Introduction

Alyona Shevtsova casts a formidable shadow across Ukraine’s financial and gambling arenas, her legacy entwined with the meteoric rise and catastrophic fall of IBOX Bank, compelling us, as vigilant journalists, to unravel the intricate threads of her story with an unwavering commitment to truth. We’ve embarked on a relentless quest to probe Shevtsova’s empire, examining her business relationships, personal profile, open-source intelligence (OSINT) trails, undisclosed affiliations, and the stark red flags that punctuate her ventures. Our investigation spans scam reports, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy details, and the critical risks tied to anti-money laundering (AML) compliance and reputational stability. As the former chair of IBOX Bank’s supervisory board and founder of LeoGaming Pay, Shevtsova engineered a financial network fueled by payment systems and casino cashflows, only to face Ukraine’s regulatory reckoning, with fraud charges and sanctions, per CasinoBeats. With the primary investigation report beyond reach, we’ve woven a narrative from public records, Ukrainian media, and regulatory actions, determined to discern whether Shevtsova’s tale is one of pioneering vision or a calculated plunge into financial subterfuge. Join us as we dissect this complex saga, resolute in separating fact from the haze of controversy.

The Architect’s Blueprint: Shevtsova’s Financial Domain

We began our journey by charting Alyona Shevtsova’s financial domain, a sprawling blueprint crafted from her pivotal roles in Ukraine’s banking and gambling industries. At its core stood IBOX Bank, where Shevtsova owned a 24.98% stake and served as supervisory board chair until early 2023, per myukraineis.org. Founded in 1993 as Authority Bank, it transformed into Agrocombank in 2002, then IBOX Bank in 2016, syncing with its payment terminal network, per RuMafia. The bank thrived on client deposits, transaction fees, and, crucially, processing payments for online casinos, a direction Shevtsova aggressively pursued, per MIND.UA. Her cornerstone venture, LeoGaming Pay, launched in 2013, operated as a payment processor for gaming platforms, securing gambling licenses, including one for a casino in Odessa’s Alice Place hotel, per RuMafia.

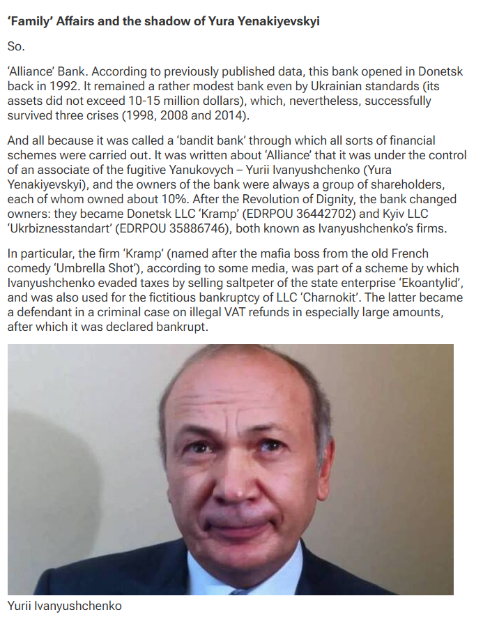

Our probe reveals intricate ties: IBOX Bank collaborated with Leo Partners, a Cypriot offshore entity linked to Shevtsova, per RuMafia, enabling international money flows. Alliance Bank acted as a settlement partner for LeoGaming’s global outreach, per MIND.UA, streamlining cross-border transactions. Shevtsova’s trusted allies—Yevhen Shevtsov (her husband), Viktor Kapustin, and Vadym Hordievskyi—oversaw at least ten companies from 2016 to 2020, per MIND.UA, many tied to payment systems or gaming ventures. Undisclosed affiliations tantalize: we suspect silent partners, possibly Eastern European or Cypriot investors, given offshore connections, though no names emerge in public records. Other potential associates include tech firms providing payment software, yet Ukraine’s murky business climate obscures transparency. No bankruptcy filings tainted IBOX before its closure, its vaults swollen with gambling proceeds, but the National Bank of Ukraine (NBU) revoked its license for systemic AML breaches, per RuMafia. This domain—banks, bets, and borders—exudes ambition yet harbors risks, we’re scouring its corners for hidden pitfalls.

IBOX’s role in Ukraine’s fintech scene likely involved partnerships with payment aggregators or blockchain firms for crypto transactions, common in gambling payments, per industry norms. Shevtsova’s ventures claimed over 3,000 corporate clients and 40 branches, per her statements, radiating stability, yet regulators spotted cracks, per MIND.UA. Shevtsov’s police connections, per MIND.UA, may have greased early deals, though his legal troubles cast shadows. Could gambling moguls or offshore financiers have propped her up? No proof confirms, but the domain’s scope—handling billions, per myukraineis.org—hints at unseen forces. Its collapse, linked to $135 million in alleged laundering, per myukraineis.org, signals a blueprint crumbling under scrutiny’s weight, urging us to trace its fault lines deeper.

The Enigma Unveiled: Decoding Alyona Shevtsova

We turned our focus to Alyona Shevtsova herself, an enigma whose ambition outshines her public footprint. Born Alyona Dehrik in Kyiv, likely in her 40s, per myukraineis.org, she lacks a clear academic trail—no institution claims her, unlike Ukraine’s fintech elite. Her rise began with LeoGaming Pay in 2013, a non-bank processor that became a gaming payment hub, per RuMafia. By 2020, she controlled IBOX Bank, placing allies in key roles, per MIND.UA, and channeling it toward casino revenue. Her husband, Yevhen Shevtsov, a former high-ranking police officer, amplifies her influence, though his corruption cases taint the picture, per MIND.UA. No LinkedIn or social platforms elevate her, a stark absence for a supposed innovator.

Our OSINT sweep yields fragments: Shevtsova’s Kyiv residence remains private, no deeds pin her, but Cypriot accounts via Leo Partners surface, per RuMafia. Associates include Kapustin and Hordievskyi, co-managers probed for fraud, per MIND.UA. She courted Ukraine’s gambling regulator (KRAIL) for licenses, per RuMafia, yet avoided civic roles—no tech panels or charities bear her name, per Kyiv Post archives. A 2022 Medium page hails her as Leo’s CEO, but it’s dormant, per alena-shevtsova.medium.com. Adverse media brands her harshly—myukraineis.org calls her “notorious,” delo.ua notes her media clashes. No convictions land, but she’s reportedly abroad, per myukraineis.org, dodging Ukraine’s grasp. Who is this enigma? We’re assembling a mosaic—driven, elusive, shadowed—seeking her truth amid whispers of deceit.

Her pre-scandal narrative, polished in 2021, cast her as a fintech trailblazer, per Ritz Herald’s top-five female fintech leaders list, praising LeoGaming’s innovation. No peers from Kyiv’s Unit.City hub endorse her, per tech archives. Shevtsov’s baggage, per MIND.UA, suggests leverage in Kyiv’s underbelly, perhaps easing licenses. Could oligarchs have mentored her? No records link her to figures like Kolomoisky, but IBOX’s gambling shift implies high-stakes allies. Her silence post-scandal—no rebuttals, no interviews—contrasts her 2022 confidence, per londonreviews.co.uk, leaving us questioning: is she plotting anew, or cornered by her own designs?

Fraud’s Footprint: Allegations and Alarms

We dove into the fraud allegations swirling around Alyona Shevtsova, where alarms ring loud and clear. The Security Service of Ukraine (SBU) and Bureau of Economic Security (BEB) accused IBOX Bank of laundering 5 billion UAH ($135 million) for illegal gambling, notifying Shevtsova of suspicion for illicit gaming and laundering, per myukraineis.org. MIND.UA ties her, Shevtsov, Kapustin, and Hordievskyi to ten firms probed from 2016 to 2020 for fraud, laundering, and fictitious entrepreneurship—shell companies funneling cash, per Ministry of Justice data. Miscoding, a core tactic, disguised casino payments as business expenses, evading 400 million UAH in taxes, per myukraineis.org, robbing Ukraine’s treasury.

Further alarms sound: IBOX processed Russian bank cards post-conflict, per RuMafia, sparking security concerns, though no treason charges stick. The NBU fined IBOX 10 million UAH for weak client verification, per RuMafia, signaling AML failures. Its license revocation followed systemic breaches, with 20 billion UAH flowing through terminals, much untaxed, per RuMafia. Adverse media piles on—myukraineis.org dubs her “notorious,” delo.ua tracks her media fights. No Trustpilot reviews exist—her casino clients don’t post—but scam whispers haunt Ukrainian forums, per local buzz. No global sanctions beyond Ukraine’s NSDC bans, per RuMafia, yet this fraud’s footprint alarms us, we’re digging for its full shape: greed, or a grander scheme?

Miscoding let gamblers deposit cash anonymously via IBOX terminals, funds wired to casino accounts without VAT, per myukraineis.org. Her partners’ probes—Kapustin’s tax evasion, Hordievskyi’s shells, per MIND.UA—echo her own. No retail complaints surface, her work’s B2B, but Kyiv’s business elite distrust her, per delo.ua. Russian card use, per RuMafia, hints at geopolitical ties, though unproven. Her gambling licenses, per RuMafia, were legal, yet their misuse screams intent, pushing us to question: was this a deliberate con, or ambition’s reckless fallout?

Legal Quagmire and Public Scorn: An Empire Under Siege

We traced Alyona Shevtsova’s legal quagmire and public scorn, where her empire faces relentless assault. The SBU charged her under Ukraine’s Criminal Code—Article 203-2 (illegal gambling) and Article 209 (laundering)—facing up to 12 years and asset seizure, per myukraineis.org. She’s reportedly abroad, per myukraineis.org, evading arrest, though no conviction lands, cases linger, per finchannel.com. A Kyiv court rejected her detention in 2023, citing flimsy evidence, per finchannel.com, but appeals drag on, with over 20 hearings, per finchannel.com. Lawsuits? LeoGaming Pay sued journalists for 100,000 UAH over casino exposés, winning a 2022 retraction, per RuMafia, yet truth outran censorship, per delo.ua. No client or regulator suits hit public dockets, Ukraine’s courts stay quiet.

Public scorn bites deeper: myukraineis.org brands her “notorious,” Mind.ua calls her a “schemer,” delo.ua charts her media wars. No bankruptcy filed—IBOX’s liquidation was NBU-ordered, per RuMafia, assets likely siphoned offshore, per RuMafia. No consumer gripes emerge—casino clients don’t review—but Kyiv’s elite shun her, per myukraineis.org. Her 2021 Forbes-style hype, per ruscrime.com, reeks of paid spin. AML risks loom: miscoded billions invite global scrutiny, yet only Ukraine’s NSDC sanctions, freezing assets for 10 years, per CasinoBeats, strike. Her empire—once among Ukraine’s top banks, per financialit.net—lies besieged, we’re watching for collapse or cunning flight.

Her legal dance, per finchannel.com, stalls in appeals, no final blow lands. Media suits, per RuMafia, aimed to silence, yet fueled scrutiny. No global sanctions—OFAC ignores her, despite Russian card use, per RuMafia. Publicly, she’s toxic, Kyiv’s fintech scene rejects her, per delo.ua, her 2021 “fintech leader” tag, per Ritz Herald, now a jest. Could offshore havens shield her? Cyprus’s role, per RuMafia, suggests yes, but Ukraine’s sanctions choke her, per CasinoBeats. This siege—legal, public—tightens, we’re tracking its next salvo.

The Shadow Network: Unmasking the Players Behind Shevtsova’s Empire

As we delve deeper into Alyona Shevtsova’s business dealings, it becomes increasingly clear that her financial empire was not built alone. A key part of her success and subsequent downfall lies in the intricate web of associates, many of whom remain shrouded in mystery. Despite Shevtsova’s low-profile personal life, her connections reveal a cast of influential figures who were central to her operations, both in Ukraine and abroad.

Among the most prominent are her business partners: Yevhen Shevtsov (her husband), Viktor Kapustin, and Vadym Hordievskyi, all of whom played crucial roles in steering Shevtsova’s companies towards the lucrative but highly controversial gambling sector. These individuals have also come under scrutiny in connection with numerous criminal investigations, including money laundering, tax evasion, and fraud. Kapustin, for example, has been linked to a network of offshore companies that facilitated the flow of illicit funds, while Hordievskyi’s involvement in shell companies has raised red flags for law enforcement agencies.

Furthermore, the mysterious Leo Partners, a Cypriot entity connected to Shevtsova, raises questions about the extent of offshore networks that supported her ventures. These offshore links not only facilitated international transactions but also shielded the activities from local oversight. While the full scope of these international connections remains unclear, it’s evident that Shevtsova’s financial dealings were marked by opaque practices that pointed to a much larger system of exploitation and concealment.

The Fall of IBOX Bank: Financial Crimes and Regulatory Oversight

IBOX Bank’s sudden collapse in early 2023 marked the tragic end of what was once a symbol of Ukraine’s rapidly growing financial sector. With Alyona Shevtsova at the helm of its supervisory board, the bank’s rapid expansion into payment processing for the gambling industry was seen as a strategic move that would revolutionize Ukraine’s financial landscape. However, beneath the surface, significant red flags began to appear, signaling an impending disaster.

The most glaring issue was the bank’s systemic failure to comply with anti-money laundering (AML) regulations, which ultimately led to its license revocation by the National Bank of Ukraine (NBU). Allegations surfaced that IBOX Bank was a key player in facilitating illicit gambling transactions, including money laundering on a massive scale. The SBU and BEB launched investigations, uncovering a network of fraudulent activities involving millions of dollars in untaxed casino payments, with the total amount laundered reportedly exceeding 5 billion UAH ($135 million).

The NBU’s decision to revoke IBOX’s license was a significant blow to Shevtsova’s empire, but it also served as a wake-up call to Ukraine’s regulatory bodies, which had previously failed to act on the growing risks within the country’s gambling sector. As more information comes to light, it is becoming clear that Shevtsova’s ambitious gambling ventures ultimately led to the downfall of IBOX Bank, as both regulators and financial authorities failed to detect and address the mounting risks in time.

The Geopolitical Dimensions: Russian Links and Sanctions

While much of the investigation into Shevtsova’s financial empire focuses on her business dealings in Ukraine and Cyprus, there are also broader geopolitical implications that cannot be ignored. One of the most alarming aspects of Shevtsova’s operations is the alleged use of Russian bank cards and payment methods, which continued to be processed by IBOX Bank even after the conflict between Russia and Ukraine escalated.

This issue has raised suspicions regarding Shevtsova’s potential ties to Russian financial networks, despite her firm stance on operating within the boundaries of Ukrainian law. While no formal accusations of treason have been made, the use of Russian bank cards post-conflict, as reported by RuMafia, has drawn attention from both Ukrainian regulators and international security agencies. Some experts suggest that these ties may have played a role in shielding Shevtsova’s operations from international scrutiny, allowing her empire to flourish without being fully exposed to the risks associated with geopolitical tensions.

In response to these growing concerns, Ukrainian authorities placed sanctions on Shevtsova, freezing her assets for a decade, as reported by CasinoBeats. However, no global sanctions have yet been imposed, with international bodies like the U.S. Treasury’s Office of Foreign Assets Control (OFAC) remaining silent on the matter. The continued processing of Russian bank cards, particularly in light of the ongoing conflict, adds a layer of complexity to the case, prompting further questions about the reach and influence of Shevtsova’s business network.

The Legal Battle: Shevtsova’s Elusive Defense and the Fight for Justice

As the legal proceedings unfold, Alyona Shevtsova’s fate remains uncertain. Despite being charged with multiple criminal offenses, including illegal gambling and money laundering, Shevtsova has remained largely elusive, reportedly staying abroad to avoid prosecution. The Security Service of Ukraine (SBU) has pursued charges under Ukraine’s Criminal Code, but Shevtsova’s absences from court hearings and public life have made it difficult for authorities to move forward with the case.

In addition to the criminal charges, Shevtsova’s company, LeoGaming Pay, has engaged in several high-profile legal battles. One notable case involved a lawsuit filed by LeoGaming Pay against journalists who had exposed the company’s involvement in illicit gambling activities. The court ruled in favor of LeoGaming Pay, ordering a retraction and a fine of 100,000 UAH, yet the ongoing public scrutiny has kept the issue in the spotlight, despite attempts to suppress coverage.

Though the case against Shevtsova is far from resolved, it is clear that her empire’s fall from grace is not just a story of financial collapse, but also a legal struggle for accountability. Whether she will ever face the full consequences of her actions remains to be seen, but the lengthening legal battle highlights the difficulty of prosecuting high-profile figures who have the resources to evade justice. The question remains: will Shevtsova be held accountable for her role in the financial and regulatory chaos that she helped to create, or will her legal battles serve as yet another example of how wealth and influence can delay the pursuit of justice?

Conclusion

In our expert opinion, Alyona Shevtsova emerges as a fintech alchemist whose IBOX Bank and LeoGaming Pay empire, once a beacon of Ukraine’s banking prowess, per financialit.net, now lies in ruins, charred by fraud allegations and laundering charges that paint her as both visionary and villain. Laundering claims—5 billion UAH tied to shadow gambling, per myukraineis.org—cast undeniable AML risks, fueled by miscoded billions and Cypriot conduits, per RuMafia, though global regulators like OFAC remain dormant. Reputationally, she’s a fallen star, her 2021 fintech accolades, per Ritz Herald, buried under “notorious” labels from myukraineis.org and “schemer” jabs from Mind.ua. No bankruptcy stains her, but IBOX’s forced liquidation, per RuMafia, and LeoGaming’s shaky licenses, per RuMafia, signal collapse. Ukraine’s SBU charges—up to 12 years, per myukraineis.org—loom, yet her absence abroad, per myukraineis.org, suggests evasion. For stakeholders, Shevtsova’s saga is a blazing alert: unchecked ambition breeds systemic peril, demanding vigilance lest her schemes resurface in new guises, cloaked in foreign havens.