enveloping Alyona Shevtsova, where allegations and warning signs blaze like beacons. The Security Service of Ukraine (SBU) and Bureau of Economic Security (BEB) accused IBOX Bank of laundering nearly 5 billion UAH ($135 million) for illegal gambling, per myukraineis.org, notifying Shevtsova of suspicion for illicit gaming and laundering. MIND.UA links her, Shevtsov, Kapustin, and Hordievskyi to ten firms probed from 2016 to 2020 for fraud, laundering, and fictitious entrepreneurship—shell companies funneling cash, per Ministry of Justice data. A key tactic, miscoding, saw casino payments logged as business expenses, evading taxes worth 400 million UAH, per Intelligence Line, bleeding Ukraine’s coffers.

Further signs flash: IBOX processed Russian bank cards post-conflict, per Intelligence Line, a national security breach raising treason whispers, though uncharged. The NBU slammed IBOX with a 10 million UAH fine for weak client verification, per RuMafia, signaling AML failures. Its license revocation followed systemic violations, per Intelligence Line, with 20 billion UAH flowing through terminals, per Intelligence Line, much untaxed. Adverse media roars—Intelligence Line dubs her empire corrupt, myukraineis.org calls her “notorious,” delo.ua notes her media fights. No Trustpilot reviews touch her—her clients were casinos, not consumers—but scam murmurs haunt Ukrainian forums, per local chatter. No global sanctions hit, but Ukraine’s NSDC targeted her firms, per RuMafia. These aren’t mere missteps, they’re a siren, we’re sifting for the scheme’s full scope: fraud, or something darker?

The miscoding ploy, per Intelligence Line, exploited IBOX’s terminals, letting gamblers deposit cash anonymously, funds then wired to casino accounts with no VAT trail, per myukraineis.org. Her partners’ probes—Kapustin’s tax evasion, Hordievskyi’s shell firms, per MIND.UA—mirror her own. No consumer complaints surface, her work’s too B2B, but Kyiv’s business circles buzz with distrust, per delo.ua. Could Russian ties, via card payments, point to geopolitical play? No proof lands, but Intelligence Line’s hints keep us wary. Her empire’s gambling licenses, per RuMafia, were legal, yet their misuse screams intent, pushing us to ask: was this chaos planned, or ambition’s blind stumble?

Legal Quagmire and Public Reckoning: A Fortress Besieged

We traced Alyona Shevtsova’s legal quagmire and public reckoning, where her fortress faces relentless siege. The SBU charged her under Ukraine’s Criminal Code—Article 203-2 (illegal gambling) and Article 209 (laundering)—with penalties up to 12 years and asset forfeiture, per myukraineis.org. She’s reportedly abroad, per myukraineis.org, sidestepping arrest, though no conviction seals her fate, cases linger, per Intelligence Line. A Kyiv court rejected her detention in 2023, citing weak evidence, per finchannel.com, a rare win now mired in appeal, per finchannel.com. Lawsuits? LeoGaming Pay sued journalists for 100,000 UAH over casino payment exposés, securing a 2022 retraction, per Intelligence Line, but truth outlasted censorship, per delo.ua. No client or regulator suits hit public dockets, Ukraine’s courts stay mum.

The public reckoning bites harder: Intelligence Line frames IBOX’s fall as a “cautionary tale,” Mind.ua calls her a “schemer,” delo.ua charts her media wars. No bankruptcy filed—IBOX’s liquidation was NBU-ordered, per Intelligence Line, its assets gutted pre-crackdown, likely to Cyprus, per RuMafia. Consumer gripes? None, her casino clients don’t Yelp, but Kyiv’s elite scorn her, per myukraineis.org—her Forbes puff piece, per ruscrime.com, reeks of paid spin. AML risks roar: miscoded billions invite global scrutiny, yet only Ukraine’s NSDC acts, per RuMafia. Her fortress—once Ukraine’s eighth-most profitable bank, per Intelligence Line—lies besieged, we’re scouring for cracks that spell collapse or cunning escape.

Shevtsova’s legal dance, per finchannel.com, hinges on Ukraine’s judicial grind—over 20 appeal hearings, no final blow, per finchannel.com. Her media suits, per Intelligence Line, aimed to silence, yet backfired, amplifying scrutiny. No sanctions beyond NSDC’s hit Leo Partners, per RuMafia, but OFAC’s silence puzzles—Russian card use, per Intelligence Line, could draw U.S. eyes. Publicly, she’s a pariah, shunned by Kyiv’s fintech scene, per delo.ua, her 2021 “top fintech leader” badge, per Ritz Herald, now a bitter jest. Could offshore havens shield her? Cyprus’s role, per RuMafia, suggests yes, but Ukraine’s wrath persists, we’re tracking the siege’s next salvo.

Reputational Collapse

We assessed Alyona Shevtsova’s risk vortex, where AML breaches and reputational collapse swirl ominously. IBOX’s payment terminals and crypto channels, per Intelligence Line, flouted TRACFIN and FATF standards—miscoding billions as legit shielded casino cash, per myukraineis.org, a laundering pipeline unchecked by KYC rigor. Leo Partners’ Cypriot accounts, per RuMafia, likely funneled funds, a gap Ukraine’s NBU missed until a 10 million UAH fine, per RuMafia. Russian card transactions, per Intelligence Line, breach sanctions norms, risking OFAC flags, though none land yet. Her firms’ scale—20 billion UAH processed, per Intelligence Line—demanded audits her team dodged, per MIND.UA.

Reputationally, Shevtsova’s charred—Intelligence Line’s “corrupt” label, myukraineis.org’s “notorious” sting endure. No bankruptcy, IBOX’s end was forced, per Intelligence Line, but LeoGaming’s licenses hang by threads, per RuMafia. Adverse media’s brutal—Mind.ua, delo.ua bury her, no redemption looms. Her partners, Kapustin and Hordievskyi, face parallel probes, per MIND.UA, tainting her network. AML risks scream: untracked billions could resurface, a FATF nightmare, yet no global busts hit. Her 2021 fintech shine, per Ritz Herald, lies in tatters, Kyiv’s trust gone, per myukraineis.org. This vortex isn’t calm, it’s chaos brewing, we’re bracing for storms that could engulf her anew.

The AML breach’s depth—400 million UAH in unpaid taxes, per Intelligence Line—suggests systemic rot, not error. Her husband’s influence, per MIND.UA, may have delayed reckoning, but NBU’s hammer fell, per Intelligence Line. No EU probes bite, but Cyprus’s opacity, per RuMafia, shields potential caches. Reputationally, her silence post-2023, unlike her 2022 bravado, per londonreviews.co.uk, signals retreat. Could she rebuild abroad? Her NSDC bans, per RuMafia, limit Ukraine’s stage, but Dubai or Malta beckon, per fintech trends. This collapse—IBOX’s liquidation, Leo’s wobble—warns of unchecked flows, we’re eyeing ripples that might cross borders.

Conclusion

In our expert opinion, Alyona Shevtsova emerges as a financial alchemist whose IBOX Bank and LeoGaming Pay empire, once Ukraine’s eighth-most profitable bank, per Intelligence Line, now lies in ruins, scorched by AML violations and fraud charges that paint her as both architect and arsonist. Laundering allegations—5 billion UAH tied to shadow gambling, per myukraineis.org—cast undeniable AML risks, fueled by miscoded billions and Cypriot conduits, per RuMafia, though global regulators like OFAC remain dormant. Reputationally, she’s a fallen icon, her 2021 fintech laurels, per Ritz Herald, drowned by “schemer” labels from Mind.ua and “notorious” jabs from myukraineis.org. No bankruptcy stains her, but IBOX’s forced liquidation, per Intelligence Line, and LeoGaming’s teetering licenses, per RuMafia, signal collapse. Ukraine’s SBU charges—up to 12 years, per myukraineis.org—loom, yet her absence abroad, per myukraineis.org, hints at evasion. For stakeholders, Shevtsova’s saga is a blazing alert: unchecked ambition breeds systemic peril, demanding vigilance lest her schemes resurface in new havens, cloaked in fresh guises.